Trading Profit and Loss Account and Balance Sheet Form

What is the trading profit and loss account and balance sheet?

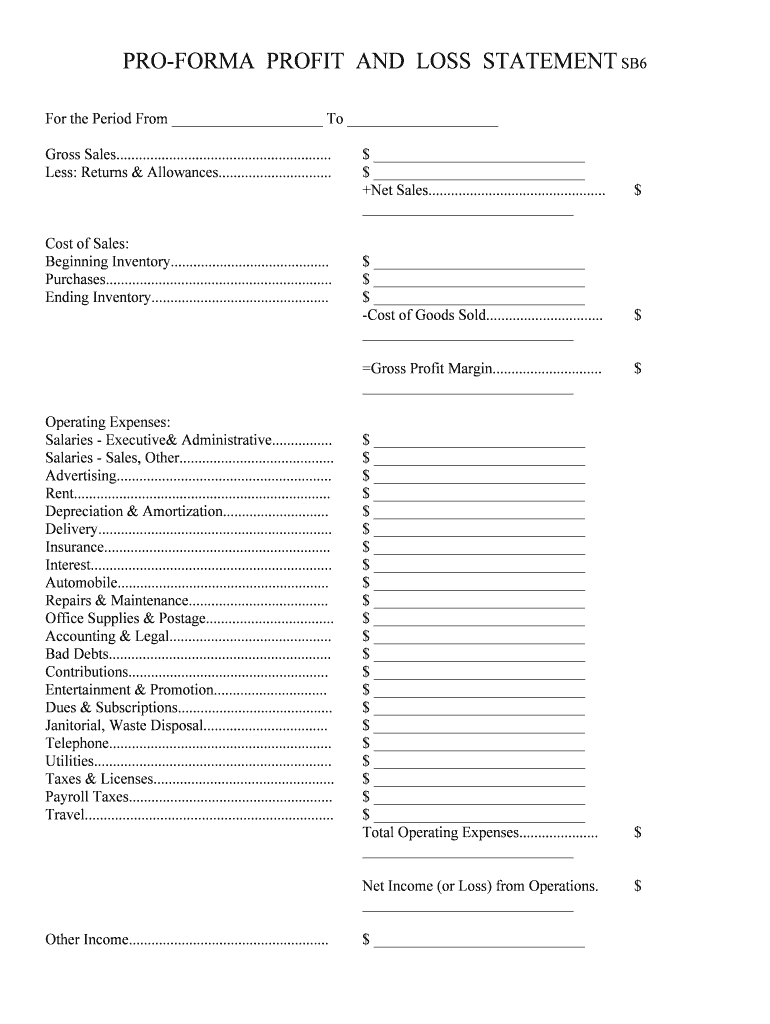

The trading profit and loss account and balance sheet are essential financial documents that provide a comprehensive overview of a business's financial performance and position. The trading profit and loss account summarizes revenues, costs, and expenses over a specific period, typically a fiscal year. It helps businesses assess their profitability by detailing income generated from trading activities and the associated costs. The balance sheet, on the other hand, offers a snapshot of a company's assets, liabilities, and equity at a particular point in time, illustrating the financial health and stability of the business.

Key elements of the trading profit and loss account and balance sheet

Understanding the key elements of these documents is crucial for accurate financial reporting. The trading profit and loss account typically includes:

- Sales Revenue: Total income from goods sold or services rendered.

- Cost of Goods Sold (COGS): Direct costs attributable to the production of goods sold.

- Gross Profit: Sales revenue minus COGS.

- Operating Expenses: Costs not directly tied to production, such as rent and utilities.

- Net Profit: Total profit after all expenses have been deducted from revenue.

The balance sheet consists of:

- Assets: Resources owned by the business, such as cash, inventory, and property.

- Liabilities: Obligations or debts owed to external parties.

- Equity: The residual interest in the assets of the business after deducting liabilities, representing the owner's stake.

Steps to complete the trading profit and loss account and balance sheet

Completing these financial documents involves a systematic approach. Here are the steps to follow:

- Gather Financial Data: Collect all relevant financial records, including sales invoices, receipts, and expense reports.

- Calculate Sales Revenue: Total all income generated from sales during the reporting period.

- Determine COGS: Calculate the direct costs associated with producing goods sold.

- Calculate Gross Profit: Subtract COGS from sales revenue.

- List Operating Expenses: Document all indirect costs incurred during the period.

- Calculate Net Profit: Subtract total expenses from gross profit.

- Prepare the Balance Sheet: List all assets, liabilities, and equity to provide a comprehensive view of financial standing.

Legal use of the trading profit and loss account and balance sheet

These financial documents are not only vital for internal decision-making but also play a significant role in legal and regulatory compliance. Businesses are often required to maintain accurate records for tax purposes, and these documents serve as evidence of financial performance and position. When prepared in accordance with generally accepted accounting principles (GAAP), they can be used in legal proceedings, audits, and financial assessments. Ensuring accuracy and compliance with relevant laws is essential for the legitimacy of these documents.

How to obtain the trading profit and loss account and balance sheet

Obtaining a trading profit and loss account and balance sheet can be done through various methods. Businesses often generate these documents using accounting software, which streamlines the process and ensures accuracy. Alternatively, companies can prepare these accounts manually by following standard accounting practices. It is also possible to consult with a certified public accountant (CPA) or financial advisor to assist in the preparation of these documents, ensuring compliance with legal requirements and industry standards.

Examples of using the trading profit and loss account and balance sheet

Real-world applications of the trading profit and loss account and balance sheet include financial analysis, budgeting, and securing financing. For instance, a business may analyze its profit and loss account to identify trends in revenue and expenses, allowing for better budgeting in the future. Additionally, when seeking loans or investments, these documents provide potential lenders or investors with insight into the company's financial health, helping them make informed decisions. Accurate and well-prepared accounts are essential for effective financial management and strategic planning.

Quick guide on how to complete trading profit and loss account and balance sheet

Complete Trading Profit And Loss Account And Balance Sheet effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Handle Trading Profit And Loss Account And Balance Sheet on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The easiest way to modify and eSign Trading Profit And Loss Account And Balance Sheet with ease

- Obtain Trading Profit And Loss Account And Balance Sheet and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow supplies specifically for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worries of lost or misfiled documents, tedious form hunting, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Trading Profit And Loss Account And Balance Sheet and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the trading profit and loss account format?

The trading profit and loss account format is a structured layout used to summarize a business's revenues and expenses over a specific period. It allows businesses to evaluate their financial performance, highlighting profits or losses. This format is crucial for effective financial reporting and analysis.

-

How can airSlate SignNow help me create a trading profit and loss account format?

airSlate SignNow offers intuitive templates and document management features that simplify the creation of a trading profit and loss account format. With our platform, you can easily customize documents to meet your business's needs. This efficiency saves time and helps maintain accuracy in financial reporting.

-

Is the trading profit and loss account format customizable in airSlate SignNow?

Yes, the trading profit and loss account format in airSlate SignNow is highly customizable. Users can modify the template to include specific revenue, expense categories, and other relevant details. This flexibility allows you to tailor the account format to fit your business model and reporting requirements.

-

What are the benefits of using airSlate SignNow for managing trading profit and loss accounts?

Using airSlate SignNow for managing trading profit and loss accounts streamlines your workflow and enhances collaboration. The platform's electronic signature capabilities ensure quicker approvals and reduces paperwork. Additionally, its integration options allow seamless sharing with accounting software for improved financial management.

-

How much does airSlate SignNow cost for creating a trading profit and loss account format?

airSlate SignNow offers various pricing plans designed to accommodate different business needs. The cost may vary based on the features you choose, but the platform is generally considered a cost-effective solution. Investing in airSlate SignNow can provide you with signNow time savings and efficiency gains in managing documents like trading profit and loss account formats.

-

What features should I look for in a trading profit and loss account format tool?

When selecting a tool for a trading profit and loss account format, look for features such as template customization, electronic signature capabilities, and document automation. Additionally, integration with popular accounting software can enhance functionality. These features can signNowly improve the accuracy and efficiency of financial reporting.

-

Can I integrate airSlate SignNow with my accounting software for trading profit and loss accounts?

Yes, airSlate SignNow offers integrations with various accounting software, allowing you to enhance the management of your trading profit and loss account format. This integration enables automatic data flow between systems, reducing errors and saving time. Seamless connectivity is critical for accurate financial reporting and analysis.

Get more for Trading Profit And Loss Account And Balance Sheet

Find out other Trading Profit And Loss Account And Balance Sheet

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease