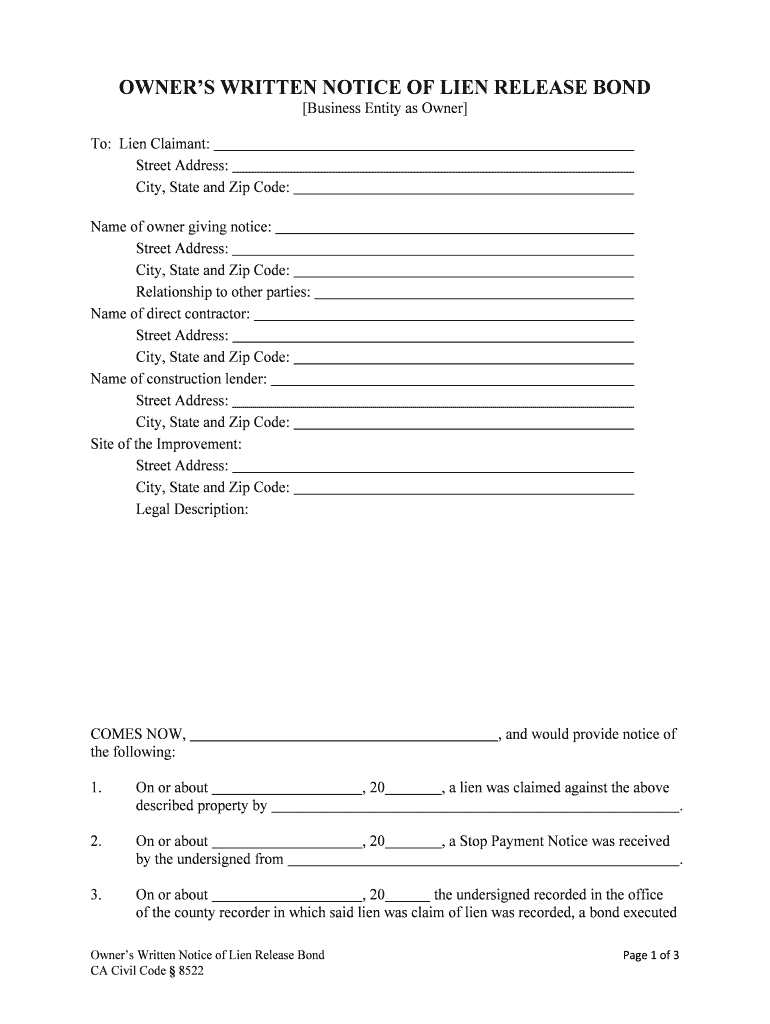

Business Entity as Owner Form

What is the Business Entity As Owner

The Business Entity As Owner form is a legal document that identifies a business entity, such as a corporation or limited liability company (LLC), as the owner of specific assets or property. This form is essential for establishing ownership rights, ensuring compliance with local and federal regulations, and facilitating various business transactions. By designating the business entity as the owner, the form helps clarify the legal status of the entity in relation to its assets, which is crucial for tax purposes and liability protection.

How to use the Business Entity As Owner

Using the Business Entity As Owner form involves a few straightforward steps. First, gather all necessary information about the business entity, including its legal name, structure, and registration details. Next, complete the form by accurately filling in the required fields, which typically include the entity's address, contact information, and the nature of the ownership. Once completed, the form must be signed by an authorized representative of the business entity. This ensures that the document is legally binding and recognized by relevant authorities.

Steps to complete the Business Entity As Owner

Completing the Business Entity As Owner form requires careful attention to detail. Follow these steps for proper completion:

- Gather necessary documentation, such as the entity's formation documents and tax identification number.

- Fill in the form with the entity's legal name and structure (e.g., LLC, corporation).

- Provide the entity's registered address and contact information.

- Specify the assets or property the entity owns.

- Ensure the form is signed by an authorized individual, such as a company officer or member.

- Review the completed form for accuracy before submission.

Legal use of the Business Entity As Owner

The legal use of the Business Entity As Owner form is pivotal in establishing the ownership rights of a business entity. It serves as a formal declaration of ownership, which can be essential in legal disputes, tax assessments, and compliance with regulatory requirements. By using this form, businesses can protect their interests and ensure that their ownership claims are recognized by courts and governmental agencies. It is important to ensure that the form is completed correctly and submitted in accordance with state and federal laws to maintain its legal validity.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the Business Entity As Owner form, particularly in relation to tax reporting and compliance. Business entities must ensure that they accurately report their ownership of assets and income generated from those assets on their tax returns. The IRS may require the submission of this form as part of the documentation needed for various tax filings. It is advisable for business owners to consult IRS resources or a tax professional to understand their obligations and ensure compliance with all relevant tax laws.

Required Documents

To complete the Business Entity As Owner form, several documents may be required. These typically include:

- The entity's formation documents, such as articles of incorporation or organization.

- A valid tax identification number (EIN) issued by the IRS.

- Proof of the entity's registered address, such as a utility bill or lease agreement.

- Any additional documents that support the ownership claim, such as purchase agreements or deeds.

Form Submission Methods

The Business Entity As Owner form can be submitted through various methods, depending on the requirements of the state or federal agency involved. Common submission methods include:

- Online submission via the relevant government agency's website.

- Mailing the completed form to the appropriate office.

- In-person submission at designated government offices or agencies.

It is essential to verify the specific submission requirements for your jurisdiction to ensure timely and proper processing of the form.

Quick guide on how to complete business entity as owner

Effortlessly Prepare Business Entity As Owner on Any Device

Digital document management has become favored by both businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents promptly without delays. Manage Business Entity As Owner on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to edit and electronically sign Business Entity As Owner without exertion

- Obtain Business Entity As Owner and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Business Entity As Owner to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Business Entity As Owner in the context of airSlate SignNow?

A Business Entity As Owner refers to an organization that uses airSlate SignNow to manage eSigning and document workflows. This allows businesses to streamline processes, improve efficiency, and ensure secure document transactions. By designating a business entity as the owner, you can easily track and manage all signing activities from a central location.

-

How does airSlate SignNow benefit a Business Entity As Owner?

airSlate SignNow offers a user-friendly platform that enables a Business Entity As Owner to send and eSign documents quickly and securely. Benefit from advanced workflow automation, compliance with legal standards, and easy integration with existing tools. This enhances collaboration and signNowly reduces the time spent on document management.

-

What pricing plans does airSlate SignNow offer for a Business Entity As Owner?

airSlate SignNow provides flexible pricing plans tailored for a Business Entity As Owner, accommodating various business sizes and needs. You can choose from monthly or annual subscriptions, depending on your usage requirements. Each plan includes features suited for effective document eSigning and management.

-

Can a Business Entity As Owner integrate airSlate SignNow with other applications?

Yes, a Business Entity As Owner can easily integrate airSlate SignNow with various applications, such as CRMs, project management tools, and cloud storage services. These integrations help streamline your document workflows and enhance productivity. The seamless connectivity ensures that all your business applications work together smoothly.

-

Is airSlate SignNow secure for a Business Entity As Owner?

Absolutely! airSlate SignNow prioritizes security for a Business Entity As Owner by employing advanced encryption methods and compliance with international security standards. Your documents are safely stored, and all eSigning activities are securely tracked. This commitment to security ensures that sensitive business information remains confidential.

-

How does airSlate SignNow improve workflow for a Business Entity As Owner?

airSlate SignNow signNowly enhances workflow efficiency for a Business Entity As Owner by automating repetitive tasks and enabling quick access to signed documents. This platform simplifies the signing process and centralizes document management. As a result, your team can focus on more strategic tasks, reducing time wasted on paperwork.

-

What features are included for a Business Entity As Owner in airSlate SignNow?

A Business Entity As Owner can take advantage of various features in airSlate SignNow, including customizable templates, multi-party signing, and automated reminders. Additionally, the platform provides robust tracking and reporting functionalities. These features empower businesses to manage their eSignatures effectively and meet deadlines.

Get more for Business Entity As Owner

Find out other Business Entity As Owner

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document