Corporation, LLC, or Partnership, Chapter 13 Bankruptcy MAY NOT BE USED, and the Filing Form

Understanding the Corporation, LLC, Or Partnership, Chapter 13 Bankruptcy MAY NOT BE USED, And The Filing

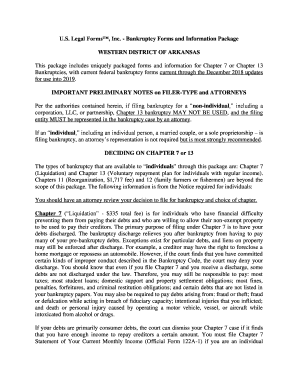

The Corporation, LLC, or Partnership, Chapter 13 Bankruptcy MAY NOT BE USED, and the filing is a legal document that outlines specific conditions under which certain business entities cannot file for Chapter 13 bankruptcy. This form is crucial for entities such as corporations, limited liability companies (LLCs), and partnerships, as it clarifies their eligibility and the legal implications of filing for bankruptcy protection. Understanding this form is essential for business owners seeking to navigate financial difficulties while adhering to U.S. bankruptcy laws.

Steps to Complete the Corporation, LLC, Or Partnership, Chapter 13 Bankruptcy MAY NOT BE USED, And The Filing

Completing the Corporation, LLC, or Partnership, Chapter 13 Bankruptcy MAY NOT BE USED, and the filing involves several key steps. First, gather all necessary financial documents, including income statements, balance sheets, and tax returns. Next, review the eligibility criteria to confirm that your entity falls under the restrictions outlined in the form. After that, accurately fill out the form, ensuring all information is complete and correct. Finally, submit the form through the appropriate channels, whether online, by mail, or in person, depending on your jurisdiction's requirements.

Legal Use of the Corporation, LLC, Or Partnership, Chapter 13 Bankruptcy MAY NOT BE USED, And The Filing

The legal use of the Corporation, LLC, or Partnership, Chapter 13 Bankruptcy MAY NOT BE USED, and the filing is governed by federal bankruptcy laws. This form serves to inform business entities of their ineligibility for Chapter 13 bankruptcy, which is typically reserved for individual debtors. Understanding the legal framework surrounding this form is essential for ensuring compliance and avoiding potential penalties. It is important to consult with a legal professional if there are any uncertainties regarding the implications of this filing.

Required Documents for the Corporation, LLC, Or Partnership, Chapter 13 Bankruptcy MAY NOT BE USED, And The Filing

To complete the Corporation, LLC, or Partnership, Chapter 13 Bankruptcy MAY NOT BE USED, and the filing, specific documents are required. These typically include proof of income, a list of debts, and financial statements. Additionally, documentation proving the entity's structure—whether it is a corporation, LLC, or partnership—must be included. Ensuring that all required documents are submitted accurately will facilitate a smoother filing process and help avoid delays.

Filing Deadlines / Important Dates for the Corporation, LLC, Or Partnership, Chapter 13 Bankruptcy MAY NOT BE USED, And The Filing

Filing deadlines for the Corporation, LLC, or Partnership, Chapter 13 Bankruptcy MAY NOT BE USED, and the filing can vary based on jurisdiction. It is crucial to be aware of these dates to ensure timely submission. Missing a deadline may result in complications or an inability to proceed with bankruptcy proceedings. Always verify the specific deadlines applicable to your state or local court to stay compliant.

Eligibility Criteria for the Corporation, LLC, Or Partnership, Chapter 13 Bankruptcy MAY NOT BE USED, And The Filing

The eligibility criteria for the Corporation, LLC, or Partnership, Chapter 13 Bankruptcy MAY NOT BE USED, and the filing are clearly defined within bankruptcy laws. Generally, corporations, LLCs, and partnerships are not eligible to file for Chapter 13 bankruptcy, which is designed for individual debtors. Understanding these criteria is vital for business owners to assess their options and determine the best course of action for managing financial distress.

Quick guide on how to complete corporation llc or partnership chapter 13 bankruptcy may not be used and the filing

Effortlessly prepare Corporation, LLC, Or Partnership, Chapter 13 Bankruptcy MAY NOT BE USED, And The Filing on any device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage Corporation, LLC, Or Partnership, Chapter 13 Bankruptcy MAY NOT BE USED, And The Filing on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

How to modify and electronically sign Corporation, LLC, Or Partnership, Chapter 13 Bankruptcy MAY NOT BE USED, And The Filing with ease

- Find Corporation, LLC, Or Partnership, Chapter 13 Bankruptcy MAY NOT BE USED, And The Filing and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your updates.

- Select your preferred method of sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or mistakes that require printing new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Corporation, LLC, Or Partnership, Chapter 13 Bankruptcy MAY NOT BE USED, And The Filing and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What types of entities are affected by Corporation, LLC, Or Partnership, Chapter 13 Bankruptcy MAY NOT BE USED, And The Filing?

The Corporation, LLC, Or Partnership, Chapter 13 Bankruptcy MAY NOT BE USED, And The Filing applies primarily to corporations and limited liability companies (LLCs), as well as partnerships that are looking to restructure their debt. This restriction makes it crucial to understand alternative bankruptcy options available to these entities.

-

How does airSlate SignNow assist in the filing process for entities under Corporation, LLC, Or Partnership, Chapter 13 Bankruptcy MAY NOT BE USED?

airSlate SignNow provides an easy-to-use platform that allows businesses to prepare and eSign documents needed for various filing requirements, including those related to corporations and LLCs. By streamlining the document preparation process, users can ensure that they meet all necessary legal criteria.

-

What features does airSlate SignNow offer for businesses considering bankruptcy options?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking to help businesses manage their filing processes. These features are especially important for entities affected by Corporation, LLC, Or Partnership, Chapter 13 Bankruptcy MAY NOT BE USED, And The Filing, as they enable efficient and secure document handling.

-

Is there a free trial available for airSlate SignNow, and how does it benefit users exploring bankruptcy options?

Yes, airSlate SignNow offers a free trial that allows users to explore its features and benefits without commitment. This is particularly useful for entities evaluating how to navigate the complexities of Corporation, LLC, Or Partnership, Chapter 13 Bankruptcy MAY NOT BE USED, And The Filing, giving businesses a chance to understand how the platform can simplify their document management.

-

What are the pricing plans for airSlate SignNow, especially for small businesses considering bankruptcy?

airSlate SignNow offers several pricing plans tailored to various business needs, including affordable options for small businesses. Understanding these plans is vital for those affected by Corporation, LLC, Or Partnership, Chapter 13 Bankruptcy MAY NOT BE USED, And The Filing, as they provide a cost-effective solution for document management.

-

How does airSlate SignNow ensure the security of documents related to bankruptcy filings?

airSlate SignNow prioritizes document security with advanced encryption and secure cloud storage. This is crucial for businesses involved in Corporation, LLC, Or Partnership, Chapter 13 Bankruptcy MAY NOT BE USED, And The Filing, where sensitive information must be protected throughout the eSigning and document management process.

-

Can airSlate SignNow integrate with other software to assist in the bankruptcy filing process?

Yes, airSlate SignNow offers integrations with various software applications to streamline the filing process. This is particularly beneficial for entities navigating Corporation, LLC, Or Partnership, Chapter 13 Bankruptcy MAY NOT BE USED, And The Filing, as it helps consolidate all necessary tools for efficient document management.

Get more for Corporation, LLC, Or Partnership, Chapter 13 Bankruptcy MAY NOT BE USED, And The Filing

Find out other Corporation, LLC, Or Partnership, Chapter 13 Bankruptcy MAY NOT BE USED, And The Filing

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer