OWNER'S RESPONSE to WRITTEN REQUESTCORPORATION, LLC, Etc Form

What is the OWNER'S RESPONSE TO WRITTEN REQUESTCORPORATION, LLC, Etc

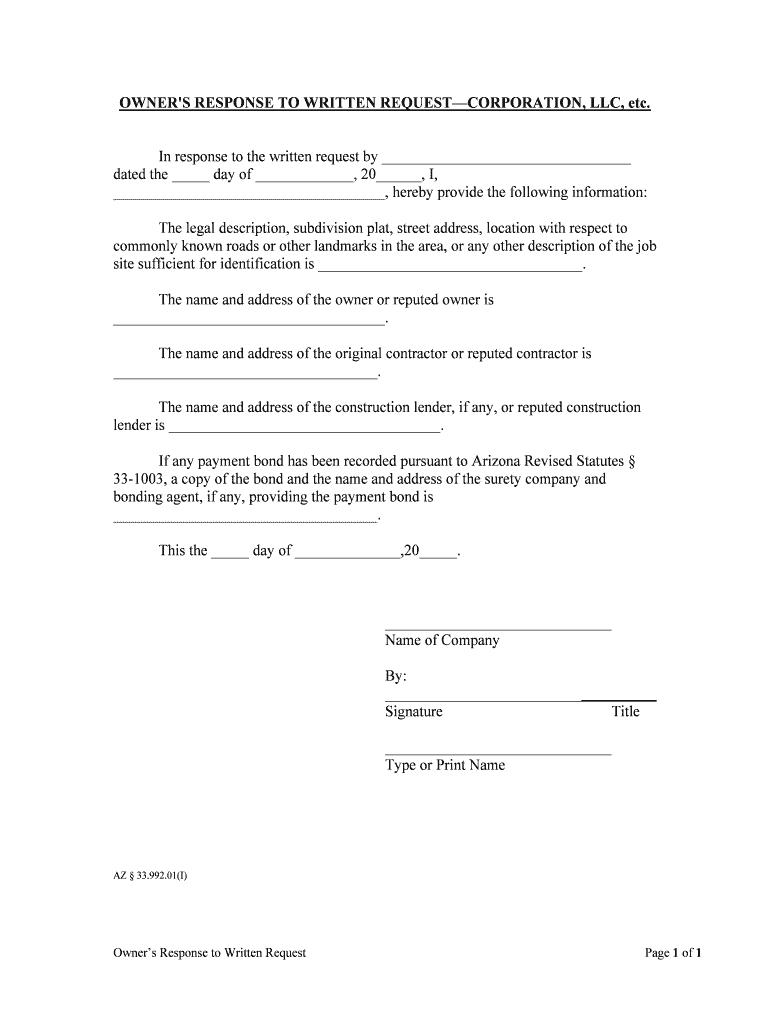

The OWNER'S RESPONSE TO WRITTEN REQUESTCORPORATION, LLC, Etc is a formal document that serves as a reply from a business entity, such as a corporation or limited liability company (LLC), to a written request made by another party. This form is essential in maintaining clear communication and ensuring that the responding entity addresses the inquiry or request appropriately. It typically includes details such as the name of the business, the nature of the request, and the owner's response, which may contain information, clarifications, or denials regarding the request.

Key elements of the OWNER'S RESPONSE TO WRITTEN REQUESTCORPORATION, LLC, Etc

When completing the OWNER'S RESPONSE TO WRITTEN REQUESTCORPORATION, LLC, Etc, it is crucial to include specific key elements to ensure its validity and clarity. These elements typically include:

- Business Information: The name and address of the corporation or LLC.

- Request Details: A clear reference to the original written request, including the date it was received.

- Response Content: The owner's detailed response, addressing the request's specifics.

- Signature: The owner's signature, which may need to be notarized depending on the jurisdiction.

- Date: The date when the response is completed and sent.

Steps to complete the OWNER'S RESPONSE TO WRITTEN REQUESTCORPORATION, LLC, Etc

Completing the OWNER'S RESPONSE TO WRITTEN REQUESTCORPORATION, LLC, Etc involves several methodical steps to ensure accuracy and compliance. Here are the recommended steps:

- Gather all relevant information regarding the original request.

- Draft the response, ensuring clarity and addressing all points raised in the request.

- Include all required elements, such as business information and the owner's signature.

- Review the document for any errors or omissions.

- Finalize the document by signing and dating it.

- Send the completed response to the requesting party, ensuring it is delivered securely.

Legal use of the OWNER'S RESPONSE TO WRITTEN REQUESTCORPORATION, LLC, Etc

The legal use of the OWNER'S RESPONSE TO WRITTEN REQUESTCORPORATION, LLC, Etc is significant in ensuring that the response is recognized as valid and binding. This document should comply with applicable state laws regarding business communications and responses. It is essential to maintain a record of the request and the response, as these documents may be necessary for legal proceedings or audits. Additionally, ensuring that the response is sent in a manner that confirms receipt can help protect the business's interests.

How to obtain the OWNER'S RESPONSE TO WRITTEN REQUESTCORPORATION, LLC, Etc

Obtaining the OWNER'S RESPONSE TO WRITTEN REQUESTCORPORATION, LLC, Etc typically involves accessing the necessary forms through official business resources or legal document providers. Many states may have specific templates available online, or businesses can create their own using standard legal formats. It is advisable to consult with a legal professional to ensure that the form meets all legal requirements and is tailored to the specific situation at hand.

Examples of using the OWNER'S RESPONSE TO WRITTEN REQUESTCORPORATION, LLC, Etc

Examples of situations where the OWNER'S RESPONSE TO WRITTEN REQUESTCORPORATION, LLC, Etc may be used include:

- A request for information from a regulatory body regarding compliance issues.

- A response to a customer inquiry about a product or service.

- Addressing a formal complaint from a client or partner.

- Providing clarification on contractual obligations after a written request.

Quick guide on how to complete owners response to written requestcorporation llc etc

Complete OWNER'S RESPONSE TO WRITTEN REQUESTCORPORATION, LLC, Etc seamlessly on any device

Web-based document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage OWNER'S RESPONSE TO WRITTEN REQUESTCORPORATION, LLC, Etc on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign OWNER'S RESPONSE TO WRITTEN REQUESTCORPORATION, LLC, Etc effortlessly

- Locate OWNER'S RESPONSE TO WRITTEN REQUESTCORPORATION, LLC, Etc and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive data using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign OWNER'S RESPONSE TO WRITTEN REQUESTCORPORATION, LLC, Etc to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an OWNER'S RESPONSE TO WRITTEN REQUEST CORPORATION, LLC, Etc.?

An OWNER'S RESPONSE TO WRITTEN REQUEST CORPORATION, LLC, Etc. is a formal document that addresses inquiries or requests submitted to a business entity. It ensures that the organization responds appropriately and maintains proper communication protocols, which is essential for legal compliance and customer relations.

-

How can airSlate SignNow facilitate my OWNER'S RESPONSE TO WRITTEN REQUEST CORPORATION, LLC, Etc.?

airSlate SignNow allows you to easily create, send, and eSign your OWNER'S RESPONSE TO WRITTEN REQUEST CORPORATION, LLC, Etc. documents. With its user-friendly interface, you can streamline your document processes and ensure that your responses are timely and legally binding.

-

Is there a cost associated with using airSlate SignNow for OWNER'S RESPONSE TO WRITTEN REQUEST CORPORATION, LLC, Etc.?

Yes, airSlate SignNow offers competitive pricing based on your usage needs. We provide different plans suitable for individuals and businesses, ensuring that our solutions for handling OWNER'S RESPONSE TO WRITTEN REQUEST CORPORATION, LLC, Etc. documents are cost-effective and scalable.

-

What features does airSlate SignNow provide for my OWNER'S RESPONSE TO WRITTEN REQUEST CORPORATION, LLC, Etc. documents?

airSlate SignNow includes features such as document templates, team collaboration tools, and real-time tracking. These functionalities help you efficiently manage your OWNER'S RESPONSE TO WRITTEN REQUEST CORPORATION, LLC, Etc. communications and improve your workflow.

-

Can I integrate airSlate SignNow with other tools I use for managing OWNER'S RESPONSE TO WRITTEN REQUEST CORPORATION, LLC, Etc.?

Absolutely! airSlate SignNow provides seamless integrations with various business applications, enhancing your ability to manage OWNER'S RESPONSE TO WRITTEN REQUEST CORPORATION, LLC, Etc. documents alongside your other critical tools. This integration capability maximizes efficiency and reduces manual entry.

-

How secure is the process of eSigning OWNER'S RESPONSE TO WRITTEN REQUEST CORPORATION, LLC, Etc. documents with airSlate SignNow?

Security is paramount at airSlate SignNow. We ensure that the eSigning of OWNER'S RESPONSE TO WRITTEN REQUEST CORPORATION, LLC, Etc. documents is protected through encryption and compliance with industry standards, assuring that your sensitive data remains confidential.

-

What customer support options are available for airSlate SignNow users dealing with OWNER'S RESPONSE TO WRITTEN REQUEST CORPORATION, LLC, Etc.?

airSlate SignNow offers various customer support options including live chat, email support, and comprehensive online resources. Our dedicated team is ready to assist you with any inquiries or issues related to your OWNER'S RESPONSE TO WRITTEN REQUEST CORPORATION, LLC, Etc. processes.

Get more for OWNER'S RESPONSE TO WRITTEN REQUESTCORPORATION, LLC, Etc

- Saint davids episcopal church sunday school registration form sdlife

- Htma submittal form tei trace elements

- Illinois death certificate worksheet cremation society of illinois form

- Onlinewellsfargo form

- Affidavit of landlord form

- State form 50181 r2 5 13

- Hipaa non disclosure agreement template form

- Consultant service master agreement template form

Find out other OWNER'S RESPONSE TO WRITTEN REQUESTCORPORATION, LLC, Etc

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT