$750,000 Fee to Settle an Estate?The Welch Group Form

What is the $750,000 Fee To Settle An Estate? The Welch Group

The $750,000 fee to settle an estate refers to the costs associated with administering an estate after a person passes away. This fee typically encompasses various expenses, including legal fees, court costs, and other administrative expenses necessary to distribute the deceased's assets. The Welch Group specializes in estate planning and settlement, providing guidance on how this fee is structured and what it includes. Understanding the components of this fee is essential for beneficiaries and executors alike, as it can significantly impact the net value of the estate.

Steps to Complete the $750,000 Fee To Settle An Estate? The Welch Group

Completing the $750,000 fee to settle an estate involves several key steps. First, the executor must gather all relevant documents, including the will, death certificate, and asset listings. Next, they should assess the estate's total value and identify any debts or liabilities. Following this, the executor will need to file the necessary legal documents with the probate court to initiate the settlement process. This may include submitting the will for validation and providing an inventory of the estate's assets. Throughout this process, it is crucial to maintain accurate records and communicate effectively with beneficiaries to ensure transparency and compliance with legal requirements.

Legal Use of the $750,000 Fee To Settle An Estate? The Welch Group

The legal use of the $750,000 fee to settle an estate is governed by state laws and regulations. This fee must be justified and documented, as it is subject to scrutiny by the probate court. Executors are responsible for ensuring that all expenses related to the estate settlement are reasonable and necessary. Legal fees, for example, should reflect the complexity of the estate and the services rendered. It is advisable for executors to consult with legal professionals to ensure compliance with applicable laws and to avoid potential disputes with beneficiaries regarding the fee's legitimacy.

Required Documents for the $750,000 Fee To Settle An Estate? The Welch Group

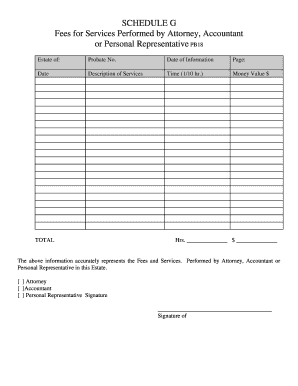

To effectively settle an estate with a $750,000 fee, several documents are required. Key documents include the original will, a certified copy of the death certificate, and an inventory of the estate's assets. Additionally, any outstanding debts or liabilities must be documented, along with receipts for expenses incurred during the settlement process. Executors should also prepare a detailed accounting of all transactions related to the estate, which will be necessary for court approval and for informing beneficiaries about the estate's financial status.

Examples of Using the $750,000 Fee To Settle An Estate? The Welch Group

Examples of using the $750,000 fee to settle an estate can vary widely based on the estate's complexity. For instance, in a straightforward case, the fee may cover basic legal services for filing the will and distributing assets among heirs. In more complex situations, such as those involving multiple properties, business interests, or disputes among beneficiaries, the fee may encompass extensive legal representation and mediation services. Understanding these examples can help executors and beneficiaries anticipate potential costs and plan accordingly.

State-Specific Rules for the $750,000 Fee To Settle An Estate? The Welch Group

State-specific rules regarding the $750,000 fee to settle an estate can significantly influence the settlement process. Each state has its own laws governing probate procedures, including how fees are calculated and what constitutes allowable expenses. Executors must familiarize themselves with their state’s regulations to ensure compliance. This may involve consulting with a local attorney who specializes in estate law to navigate the nuances of the probate process effectively.

Quick guide on how to complete 750000 fee to settle an estatethe welch group

Prepare $750,000 Fee To Settle An Estate?The Welch Group effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely maintain it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and efficiently. Manage $750,000 Fee To Settle An Estate?The Welch Group on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The easiest way to edit and eSign $750,000 Fee To Settle An Estate?The Welch Group without hassle

- Locate $750,000 Fee To Settle An Estate?The Welch Group and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight essential sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tiresome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign $750,000 Fee To Settle An Estate?The Welch Group while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the $750,000 Fee To Settle An Estate? The Welch Group?

The $750,000 Fee To Settle An Estate? The Welch Group is a comprehensive service package that assists with the legal processes involved in estate settlement. This fee typically covers attorney costs, court fees, and other administrative expenses to ensure a smooth probate process. Understanding this fee is crucial for those managing an estate to avoid unexpected costs.

-

What services are included in the $750,000 Fee To Settle An Estate? The Welch Group?

The $750,000 Fee To Settle An Estate? The Welch Group includes legal representation, document preparation, and consultation services to help navigate the complexities of estate settlement. Additionally, their services may encompass asset valuation and the management of estate debts. Utilizing these services can simplify the settlement process signNowly.

-

How does airSlate SignNow enhance the estate settlement process?

AirSlate SignNow streamlines the estate settlement process by allowing users to easily eSign important documents related to the $750,000 Fee To Settle An Estate? The Welch Group. This platform facilitates quicker approvals, reduces paperwork hassle, and ensures that all signatures are securely stored. Its user-friendly interface makes it accessible for everyone involved in the settlement.

-

What are the benefits of using airSlate SignNow for estate documents?

Using airSlate SignNow for estate documents provides a variety of benefits, including reduced turnaround time and enhanced security for sensitive information. This solution ensures that you have access to templates specifically designed for processes such as the $750,000 Fee To Settle An Estate? The Welch Group. Moreover, it allows for easy tracking and auditing of documents.

-

Are there any hidden costs associated with the $750,000 Fee To Settle An Estate? The Welch Group?

Transparency is key in understanding the $750,000 Fee To Settle An Estate? The Welch Group. Most reputable groups will outline their fees upfront to avoid any surprises. However, it is important to have detailed discussions about potential additional costs, such as court fees or expenses related to specific estate assets.

-

Can airSlate SignNow integrate with other software for estate management?

Yes, airSlate SignNow can integrate with various platforms that assist in estate management, complementing services like the $750,000 Fee To Settle An Estate? The Welch Group. This means you can connect it with financial management tools or customer relationship management systems to streamline your workflow. Integration enhances collaboration among professionals involved in the settlement process.

-

What makes the $750,000 Fee To Settle An Estate? The Welch Group a worthwhile investment?

Investing in the $750,000 Fee To Settle An Estate? The Welch Group can provide peace of mind and expert guidance in a complex legal landscape. Their extensive experience allows for a more efficient settlement, potentially saving time and minimizing stress for the estate executors. This investment can lead to smoother transitions and better overall outcomes.

Get more for $750,000 Fee To Settle An Estate?The Welch Group

Find out other $750,000 Fee To Settle An Estate?The Welch Group

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT