GC 400AC Schedule a and C, Receipts and Form

What is the GC 400AC Schedule A And C, Receipts And

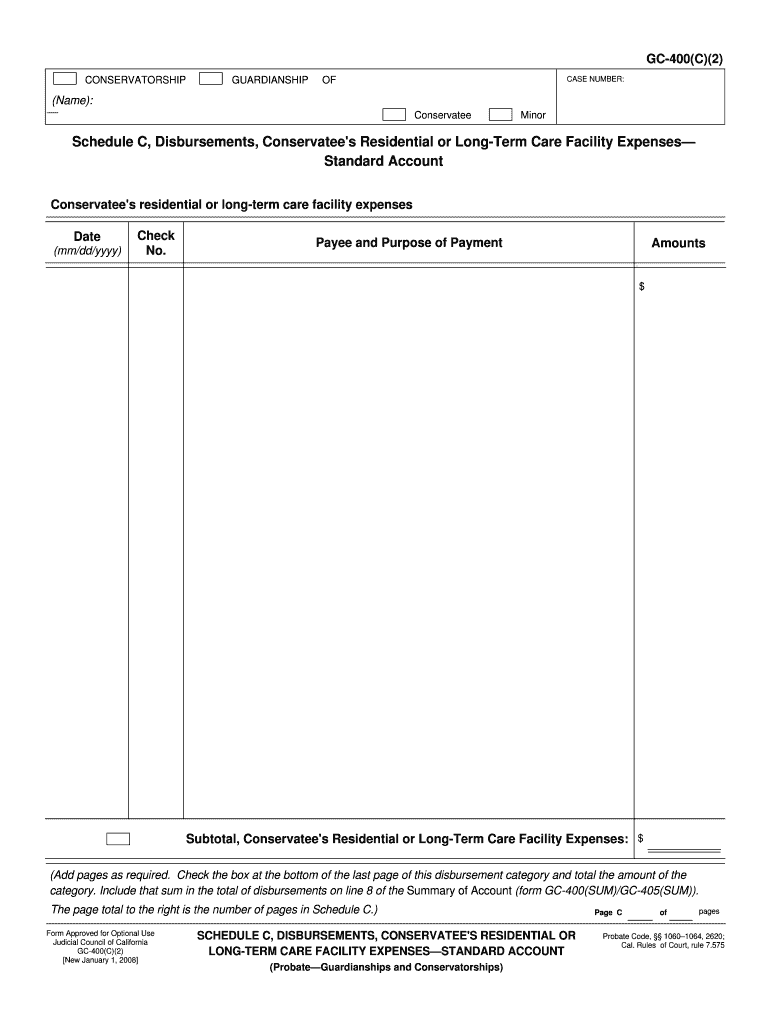

The GC 400AC Schedule A and C, Receipts And is a form used for reporting specific financial information to the Internal Revenue Service (IRS). This form is particularly relevant for individuals and businesses that need to document their income and expenses for tax purposes. It includes sections for detailing various types of receipts, which can help in calculating taxable income and ensuring compliance with federal tax regulations. Understanding this form is essential for accurate tax reporting and minimizing potential liabilities.

Steps to complete the GC 400AC Schedule A And C, Receipts And

Completing the GC 400AC Schedule A and C, Receipts And involves several key steps:

- Gather all necessary financial documents, including receipts and statements related to income and expenses.

- Fill out the personal information section at the top of the form, ensuring accuracy in names and identification numbers.

- Document all relevant income sources in the designated sections, categorizing them appropriately.

- List all expenses, providing detailed descriptions and corresponding receipts to support your claims.

- Review the completed form for accuracy and completeness before submission.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the GC 400AC Schedule A and C, Receipts And. It is crucial to follow these guidelines to ensure compliance and avoid penalties. Key points include:

- Ensure all income and expenses are reported accurately and in the correct categories.

- Retain copies of all receipts and documentation for at least three years in case of an audit.

- Stay updated on any changes to tax laws that may affect how you report your finances.

Form Submission Methods

The GC 400AC Schedule A and C, Receipts And can be submitted through various methods, allowing flexibility for taxpayers. These methods include:

- Online submission via the IRS e-file system, which is often the fastest and most secure option.

- Mailing a paper copy of the form to the appropriate IRS address, which may vary based on your location.

- In-person submission at designated IRS offices, though this option may require an appointment.

Penalties for Non-Compliance

Failing to comply with the requirements of the GC 400AC Schedule A and C, Receipts And can result in significant penalties. These may include:

- Fines for late submission or failure to file the form altogether.

- Interest on any unpaid taxes that may accrue over time.

- Potential audits from the IRS, which can lead to further scrutiny of your financial records.

Eligibility Criteria

Eligibility for using the GC 400AC Schedule A and C, Receipts And typically depends on your tax situation. Common criteria include:

- Individuals or businesses that have received income that needs to be reported to the IRS.

- Taxpayers who have incurred deductible expenses related to their income-generating activities.

- Those who meet specific income thresholds set by the IRS for reporting purposes.

Quick guide on how to complete gc 400ac schedule a and c receipts and

Prepare GC 400AC Schedule A And C, Receipts And effortlessly on any device

Digital document management has risen in popularity among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage GC 400AC Schedule A And C, Receipts And on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign GC 400AC Schedule A And C, Receipts And effortlessly

- Locate GC 400AC Schedule A And C, Receipts And and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to deliver your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign GC 400AC Schedule A And C, Receipts And to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the GC 400AC Schedule A And C, Receipts And?

The GC 400AC Schedule A And C, Receipts And is a tax form used in Canada to report income and expenses. This schedule allows individuals to detail their earnings and receipts, making it easier to manage tax obligations. Understanding this form is crucial for accurate financial reporting.

-

How can airSlate SignNow help with the GC 400AC Schedule A And C, Receipts And?

airSlate SignNow streamlines the process of managing the GC 400AC Schedule A And C, Receipts And by enabling electronic signatures and efficient document management. Users can easily send, receive, and sign necessary documents without the hassle of paper forms. This enhances productivity and ensures a reliable record-keeping system.

-

What are the pricing options for using airSlate SignNow for the GC 400AC Schedule A And C, Receipts And?

airSlate SignNow offers a variety of pricing plans tailored to fit different business needs for managing the GC 400AC Schedule A And C, Receipts And. These plans include monthly and annual subscriptions with varying features. You can choose a plan that best suits your budget and document management requirements.

-

Is airSlate SignNow secure for managing the GC 400AC Schedule A And C, Receipts And?

Yes, airSlate SignNow prioritizes the security of your documents, including those related to the GC 400AC Schedule A And C, Receipts And. The platform uses advanced encryption methods and complies with industry standards to ensure that your data is protected. You can confidently sign and store your documents knowing they are secure.

-

What features does airSlate SignNow offer for the GC 400AC Schedule A And C, Receipts And?

airSlate SignNow includes features such as customizable templates, cloud storage, and real-time tracking for documents related to the GC 400AC Schedule A And C, Receipts And. These tools help you save time and simplify the document signing process. Additionally, you can collaborate easily with others involved in the financial reporting process.

-

Can I integrate airSlate SignNow with other software for managing the GC 400AC Schedule A And C, Receipts And?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and business applications, making it easy to handle the GC 400AC Schedule A And C, Receipts And. This functionality allows you to streamline your workflow and synchronize your financial data across platforms effortlessly.

-

What benefits does airSlate SignNow provide for businesses handling the GC 400AC Schedule A And C, Receipts And?

Using airSlate SignNow, businesses can experience improved efficiency, reduced paperwork, and enhanced document security when handling the GC 400AC Schedule A And C, Receipts And. The platform helps save time and minimizes the risk of errors, leading to better management of tax-related documentation. Additionally, this solution is cost-effective, making it accessible for businesses of all sizes.

Get more for GC 400AC Schedule A And C, Receipts And

Find out other GC 400AC Schedule A And C, Receipts And

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document