GC 400C7 Schedule C, Disbursements, Living Expenses Form

What is the GC 400C7 Schedule C, Disbursements, Living Expenses

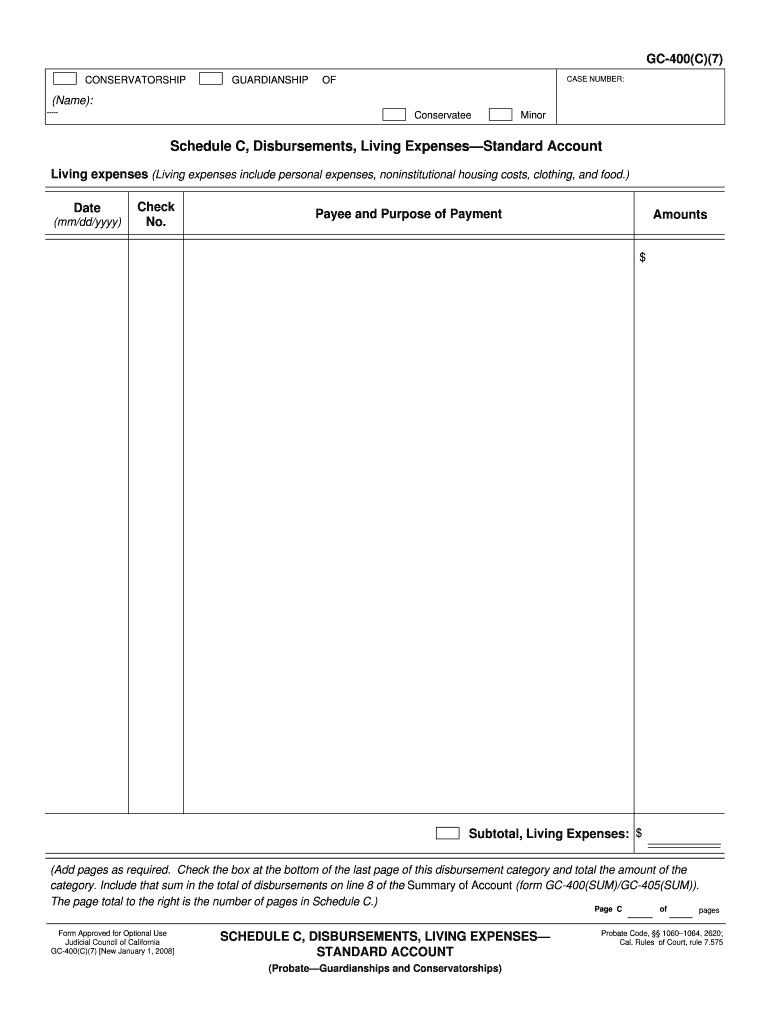

The GC 400C7 Schedule C, Disbursements, Living Expenses is a specific form used in the United States, primarily for reporting disbursements and living expenses associated with various financial activities. This form is essential for individuals and businesses to accurately document their expenses, ensuring compliance with tax regulations. It plays a crucial role in financial reporting and helps in maintaining transparency in financial dealings.

How to use the GC 400C7 Schedule C, Disbursements, Living Expenses

Using the GC 400C7 Schedule C, Disbursements, Living Expenses involves a straightforward process. First, gather all relevant financial documents that detail your disbursements and living expenses. Next, access the form, either in a digital format or as a printed copy. Fill out the required sections, ensuring that all information is accurate and complete. Once completed, review the form for any errors before submitting it according to the specified guidelines.

Steps to complete the GC 400C7 Schedule C, Disbursements, Living Expenses

Completing the GC 400C7 Schedule C, Disbursements, Living Expenses requires several key steps:

- Collect all necessary financial documents, including receipts and invoices.

- Download or print the GC 400C7 form.

- Fill in your personal information and financial details accurately.

- Detail your disbursements and living expenses in the designated sections.

- Review the completed form for accuracy and completeness.

- Submit the form through the designated method, either electronically or by mail.

Legal use of the GC 400C7 Schedule C, Disbursements, Living Expenses

The legal use of the GC 400C7 Schedule C, Disbursements, Living Expenses is governed by U.S. tax laws. This form must be filled out correctly to ensure compliance with federal and state regulations. Accurate reporting of disbursements and living expenses can protect individuals and businesses from potential legal issues, including audits or penalties for misreporting. It is essential to maintain records that support the entries made on the form.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the GC 400C7 Schedule C, Disbursements, Living Expenses. These guidelines outline the necessary information to include, the deadlines for submission, and the acceptable methods for filing. Adhering to these guidelines is crucial for ensuring that the form is processed correctly and that all reported expenses are eligible for deductions.

Filing Deadlines / Important Dates

Filing deadlines for the GC 400C7 Schedule C, Disbursements, Living Expenses typically align with the annual tax filing schedule. It is important to be aware of these dates to avoid late penalties. Generally, the deadline for submitting this form coincides with the tax return deadline, which is usually April fifteenth for most taxpayers. However, specific circumstances may warrant different deadlines, so it is advisable to check annually for any changes.

Quick guide on how to complete gc 400c7 schedule c disbursements living expenses

Complete GC 400C7 Schedule C, Disbursements, Living Expenses effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, enabling you to find the right form and securely save it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Handle GC 400C7 Schedule C, Disbursements, Living Expenses on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to modify and electronically sign GC 400C7 Schedule C, Disbursements, Living Expenses without hassle

- Obtain GC 400C7 Schedule C, Disbursements, Living Expenses and click Get Form to begin.

- Employ the tools we provide to fill out your document.

- Mark important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes seconds and bears the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from a device of your preference. Edit and electronically sign GC 400C7 Schedule C, Disbursements, Living Expenses and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the GC 400C7 Schedule C, Disbursements, Living Expenses?

The GC 400C7 Schedule C, Disbursements, Living Expenses is a tax form used to report various disbursements and living expenses associated with your business activities. With airSlate SignNow, you can easily create, edit, and eSign this document to ensure accuracy and compliance. Understanding this form is crucial for accurate tax reporting and can save you from potential fines.

-

How can airSlate SignNow help with the GC 400C7 Schedule C, Disbursements, Living Expenses?

airSlate SignNow streamlines the process of managing the GC 400C7 Schedule C, Disbursements, Living Expenses by allowing users to quickly prepare and electronically sign the document. The platform's intuitive interface simplifies data entry and enhances collaboration among stakeholders. This ensures that your disbursement records are accurate and readily accessible for tax purposes.

-

Is there a cost associated with using airSlate SignNow for the GC 400C7 Schedule C, Disbursements, Living Expenses?

Yes, airSlate SignNow offers several pricing plans to suit various business needs. Each plan provides access to features that help manage documents like the GC 400C7 Schedule C, Disbursements, Living Expenses efficiently and cost-effectively. Consider your requirements and choose a plan that best fits your budget and document volume.

-

What features does airSlate SignNow offer for handling the GC 400C7 Schedule C, Disbursements, Living Expenses?

airSlate SignNow provides a range of features for managing the GC 400C7 Schedule C, Disbursements, Living Expenses, including template creation, secure eSigning, and document storage. These features enhance productivity and ensure that your disbursement records are organized and easily retrievable. You can also track document progress, ensuring timely completion and submission.

-

Can I integrate airSlate SignNow with other tools for managing the GC 400C7 Schedule C, Disbursements, Living Expenses?

Yes, airSlate SignNow supports integration with various apps and tools, allowing for seamless workflows around the GC 400C7 Schedule C, Disbursements, Living Expenses. Whether using accounting software or project management tools, integrations enhance your document management processes. This means you can efficiently manage disbursements and living expenses while keeping all relevant systems connected.

-

How secure is my information when using airSlate SignNow for the GC 400C7 Schedule C, Disbursements, Living Expenses?

Security is a top priority at airSlate SignNow. When handling the GC 400C7 Schedule C, Disbursements, Living Expenses, your information is protected with advanced encryption and security protocols. This ensures that your sensitive data remains confidential and protected from unauthorized access.

-

Is it easy to use airSlate SignNow for the GC 400C7 Schedule C, Disbursements, Living Expenses?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to create and manage the GC 400C7 Schedule C, Disbursements, Living Expenses. With its straightforward navigation and helpful tutorials, users can quickly become proficient and improve their document management efficiency.

Get more for GC 400C7 Schedule C, Disbursements, Living Expenses

- Fillable clinical team report form

- Brief cognitive assessment tool short form jpshealthnet

- Cornhole tournament registration form friday august 5

- Matrix absence management fmla form pdf 6651831

- Eft form 34794952

- Smrf print form

- Adp substantiation claim form

- American threads application cdnshopifycom form

Find out other GC 400C7 Schedule C, Disbursements, Living Expenses

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure