The Trustors or Settlors of This Form

What is the Trustors or Settlors of This Form?

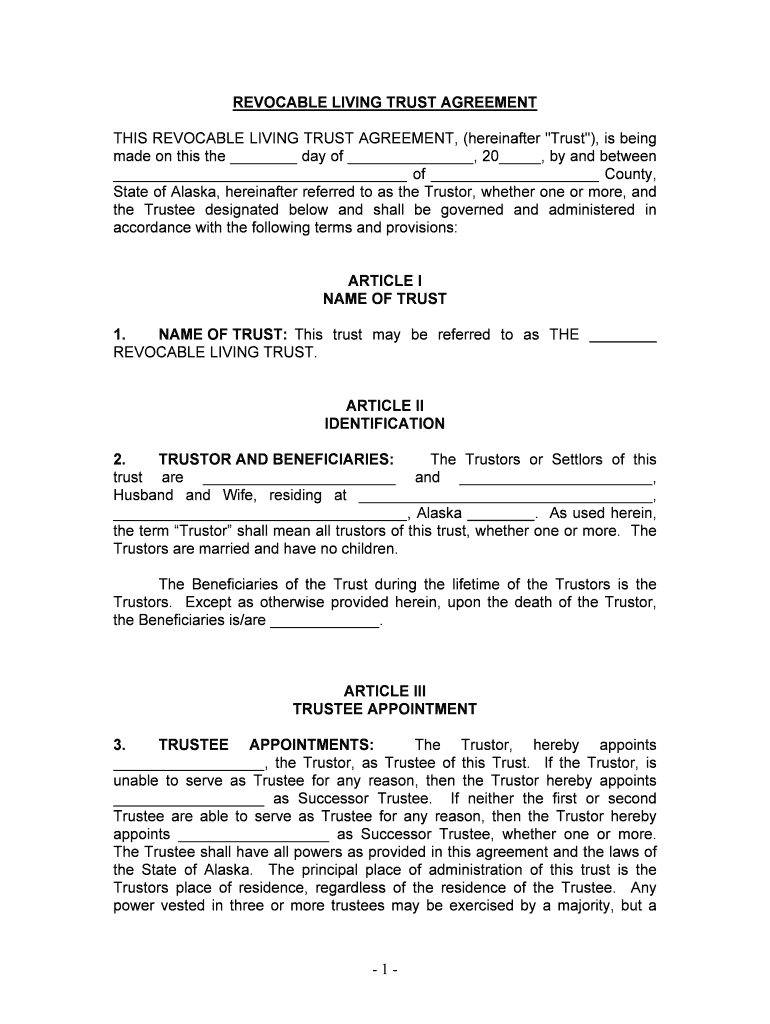

The Trustors or Settlors of This form is a legal document that outlines the individuals or entities responsible for establishing a trust. This form is crucial in defining the roles, responsibilities, and intentions of the parties involved. Trustors or settlors create a trust to manage assets for beneficiaries, ensuring that the assets are distributed according to their wishes. Understanding the purpose and implications of this form is essential for anyone looking to establish a trust.

Key Elements of the Trustors or Settlors of This Form

Several key elements must be included in the Trustors or Settlors of This form to ensure its validity and effectiveness:

- Identification of Trustors or Settlors: Full legal names and addresses of all parties involved.

- Trust Purpose: A clear statement outlining the purpose of the trust.

- Asset Description: Detailed information about the assets being placed in the trust.

- Beneficiaries: Names and details of individuals or entities who will benefit from the trust.

- Trustee Information: Identification of the person or entity responsible for managing the trust.

Steps to Complete the Trustors or Settlors of This Form

Completing the Trustors or Settlors of This form involves several important steps:

- Gather Information: Collect all necessary details about the trustors, assets, and beneficiaries.

- Draft the Form: Fill out the form accurately, ensuring all required fields are completed.

- Review for Accuracy: Double-check the information for any errors or omissions.

- Sign the Document: All trustors or settlors must sign the form to validate it.

- Store Safely: Keep the completed form in a secure location for future reference.

