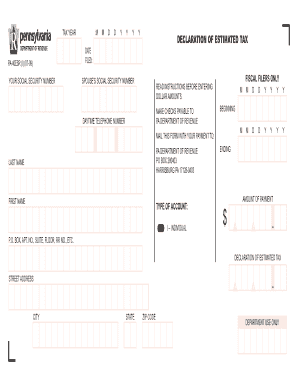

Pa 40 Esr Form

What is the PA 40 ESR?

The PA 40 ESR, or Pennsylvania 40 Estimated Tax Return, is a form used by individuals and businesses in Pennsylvania to report and pay estimated income taxes. This form is essential for taxpayers who expect to owe tax of $500 or more when they file their annual tax return. The PA 40 ESR allows taxpayers to make quarterly payments to ensure they meet their tax obligations throughout the year, rather than paying a lump sum at the end of the tax year.

Steps to Complete the PA 40 ESR

Completing the PA 40 ESR involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, calculate your expected income for the year, as well as any deductions or credits you may qualify for. After estimating your tax liability, divide the total by four to determine your quarterly payments. Finally, fill out the PA 40 ESR form with your personal information, estimated income, and payment amounts, ensuring all calculations are accurate.

Legal Use of the PA 40 ESR

The PA 40 ESR is legally recognized as a valid method for reporting and paying estimated taxes in Pennsylvania. To ensure compliance, taxpayers must adhere to the guidelines set forth by the Pennsylvania Department of Revenue. This includes filing the form on time and making the required payments by the due dates. Failure to comply with these regulations may result in penalties or interest charges on unpaid taxes.

Filing Deadlines / Important Dates

Timely filing of the PA 40 ESR is crucial to avoid penalties. The estimated tax payments are typically due on the 15th of April, June, September, and January of the following year. It is important to mark these dates on your calendar and ensure that your payments are submitted on time to maintain compliance with state tax laws.

Required Documents

When completing the PA 40 ESR, certain documents are essential for accurate reporting. These include:

- Previous tax returns to reference income and deductions.

- W-2 forms from employers showing earned income.

- 1099 forms for any additional income sources.

- Documentation of any deductions or credits you plan to claim.

Having these documents ready will streamline the process and help ensure accurate calculations.

Examples of Using the PA 40 ESR

Taxpayers can utilize the PA 40 ESR in various scenarios. For instance, a self-employed individual may use the form to report income from their business and pay estimated taxes. Similarly, a retiree receiving pension income may also be required to submit the PA 40 ESR if their expected tax liability exceeds the threshold. These examples illustrate the form's versatility in accommodating different taxpayer situations.

Quick guide on how to complete pa 40 esr

Complete Pa 40 Esr seamlessly on any gadget

Digital document management has become increasingly favored by companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the appropriate form and securely keep it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents quickly and efficiently. Handle Pa 40 Esr on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign Pa 40 Esr effortlessly

- Locate Pa 40 Esr and select Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device you prefer. Modify and eSign Pa 40 Esr and ensure outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa 40 esr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is pa 40esr and how does it work with airSlate SignNow?

The pa 40esr is an advanced eSignature feature integrated within the airSlate SignNow platform. It allows users to streamline their document signing processes by using electronic signatures that comply with legal standards, ensuring both security and efficiency.

-

How much does the airSlate SignNow plan with pa 40esr cost?

Pricing for airSlate SignNow with pa 40esr varies based on the chosen subscription plan. We offer flexible pricing options that cater to different business sizes and needs, ensuring that every customer can find a suitable plan to leverage the benefits of the pa 40esr feature.

-

What features does pa 40esr offer within airSlate SignNow?

The pa 40esr feature within airSlate SignNow includes customizable templates, automated workflows, and secure document storage. These features work together to enhance the user experience and make document management seamless and efficient.

-

Can I integrate pa 40esr with other software

Yes, airSlate SignNow with pa 40esr can be easily integrated with a variety of software applications. This capability allows businesses to streamline their operations by syncing their existing tools with the eSignature solution provided by airSlate SignNow.

-

What are the benefits of using airSlate SignNow's pa 40esr?

Using the pa 40esr feature of airSlate SignNow offers numerous benefits, including faster turnaround times for document signing and enhanced security for sensitive information. It also improves workflow efficiency, enabling teams to focus on more strategic tasks.

-

Is pa 40esr compliant with legal regulations?

Yes, the pa 40esr feature in airSlate SignNow is designed to comply with all relevant legal regulations regarding electronic signatures. This compliance ensures that your signed documents are legally binding and recognized in various jurisdictions.

-

How can I get started with pa 40esr on airSlate SignNow?

Getting started with pa 40esr on airSlate SignNow is simple. You can sign up for a free trial on our website, explore the features, and see how easy it is to use eSignatures for your documents.

Get more for Pa 40 Esr

Find out other Pa 40 Esr

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself