Partner's Outside Basis Worksheet Form

What is the Partner's Outside Basis Worksheet

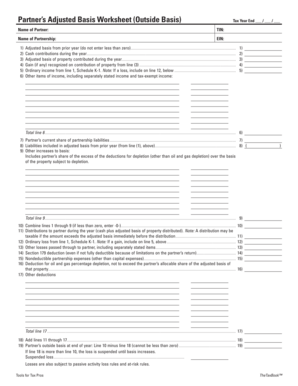

The Partner's Outside Basis Worksheet is a crucial document used in partnership accounting and taxation. It helps partners determine their outside basis, which is the amount they have invested in the partnership, including cash contributions, property contributions, and any liabilities they are responsible for. This worksheet is essential for accurately reporting gains or losses on partnership distributions and ensuring compliance with IRS regulations.

How to use the Partner's Outside Basis Worksheet

To effectively use the Partner's Outside Basis Worksheet, partners should gather all relevant financial information regarding their contributions to the partnership. This includes cash, property, and any loans made to the partnership. Partners must then fill out the worksheet by entering their contributions and any adjustments, such as distributions or share of partnership liabilities. This process ensures that each partner's outside basis is accurately calculated, which is vital for tax reporting purposes.

Steps to complete the Partner's Outside Basis Worksheet

Completing the Partner's Outside Basis Worksheet involves several steps:

- Collect all necessary financial documents related to your partnership contributions.

- Begin by entering your initial cash contributions to the partnership.

- Add the fair market value of any property contributed to the partnership.

- Include any liabilities you are responsible for that the partnership has assumed.

- Adjust for any distributions received from the partnership during the tax year.

- Calculate your total outside basis by summing all contributions and adjustments.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Partner's Outside Basis Worksheet. Partners must adhere to these guidelines to ensure compliance with tax laws. It is important to accurately report contributions, distributions, and any changes in liabilities. Failure to follow IRS guidelines can result in penalties or audits. Partners should consult IRS publications or a tax professional for detailed instructions on completing the worksheet in accordance with current tax laws.

Required Documents

To accurately complete the Partner's Outside Basis Worksheet, several documents are required:

- Partnership agreement outlining each partner's contributions and responsibilities.

- Financial statements showing the partnership's income, expenses, and distributions.

- Records of cash contributions made by each partner.

- Documentation of property contributions, including appraisals or valuations.

- Any loan agreements related to partnership liabilities.

Examples of using the Partner's Outside Basis Worksheet

Using the Partner's Outside Basis Worksheet can vary based on individual circumstances. For example, if a partner contributes cash and property, they must calculate the total basis by adding the cash amount to the fair market value of the property. In another scenario, if a partner takes a distribution, they must adjust their basis accordingly. These examples illustrate the importance of accurately tracking contributions and distributions to maintain proper tax compliance.

Quick guide on how to complete partners outside basis worksheet

Effortlessly Prepare Partner's Outside Basis Worksheet on Any Device

Online document management has gained traction among companies and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed forms, as you can obtain the required template and securely save it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle Partner's Outside Basis Worksheet on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to Modify and eSign Partner's Outside Basis Worksheet with Ease

- Obtain Partner's Outside Basis Worksheet and click Access Form to get started.

- Make use of the tools we offer to complete your document.

- Emphasize key sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes only seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Finish button to save your modifications.

- Select your preferred method to send your document, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, or errors that require reprinting new copies. airSlate SignNow manages all your document handling needs in just a few clicks from any device you choose. Modify and eSign Partner's Outside Basis Worksheet and guarantee exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the partners outside basis worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a partnership basis worksheet excel?

A partnership basis worksheet excel is a tool used to calculate and track each partner's basis in a partnership. It helps in determining the tax implications and distributions for partners. Utilizing an effective partnership basis worksheet excel can streamline financial management for partnerships.

-

How can I use airSlate SignNow with a partnership basis worksheet excel?

You can easily send, sign, and manage your partnership basis worksheet excel through airSlate SignNow. This digital solution enhances collaboration among partners by allowing them to eSign documents in real time. It simplifies the process, ensuring that updates to your partnership basis worksheet excel are immediately available to all partners.

-

Is there a free trial for preparing a partnership basis worksheet excel?

Yes, airSlate SignNow offers a free trial that lets you explore its features for preparing a partnership basis worksheet excel. This trial enables you to test the eSigning and document management capabilities at no cost. Consider trying it to see how it fits your needs.

-

What features does airSlate SignNow provide for a partnership basis worksheet excel?

AirSlate SignNow provides features like customizable templates, easy eSigning, and cloud storage for your partnership basis worksheet excel. These features allow for quick updates and secure sharing with all partners. The platform's integration options enhance its functionality further, accommodating various workflow needs.

-

Can I integrate airSlate SignNow with other tools for managing my partnership basis worksheet excel?

Absolutely! AirSlate SignNow offers seamless integrations with various applications, such as cloud storage services and accounting software. This allows you to manage your partnership basis worksheet excel efficiently by connecting it with tools you already use, simplifying your workflow.

-

What are the pricing options for airSlate SignNow when using it for a partnership basis worksheet excel?

AirSlate SignNow offers several pricing plans to cater to different business needs, including essential features for managing your partnership basis worksheet excel. The plans are designed to be cost-effective, allowing businesses of all sizes to leverage the advantages of digital document management. It's best to check the website for the most current pricing details.

-

How secure is my data when using airSlate SignNow for a partnership basis worksheet excel?

AirSlate SignNow prioritizes data security, employing robust encryption and strict access controls to protect your partnership basis worksheet excel and other sensitive documents. Your data is secured both in transit and at rest, ensuring that your information remains confidential. This allows partners to share documents confidently.

Get more for Partner's Outside Basis Worksheet

- Can i do it1040x online form

- Directions mta bidders setup form

- Maternity leaveadditional maternity leave application hse form

- Trench permit application taunton massachusetts form

- Disorder radiology requisition patient name date form

- Instructions for form ct 3 department of taxation and finance

- Work order agreement template form

- Work payment agreement template form

Find out other Partner's Outside Basis Worksheet

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast