GC 400A4 Schedule A, Receipts, RentStandard Account Form

What is the GC 400A4 Schedule A, Receipts, RentStandard Account

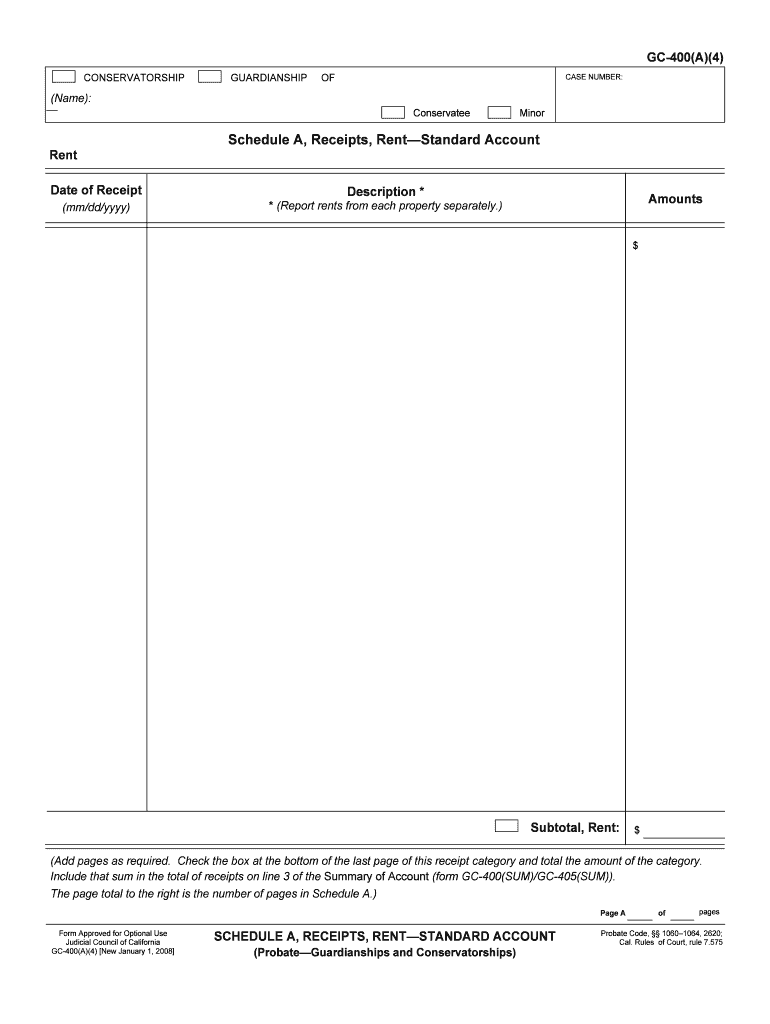

The GC 400A4 Schedule A, Receipts, RentStandard Account is a specific form used for reporting rental income and expenses for tax purposes in the United States. This form is essential for individuals and businesses that receive rental income, as it helps in documenting the amounts received and any associated expenses incurred during the rental period. It is designed to ensure compliance with tax regulations and to facilitate accurate reporting to the Internal Revenue Service (IRS).

How to use the GC 400A4 Schedule A, Receipts, RentStandard Account

To effectively use the GC 400A4 Schedule A, Receipts, RentStandard Account, you should first gather all relevant financial documents related to your rental properties. This includes receipts for repairs, maintenance, and any other expenses that can be deducted. The form requires you to input details such as the total rental income received, the expenses incurred, and any other pertinent information. Once completed, the form should be submitted along with your tax return to ensure proper processing by the IRS.

Steps to complete the GC 400A4 Schedule A, Receipts, RentStandard Account

Completing the GC 400A4 Schedule A involves several key steps:

- Gather all necessary documentation, including rental income records and expense receipts.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total rental income in the designated section.

- List all deductible expenses, such as property management fees, repairs, and utilities.

- Calculate your net rental income by subtracting total expenses from total income.

- Review the completed form for accuracy before submission.

Legal use of the GC 400A4 Schedule A, Receipts, RentStandard Account

The legal use of the GC 400A4 Schedule A, Receipts, RentStandard Account is crucial for ensuring compliance with IRS regulations. This form must be filled out accurately to avoid potential legal issues, including audits or penalties. It is important to maintain proper records and documentation to support the figures reported on the form. Using electronic signatures through a reliable platform can also enhance the legal standing of the submitted form.

Key elements of the GC 400A4 Schedule A, Receipts, RentStandard Account

Key elements of the GC 400A4 Schedule A include:

- Rental Income: Total income received from rental properties.

- Deductible Expenses: Costs that can be subtracted from rental income, such as repairs and maintenance.

- Net Income Calculation: The difference between total income and total expenses.

- Signature Section: Required for verifying the authenticity of the form.

Filing Deadlines / Important Dates

Filing deadlines for the GC 400A4 Schedule A, Receipts, RentStandard Account typically align with the annual tax return deadlines. For most taxpayers, this means submitting the form by April fifteenth of each year. It is important to stay informed about any changes to these dates, as extensions may be available under certain circumstances, but must be requested in advance.

Quick guide on how to complete gc 400a4 schedule a receipts rentstandard account

Complete GC 400A4 Schedule A, Receipts, RentStandard Account effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute to conventional printed and signed paperwork, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage GC 400A4 Schedule A, Receipts, RentStandard Account on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign GC 400A4 Schedule A, Receipts, RentStandard Account effortlessly

- Obtain GC 400A4 Schedule A, Receipts, RentStandard Account and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your changes.

- Choose how you wish to send your form, through email, SMS, or a share link, or download it to your computer.

Say goodbye to overlooked or lost documents, tedious form searches, or errors that necessitate the printing of new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your preference. Edit and eSign GC 400A4 Schedule A, Receipts, RentStandard Account to ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the GC 400A4 Schedule A, Receipts, RentStandard Account?

The GC 400A4 Schedule A, Receipts, RentStandard Account is a dedicated tool within airSlate SignNow designed to simplify the management of receipts and rental information. It enables users to efficiently track and record expenses associated with rental properties, ensuring compliance with various accounting standards.

-

How does airSlate SignNow facilitate the use of the GC 400A4 Schedule A, Receipts, RentStandard Account?

airSlate SignNow offers a user-friendly interface that integrates seamlessly with the GC 400A4 Schedule A, Receipts, RentStandard Account. This allows users to easily eSign and manage documents such as receipt submissions and rental agreements, streamlining the overall process.

-

What are the pricing options for the GC 400A4 Schedule A, Receipts, RentStandard Account?

Pricing for the GC 400A4 Schedule A, Receipts, RentStandard Account varies based on the features and number of users. airSlate SignNow provides flexible subscription plans that cater to different business needs, making it a cost-effective solution for document management.

-

Can the GC 400A4 Schedule A, Receipts, RentStandard Account integrate with other software?

Yes, the GC 400A4 Schedule A, Receipts, RentStandard Account can seamlessly integrate with various accounting and management software. This ensures that all your financial data is synchronized, enhancing productivity and reducing the risk of manual data entry errors.

-

What features are included in the GC 400A4 Schedule A, Receipts, RentStandard Account?

The features of the GC 400A4 Schedule A, Receipts, RentStandard Account include customizable templates for receipts, automated workflows for signing, and secure document storage. These features are designed to simplify the eSigning process while ensuring compliance and security.

-

How can the GC 400A4 Schedule A, Receipts, RentStandard Account benefit my business?

By using the GC 400A4 Schedule A, Receipts, RentStandard Account, your business can save time and reduce costs associated with document management. The solution provides enhanced organization, simplifies reporting, and improves compliance with industry regulations.

-

Is there customer support available for users of the GC 400A4 Schedule A, Receipts, RentStandard Account?

Yes, airSlate SignNow offers comprehensive customer support for all users of the GC 400A4 Schedule A, Receipts, RentStandard Account. You can access help via live chat, email, or phone to ensure you get the assistance you need quickly.

Get more for GC 400A4 Schedule A, Receipts, RentStandard Account

Find out other GC 400A4 Schedule A, Receipts, RentStandard Account

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement