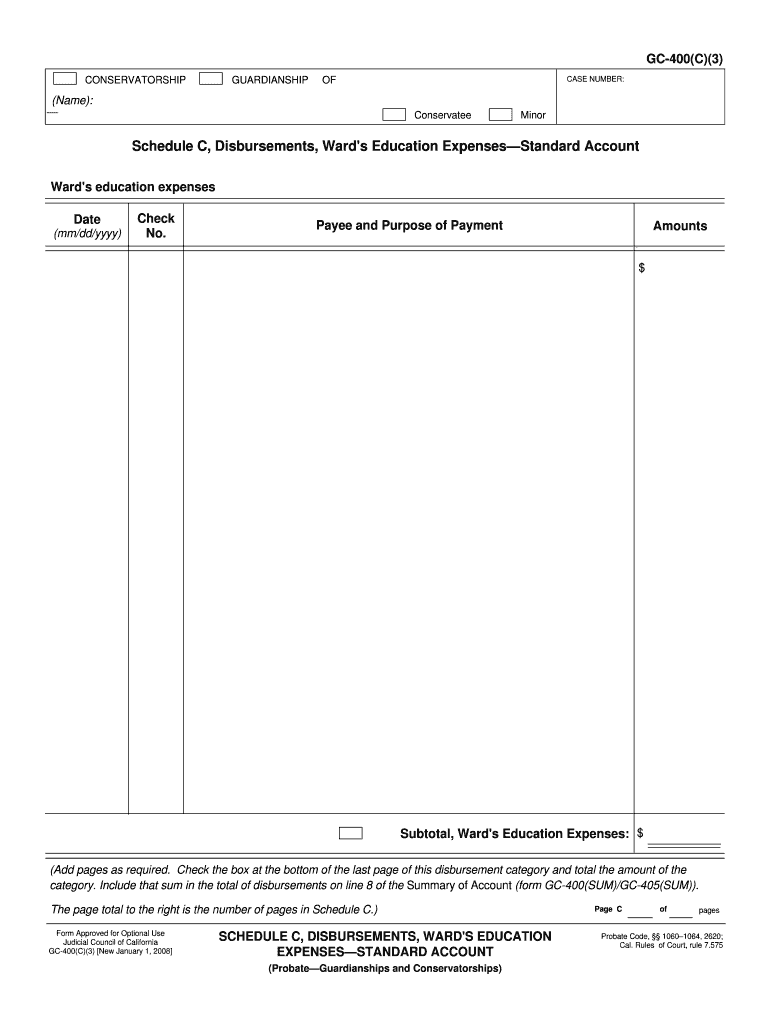

Schedule C, Disbursements, Ward's Education ExpensesStandard Account Form

What is the Schedule C, Disbursements, Ward's Education ExpensesStandard Account

The Schedule C, Disbursements, Ward's Education ExpensesStandard Account is a specific form used primarily by self-employed individuals and small businesses in the United States to report income and expenses related to educational disbursements. This form allows taxpayers to detail their educational expenses, ensuring they can accurately claim deductions on their tax returns. Understanding the purpose of this form is crucial for compliance with IRS regulations and for maximizing potential tax benefits.

How to use the Schedule C, Disbursements, Ward's Education ExpensesStandard Account

Using the Schedule C, Disbursements, Ward's Education ExpensesStandard Account involves several steps. First, gather all necessary documentation related to educational expenses, such as receipts and invoices. Next, accurately fill out the form by entering your income and categorizing your educational expenses. Ensure that all entries are precise and reflect your actual expenditures. Once completed, the form must be submitted with your annual tax return to the IRS.

Steps to complete the Schedule C, Disbursements, Ward's Education ExpensesStandard Account

Completing the Schedule C, Disbursements, Ward's Education ExpensesStandard Account requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents, including receipts for educational expenses.

- Fill in your business income at the top of the form.

- List all disbursements related to education in the appropriate sections, ensuring you categorize them correctly.

- Double-check all entries for accuracy and completeness.

- Attach the completed form to your tax return before submission.

Legal use of the Schedule C, Disbursements, Ward's Education ExpensesStandard Account

The legal use of the Schedule C, Disbursements, Ward's Education ExpensesStandard Account is governed by IRS regulations. To ensure compliance, it is essential to maintain accurate records of all educational expenses claimed. This form must be filled out truthfully and submitted as part of your tax return. Misrepresentation or failure to comply with IRS guidelines can lead to penalties, including fines or audits.

Key elements of the Schedule C, Disbursements, Ward's Education ExpensesStandard Account

Key elements of the Schedule C, Disbursements, Ward's Education ExpensesStandard Account include:

- Identification of the taxpayer and business details.

- Documentation of income earned from self-employment.

- Detailed reporting of educational expenses, categorized appropriately.

- Signature and date to validate the form.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule C, Disbursements, Ward's Education ExpensesStandard Account align with the annual tax return deadlines. Typically, self-employed individuals must file their tax returns by April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is crucial to stay informed about any changes to these dates to ensure timely submission.

Quick guide on how to complete schedule c disbursements wards education expensesstandard account

Effortlessly Prepare Schedule C, Disbursements, Ward's Education ExpensesStandard Account on Any Device

Managing documents online has gained popularity among companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly and without delays. Handle Schedule C, Disbursements, Ward's Education ExpensesStandard Account on any platform using the airSlate SignNow Android or iOS applications and enhance any document-oriented operation today.

How to Alter and Electronically Sign Schedule C, Disbursements, Ward's Education ExpensesStandard Account with Ease

- Locate Schedule C, Disbursements, Ward's Education ExpensesStandard Account and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or conceal sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and electronically sign Schedule C, Disbursements, Ward's Education ExpensesStandard Account and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Schedule C, and how does it relate to disbursements?

Schedule C is a tax form used by sole proprietors to report income or loss from their business. Understanding disbursements related to Schedule C is crucial, as these expenses directly impact your taxable income. By accurately tracking these disbursements, you can optimize your tax filings and maximize deductions.

-

How can I track Ward's Education Expenses Standard Account with airSlate SignNow?

With airSlate SignNow, you can easily track Ward's Education Expenses Standard Account by uploading and eSigning relevant documents directly. The platform enables seamless management of educational expenses, ensuring that all pertinent disbursement records are kept organized and accessible. This feature also helps in simplifying tax preparation.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to suit your needs, starting with a free trial that allows you to explore features. Each plan is designed to deliver value for your investment, especially for those managing Schedule C, disbursements, and educational expense accounts. Contact our sales team to find the best option for your business.

-

What features does airSlate SignNow provide for managing tax-related documents?

airSlate SignNow includes features such as document templates, customizable workflows, and secure cloud storage, all crucial for managing tax-related documents, including Schedule C and disbursements. The platform simplifies the eSigning process and ensures that all documents are legally binding and compliant with regulations. These features streamline your operations and enhance productivity.

-

How does airSlate SignNow integrate with other financial software?

airSlate SignNow integrates seamlessly with various financial software solutions, helping you manage Schedule C, disbursements, and Ward's Education Expenses Standard Account efficiently. This integration allows for easy data transfer between platforms, reducing the risk of errors and ensuring that all financial records are up-to-date. Check our integration directory for compatible applications.

-

What benefits can I expect from using airSlate SignNow for my business?

Using airSlate SignNow provides numerous benefits, including enhanced efficiency in eSigning documents and managing financial records like Schedule C and disbursements. The platform offers a user-friendly interface and robust security measures, which makes managing Ward's Education Expenses Standard Account straightforward. Ultimately, it helps businesses save time and reduce costs associated with document management.

-

Is airSlate SignNow secure for handling sensitive financial information?

Yes, airSlate SignNow is designed with security in mind, employing encryption and secure cloud storage to protect sensitive financial information. This makes it a reliable choice for managing important documents like Schedule C, disbursements, and Ward's Education Expenses Standard Account. You can trust that your data is secure while you eSign and manage documents.

Get more for Schedule C, Disbursements, Ward's Education ExpensesStandard Account

Find out other Schedule C, Disbursements, Ward's Education ExpensesStandard Account

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF