El Paso County Property Tax Exemption for Seniors 2015

What is the El Paso County Property Tax Exemption For Seniors

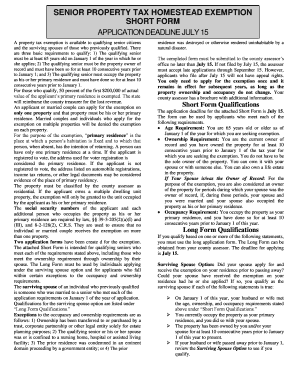

The El Paso County property tax exemption for seniors is a financial benefit designed to reduce the property tax burden for eligible senior citizens. This exemption allows qualifying seniors to receive a reduction in the assessed value of their property, which in turn lowers the amount of property tax owed. The program aims to support older adults, particularly those on fixed incomes, by making homeownership more affordable. Eligibility criteria typically include age requirements, income limits, and residency stipulations.

Eligibility Criteria

To qualify for the El Paso County senior property tax exemption, applicants generally need to meet specific criteria:

- Age: Applicants must be at least sixty-five years old.

- Residency: The property must be the applicant's primary residence.

- Income: There may be income limits that determine eligibility, ensuring the exemption assists those in greater financial need.

It's important for applicants to verify their eligibility based on the most current guidelines set by local authorities.

How to Obtain the El Paso County Property Tax Exemption For Seniors

Obtaining the El Paso County property tax exemption for seniors typically involves several steps. First, seniors should gather necessary documentation, including proof of age, residency, and income. Next, they need to complete the application form, which can often be found on the county's official website or at local government offices. After filling out the form, applicants can submit it either online, by mail, or in person, depending on the options available. Following submission, it is advisable to keep a copy of the application for personal records.

Steps to Complete the El Paso County Property Tax Exemption For Seniors

Completing the application for the El Paso County property tax exemption for seniors involves the following steps:

- Gather required documents, including proof of age and income.

- Access the application form through the county's website or local office.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the application for any errors or missing information.

- Submit the application via the preferred method: online, mail, or in person.

- Keep a copy of the submitted application for your records.

Required Documents

When applying for the El Paso County property tax exemption for seniors, applicants typically need to provide several key documents:

- Proof of age, such as a birth certificate or driver's license.

- Documentation of income, which may include tax returns or pay stubs.

- Proof of residency, such as a utility bill or lease agreement.

Having these documents ready can streamline the application process and help ensure eligibility is clearly demonstrated.

Form Submission Methods

Applicants for the El Paso County property tax exemption for seniors can submit their forms through various methods, depending on the options provided by the county. Common submission methods include:

- Online submission via the county's official website.

- Mailing the completed form to the designated county office.

- In-person submission at local government offices.

Choosing the most convenient method can help ensure timely processing of the application.

Quick guide on how to complete el paso county property tax exemption for seniors

Effortlessly Create El Paso County Property Tax Exemption For Seniors on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to swiftly create, modify, and electronically sign your documents without any holdups. Handle El Paso County Property Tax Exemption For Seniors on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Simplest Method to Edit and eSign El Paso County Property Tax Exemption For Seniors with Ease

- Find El Paso County Property Tax Exemption For Seniors and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive details using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method of sending your form—via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, frustrating form searches, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Edit and eSign El Paso County Property Tax Exemption For Seniors to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct el paso county property tax exemption for seniors

Create this form in 5 minutes!

How to create an eSignature for the el paso county property tax exemption for seniors

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the el paso county property tax exemption for seniors?

The El Paso County property tax exemption for seniors is a program designed to reduce property taxes for eligible senior citizens. This exemption helps alleviate the financial burden on seniors, allowing them to retain their homes and improve their overall quality of life.

-

Who qualifies for the el paso county property tax exemption for seniors?

To qualify for the El Paso County property tax exemption for seniors, applicants must be at least 65 years old and have lived in their home for a specific period. Additionally, they must meet certain income limits set by the county to ensure that the exemption benefits those in need.

-

How much can I save with the el paso county property tax exemption for seniors?

The savings from the El Paso County property tax exemption for seniors can vary based on property values and tax rates. However, eligible seniors can signNowly reduce their property tax bills, providing them with essential financial relief.

-

How do I apply for the el paso county property tax exemption for seniors?

To apply for the El Paso County property tax exemption for seniors, you will need to complete an application form available through the county's official website. It's essential to gather all necessary documents, such as proof of age and income, to ensure a smooth application process.

-

Is there a deadline to apply for the el paso county property tax exemption for seniors?

Yes, there is typically a deadline to apply for the El Paso County property tax exemption for seniors. It is crucial to submit your application by the designated deadline, which is usually set by the county each year to qualify for the following tax year's exemption.

-

Can the el paso county property tax exemption for seniors be renewed annually?

Yes, the El Paso County property tax exemption for seniors can be renewed each year, provided that the homeowner continues to meet eligibility requirements. It is advisable to keep updated records of income and residency for seamless renewal.

-

Will receiving the el paso county property tax exemption for seniors affect my eligibility for other programs?

Receiving the El Paso County property tax exemption for seniors generally does not affect eligibility for other senior programs. However, it is advisable to consult with a financial advisor or program representative to understand any potential impacts on additional benefits.

Get more for El Paso County Property Tax Exemption For Seniors

Find out other El Paso County Property Tax Exemption For Seniors

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure