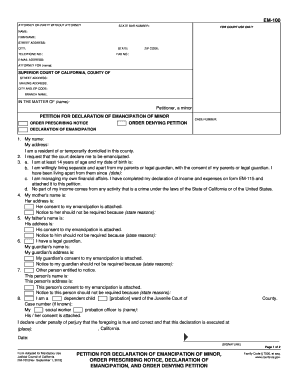

EM 100 Form

What is the EM 100

The EM 100 form is a specific document used primarily in the context of tax and legal compliance in the United States. This form serves various purposes depending on the specific circumstances of the user. It is essential for individuals or businesses to understand its function, as it can impact their financial and legal standing. The EM 100 may be required for reporting income, claiming deductions, or fulfilling other obligations set forth by regulatory bodies.

How to use the EM 100

Using the EM 100 form involves several key steps to ensure proper completion and submission. First, gather all necessary information, including personal details and financial records relevant to the form's purpose. Next, carefully fill out each section of the form, ensuring accuracy to avoid potential issues. After completing the form, review it thoroughly for any errors before submission. Depending on the requirements, you may need to submit it electronically or via mail.

Steps to complete the EM 100

Completing the EM 100 form requires attention to detail and adherence to specific guidelines. Follow these steps:

- Collect required information, such as identification numbers and financial data.

- Access the EM 100 form from a reliable source.

- Fill in each section accurately, ensuring all fields are completed as necessary.

- Double-check your entries for accuracy and completeness.

- Submit the form according to the specified method, whether online, by mail, or in person.

Legal use of the EM 100

The legal use of the EM 100 form is governed by various regulations that ensure its validity. For a form to be legally binding, it must meet specific criteria, such as proper signatures and compliance with applicable laws. Understanding these legal requirements is crucial for users to avoid penalties or disputes. It is advisable to consult with a legal expert if there are uncertainties regarding the form's use.

Required Documents

When preparing to complete the EM 100 form, certain documents are typically required to support the information provided. These may include:

- Identification documents, such as a driver's license or Social Security card.

- Financial records, including income statements and tax returns.

- Any relevant correspondence from tax authorities or legal entities.

Having these documents ready will facilitate a smoother completion process and ensure accuracy.

Filing Deadlines / Important Dates

Filing deadlines for the EM 100 form can vary based on the specific context in which it is used. It is essential to be aware of these deadlines to avoid late submissions, which may result in penalties. Typically, deadlines may align with tax seasons or specific legal requirements. Users should check the relevant guidelines to ensure timely filing.

Examples of using the EM 100

The EM 100 form can be utilized in various scenarios, illustrating its versatility. For instance, a self-employed individual may use the form to report income and claim deductions. Similarly, a business entity might need the EM 100 to comply with regulatory requirements related to financial reporting. Understanding these examples can help users identify when and how to use the form effectively.

Quick guide on how to complete em 100

Complete EM 100 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without any holdups. Manage EM 100 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign EM 100 without hassle

- Acquire EM 100 and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Modify and eSign EM 100 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the EM 100, and how does it work?

The EM 100 is a powerful tool within the airSlate SignNow platform that allows users to create, send, and eSign documents securely and efficiently. It simplifies the document workflow process, enabling businesses to manage contracts and forms seamlessly. With the EM 100, users can easily track document status and gather signatures in real-time.

-

What are the key features of the EM 100?

The EM 100 offers a range of features designed to enhance document management, including customizable templates, in-app notifications, and advanced security measures. Users can create workflows that suit their business needs and automate repetitive tasks. This makes the EM 100 an invaluable asset for any organization aiming to streamline their signing process.

-

How much does the EM 100 cost?

Pricing for the EM 100 varies based on the specific plan selected and the number of users. airSlate SignNow offers competitive pricing models that cater to businesses of all sizes, ensuring access to essential features without breaking the budget. For detailed pricing information, it's best to visit the airSlate SignNow website or contact their sales team.

-

Can the EM 100 integrate with other software?

Yes, the EM 100 seamlessly integrates with various business applications, such as CRMs, Google Drive, and Dropbox, allowing for a smoother workflow. These integrations enable users to auto-populate documents and sync data, saving time and reducing errors. This versatility enhances the usability of the EM 100 across different business systems.

-

What are the benefits of using the EM 100 for businesses?

The EM 100 signNowly boosts productivity by reducing the time spent on handling physical documents. Businesses can close deals faster and improve client satisfaction with quick turnaround times. The enhanced security features also ensure that sensitive data is protected, giving businesses peace of mind.

-

Is the EM 100 user-friendly for non-technical users?

Absolutely! The EM 100 is designed with user experience in mind, making it accessible for users of all technical skill levels. The intuitive interface ensures that even those unfamiliar with electronic signatures can navigate the platform with ease and efficiency.

-

What support resources are available for EM 100 users?

airSlate SignNow provides a robust support system for EM 100 users, including comprehensive documentation, tutorials, and a responsive customer service team. Users can access a variety of resources to help them make the most of the EM 100. Additionally, forums and community support enhance the overall user experience.

Get more for EM 100

Find out other EM 100

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now

- Sign Maryland Web Hosting Agreement Free

- Sign Maryland Web Hosting Agreement Fast

- Help Me With Sign New York Web Hosting Agreement

- Sign Connecticut Joint Venture Agreement Template Free

- Sign South Dakota Web Hosting Agreement Free

- Sign Wisconsin Web Hosting Agreement Later

- Sign Wisconsin Web Hosting Agreement Easy

- Sign Illinois Deposit Receipt Template Myself

- Sign Illinois Deposit Receipt Template Free

- Sign Missouri Joint Venture Agreement Template Free