FINAL ACCOUNTING of Form

What is the FINAL ACCOUNTING OF

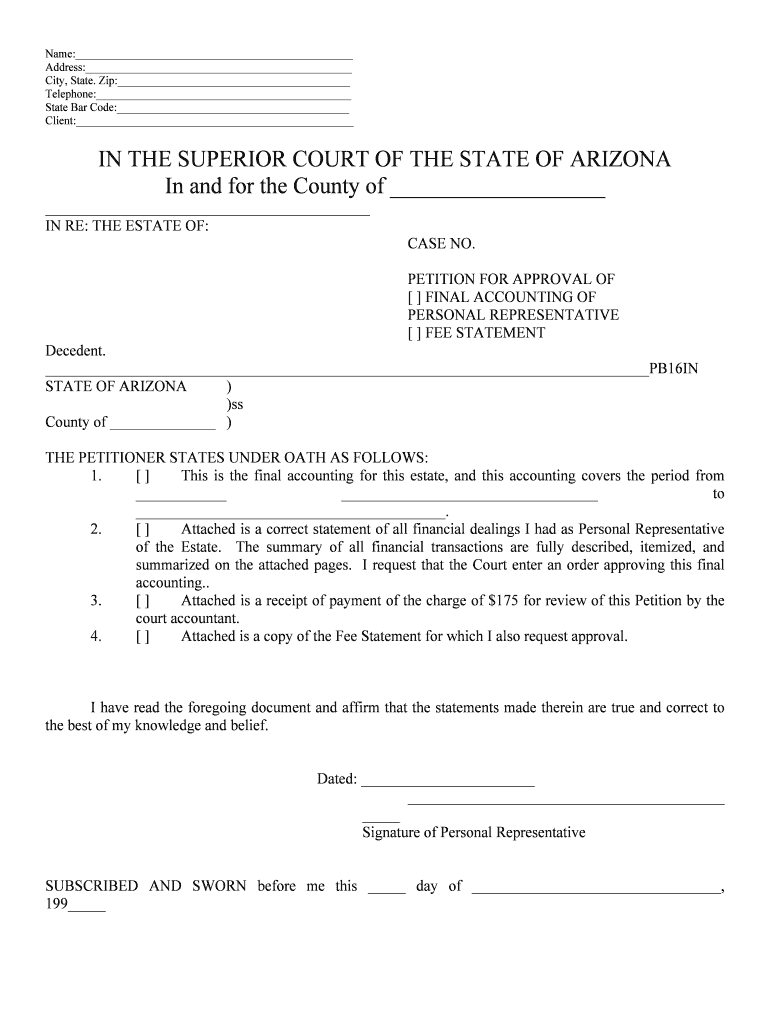

The final accounting of is a crucial document used primarily in legal and financial contexts. It serves to summarize all financial transactions and obligations of an estate or business at the conclusion of a fiscal period or after the settlement of an estate. This document ensures that all debts, expenses, and distributions are accounted for, providing transparency and clarity for all stakeholders involved. The final accounting of is often required by courts or regulatory bodies to verify that all financial matters have been properly handled.

Steps to complete the FINAL ACCOUNTING OF

Completing the final accounting of involves several key steps to ensure accuracy and compliance. Begin by gathering all relevant financial records, including receipts, invoices, and bank statements. Next, categorize the transactions into income, expenses, and distributions. It is essential to calculate the total amounts for each category accurately. Once you have organized the data, prepare the final accounting document by clearly listing each transaction along with its corresponding amount. Finally, review the document for completeness and accuracy before submitting it to the appropriate authority or stakeholders.

Legal use of the FINAL ACCOUNTING OF

The final accounting of holds significant legal weight, particularly in estate settlements and business closures. It must comply with applicable laws and regulations to be considered valid. In many jurisdictions, the final accounting of must be filed with a court or regulatory agency, which may require specific formats or additional documentation. Ensuring that the final accounting of meets these legal standards is essential to avoid potential disputes or penalties. Additionally, proper execution of this document can protect the executor or business owner from liability regarding financial mismanagement.

Required Documents

To complete the final accounting of, certain documents are typically required. These may include:

- Bank statements for the relevant period

- Receipts for all expenses incurred

- Invoices for income received

- Previous financial statements

- Any legal documents related to the estate or business

Having these documents readily available will facilitate a smoother process in preparing the final accounting of.

Examples of using the FINAL ACCOUNTING OF

The final accounting of can be utilized in various scenarios. For instance, in the context of estate management, it is used to summarize the financial activities of the deceased's estate, detailing how assets were distributed among heirs. In a business setting, it may be employed to report the financial status of a company at the end of its operational life, ensuring all debts are settled and assets are appropriately allocated. Each example underscores the importance of thorough documentation and transparency in financial reporting.

Filing Deadlines / Important Dates

Timely filing of the final accounting of is crucial to avoid penalties and legal issues. Deadlines can vary based on jurisdiction and the specific context of the accounting. Generally, it is advisable to file the final accounting of within a few months after the end of the fiscal period or the conclusion of an estate settlement. Checking local regulations is essential to ensure compliance with specific deadlines that may apply.

Quick guide on how to complete final accounting of

Complete FINAL ACCOUNTING OF seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the needed form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without delays. Handle FINAL ACCOUNTING OF on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign FINAL ACCOUNTING OF effortlessly

- Locate FINAL ACCOUNTING OF and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that use.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the data and then click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that require printing new document copies. airSlate SignNow fulfills your needs in document management with just a few clicks from any device of your choice. Edit and eSign FINAL ACCOUNTING OF and ensure effective communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the FINAL ACCOUNTING OF feature in airSlate SignNow?

The FINAL ACCOUNTING OF feature in airSlate SignNow allows you to finalize and review all necessary documents related to accounting transactions seamlessly. This ensures that all required signatures and approvals are captured efficiently, reducing the chances of errors in financial documentation.

-

How does airSlate SignNow streamline the FINAL ACCOUNTING OF process?

airSlate SignNow streamlines the FINAL ACCOUNTING OF process by providing an intuitive platform where users can send, sign, and manage documents electronically. This automation reduces manual paperwork and speeds up the time it takes to finalize accounting documents, enhancing overall productivity.

-

Are there any costs associated with the FINAL ACCOUNTING OF solutions from airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs, including solutions for FINAL ACCOUNTING OF. Each plan provides a range of features, ensuring you get value for your investment while benefiting from efficient document management.

-

What benefits does airSlate SignNow provide for FINAL ACCOUNTING OF?

Using airSlate SignNow for your FINAL ACCOUNTING OF has several benefits, including faster document turnaround times, enhanced security, and reduced operational costs. The platform allows you to track the status of documents in real-time, ensuring you’re always updated on the progress of your accounting tasks.

-

Can I integrate airSlate SignNow with my existing accounting software for FINAL ACCOUNTING OF?

Absolutely! airSlate SignNow offers integration capabilities with various accounting software, making it easier to incorporate the FINAL ACCOUNTING OF process into your existing workflow. This ensures a smooth transition and enhances your overall document management efficiency.

-

Is airSlate SignNow user-friendly for teams handling FINAL ACCOUNTING OF?

Yes, airSlate SignNow is designed to be user-friendly, making it accessible for teams of all technical skill levels handling FINAL ACCOUNTING OF. Its intuitive interface helps users navigate the platform effortlessly, allowing for easy document sharing and signing processes.

-

What types of documents can airSlate SignNow help with in the FINAL ACCOUNTING OF process?

airSlate SignNow can assist with a variety of documents in the FINAL ACCOUNTING OF process, including invoices, contracts, and financial disclosures. This flexibility allows businesses to manage all related documentation electronically, facilitating a more organized accounting approach.

Get more for FINAL ACCOUNTING OF

- Grammar worksheet past continuous form

- Writing exponential equations using a graph 36 form

- Dte form 100 ex

- Notary insert form

- Ia 1120 iowa corporation income tax return 42001 771914701 form

- Nonresident claim for release from withholding tax form

- Civil settlement agreement template form

- Class agreement template form

Find out other FINAL ACCOUNTING OF

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT