Fdic Notification 2005-2026

What is the FDIC Notification

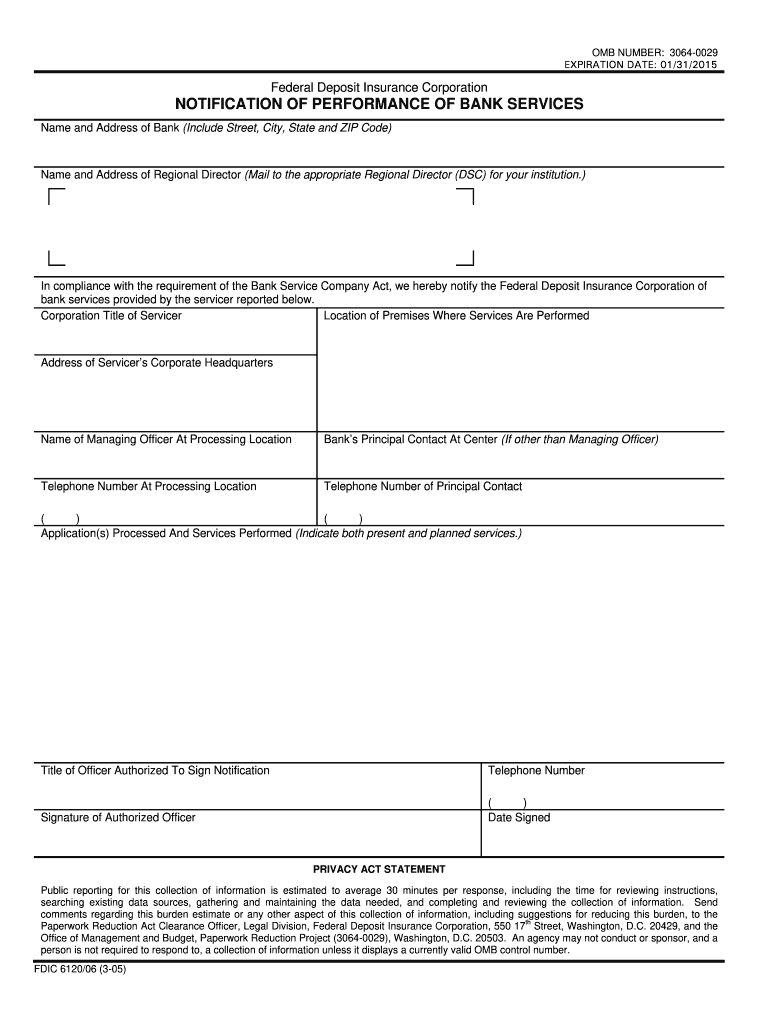

The FDIC notification is a formal document that informs customers about the performance of bank services as required by the Federal Deposit Insurance Corporation (FDIC). This notification is essential for maintaining transparency between financial institutions and their clients, ensuring that customers are aware of their rights and the services provided. It typically includes details about the bank's operations, any changes in services, and important compliance information.

How to Use the FDIC Notification

Using the FDIC notification involves understanding its contents and implications for your banking relationship. Customers should review the notification carefully to comprehend the services offered and any changes that may affect them. It is advisable to keep a copy of the notification for personal records and reference it when needed, especially if there are questions regarding service performance or compliance issues.

Steps to Complete the FDIC Notification

Completing the FDIC notification involves several key steps:

- Obtain the correct form from your financial institution or the FDIC website.

- Fill in all required fields accurately, ensuring that the information is current and truthful.

- Sign the notification using a legally-recognized electronic signature if submitting online.

- Submit the completed notification according to the instructions provided, whether online, by mail, or in person.

Legal Use of the FDIC Notification

The legal use of the FDIC notification is crucial for ensuring that all banking transactions and communications are compliant with federal regulations. This document serves as a record of the bank's obligations to its customers and can be referenced in case of disputes. It is essential to use the notification in accordance with FDIC guidelines to maintain its legal standing.

Key Elements of the FDIC Notification

Key elements of the FDIC notification include:

- Identification of the financial institution and its services.

- Disclosure of any changes in service terms or conditions.

- Information regarding customer rights and responsibilities.

- Contact information for customer inquiries or complaints.

Form Submission Methods

The FDIC notification can be submitted through various methods, depending on the bank's policies. Common submission methods include:

- Online submission through the bank's secure portal.

- Mailing the completed form to the designated address provided by the bank.

- In-person submission at the bank's branch office.

Penalties for Non-Compliance

Failure to comply with the requirements of the FDIC notification can result in penalties for both the financial institution and the customer. These penalties may include fines, legal action, or loss of banking privileges. It is important for customers to understand their responsibilities regarding the notification to avoid potential issues.

Quick guide on how to complete notification performance bank

A simple guide on how to complete Fdic Notification

Filling out digital documents has shown to be more efficient and reliable than conventional pen-and-paper techniques. Unlike physically writing on paper forms, correcting a mistake or inserting data in the wrong area is swift. Such errors can be a signNow hindrance when preparing applications and requests. Consider utilizing airSlate SignNow for processing your Fdic Notification. Our robust, user-friendly, and compliant electronic signature platform will streamline this process for you.

Follow our steps on how to quickly fill out and sign your Fdic Notification with airSlate SignNow:

- Verify your chosen document’s intent to ensure it meets your needs, and click Get Form if it does.

- Find your template uploaded to our editor and explore what our tool provides for form customization.

- Complete vacant fields with your information and check boxes using Check or Cross options.

- Insert Text boxes, replace existing content, and place Images wherever needed.

- Utilize the Highlight feature to emphasize what you wish to showcase, and conceal irrelevant parts for your recipient with the Blackout tool.

- In the right panel, create additional fillable fields designated to specific parties if necessary.

- Secure your form with watermarks or establish a password after completing the edits.

- Input Date, click Sign → Add signature and choose your signing method.

- Sketch, type, upload, or create your legally binding electronic signature with a QR code or by using the camera on your device.

- Review your responses and click Done to finalize editing and proceed with form sharing.

Utilize airSlate SignNow to complete your Fdic Notification and manage other professional fillable forms securely and efficiently. Register today!

Create this form in 5 minutes or less

FAQs

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

Musicians: How many songs do you think you'd need to perform to fill out a two-hour gig?

A two-hour gig? That's 120 minutes of on stage performance or setup inclusion? I'll go with stage time, and also assume you've negotiated appropriate setup, and such.Another assumption is genre. I'll assume it's pop structured (as most radio friendly music is these days), so average song time would be roughly 3 and a half minutes…give or take.You're looking at roughly 30 songs. Thats…over 2 hours. Now, that's a rough estimate, as song times vary, etc.Oh, but wait. You'll need to include breaks, for “personnel” i.e. the band members. Normally, the drummer will need the longest break, followed by others. The drummer is using all four limbs continuously, so…they need them.If you're headlining, and depending on what you've negotiated, you might not be allotted “dead air”, so someone's staying on stage on breaks. Usually, that means at least a guitar player and/or the singer. Maybe not a long guitar solo, but…maybe an acoustic filler/singalong for the crowd. Plus, in between banter, there's that too (paring that down was always a plus for us back in the day)So, practice 30ish and get them flawless, because you're only going to need 20ish. Why 30ish? Because…more is good for flexibility. Always. Plus, it allows you to keep your set list semi-”fresh”, while only putting in a little extra work.setlist.fm - the setlist wiki is a good resource for structuring a setlist in a professional way (I wish it was around during the “trial and error” days.)

-

How do I apply for ISP (Internet service provider) license in India?

Step 1: How to (apply for &) get an ISP license in India? – Check EligibilityTo obtain an ISP license, you require a registered company under the Companies Act, 1956. You can log on to the Registrar of Companies’ website for more information on how to register a company if you haven’t already registered yours.Step 2: How to (apply for &) get an ISP license in India? – Choose a suitable ISP license category to apply underThe next step to obtaining an ISP license is to know / decide which category of license you require – category A, B or C. Click here to know more about how to select the right category for your ISP License.In India, there are 3 different categories of licenses to become an internet service provider, depending upon the City/State/Town/District/Village you want to start your ISP business in.The 3 categories of ISP licenses are:Class A (National Area)Class B (Telecom Circle/Metro Area)Class C (Secondary Switching Area)Naturally, a Class A ISP license would be quite expensive, followed by Class B & C respectively.Step 3: How to (apply for &) get an ISP license in India? – Budgeting and CostingTo promote internet access in smaller towns, cities & villages, the Government of India has made a conscious effort to ease prices of a Class C license compared to a Class A or B license.The following table will explain the financial entry conditions you require to fulfill in order to obtain a Class A/B/C ISP license:ServiceMinimum EquityMinimum Net worthEntry Fee (Rs.)Performance BG (Rs.)Financial BG (Rs.)Application Processing Fee (Rs.)Total Capital Required (Rs.)ISP “A” (National Area)NilNil30 Lakh2 Crores10 Lakh50 Thousand2,40,50,000ISP “B” (Telecom circle/Metro Area)NilNil2 Lakh10 Lakh1 Lakh15 Thousand13,15,000ISP “C” (SSA)NilNil20 Thousand50 Thousand10 Thousand10 Thousand90,000As you can see above, the total capital required for a Class C license is INR 90,000/- whereas for a Class A license is as high as 2 ½ crores.Thus, in order to become a Class C ISP licence holder, you don’t require more than Rs. 3-4 lakhs, depending on the lawyer / ISP consultant fees.Once you have selected the category of the ISP license you want to obtain, it is important to know how the entire application process goes.Now, let’s take you through on how to apply for an ISP license & the documents, legal help, etc. you will require.Step 4: How to (apply for &) get an ISP license in India? – Initial Application ProcessAfter you have chosen your ISP license category, you will need to fill out an application form.Along with the form, a non-refundable Processing Fee of INR 15,000/- must be paid by the applicant, along with 2 copies of the application form, by DD/Pay Order from a Schedule Bank payable at New Delhi issued in the name of Pay & Accounts Officer (Headquarter) DOT.Provide all required official documents. Click here to know the list of documents required.Step 5: How to (apply for &) get an ISP license in India? – Document ReviewOnce you have submitted your application form along with the required documents & fees, the Department of Telecom will review your application & respond to you, the applicant, in under 60 days, as far as practicable i.e. in case there are any issues with your application, there may be a delay in the issuing of a response from the DOT.If there is no problem with your complete application, the DOT will issue a ‘Letter of Intent’ in your favor. However, there are chances that your application may be rejected or delayed due to non-compliance with legal, security, hardware, commercial and contractual compliance and human errors such as incomplete form submission.Therefore, it is important to get an ISP consultant / lawyer to review your application before you submit your application form for obtaining the ISP authorization under the Unified License . Click here to know more.Step 6: How to (apply for &) get an ISP license in India? – Letter of IntentIf there are no issues with your application form for obtaining the ISP authorization under the Unified License, the DOT will issue a ‘Letter of Intent’ in your favor. Once the Letter of Intent is issued,You will have to submit the one-time entry fee (as mentioned in the table above) along with the required bank guarantees.The total of both for Category A is 2.4 crores, for category B is 13 lakh & for category C is 80,000/-.Furthermore, you will have to submit a signed license agreement with the DOT and any other documents required, including the documents mentioned in the Letter of Intent.Do note that the one-time entry fee is non-refundable & once the Letter of intent is issued, all the above requirements have to be fulfilled within a specific period that will be mentioned in the Letter of Intent.Step 7: How to (apply for &) get an ISP license in India? – ConfirmationIf everything goes smoothly, you will be issued an ISP authorization under the Unified License for a period of 20 years. The DOT will contact you / mail you directly to inform you whether you have been issued the ISP License.Step 8: How to (apply for &) get an ISP license in India? Conclusion – Need for Expertise: Get/Apply an ISP license in IndiaThe process of ISP licensing is technical and lengthy for a common person to comprehend. There have been quite a few instances where the application is rejected because of an incomplete submission, missing information, non-compliance, missing documents etc. Thus, it is advisable to get your documents & forms reviewed by a professional ISP consultant or lawyer to make sure you don’t lose out on time & money.Click here to know more about our ISP consultancy.Disclaimer: the rules keep changing as per notifications by DOT and Govt. This information was published on Oct’2016. Do not treat this as professional advice, kindly contact us for up-to-date compliance and to avail professional assistance for your application.- FROM How to apply for an ISP license in India

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How do I fill out a bank deposit slip?

You would have to show up in person at a branch location that belongs to your bank where your bank account is open. Most banks have a lines for the customers to get in line and wait for their turn to talk to the bank teller. Most banks will have a section in the middle of this section where they have a bunch of blank documents and a deposit slip is included there.There is specific information that you need to know in order to fill the bank deposit slip correctly and you don't have to spend time memorizing it or take documents of that information with you. All you have to do is just write it down in a piece of paper and then reap into pieces the paper when you are done. The information that you need to fill out the deposit slip is your account number. What is it that you are depositing a check or cash and what is the exact amount to be deposited. The deposit slip should include your name and your signature.In type of deposit slip, you would have to also check whether you are depositing the funds into your bank checkings account or into your bank savings account and your address. The signature section is a part that can only be signed in the presence of a bank teller. You would also have to write the date on which this deposit takes place.Some deposit slips differ in one or two things from the others but for the most part they all are very similar in many ways. In this deposit slip, you would not have to write the date or your address or whether it goes to a savings or checking accounts but all other information still applies.Note that in the two types of the deposits samples there is a section that says “subtotal” and another that says “less cash”. Those two sections are only applicable when you present a check to be cash but you also want part of that check to deposit into your account. For example, let us say that you present a check with the total funds of 1458 but you want to receive 800 in cash and the remaining balance is two be deposited. In that case, the subtotal would say “1458” and the “less cash” section would say “800” the the “total” section would say “658”. Those types of deposit slips are provided to you free of charge at the bank.The deposit slip shown above is another type of bank deposit slip which is more convenient and you have less possibilities of making entry errors because those types of deposit slips are already personalized and they already have your bank account, name and address printed on them. All you have to do is fill out the amount that you depositing into your bank account and whether it is a check or cash. However, the personalized deposit slips costs money.At the end of the successful deposit transaction, you should received from the bank teller a deposit receipt which summarizes the how much was deposited and your new bank account balance. Some advanced banks will even print a receipt with an image of the check that was deposited.

-

How do I fill out a SunTrust Bank application?

Go to the website Personal, Mortgage & Small Business Banking.You will find a link to fill out an application.

Create this form in 5 minutes!

How to create an eSignature for the notification performance bank

How to make an electronic signature for the Notification Performance Bank online

How to generate an eSignature for your Notification Performance Bank in Google Chrome

How to create an eSignature for putting it on the Notification Performance Bank in Gmail

How to create an electronic signature for the Notification Performance Bank right from your smartphone

How to make an electronic signature for the Notification Performance Bank on iOS devices

How to generate an eSignature for the Notification Performance Bank on Android OS

People also ask

-

What is FDIC Notification and why is it important for businesses?

FDIC Notification refers to the alerts and updates from the Federal Deposit Insurance Corporation regarding important financial regulations and compliance requirements. Understanding FDIC Notification is crucial for businesses as it helps them stay compliant and avoid potential penalties. By using airSlate SignNow, businesses can ensure that their document management processes align with these notifications.

-

How does airSlate SignNow ensure compliance with FDIC Notification?

airSlate SignNow provides features that help businesses align with FDIC Notification by ensuring secure electronic signatures and document management. Our platform offers audit trails and compliance checks that can assist in meeting regulatory requirements. This means you can focus on your business while we handle the compliance aspects related to FDIC Notification.

-

What are the pricing plans for airSlate SignNow in relation to FDIC Notification compliance?

Our pricing plans for airSlate SignNow are designed to be cost-effective, catering to businesses of all sizes. Each plan includes features that help manage compliance with FDIC Notification, ensuring you have the tools to stay updated without breaking the bank. You can choose a plan that fits your needs, whether you're a small business or a large enterprise.

-

Can I integrate airSlate SignNow with other software to manage FDIC Notification?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing your ability to manage FDIC Notification effectively. Whether you use CRM systems, document management solutions, or other business tools, our integrations ensure that all your documents are compliant and accessible. This way, you can streamline your processes while staying informed about FDIC Notification.

-

What features of airSlate SignNow assist with understanding FDIC Notification?

airSlate SignNow offers features like document templates, e-signatures, and real-time notifications that can help you understand and act on FDIC Notification quickly. These tools streamline document workflows, allowing you to focus on important updates and compliance requirements. With airSlate SignNow, you can easily manage your documents while staying informed about any FDIC Notification.

-

How does e-signing with airSlate SignNow support FDIC Notification requirements?

E-signing with airSlate SignNow supports FDIC Notification requirements by providing a secure and legally binding way to sign documents. Our platform ensures that all signatures are encrypted and comply with federal regulations, making it easier for businesses to adhere to FDIC Notification guidelines. This provides peace of mind that your signed documents are both secure and compliant.

-

What benefits does airSlate SignNow offer in relation to FDIC Notification?

The primary benefit of using airSlate SignNow in relation to FDIC Notification is enhanced compliance and security in document management. Our platform simplifies the signing process while ensuring that you receive timely updates regarding FDIC Notification, helping you avoid any compliance issues. Additionally, the cost-effective nature of our solution allows businesses to manage their resources efficiently.

Get more for Fdic Notification

- Of chart coordinated highways action response team form

- Illinois history of illinois dui laws form

- Free illinois boat bill of sale formpdfword doc

- Application for authorization to use crossbow for iowa dnr form

- Application for authorization to use crossbow for iowadnr form

- Npdes form 2 for industrial facilities

- Manual for the certification of laboratories form

- Free louisiana movable property bill of sale formpdf

Find out other Fdic Notification

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online