Code PGM or Form

What is the Code PGM Or

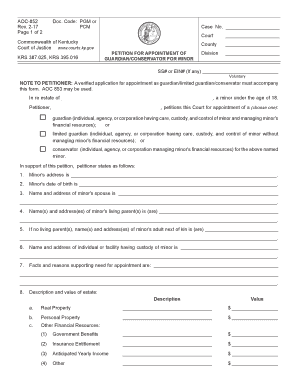

The Code PGM Or is a specific form used for reporting purposes, particularly in the context of tax filings. This form is essential for individuals and businesses to declare certain types of income or deductions that may not be captured by standard forms. Understanding its purpose is crucial for compliance with tax regulations and ensuring accurate reporting to the IRS.

How to use the Code PGM Or

Using the Code PGM Or involves several steps to ensure proper completion and submission. First, gather all necessary financial documents that pertain to the income or deductions you plan to report. Next, fill out the form accurately, ensuring that all information is complete and correct. Once completed, review the form for any errors before submission. Finally, submit the form through the appropriate channels, whether online, by mail, or in person, to ensure it is received by the IRS or relevant authority.

Steps to complete the Code PGM Or

Completing the Code PGM Or requires careful attention to detail. Begin by identifying the specific sections of the form that apply to your situation. Fill in your personal information, including your name, address, and taxpayer identification number. Next, detail the income or deductions you are reporting, ensuring that all figures are accurate. After completing all sections, double-check for any mistakes or omissions. Once you are confident that the form is accurate, sign and date it before submitting it.

Legal use of the Code PGM Or

The legal use of the Code PGM Or is governed by IRS guidelines, which dictate how and when the form should be used. It is important to ensure that the information reported is truthful and reflects your financial situation accurately. Misuse of the form can lead to penalties or audits, so understanding the legal implications is vital. Compliance with the requirements set forth by the IRS helps protect taxpayers from potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Code PGM Or are critical for compliance with tax regulations. Typically, forms must be submitted by the tax filing deadline, which is usually April 15 for most taxpayers. However, specific situations may warrant different deadlines, such as extensions or special circumstances. It is important to stay informed about any changes to deadlines to avoid penalties associated with late submissions.

Required Documents

When completing the Code PGM Or, certain documents are required to support the information reported. These may include W-2 forms, 1099 forms, and any relevant receipts or financial statements that substantiate your claims. Having these documents readily available will facilitate a smoother completion process and ensure that your submission is accurate and complete.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Code PGM Or can result in significant penalties. These may include fines, interest on unpaid taxes, and potential audits by the IRS. It is crucial to understand the importance of timely and accurate submissions to avoid these consequences. Maintaining proper records and adhering to filing deadlines can help mitigate the risk of non-compliance.

Quick guide on how to complete code pgm or

Complete Code PGM Or seamlessly on any device

Online document management has gained traction with businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Code PGM Or on any device with airSlate SignNow Android or iOS applications and enhance any document-centered procedure today.

How to modify and eSign Code PGM Or effortlessly

- Find Code PGM Or and then click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your updates.

- Choose your preferred method to send your form: via email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or mislaid documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Code PGM Or and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Code PGM Or and how does it work with airSlate SignNow?

Code PGM Or is a unique identifier that helps streamline document processes in airSlate SignNow. This code allows users to easily track, manage, and access their documents for eSigning. By integrating Code PGM Or, businesses can enhance their document workflow efficiency.

-

How much does airSlate SignNow cost when using Code PGM Or?

The pricing of airSlate SignNow varies based on the plan you choose, and using Code PGM Or typically falls within these plans. The platform offers competitive pricing that makes it cost-effective for businesses of all sizes. You can find detailed pricing information on our website.

-

What are the key features of airSlate SignNow related to Code PGM Or?

Key features of airSlate SignNow include eSigning, automated workflows, and document management, all enhanced by the use of Code PGM Or. This easy-to-use solution allows users to create, send, and sign documents with unique identifiers for better organization and tracking. Discover how these features can signNowly improve your business processes.

-

What benefits does Code PGM Or provide when using airSlate SignNow?

Using Code PGM Or with airSlate SignNow provides several benefits, including improved document tracking and management. It simplifies workflow automation and enhances collaboration among team members. This results in reduced turnaround times and increased productivity.

-

Can I integrate airSlate SignNow with other applications using Code PGM Or?

Yes, airSlate SignNow offers seamless integrations with various applications, and the use of Code PGM Or further simplifies this process. You can connect with CRM, productivity tools, and more to enhance your document management capabilities. Check our integrations page for a full list of supported platforms.

-

Is there a mobile app for airSlate SignNow that supports Code PGM Or?

Absolutely, airSlate SignNow has a mobile app that fully supports the usage of Code PGM Or. With the app, you can manage your documents, eSign on-the-go, and utilize the unique identifier for better organization. This mobile capability ensures that you can access your important documents anytime, anywhere.

-

How secure is my data when using Code PGM Or with airSlate SignNow?

Data security is a top priority at airSlate SignNow, and using Code PGM Or does not compromise that. The platform utilizes advanced encryption and secure protocols to protect your documents and personal information. You can confidently manage your documents knowing that they are safe and secure.

Get more for Code PGM Or

Find out other Code PGM Or

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed