Transfer Deed Beneficiary Form

What is the Transfer Deed Beneficiary

The transfer deed beneficiary is a legal document that designates a person or entity to receive property upon the death of the property owner. This type of deed allows for a smooth transition of ownership without the need for probate, making it an efficient estate planning tool. By specifying a beneficiary, the owner can ensure that their wishes are honored and that the property is transferred directly to the intended recipient, simplifying the process for loved ones.

How to Use the Transfer Deed Beneficiary

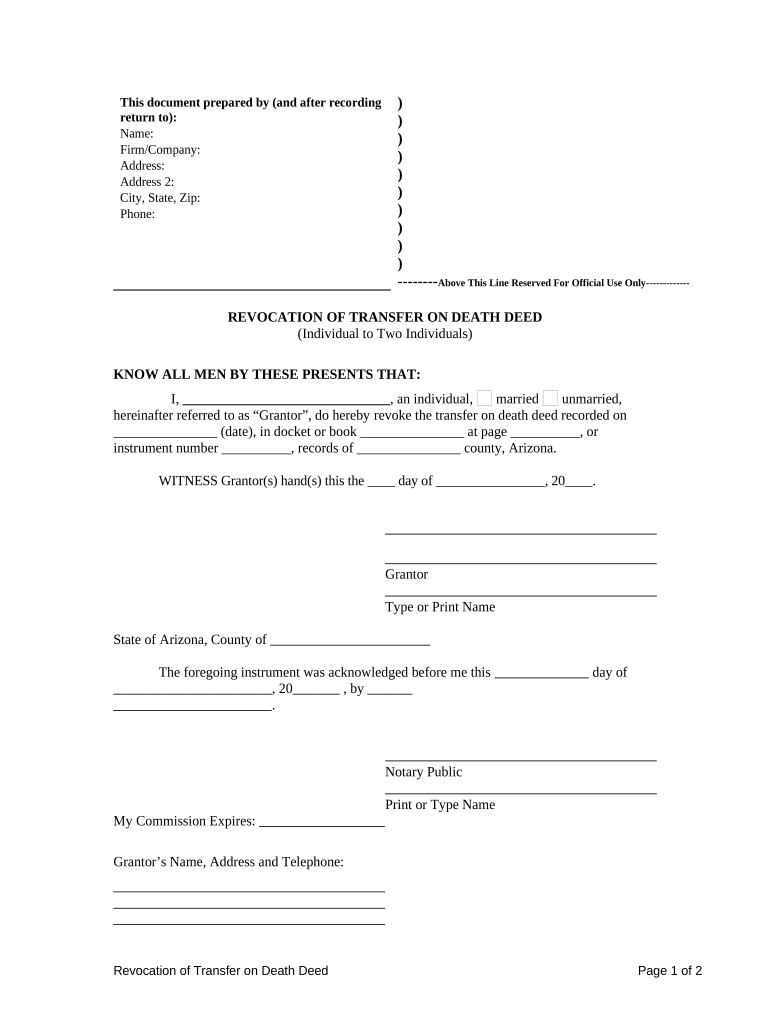

To use the transfer deed beneficiary effectively, the property owner must first complete the deed form, ensuring that all required information is accurately filled out. This includes the legal description of the property and the full name of the beneficiary. Once completed, the document must be signed and notarized to validate its legality. It is crucial to file the transfer deed with the appropriate local government office, such as the county recorder's office, to make the designation official and enforceable.

Steps to Complete the Transfer Deed Beneficiary

Completing the transfer deed beneficiary involves several key steps:

- Obtain the appropriate transfer deed form from a reliable source.

- Fill out the form with accurate property details and beneficiary information.

- Sign the document in the presence of a notary public to ensure its validity.

- File the signed deed with the local county recorder's office to make it legally binding.

Legal Use of the Transfer Deed Beneficiary

The legal use of the transfer deed beneficiary is governed by state laws, which can vary significantly. Generally, this type of deed must comply with state-specific requirements regarding execution and recording. It is essential to ensure that the document adheres to these regulations to avoid any potential legal challenges. Consulting with a legal professional can provide clarity on the specific legal implications and requirements in your state.

Key Elements of the Transfer Deed Beneficiary

Several key elements are essential for a valid transfer deed beneficiary:

- Property Description: A clear and accurate description of the property being transferred.

- Beneficiary Information: Full legal name and address of the designated beneficiary.

- Grantor's Signature: The property owner's signature, which must be notarized.

- Recording Information: Details of where and when the deed is recorded with the local government.

State-Specific Rules for the Transfer Deed Beneficiary

Each state has its own rules regarding the use of transfer deed beneficiaries. Some states may require specific language or additional documentation to be included in the deed. Others may have restrictions on who can be named as a beneficiary or how many beneficiaries can be designated. It is important to research the specific regulations in your state or consult with a legal expert to ensure compliance and validity of the transfer deed beneficiary.

Quick guide on how to complete transfer deed beneficiary

Effortlessly Prepare Transfer Deed Beneficiary on Any Device

Digital document management has become increasingly popular among companies and individuals. It serves as a perfect environmentally friendly alternative to traditional printed and signed paperwork, as you can easily find the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without interruptions. Manage Transfer Deed Beneficiary on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Modify and Electronically Sign Transfer Deed Beneficiary with Ease

- Locate Transfer Deed Beneficiary and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Transfer Deed Beneficiary to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a transfer deed beneficiary?

A transfer deed beneficiary is an individual or entity designated to receive property upon the owner's death. This type of beneficiary can simplify the transfer process, avoiding probate and ensuring a smooth transition of ownership.

-

How does airSlate SignNow assist with creating a transfer deed beneficiary?

AirSlate SignNow offers a user-friendly platform that allows you to draft and eSign transfer deeds effortlessly. By using our templates, you can create a legally binding document that clearly outlines the transfer deed beneficiary, ensuring your wishes are documented accurately.

-

Is there a cost associated with using airSlate SignNow for transfer deeds?

AirSlate SignNow provides a cost-effective solution for managing your documents, including transfer deeds. Our pricing plans are designed to fit various business needs, and you can choose a package that meets your requirements without overspending.

-

Can I integrate airSlate SignNow with other tools for managing transfer deed beneficiaries?

Yes, airSlate SignNow offers seamless integrations with various applications, enhancing your workflow when managing transfer deed beneficiaries. Whether it’s a CRM or project management tool, our integrations ensure you can streamline processes effectively.

-

What features does airSlate SignNow provide for managing documents related to transfer deed beneficiaries?

AirSlate SignNow includes features such as document templates, eSigning, and collaboration tools that enhance your ability to manage transfer deed beneficiaries. These tools enable you to work efficiently and keep all stakeholders informed during the signing process.

-

Is the eSigning process secure when using airSlate SignNow for transfer deeds?

Absolutely! AirSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your sensitive information during the eSigning process for transfer deeds. You can sign with confidence knowing your documents are safe.

-

How long does it take to complete a transfer deed using airSlate SignNow?

Completing a transfer deed using airSlate SignNow can take just minutes. With our intuitive interface and eSigning capabilities, you can quickly prepare and send documents to your transfer deed beneficiaries, ensuring a fast and efficient process.

Get more for Transfer Deed Beneficiary

Find out other Transfer Deed Beneficiary

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free