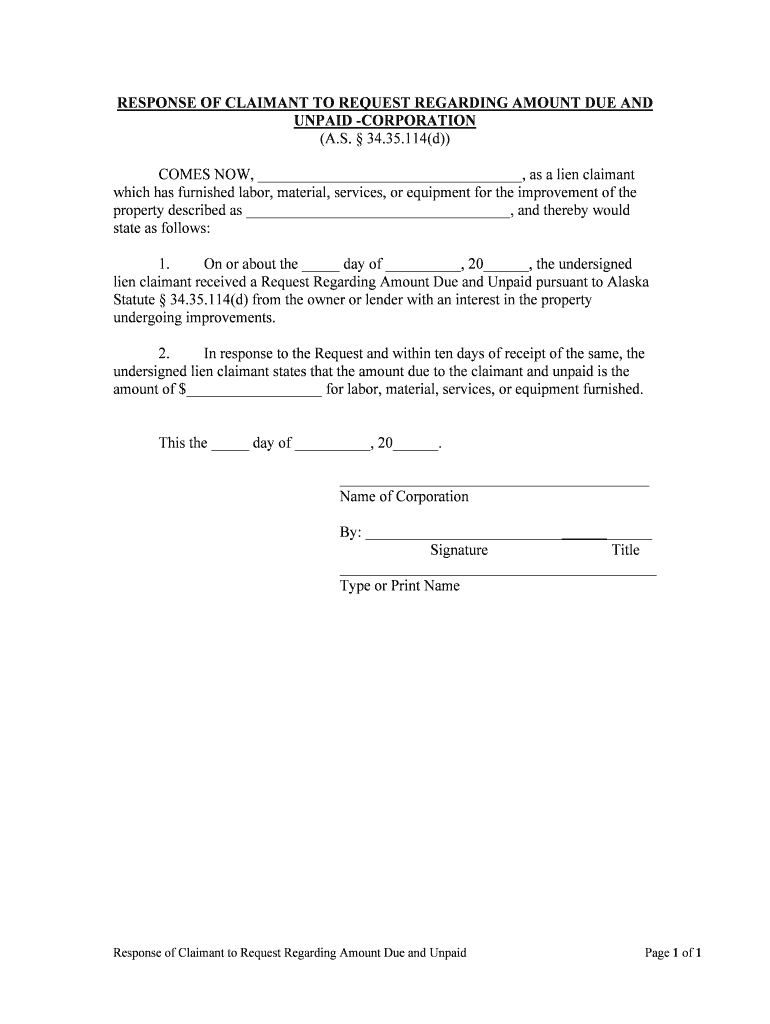

UNPAID CORPORATION Form

What is the Unpaid Corporation?

The unpaid corporation form is a legal document used primarily in the context of business operations where no financial transactions occur. This form is essential for organizations that operate without generating income, often for non-profit purposes or as part of a larger corporate structure. It helps clarify the status of the corporation, ensuring compliance with state regulations and maintaining transparency in operations. Understanding the implications of this form is crucial for any entity considering its use.

Steps to Complete the Unpaid Corporation

Completing the unpaid corporation form involves several key steps to ensure accuracy and compliance. Begin by gathering the necessary information about your corporation, including its legal name, address, and the names of the officers. Next, fill out the form with precise details, ensuring that all required fields are completed. Once the form is filled out, review it for any errors or omissions. After verification, you can submit the form according to your state’s guidelines, either online or via mail.

Legal Use of the Unpaid Corporation

The unpaid corporation form serves a specific legal purpose within the framework of business law. It is vital for organizations to understand the legal implications of operating as an unpaid corporation. This form helps establish the entity's legitimacy, ensuring that it complies with state laws regarding corporate registration and operation. Additionally, it can protect the corporation's officers from personal liability, provided that all legal requirements are met. Consulting with a legal professional can further clarify the responsibilities and protections associated with this form.

State-Specific Rules for the Unpaid Corporation

Each state has its own regulations regarding the unpaid corporation form, which can significantly affect how it is processed and utilized. It is important to familiarize yourself with the specific requirements in your state, including filing deadlines, necessary documentation, and any fees associated with submission. Some states may have additional stipulations that must be met for the form to be considered valid. Checking with your state’s business regulatory agency can provide clarity on these rules.

Examples of Using the Unpaid Corporation

There are various scenarios in which an unpaid corporation form may be utilized. For instance, a non-profit organization that provides community services without charging fees may need to file this form to maintain its corporate status. Similarly, a start-up that is in the early stages of development and has not yet generated revenue might also use this form to clarify its operational status. These examples illustrate the form's versatility and importance in different business contexts.

Filing Deadlines / Important Dates

Filing deadlines for the unpaid corporation form can vary by state, making it essential to be aware of specific dates to avoid penalties. Generally, the form should be filed annually or as required by state law. Missing these deadlines can result in late fees or even the dissolution of the corporation. Keeping a calendar of important dates related to your corporation's filings can help ensure compliance and maintain good standing with state authorities.

Required Documents

When completing the unpaid corporation form, certain documents may be required to support your submission. These can include proof of the corporation's formation, such as articles of incorporation, identification for the officers, and any previous filings related to the corporation's status. Ensuring that all required documents are included with your submission can help streamline the process and reduce the likelihood of delays or rejections.

Quick guide on how to complete unpaid corporation

Complete UNPAID CORPORATION effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily access the correct template and securely store it online. airSlate SignNow provides all the resources you require to create, amend, and electronically sign your documents swiftly without delays. Manage UNPAID CORPORATION on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to amend and electronically sign UNPAID CORPORATION effortlessly

- Find UNPAID CORPORATION and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select relevant sections of the documents or hide sensitive information with tools specifically designed for that intent by airSlate SignNow.

- Generate your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to finalize your modifications.

- Choose how you wish to distribute your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes requiring the printing of new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign UNPAID CORPORATION and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an UNPAID CORPORATION and how does it affect my business?

An UNPAID CORPORATION is a business entity that has not fulfilled its financial obligations, which can have serious implications for operations. Understanding the status of your UNPAID CORPORATION is essential for maintaining good standing and avoiding penalties. Using tools like airSlate SignNow can help streamline document management, ensuring timely payments and smooth operations.

-

How can airSlate SignNow help with UNPAID CORPORATION management?

airSlate SignNow offers robust document automation features that streamline the management of contracts and invoices related to an UNPAID CORPORATION. By utilizing electronic signatures and secure storage, you can effectively track documents and ensure timely payments. This minimizes the risks associated with unpaid debts and strengthens your business's financial standing.

-

What are the pricing options available for airSlate SignNow regarding UNPAID CORPORATION services?

airSlate SignNow provides flexible pricing plans that cater to different business sizes and needs, particularly for managing UNPAID CORPORATION tasks. Each plan includes features that can help in document management and eSigning, ensuring your corporation stays compliant. Contact our sales team to find the best solution for your specific requirements.

-

Can I integrate airSlate SignNow with my existing software for UNPAID CORPORATION matters?

Yes, airSlate SignNow offers seamless integrations with various software platforms, enhancing your ability to manage UNPAID CORPORATION matters effectively. Popular integrations include CRM and accounting software, which help centralize your business processes. These integrations save time and reduce errors in document handling related to unpaid invoices.

-

What features does airSlate SignNow offer that benefit an UNPAID CORPORATION?

Key features of airSlate SignNow that benefit an UNPAID CORPORATION include electronic signatures, document tracking, and automated workflows. These tools help ensure quick processing of agreements and invoices, thereby improving cash flow. By utilizing these features, you can reduce the likelihood of unpaid debts and enhance operational efficiency.

-

How does airSlate SignNow ensure the security of documents related to my UNPAID CORPORATION?

Security is a priority for airSlate SignNow, especially when dealing with sensitive documents related to an UNPAID CORPORATION. The platform employs bank-level encryption and secure access controls to protect your documents. This ensures that only authorized personnel can view or sign contracts, maintaining the integrity of your sensitive financial information.

-

Are there any benefits of using airSlate SignNow for startups facing UNPAID CORPORATION issues?

For startups, managing an UNPAID CORPORATION can be challenging, but airSlate SignNow offers user-friendly solutions to simplify this process. The platform allows for rapid deployment of documentation procedures, ensuring that startups can secure their cash flow quickly. Additionally, its affordability makes it an attractive option for new businesses looking to minimize operational costs.

Get more for UNPAID CORPORATION

Find out other UNPAID CORPORATION

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form