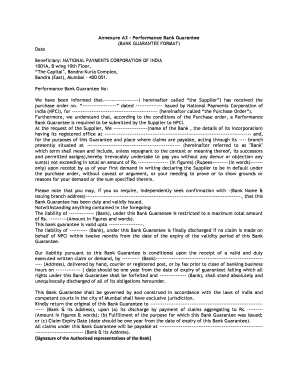

Performance Bank Guarantee

What is the Performance Bank Guarantee

A performance bank guarantee is a financial instrument issued by a bank to ensure the fulfillment of a contractual obligation by a party, typically a contractor. In essence, it serves as a safety net for the beneficiary, providing assurance that the contractor will meet their commitments. If the contractor fails to perform as agreed, the bank will compensate the beneficiary up to the guaranteed amount. This type of guarantee is commonly used in construction projects, service contracts, and various business transactions where performance is critical.

How to Obtain the Performance Bank Guarantee

Obtaining a performance bank guarantee involves several steps. First, the applicant must approach a bank or financial institution that offers such guarantees. The bank will typically require a detailed proposal outlining the project and the specific obligations to be guaranteed. The applicant may also need to provide financial statements and other relevant documentation to demonstrate their creditworthiness. After assessing the application, the bank will determine the terms of the guarantee, including the fee structure and the duration of the guarantee.

Steps to Complete the Performance Bank Guarantee

Completing a performance bank guarantee requires careful attention to detail. Here are the essential steps:

- Gather necessary documentation, including contracts and financial statements.

- Fill out the application form provided by the bank, ensuring all information is accurate.

- Submit the application along with any required supporting documents.

- Review the terms and conditions outlined by the bank before signing.

- Obtain a copy of the finalized guarantee for your records.

Key Elements of the Performance Bank Guarantee

Several key elements must be included in a performance bank guarantee to ensure its validity:

- Parties Involved: Clearly identify the beneficiary, the contractor, and the issuing bank.

- Amount: Specify the maximum amount the bank is liable for under the guarantee.

- Conditions of Payment: Outline the circumstances under which the bank will make a payment.

- Validity Period: Indicate the duration for which the guarantee is valid.

- Governing Law: State the legal jurisdiction that governs the guarantee.

Legal Use of the Performance Bank Guarantee

The legal use of a performance bank guarantee is governed by various regulations and laws. In the United States, it is essential to ensure that the guarantee complies with the Uniform Commercial Code (UCC) and any applicable state laws. The guarantee must be executed properly, with all parties understanding their rights and obligations. Additionally, maintaining transparency and providing accurate information during the application process is crucial to avoid potential disputes.

Examples of Using the Performance Bank Guarantee

Performance bank guarantees are commonly used in various scenarios, including:

- Construction projects, where contractors must assure project owners of timely completion.

- Service contracts, ensuring that service providers fulfill their obligations.

- Supply agreements, where suppliers guarantee the delivery of goods as per the contract terms.

These examples illustrate the versatility of performance bank guarantees in safeguarding interests across different industries.

Quick guide on how to complete performance bank guarantee

Complete Performance Bank Guarantee effortlessly on any device

Digital document administration has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the correct template and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Manage Performance Bank Guarantee on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

How to modify and electronically sign Performance Bank Guarantee with ease

- Obtain Performance Bank Guarantee and then click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize essential sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Performance Bank Guarantee to ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the performance bank guarantee

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a bank guarantee?

A bank guarantee is a financial promise made by a bank to cover a loss if a borrower defaults on a loan or agreement. With airSlate SignNow, securing a bank guarantee can streamline your transaction processes and enhance your business credibility. This feature helps ensure that all parties involved feel protected and secure.

-

How does airSlate SignNow help with bank guarantees?

airSlate SignNow simplifies the process of obtaining and managing bank guarantees by allowing businesses to eSign necessary documents electronically. This saves time and reduces the stress of traditional paperwork. Additionally, our user-friendly platform ensures that your bank guarantee documents are signed and stored securely.

-

What are the pricing options for using airSlate SignNow for bank guarantees?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes looking to manage bank guarantees effectively. Our cost-effective solutions include different tiers with varying features, making it easy to choose one that aligns perfectly with your needs. Visit our pricing page for detailed information and select the best plan for your bank guarantee requirements.

-

Are there any features specific to managing bank guarantees with airSlate SignNow?

Yes, airSlate SignNow includes features specifically designed for managing bank guarantees, such as document templates, automated reminders, and tracking capabilities. These tools help ensure that you never miss important deadlines or documentation requirements. Our platform makes handling bank guarantees straightforward and efficient.

-

Can I integrate airSlate SignNow with other software while managing bank guarantees?

Absolutely! airSlate SignNow seamlessly integrates with various third-party applications, which can enhance your bank guarantee management. This includes CRM systems, accounting software, and other business tools. The integrations make it easy to automate workflows and maintain consistency in your documentation process.

-

What benefits does eSigning bank guarantees provide?

eSigning bank guarantees with airSlate SignNow offers numerous benefits, including enhanced security and quicker turnaround times. The digital signature process ensures that your agreements are legally binding while reducing the need for physical documentation. This efficiency not only saves time but also enhances transparency between parties.

-

Is airSlate SignNow compliant with regulations for bank guarantees?

Yes, airSlate SignNow is compliant with essential regulations regarding electronic signatures and document management, making it a reliable choice for handling bank guarantees. Our platform adheres to industry standards, ensuring that all your transactions are secure and legally enforceable. This compliance helps protect your business when executing bank guarantees.

Get more for Performance Bank Guarantee

- Tennessee burn permit application form

- Child tennessee neglect form

- Bill lee state of tennessee penny schwinn governor tn form

- Maryville fire department 402 w broadway ave yp com form

- Youth form

- Virtual scholars academy vsa is a viable substitute to form

- Parking tabulation form parking tabulation form

- Fillable online notarized affidavit stafford county public schools form

Find out other Performance Bank Guarantee

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent