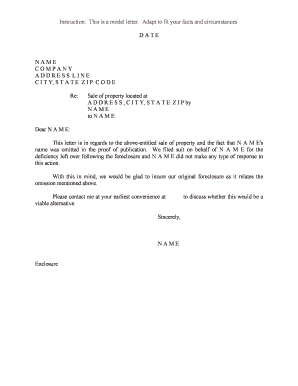

Sale of Property Located at Form

What is the Sale Of Property Located At

The Sale Of Property Located At form is a legal document used in real estate transactions to facilitate the transfer of ownership from the seller to the buyer. This form outlines essential details regarding the property, including its address, legal description, and the terms of the sale. It serves as a binding agreement that ensures both parties understand their rights and obligations in the transaction. Properly completing this form is crucial for a smooth transfer of property ownership and helps prevent future disputes.

Steps to complete the Sale Of Property Located At

Completing the Sale Of Property Located At form involves several important steps to ensure accuracy and compliance with legal standards. Here are the key steps:

- Gather necessary information: Collect details about the property, including its address, legal description, and any existing liens or encumbrances.

- Fill out the form: Accurately input all required information, ensuring that names, dates, and property details are correct.

- Review the document: Carefully check for any errors or omissions. It's essential to ensure that all terms are clear and agreed upon by both parties.

- Obtain signatures: Both the seller and buyer must sign the document, either digitally or in person, to validate the agreement.

- Submit the form: Depending on local regulations, submit the completed form to the appropriate government office or agency for recording.

Legal use of the Sale Of Property Located At

The legal use of the Sale Of Property Located At form is critical in establishing the legitimacy of the property transfer. This form must comply with state laws governing real estate transactions, including any specific requirements for signatures and notarization. To ensure its legal validity, the form should be executed in accordance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA), which govern the use of electronic signatures in the United States. Adhering to these legal frameworks helps protect the rights of both parties involved in the transaction.

Key elements of the Sale Of Property Located At

Understanding the key elements of the Sale Of Property Located At form is essential for both buyers and sellers. The primary components typically include:

- Property description: A detailed account of the property being sold, including its physical address and legal description.

- Purchase price: The agreed-upon amount for the sale, which may include any contingencies or conditions.

- Closing date: The date on which the transfer of ownership will be finalized.

- Signatures: Signatures from both the seller and buyer, confirming their agreement to the terms outlined in the document.

State-specific rules for the Sale Of Property Located At

Each state in the United States may have specific rules and regulations regarding the Sale Of Property Located At form. These rules can vary significantly, affecting aspects such as required disclosures, notarization, and recording processes. It is important for both buyers and sellers to familiarize themselves with their state's requirements to ensure compliance and avoid potential legal issues. Consulting with a real estate attorney or local real estate professional can provide valuable guidance in navigating these state-specific rules.

Examples of using the Sale Of Property Located At

There are various scenarios in which the Sale Of Property Located At form is utilized. Common examples include:

- Residential property sales: When a homeowner sells their house to a buyer, this form is used to document the transaction.

- Commercial real estate transactions: Businesses may use this form when transferring ownership of commercial properties, ensuring all terms are clearly defined.

- Investment property sales: Investors buying or selling rental properties rely on this form to formalize the transfer of ownership.

Quick guide on how to complete sale of property located at

Effortlessly Prepare Sale Of Property Located At on Any Device

Online document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly and without delays. Manage Sale Of Property Located At on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

How to Edit and eSign Sale Of Property Located At with Ease

- Obtain Sale Of Property Located At and click Get Form to begin.

- Use the tools available to fill out your document.

- Highlight important sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as an ink signature.

- Verify all details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the stress of lost or misplaced documents, tedious form searches, or mistakes needing new paper copies. airSlate SignNow caters to all your document management needs in just a few clicks from any chosen device. Edit and eSign Sale Of Property Located At and ensure effective communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the importance of the Sale Of Property Located At process?

The Sale Of Property Located At is crucial because it ensures that all legal documents are properly executed, safeguarding your investment. It streamlines the transaction process, providing clarity and security for both buyers and sellers. With airSlate SignNow, you can manage these documents efficiently, making your sale process smoother.

-

How can airSlate SignNow assist in the Sale Of Property Located At?

airSlate SignNow simplifies the Sale Of Property Located At by providing an easy-to-use platform for eSigning and managing essential documents. Our solution allows you to quickly prepare and send documents to all parties involved. This efficiency helps expedite the property sale process and enhances overall communication.

-

Are there any costs associated with using airSlate SignNow for Sale Of Property Located At?

Yes, airSlate SignNow offers various pricing plans to cater to different needs related to the Sale Of Property Located At. Our plans are designed to be cost-effective, ensuring you only pay for the features you require. This allows you to efficiently manage the sale process without overspending.

-

What features does airSlate SignNow offer for the Sale Of Property Located At?

Key features of airSlate SignNow that benefit the Sale Of Property Located At include templates for common real estate documents, automated workflows, and real-time tracking of document status. These tools help you maintain organization and ensure compliance throughout the transaction, making your experience seamless.

-

Is airSlate SignNow secure for handling documents related to the Sale Of Property Located At?

Absolutely, airSlate SignNow prioritizes security for all documents associated with the Sale Of Property Located At. We utilize advanced encryption and comply with industry standards to protect your sensitive information. You can trust that your documents are safe from unauthorized access.

-

Can I integrate airSlate SignNow with other tools for the Sale Of Property Located At?

Yes, airSlate SignNow offers seamless integrations with other essential tools, enhancing the experience for the Sale Of Property Located At. Whether you use CRM systems, cloud storage, or accounting software, you can easily connect our platform to streamline your workflows. This integration helps in maintaining consistency in your processes.

-

How can airSlate SignNow improve the efficiency of the Sale Of Property Located At?

By using airSlate SignNow for the Sale Of Property Located At, you can automate repetitive tasks, signNowly reducing the time spent on document management. Our platform allows for quick retrieval and signing of documents, improving your overall workflow. This efficiency not only saves time but also enhances the transaction experience for all parties.

Get more for Sale Of Property Located At

Find out other Sale Of Property Located At

- Electronic signature Maine Lease agreement template Later

- Electronic signature Arizona Month to month lease agreement Easy

- Can I Electronic signature Hawaii Loan agreement

- Electronic signature Idaho Loan agreement Now

- Electronic signature South Carolina Loan agreement Online

- Electronic signature Colorado Non disclosure agreement sample Computer

- Can I Electronic signature Illinois Non disclosure agreement sample

- Electronic signature Kentucky Non disclosure agreement sample Myself

- Help Me With Electronic signature Louisiana Non disclosure agreement sample

- How To Electronic signature North Carolina Non disclosure agreement sample

- Electronic signature Ohio Non disclosure agreement sample Online

- How Can I Electronic signature Oklahoma Non disclosure agreement sample

- How To Electronic signature Tennessee Non disclosure agreement sample

- Can I Electronic signature Minnesota Mutual non-disclosure agreement

- Electronic signature Alabama Non-disclosure agreement PDF Safe

- Electronic signature Missouri Non-disclosure agreement PDF Myself

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement