The Deed of Trust What it is and How It's Used Form

What is the deed of trust and how is it used?

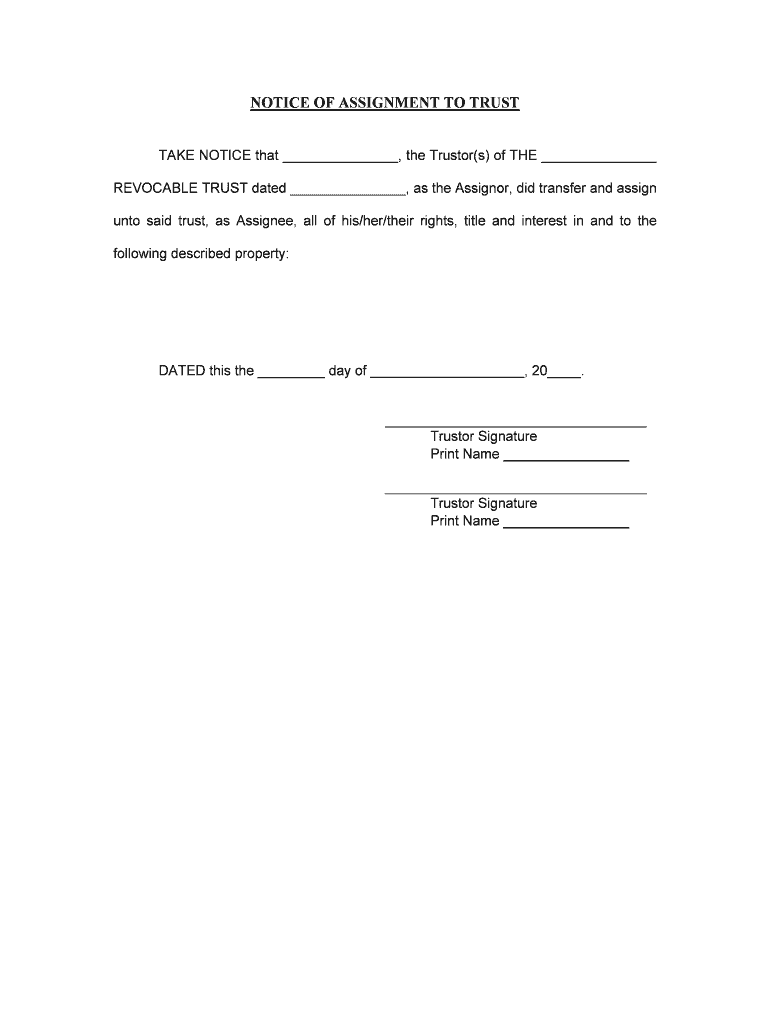

A deed of trust is a legal document that secures a loan by transferring the title of a property to a third party, known as a trustee, until the borrower repays the lender. This arrangement is commonly used in real estate transactions, particularly in the United States. The borrower retains the right to use and occupy the property while making payments, but the trustee holds the title as collateral. In the event of a default, the trustee can initiate a foreclosure process on behalf of the lender, allowing for the sale of the property to recover the owed amount.

Key elements of the deed of trust

Understanding the key elements of a deed of trust is essential for both borrowers and lenders. The primary components include:

- Parties involved: The deed of trust involves three parties: the borrower (trustor), the lender (beneficiary), and the trustee.

- Property description: A detailed description of the property being secured is included to avoid any ambiguity.

- Loan amount: The total amount borrowed is specified, outlining the financial obligation of the borrower.

- Terms of repayment: The deed outlines the repayment schedule, interest rate, and other financial terms.

- Default provisions: Conditions under which the lender can initiate foreclosure in case of borrower default are clearly stated.

Steps to complete the deed of trust

Completing a deed of trust involves several important steps. The process typically includes:

- Drafting the document: Ensure all necessary information, such as the parties involved and property details, is accurately included.

- Reviewing legal requirements: Verify compliance with state laws regarding deed of trust documentation.

- Signing the document: All parties must sign the deed in the presence of a notary public to ensure its validity.

- Recording the deed: Submit the signed deed of trust to the appropriate county recorder’s office to make it a matter of public record.

Legal use of the deed of trust

The legal use of a deed of trust is primarily to secure a loan for real estate transactions. It provides a framework for the lender to recover the loan amount in case of default while allowing the borrower to maintain possession of the property. The deed must comply with state-specific laws and regulations, which can vary significantly. It is crucial for all parties to understand their rights and obligations under the deed of trust and to seek legal advice if necessary.

State-specific rules for the deed of trust

Each state in the U.S. has its own regulations governing the use of deeds of trust. These rules can affect various aspects, including:

- Foreclosure processes: States may have different procedures for how a foreclosure must be conducted.

- Notarization requirements: Some states require specific notarization practices to validate the deed.

- Recording fees: Fees for recording the deed of trust can vary by state and county.

It is advisable for borrowers and lenders to familiarize themselves with their state's specific laws to ensure compliance and avoid potential legal issues.

Examples of using the deed of trust

Deeds of trust are commonly used in various scenarios, such as:

- Home purchases: A borrower secures a mortgage to buy a home, with the property serving as collateral.

- Investment properties: Investors use deeds of trust to finance the purchase of rental properties.

- Refinancing: Homeowners may refinance their existing mortgage using a new deed of trust to secure better terms.

These examples illustrate the versatility of the deed of trust in facilitating real estate transactions while providing security for lenders.

Quick guide on how to complete the deed of trust what it is and how its used

Complete The Deed Of Trust What It Is And How It's Used effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly with no delays. Manage The Deed Of Trust What It Is And How It's Used on any device with the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign The Deed Of Trust What It Is And How It's Used without any hassle

- Obtain The Deed Of Trust What It Is And How It's Used and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional ink signature.

- Review the details and then click the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign The Deed Of Trust What It Is And How It's Used and ensure excellent communication at every step of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is The Deed Of Trust and how is it used?

The Deed Of Trust is a legal document that secures a loan by using property as collateral. It outlines the terms between the borrower, lender, and a third-party trustee. Understanding The Deed Of Trust What It Is And How It's Used is essential for anyone involved in real estate transactions, as it protects both the lender and the borrower.

-

How does airSlate SignNow simplify the process of signing The Deed Of Trust?

airSlate SignNow offers an intuitive platform for digital signatures, making it easy to eSign The Deed Of Trust online. This reduces the need for paper documents and in-person meetings, allowing for a faster and more efficient closing process. It's an effective solution for understanding The Deed Of Trust What It Is And How It's Used.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow provides flexible pricing plans to accommodate various business needs. Users can choose from free trials or subscription plans, depending on the features they require. This cost-effective solution enables users to manage The Deed Of Trust What It Is And How It's Used within their budget.

-

Can I integrate airSlate SignNow with other software for handling The Deed Of Trust?

Yes, airSlate SignNow offers integrations with popular applications such as Google Drive, Salesforce, and more. This makes it easier to manage documents related to The Deed Of Trust What It Is And How It's Used alongside your existing workflows. Such integrations enhance efficiency and document management capabilities.

-

What features does airSlate SignNow provide for The Deed Of Trust?

airSlate SignNow provides features like customizable templates, document tracking, and automated reminders. These tools help streamline the signing process for The Deed Of Trust What It Is And How It's Used. By utilizing these features, you can ensure timely execution and compliance.

-

How secure is airSlate SignNow when handling The Deed Of Trust?

airSlate SignNow prioritizes security with bank-level encryption and secure cloud storage. This ensures that your documents, including The Deed Of Trust What It Is And How It's Used, are safeguarded against unauthorized access. Trust in airSlate SignNow for secure document handling.

-

What benefits can users expect from using airSlate SignNow for The Deed Of Trust?

By using airSlate SignNow, users can expect increased efficiency, reduced turnaround times, and improved document accuracy. Understanding The Deed Of Trust What It Is And How It's Used becomes less complicated, as the platform simplifies the signing process for all parties involved. Enhanced productivity is just a few clicks away.

Get more for The Deed Of Trust What It Is And How It's Used

Find out other The Deed Of Trust What It Is And How It's Used

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online