Form 512

What is the Form 512

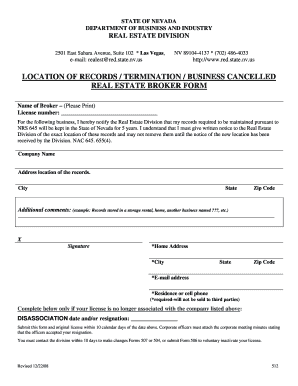

The form 512 is a specific document utilized by the Nevada Real Estate Division. It serves as an essential tool for individuals and entities involved in real estate transactions within the state. The form is designed to collect necessary information related to real estate activities, ensuring compliance with state regulations. Understanding the purpose of this form is crucial for anyone engaging in real estate dealings in Nevada.

How to use the Form 512

Using the form 512 involves several straightforward steps. First, ensure you have the latest version of the form, which can typically be obtained from the Nevada Real Estate Division's official website. Next, carefully fill out the required fields, providing accurate and complete information. Once completed, the form must be submitted according to the guidelines set forth by the Nevada Real Estate Division, which may include online submission or mailing the form to the appropriate office.

Steps to complete the Form 512

Completing the form 512 requires attention to detail. Follow these steps for a successful submission:

- Download the form from the Nevada Real Estate Division's website.

- Review the instructions carefully to understand the required information.

- Fill in your personal details, including name, address, and any relevant identification numbers.

- Provide specific information related to the real estate transaction, such as property details and transaction type.

- Double-check all entries for accuracy before submission.

Legal use of the Form 512

The legal use of the form 512 is governed by Nevada state regulations. It is essential for ensuring that all real estate transactions comply with local laws. The form must be completed accurately and submitted in a timely manner to avoid any legal repercussions. Misuse or incorrect completion of the form can lead to penalties or delays in processing real estate transactions.

State-specific rules for the Form 512

Each state has its own regulations regarding real estate forms, and Nevada is no exception. Specific rules for the form 512 include deadlines for submission, required signatures, and any accompanying documentation that must be provided. Familiarizing yourself with these state-specific rules is vital to ensure compliance and avoid potential issues during the transaction process.

Form Submission Methods

The form 512 can be submitted through various methods, depending on the preferences of the submitter and the guidelines of the Nevada Real Estate Division. Common submission methods include:

- Online submission through the Nevada Real Estate Division's portal.

- Mailing the completed form to the designated office address.

- In-person submission at the local Nevada Real Estate Division office.

Key elements of the Form 512

The form 512 contains several key elements that are crucial for its validity. These include:

- Identification of the parties involved in the transaction.

- Details regarding the property, including its location and type.

- Transaction specifics, such as sale price or lease terms.

- Signatures of all parties involved, affirming the accuracy of the information provided.

Quick guide on how to complete form 512 159290

Complete Form 512 effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents quickly without delays. Manage Form 512 on any platform using airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to edit and eSign Form 512 with ease

- Locate Form 512 and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to share your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, frustrating form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 512 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 512 159290

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 512 and how can airSlate SignNow help with it?

Form 512 is a tax form required for certain business filings. airSlate SignNow provides an efficient platform that allows users to upload, edit, and eSign form 512 quickly and securely, streamlining the process and ensuring compliance.

-

Is there a cost associated with using airSlate SignNow for form 512?

AirSlate SignNow offers affordable pricing plans that cater to various business needs. Users can choose a plan that fits their budget while enjoying full access to features necessary for managing and eSigning form 512 efficiently.

-

What features does airSlate SignNow offer for managing form 512?

AirSlate SignNow includes features such as document templates, customizable workflows, and secure eSignature capabilities specifically designed to simplify the management of form 512. These features ensure that users can complete and send their forms quickly and without hassle.

-

Can I integrate airSlate SignNow with other applications to handle form 512?

Yes, airSlate SignNow easily integrates with various applications, enhancing your workflow when dealing with form 512. Users can connect with tools like Google Drive, Dropbox, and Salesforce to manage their documents efficiently.

-

How does airSlate SignNow ensure the security of form 512?

AirSlate SignNow prioritizes security with features like advanced encryption, secure cloud storage, and compliance with industry standards. This ensures that your form 512 and sensitive data are protected throughout the signing process.

-

What are the benefits of using airSlate SignNow for form 512?

Using airSlate SignNow for form 512 can signNowly reduce turnaround time and improve efficiency. With electronic signatures and an easy-to-use interface, businesses can expedite their filing processes while maintaining professionalism and compliance.

-

Is it easy to set up and start using airSlate SignNow for form 512?

Absolutely! airSlate SignNow is designed for easy setup and user-friendly navigation. Users can quickly create, upload, and send form 512 documents within minutes, making it an ideal solution for businesses of all sizes.

Get more for Form 512

Find out other Form 512

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself