Anatomy of a Stock Purchase Agreement the M&A Lawyer Blog Form

Understanding the Anatomy of a Stock Purchase Agreement

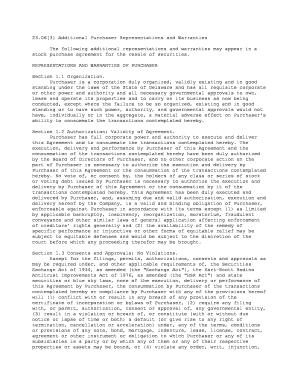

The Anatomy of a Stock Purchase Agreement is a crucial document in mergers and acquisitions. It outlines the terms and conditions under which one party purchases shares from another. This agreement typically includes key details such as the purchase price, payment terms, and representations and warranties from both parties. Understanding this document is essential for ensuring a smooth transaction and protecting the interests of all involved parties.

Key Elements of the Stock Purchase Agreement

Several key elements define the structure of a Stock Purchase Agreement. These include:

- Parties Involved: Clearly identifies the buyer and seller.

- Purchase Price: Specifies the amount to be paid for the shares.

- Payment Terms: Outlines how and when the payment will be made.

- Representations and Warranties: Statements made by both parties regarding their authority and the condition of the shares.

- Conditions Precedent: Lists any conditions that must be met before the transaction can close.

- Indemnification: Details the obligations of the parties in case of breaches of the agreement.

Steps to Complete the Stock Purchase Agreement

Completing a Stock Purchase Agreement involves several steps to ensure accuracy and legality:

- Draft the Agreement: Begin by drafting the agreement based on the specific transaction details.

- Review Legal Requirements: Ensure compliance with state and federal laws relevant to the transaction.

- Negotiate Terms: Both parties should negotiate and agree on the terms outlined in the document.

- Obtain Necessary Approvals: Secure any required approvals from boards or stakeholders.

- Sign the Agreement: Both parties must sign the document, preferably using a digital solution for efficiency and security.

Legal Use of the Stock Purchase Agreement

The Stock Purchase Agreement serves as a legally binding contract that protects the interests of both the buyer and seller. It is essential that the agreement is executed in accordance with applicable laws to ensure its enforceability. Utilizing a reliable eSignature platform can enhance the legal standing of the document by providing a digital certificate and maintaining compliance with eSignature laws.

State-Specific Rules for the Stock Purchase Agreement

Each state may have specific rules and regulations governing Stock Purchase Agreements. It is important to consult local laws to ensure compliance. This may include requirements for notarization, filing with state agencies, or other legal formalities that vary by jurisdiction. Understanding these nuances can help avoid potential legal issues during the transaction.

Examples of Using the Stock Purchase Agreement

Stock Purchase Agreements are commonly used in various scenarios, such as:

- Acquisition of a startup by a larger corporation.

- Transfer of shares between family members in a closely-held business.

- Investment transactions where investors acquire equity in a company.

These examples illustrate the versatility and importance of having a well-drafted Stock Purchase Agreement in place to govern the terms of the transaction.

Quick guide on how to complete anatomy of a stock purchase agreement the mampampampa lawyer blog

Easily prepare Anatomy Of A Stock Purchase Agreement The M&A Lawyer Blog on any device

Internet-based document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to access the correct template and securely store it online. airSlate SignNow offers all the functionalities necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Anatomy Of A Stock Purchase Agreement The M&A Lawyer Blog on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

How to alter and electronically sign Anatomy Of A Stock Purchase Agreement The M&A Lawyer Blog effortlessly

- Locate Anatomy Of A Stock Purchase Agreement The M&A Lawyer Blog and click on Get Form to begin.

- Utilize the tools provided to fill out your document.

- Mark relevant sections of your documents or obscure confidential information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Alter and electronically sign Anatomy Of A Stock Purchase Agreement The M&A Lawyer Blog and guarantee effective communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Anatomy Of A Stock Purchase Agreement?

The Anatomy Of A Stock Purchase Agreement is a comprehensive guide provided on The M&A Lawyer Blog that outlines the essential components and clauses typically found in stock purchase agreements. Understanding this anatomy helps businesses grasp the legal implications involved in the transaction, ensuring they are well-prepared for negotiations.

-

How does airSlate SignNow facilitate the signing process for stock purchase agreements?

airSlate SignNow streamlines the signing process for stock purchase agreements by allowing users to send, receive, and eSign documents effortlessly. With its intuitive interface, businesses can efficiently manage their agreements while ensuring compliance with legal standards highlighted in the Anatomy Of A Stock Purchase Agreement on The M&A Lawyer Blog.

-

What are the pricing options available for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business sizes and needs. These plans are designed to provide value without compromising on the features necessary for handling documents like those detailed in the Anatomy Of A Stock Purchase Agreement from The M&A Lawyer Blog.

-

What features does airSlate SignNow offer for managing stock purchase agreements?

airSlate SignNow includes features like document templates, customizable workflows, and secure storage that allow users to manage stock purchase agreements efficiently. These tools are essential for ensuring that all necessary elements, as described in the Anatomy Of A Stock Purchase Agreement from The M&A Lawyer Blog, are included and easily accessible.

-

What benefits can businesses expect when using airSlate SignNow?

By using airSlate SignNow, businesses can enhance their operational efficiency, reduce turnaround times, and minimize risks associated with manual documentation. The ease of eSigning stock purchase agreements aligns well with understanding the Anatomy Of A Stock Purchase Agreement discussed on The M&A Lawyer Blog.

-

Can airSlate SignNow integrate with other software platforms?

Yes, airSlate SignNow offers integrations with various software platforms, ensuring seamless workflows across your business ecosystem. These integrations enhance the ability to manage stock purchase agreements effectively, as outlined in the Anatomy Of A Stock Purchase Agreement on The M&A Lawyer Blog.

-

Is airSlate SignNow compliant with legal standards for stock purchase agreements?

Absolutely, airSlate SignNow adheres to legal standards required for electronic signatures and document management, making it a trustworthy solution for handling stock purchase agreements. This compliance correlates with the guidelines provided in the Anatomy Of A Stock Purchase Agreement featured on The M&A Lawyer Blog.

Get more for Anatomy Of A Stock Purchase Agreement The M&A Lawyer Blog

Find out other Anatomy Of A Stock Purchase Agreement The M&A Lawyer Blog

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now