Legal Use of the Trustors or Settlors of This Form

The Trustors or Settlors of This form is legally binding when completed correctly. It must adhere to state laws and regulations governing trusts. This includes ensuring that the trust is established for lawful purposes and that all parties involved understand their rights and obligations. Failure to comply with legal requirements can result in disputes or challenges to the trust's validity.

How to Obtain the Trustors or Settlors of This Form

The Trustors or Settlors of This form can typically be obtained through legal resources, such as attorneys specializing in estate planning, or online legal document services. It is crucial to ensure that the version used complies with state-specific regulations. Consulting with a legal professional can provide guidance on obtaining the correct form and completing it accurately.

Examples of Using the Trustors or Settlors of This Form

There are various scenarios in which the Trustors or Settlors of This form may be utilized:

- Estate Planning: Individuals creating a trust to manage their assets after death.

- Tax Planning: Establishing a trust to minimize tax liabilities for beneficiaries.

- Asset Protection: Protecting assets from creditors or legal claims through a trust.

Quick guide on how to complete the trustors or settlors of this

Effortlessly prepare The Trustors Or Settlors Of This on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as it allows you to obtain the right form and securely save it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents quickly and efficiently. Handle The Trustors Or Settlors Of This seamlessly on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The easiest method to edit and electronically sign The Trustors Or Settlors Of This without hassle

- Obtain The Trustors Or Settlors Of This and then click Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight important sections of your documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to deliver your form, via email, SMS, an invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any chosen device. Modify and electronically sign The Trustors Or Settlors Of This to ensure outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

Who are the trustors or settlors of this document?

The trustors or settlors of this refer to the individuals or entities that create the trust document. They are responsible for establishing the terms and conditions within the trust. Understanding the roles of the trustors or settlors of this is crucial for the effective administration of the trust.

-

How can airSlate SignNow help with trust documentation?

AirSlate SignNow provides a seamless, cost-effective solution for creating and signing trust documents. By utilizing the eSignature features, trustors or settlors of this can easily manage their documents while ensuring compliance. This streamlines the process, allowing for a more efficient document workflow.

-

What are the costs associated with using airSlate SignNow for trust documents?

AirSlate SignNow offers flexible pricing plans designed to suit various needs, including those involving trust documents. The costs can vary depending on the volume of documents and features required. Trustors or settlors of this can review the pricing plans to choose the best fit for their document management needs.

-

Does airSlate SignNow integrate with other software for managing trusts?

Yes, airSlate SignNow offers integrations with various third-party applications that can enhance the management of trust documents. This means trustors or settlors of this can connect their existing tools, which will help streamline operations. Integrating with tools like CRMs or document management systems can greatly improve efficiency.

-

What features does airSlate SignNow offer for trust documentation?

AirSlate SignNow provides an array of features tailored for trust documentation, including customizable templates, audit trails, and secure storage. These features ensure that trustors or settlors of this can create, sign, and manage their documents effectively. Additionally, user-friendly interfaces make it accessible for all parties involved.

-

Is airSlate SignNow secure for handling trust documents?

Absolutely, airSlate SignNow prioritizes security and complies with industry standards to ensure the protection of sensitive documents. Trustors or settlors of this can trust that their information is safeguarded with encryption and secure access protocols. This level of security is essential when dealing with important legal documents.

-

Can I edit trust documents after they have been signed through airSlate SignNow?

Once a trust document is signed through airSlate SignNow, it is typically finalized to maintain its integrity. However, trustors or settlors of this can take advantage of the document versioning features that allow them to create new drafts based on previously signed documents. This makes it easy to revise or update arrangements as needed.

Get more for The Trustors Or Settlors Of This

- F145 1 caac form

- Sch 4u0 unit hydrocarbons worksheet alkanes form

- Form n 445 sample

- Practice creating persuasive leads answer key form

- Nrb bank account opening form

- Sunday school registration form kol hadash humanistic

- Fafsa ready worksheet ladder up goladderup form

- Purchase request check request form account distribution hickoryflat

Find out other The Trustors Or Settlors Of This

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure