Computed on Full Value of Property Conveyed, or Computed on Full Value Less Value of Liens or Encumbrances Form

Understanding the Computed On Full Value Of Property Conveyed, Or Computed On Full Value Less Value Of Liens Or Encumbrances

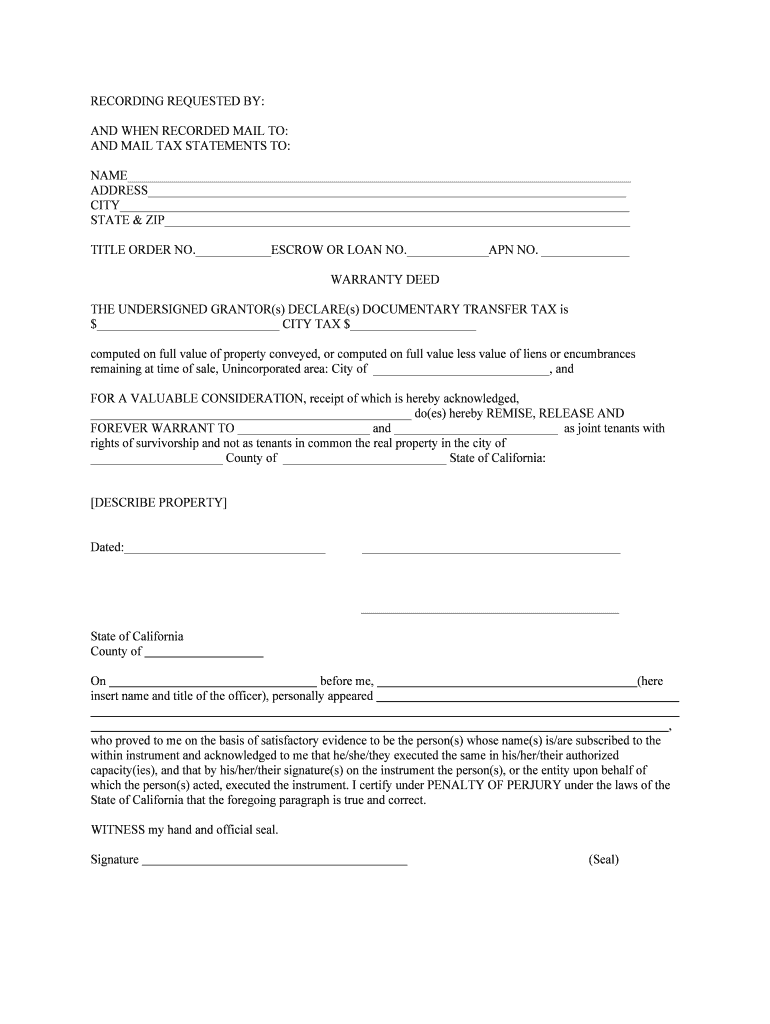

The Computed On Full Value Of Property Conveyed, Or Computed On Full Value Less Value Of Liens Or Encumbrances form is essential in real estate transactions. It outlines the financial obligations tied to a property, including any liens or encumbrances that may affect its value. A lien is a legal right or interest that a lender has in the borrower's property, granted until the debt obligation is satisfied. Encumbrances can include various claims against the property, such as easements or restrictions. Understanding these terms is crucial for buyers and sellers to ensure a clear transfer of ownership and to avoid future disputes.

Steps to Complete the Computed On Full Value Of Property Conveyed, Or Computed On Full Value Less Value Of Liens Or Encumbrances

Completing this form involves several key steps to ensure accuracy and compliance. First, gather all relevant property information, including the full value of the property and any existing liens or encumbrances. Next, fill out the form by clearly stating the computed value, taking into account the deductions for any liens. Ensure that all parties involved in the transaction review the information for accuracy. Finally, sign the document electronically using a trusted eSignature solution to ensure it is legally binding. This process not only streamlines the transaction but also provides a secure method of documentation.

Legal Use of the Computed On Full Value Of Property Conveyed, Or Computed On Full Value Less Value Of Liens Or Encumbrances

This form serves a legal purpose in real estate transactions by providing a clear record of the property’s value after accounting for any financial claims. It is crucial for lenders, buyers, and sellers to understand that this document can be used in legal proceedings to establish ownership rights and financial obligations. Compliance with eSignature regulations, such as ESIGN and UETA, ensures that the electronically signed document holds the same legal weight as a traditional paper document. This legal recognition is vital for protecting all parties involved in the transaction.

Key Elements of the Computed On Full Value Of Property Conveyed, Or Computed On Full Value Less Value Of Liens Or Encumbrances

When completing this form, several key elements must be included to ensure its validity. These include:

- Property Description: A detailed description of the property, including its address and any relevant identifiers.

- Full Value: The total market value of the property before any deductions.

- Liens and Encumbrances: A comprehensive list of any existing liens or encumbrances, along with their respective values.

- Signatures: Signatures of all parties involved, confirming their agreement to the terms outlined in the form.

Including these elements helps ensure that the document is complete and legally enforceable.

How to Use the Computed On Full Value Of Property Conveyed, Or Computed On Full Value Less Value Of Liens Or Encumbrances

Using this form effectively requires understanding its purpose within the real estate transaction process. Once completed, the form should be presented to all parties involved for review. It is typically submitted to the relevant authorities, such as the county recorder's office, to officially document the transfer of ownership. Additionally, keeping a copy for personal records is advisable, as it serves as proof of the transaction and the financial obligations associated with the property. Utilizing a digital platform for filling out and signing the form can enhance efficiency and security.

Examples of Using the Computed On Full Value Of Property Conveyed, Or Computed On Full Value Less Value Of Liens Or Encumbrances

Consider a scenario where a homeowner sells their property valued at three hundred thousand dollars. However, there is an existing mortgage lien of fifty thousand dollars. In this case, the computed value on the form would reflect the property's full value, minus the lien, resulting in a net value of two hundred fifty thousand dollars. Another example includes a property with easements that restrict its use, which should also be noted in the form to inform potential buyers of any limitations. These examples illustrate the importance of accurately reflecting all financial obligations to ensure a smooth transaction.

Quick guide on how to complete computed on full value of property conveyed or computed on full value less value of liens or encumbrances

Effortlessly Prepare Computed On Full Value Of Property Conveyed, Or Computed On Full Value Less Value Of Liens Or Encumbrances on Any Gadget

The management of online documents has gained popularity among companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct template and securely keep it online. airSlate SignNow offers all the tools necessary to create, edit, and electronically sign your documents rapidly without any holdups. Handle Computed On Full Value Of Property Conveyed, Or Computed On Full Value Less Value Of Liens Or Encumbrances on any gadget with airSlate SignNow's Android or iOS applications and enhance your document-driven processes today.

The easiest method to alter and electronically sign Computed On Full Value Of Property Conveyed, Or Computed On Full Value Less Value Of Liens Or Encumbrances without any hassle

- Locate Computed On Full Value Of Property Conveyed, Or Computed On Full Value Less Value Of Liens Or Encumbrances and click on Get Form to initiate.

- Use the tools we offer to fill out your document.

- Underline important sections of the documents or obscure sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all information and then click the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets your document management requirements in just a few clicks from any chosen gadget. Alter and electronically sign Computed On Full Value Of Property Conveyed, Or Computed On Full Value Less Value Of Liens Or Encumbrances and maintain exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are liens and encumbrances in the context of legal documents?

Liens and encumbrances are legal claims or rights against a property that can affect ownership and transferability. Understanding how airSlate SignNow works with these documents can help businesses manage risk effectively. Our platform streamlines the eSigning process for documents that involve liens and encumbrances.

-

How can airSlate SignNow assist in managing liens and encumbrances?

AirSlate SignNow provides features that allow users to create, send, and securely sign documents related to liens and encumbrances. Our solution ensures that all parties can review and approve important legal documents quickly and efficiently. This not only saves time but also minimizes the risk of errors in managing liens and encumbrances.

-

What pricing plans does airSlate SignNow offer for handling liens and encumbrances?

AirSlate SignNow offers flexible pricing plans designed to suit different business needs, whether you're dealing with liens and encumbrances or other document types. Our plans are cost-effective, ensuring that you only pay for the features you need. You can choose from basic to more advanced plans that include custom workflows for document management.

-

Are there any benefits to using airSlate SignNow for liens and encumbrances?

Using airSlate SignNow for liens and encumbrances offers numerous benefits, including streamlined workflows and enhanced security. Our platform helps reduce paper usage and allows for quick document tracking. Additionally, eSigning reduces turnaround time, making it easier to manage liens and encumbrances efficiently.

-

Can airSlate SignNow integrate with other tools to manage liens and encumbrances?

Yes, airSlate SignNow integrates seamlessly with various software tools to improve document management, especially for liens and encumbrances. This includes CRM systems, cloud storage services, and other business applications. Such integrations ensure that you can manage your documents from one central location.

-

Is airSlate SignNow compliant with regulations related to liens and encumbrances?

Absolutely! AirSlate SignNow is designed to comply with relevant regulations concerning eSignatures and document management, including those related to liens and encumbrances. Our platform adheres to industry standards, helping protect both the user and the validity of the documents signed.

-

Can I customize documents involving liens and encumbrances using airSlate SignNow?

Yes, airSlate SignNow allows users to customize documents that relate to liens and encumbrances. You can add fields, create templates, and choose specific signing workflows according to your needs. This flexibility helps ensure that all legal requirements are met in your documentation.

Get more for Computed On Full Value Of Property Conveyed, Or Computed On Full Value Less Value Of Liens Or Encumbrances

Find out other Computed On Full Value Of Property Conveyed, Or Computed On Full Value Less Value Of Liens Or Encumbrances

- Sign Arkansas Mortgage Quote Request Online

- Sign Nebraska Mortgage Quote Request Simple

- Can I Sign Indiana Temporary Employment Contract Template

- How Can I Sign Maryland Temporary Employment Contract Template

- How Can I Sign Montana Temporary Employment Contract Template

- How Can I Sign Ohio Temporary Employment Contract Template

- Sign Mississippi Freelance Contract Online

- Sign Missouri Freelance Contract Safe

- How Do I Sign Delaware Email Cover Letter Template

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple

- Sign Vermont Independent Contractor Agreement Template Free