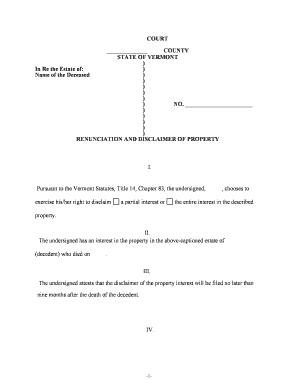

Estate Tax Vermont Department of Taxes Form

What is the Estate Tax Vermont Department Of Taxes

The Estate Tax Vermont Department Of Taxes is a state tax imposed on the transfer of property upon a person's death. This tax applies to estates with a value exceeding a specific threshold, which is subject to change annually. The tax is calculated based on the total value of the estate, including real estate, personal property, and financial assets. Understanding the estate tax is crucial for individuals planning their estates, as it can significantly impact the inheritance received by beneficiaries.

Steps to complete the Estate Tax Vermont Department Of Taxes

Completing the Estate Tax Vermont Department Of Taxes form involves several important steps. First, gather all relevant financial documents, including property valuations, bank statements, and investment records. Next, calculate the total value of the estate to determine if it exceeds the taxable threshold. After that, fill out the required forms accurately, ensuring all information is complete and correct. Finally, submit the forms to the Vermont Department of Taxes by the specified deadline, either online or via mail.

Required Documents

When filing the Estate Tax Vermont Department Of Taxes, certain documents are necessary to support the valuation and details of the estate. These documents typically include:

- Death certificate of the decedent

- Will or trust documents

- Property appraisals

- Bank and investment account statements

- Records of debts and liabilities

Having these documents ready can streamline the filing process and ensure compliance with state requirements.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the Estate Tax Vermont Department Of Taxes to avoid penalties. Generally, the estate tax return must be filed within nine months of the decedent's date of death. If additional time is needed, an extension may be requested, but it is crucial to understand that any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Legal use of the Estate Tax Vermont Department Of Taxes

The legal use of the Estate Tax Vermont Department Of Taxes form is governed by state tax laws. To ensure the form is legally binding, it must be completed accurately and submitted in accordance with Vermont's regulations. Additionally, electronic signatures can be used, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). This allows for a more efficient and secure filing process.

State-specific rules for the Estate Tax Vermont Department Of Taxes

Vermont has specific rules regarding the estate tax that differ from federal regulations. These include the exemption threshold, tax rates, and allowable deductions. It is important for individuals to familiarize themselves with these state-specific rules to ensure compliance and optimize their estate planning strategies. Consulting with a tax professional familiar with Vermont laws can provide valuable insights and guidance.

Quick guide on how to complete estate tax vermont department of taxes

Prepare Estate Tax Vermont Department Of Taxes effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed forms, as you can easily locate the necessary document and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage Estate Tax Vermont Department Of Taxes on any device using airSlate SignNow's Android or iOS applications and enhance your document-oriented workflow today.

How to alter and eSign Estate Tax Vermont Department Of Taxes with ease

- Locate Estate Tax Vermont Department Of Taxes and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Verify the details and click on the Done button to confirm your changes.

- Select your preferred method for sharing your document, whether by email, text message (SMS), invite link, or by downloading it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that require printing new document versions. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Alter and eSign Estate Tax Vermont Department Of Taxes to guarantee excellent communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Estate Tax Vermont Department Of Taxes?

The Estate Tax Vermont Department Of Taxes refers to the tax imposed on the transfer of assets upon an individual's death. This tax is calculated based on the total value of the deceased's estate, and it requires careful planning to ensure compliance. Understanding this tax is essential for estate planning in Vermont.

-

How can I ensure compliance with the Estate Tax Vermont Department Of Taxes?

To ensure compliance with the Estate Tax Vermont Department Of Taxes, it is advisable to consult a tax professional or estate planner. They can help you navigate the complexities of asset valuation, filing requirements, and potential deductions. Keeping detailed records and staying informed about current tax laws is crucial for compliance.

-

What are the benefits of using airSlate SignNow for managing estate documents?

Using airSlate SignNow allows you to efficiently manage and eSign estate documents related to the Estate Tax Vermont Department Of Taxes. Its user-friendly interface streamlines the document workflow, ensuring all necessary forms are easily accessible. This helps you save time and reduce the risk of errors during the estate planning process.

-

Does airSlate SignNow integrate with tax preparation software?

Yes, airSlate SignNow offers seamless integrations with various tax preparation software, enhancing your ability to manage estate documents for the Estate Tax Vermont Department Of Taxes. These integrations allow for real-time updates and easy sharing of necessary documents, facilitating smoother communication with tax professionals.

-

What features does airSlate SignNow provide for estate planning?

airSlate SignNow provides essential features such as document templates, eSignature capabilities, and secure cloud storage for estate planning. These features ensure that all documents needed for the Estate Tax Vermont Department Of Taxes are prepared and signed accurately. The platform also enables collaboration with legal and tax professionals to streamline the process.

-

What is the pricing structure for airSlate SignNow?

airSlate SignNow offers a cost-effective pricing structure with various plans to meet your business needs. Whether you're an individual or a business managing estate documents for the Estate Tax Vermont Department Of Taxes, you can choose a plan that suits your budget. Each plan includes essential features for document management and eSignature.

-

How secure is airSlate SignNow for handling sensitive estate documents?

Security is a top priority for airSlate SignNow, especially when handling sensitive estate documents related to the Estate Tax Vermont Department Of Taxes. The platform employs advanced encryption protocols to protect your data and ensure compliance with industry standards. You can eSign documents with confidence, knowing your information is secure.

Get more for Estate Tax Vermont Department Of Taxes

Find out other Estate Tax Vermont Department Of Taxes

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself