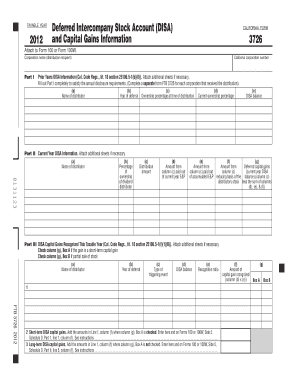

Ca Form 3726

What is the Ca Form 3726

The Ca Form 3726 is a specific document used in California for various administrative and legal purposes. It serves as a formal request or declaration, often required by governmental agencies or organizations. Understanding its purpose is essential for individuals and businesses operating within the state, as it ensures compliance with local regulations and facilitates necessary processes.

How to use the Ca Form 3726

Using the Ca Form 3726 involves several steps to ensure accurate completion and submission. Initially, gather all required information and documents that pertain to the form's purpose. Carefully fill out each section of the form, ensuring that all details are correct and complete. Once filled, review the form for any errors or omissions before submitting it to the appropriate agency or organization as specified in the instructions.

Steps to complete the Ca Form 3726

Completing the Ca Form 3726 requires a systematic approach:

- Gather necessary information, including personal details and any relevant documentation.

- Carefully read the instructions provided with the form to understand specific requirements.

- Fill out the form accurately, ensuring all fields are completed as required.

- Review the form for accuracy, checking for any errors or missing information.

- Submit the completed form via the designated method, whether online, by mail, or in person.

Legal use of the Ca Form 3726

The legal use of the Ca Form 3726 is governed by specific regulations that dictate how and when it can be utilized. To be considered legally binding, the form must be completed in accordance with applicable laws and regulations. This includes ensuring that all signatures are valid and that the form is submitted to the correct authority. Compliance with these legal standards is crucial for the form to hold up in any legal or administrative proceedings.

Key elements of the Ca Form 3726

The Ca Form 3726 contains several key elements that are essential for its validity. These typically include:

- Identification of the individual or entity submitting the form.

- Clear description of the purpose of the form.

- Signature of the applicant, which may require notarization.

- Date of submission, which is important for record-keeping and compliance.

Form Submission Methods

The Ca Form 3726 can be submitted through various methods, depending on the requirements set by the issuing authority. Common submission methods include:

- Online submission through designated portals.

- Mailing the completed form to the appropriate address.

- In-person submission at specified locations.

Eligibility Criteria

Eligibility to use the Ca Form 3726 may vary based on the specific context in which it is required. Generally, individuals or entities must meet certain criteria, such as residency requirements or specific qualifications related to the form's purpose. It is important to review the eligibility requirements carefully to ensure compliance before attempting to complete and submit the form.

Quick guide on how to complete ca form 3726

Complete Ca Form 3726 seamlessly on any device

Online document management has gained popularity among companies and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Handle Ca Form 3726 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The easiest way to edit and eSign Ca Form 3726 with ease

- Locate Ca Form 3726 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you prefer to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about missing or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Ca Form 3726 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ca form 3726

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Ca Form 3726?

Ca Form 3726 is a document used in California for specific business transactions. It is essential for companies to ensure compliance with state regulations. Using airSlate SignNow, businesses can easily manage and sign this form digitally, saving time and reducing paperwork.

-

How does airSlate SignNow help with Ca Form 3726?

AirSlate SignNow simplifies the process of sending and eSigning Ca Form 3726. Our intuitive platform allows users to remotely prepare the form, add signatures, and track its status. This ensures that all necessary steps are completed efficiently and securely.

-

What are the pricing options for using airSlate SignNow?

AirSlate SignNow offers flexible pricing plans to cater to different business needs, including those needing to manage Ca Form 3726. Plans are designed to be cost-effective, allowing businesses to scale as they grow. Visit our pricing page for more details and choose a plan that suits your requirements.

-

Can I integrate airSlate SignNow with other applications for handling Ca Form 3726?

Yes, airSlate SignNow provides integration options with various applications, enhancing your ability to manage Ca Form 3726 effectively. Whether you are using CRM systems, cloud storage, or project management tools, our platform can easily connect to streamline your workflow.

-

What are the key features for managing Ca Form 3726 with airSlate SignNow?

Key features of airSlate SignNow for managing Ca Form 3726 include customizable templates, advanced security measures, and real-time tracking. The platform also allows multiple users to collaborate seamlessly, ensuring that everyone involved in the signing process is on the same page.

-

Is airSlate SignNow compliant with legal standards for Ca Form 3726?

Absolutely, airSlate SignNow is compliant with legal standards, ensuring that Ca Form 3726 is handled securely and in accordance with California state laws. Our electronic signatures are legally binding, making this solution a reliable choice for your business transactions.

-

What benefits can I expect when using airSlate SignNow for Ca Form 3726?

Using airSlate SignNow for Ca Form 3726 offers numerous benefits, including increased efficiency, reduced turnaround times, and diminished paperwork. Businesses can save time and resources while ensuring their documents are securely managed and easily accessible.

Get more for Ca Form 3726

Find out other Ca Form 3726

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free