GC 400DGC 405D Schedule D, Losses on SalesStandard and Simplified Accounts Judicial Council Forms

What is the GC 400DGC 405D Schedule D, Losses On SalesStandard And Simplified Accounts Judicial Council Forms

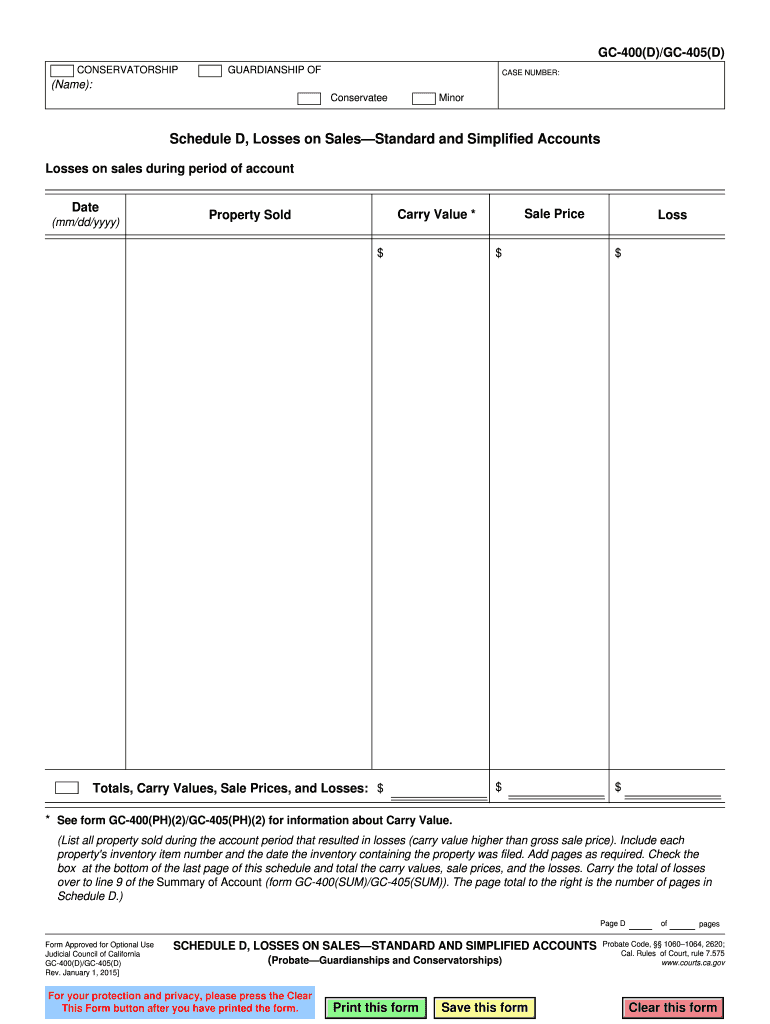

The GC 400DGC 405D Schedule D, Losses On SalesStandard And Simplified Accounts Judicial Council Forms are essential documents used in legal and financial contexts within the United States. These forms are designed to report losses incurred from sales, particularly for individuals and businesses that may be navigating complex tax situations. They help ensure compliance with state and federal regulations by providing a structured way to document financial losses.

How to use the GC 400DGC 405D Schedule D, Losses On SalesStandard And Simplified Accounts Judicial Council Forms

Using the GC 400DGC 405D Schedule D forms involves several key steps. First, gather all necessary financial records related to sales and losses. This includes invoices, receipts, and any relevant documentation that supports your claims. Next, accurately fill out the forms, ensuring that all information is complete and truthful. Once completed, the forms should be reviewed for accuracy before submission. Utilizing a digital platform can streamline this process, allowing for easy edits and secure storage of your documents.

Steps to complete the GC 400DGC 405D Schedule D, Losses On SalesStandard And Simplified Accounts Judicial Council Forms

Completing the GC 400DGC 405D Schedule D forms involves a systematic approach:

- Collect all relevant financial documents.

- Fill in personal or business identification details at the top of the form.

- Document all sales transactions, including dates and amounts.

- Clearly outline the losses incurred, providing necessary explanations.

- Review the completed form for accuracy and completeness.

- Submit the form through the designated method, whether online or by mail.

Legal use of the GC 400DGC 405D Schedule D, Losses On SalesStandard And Simplified Accounts Judicial Council Forms

The legal use of the GC 400DGC 405D Schedule D forms is crucial for ensuring that reported losses are recognized by tax authorities. These forms must be filled out in accordance with state and federal laws to avoid penalties. Proper use of these forms can also protect individuals and businesses from potential audits by providing clear documentation of financial activities.

Key elements of the GC 400DGC 405D Schedule D, Losses On SalesStandard And Simplified Accounts Judicial Council Forms

Key elements of the GC 400DGC 405D Schedule D forms include:

- Identification Information: Personal or business details.

- Transaction Records: Detailed accounts of sales and losses.

- Supporting Documentation: Evidence such as receipts and invoices.

- Signature: Required for legal validation of the information provided.

Form Submission Methods (Online / Mail / In-Person)

The GC 400DGC 405D Schedule D forms can be submitted through various methods. Online submission is often the most efficient, allowing for immediate processing. Alternatively, forms can be mailed to the appropriate judicial council office. In-person submission may also be available, depending on local regulations. Each method has its own requirements and processing times, so it is important to choose the one that best fits your needs.

Quick guide on how to complete gc 400dgc 405d schedule d losses on salesstandard and simplified accounts judicial council forms

Easily Prepare GC 400DGC 405D Schedule D, Losses On SalesStandard And Simplified Accounts Judicial Council Forms on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle GC 400DGC 405D Schedule D, Losses On SalesStandard And Simplified Accounts Judicial Council Forms on any device through airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and eSign GC 400DGC 405D Schedule D, Losses On SalesStandard And Simplified Accounts Judicial Council Forms Effortlessly

- Obtain GC 400DGC 405D Schedule D, Losses On SalesStandard And Simplified Accounts Judicial Council Forms and click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the details and click on the Done button to keep your modifications.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you choose. Update and eSign GC 400DGC 405D Schedule D, Losses On SalesStandard And Simplified Accounts Judicial Council Forms to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the purpose of the GC 400DGC 405D Schedule D, Losses On SalesStandard And Simplified Accounts Judicial Council Forms?

The GC 400DGC 405D Schedule D, Losses On SalesStandard And Simplified Accounts Judicial Council Forms are designed to help users accurately report losses from sales in judicial proceedings. These forms streamline the documentation process, ensuring compliance and clarity in your filings. By utilizing these forms, businesses can effectively manage their financial reporting.

-

How can airSlate SignNow help with GC 400DGC 405D Schedule D, Losses On SalesStandard And Simplified Accounts Judicial Council Forms?

airSlate SignNow facilitates the electronic signing and management of the GC 400DGC 405D Schedule D, Losses On SalesStandard And Simplified Accounts Judicial Council Forms. Our platform makes it easy to send, sign, and store documents securely, saving time and reducing the risk of errors. This efficiency ensures that you can focus on what matters most—your business.

-

What are the pricing plans for using airSlate SignNow for GC 400DGC 405D Schedule D forms?

airSlate SignNow offers competitive pricing plans tailored to different business needs, including those requiring the GC 400DGC 405D Schedule D, Losses On SalesStandard And Simplified Accounts Judicial Council Forms. Our plans are designed to provide cost-effective solutions while ensuring full access to essential features for document management. Contact us for a detailed breakdown of our pricing.

-

Are there any integrations available for managing GC 400DGC 405D Schedule D forms within airSlate SignNow?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing the management of GC 400DGC 405D Schedule D, Losses On SalesStandard And Simplified Accounts Judicial Council Forms. These integrations allow for smoother workflows and data transfer between different platforms, improving your overall productivity. Explore our integration options to find what best suits your needs.

-

What features does airSlate SignNow offer for the GC 400DGC 405D Schedule D forms?

airSlate SignNow provides a robust set of features for managing GC 400DGC 405D Schedule D, Losses On SalesStandard And Simplified Accounts Judicial Council Forms. Key features include document templates, real-time collaboration, and advanced security options to protect sensitive data. These tools make it easy for businesses to handle their documentation efficiently.

-

How can using airSlate SignNow improve compliance for GC 400DGC 405D Schedule D forms?

By using airSlate SignNow for GC 400DGC 405D Schedule D, Losses On SalesStandard And Simplified Accounts Judicial Council Forms, businesses can enhance their compliance efforts. Our solution provides automated tracking and audit trails, ensuring that every signature and action is documented. This transparency helps protect your organization during audits and legal proceedings.

-

Is it easy to access GC 400DGC 405D Schedule D forms on airSlate SignNow?

Absolutely! Accessing GC 400DGC 405D Schedule D, Losses On SalesStandard And Simplified Accounts Judicial Council Forms on airSlate SignNow is straightforward. Users can easily navigate through our user-friendly interface, allowing for quick generation and management of all necessary documents. No extensive training is required, making it ideal for any business.

Get more for GC 400DGC 405D Schedule D, Losses On SalesStandard And Simplified Accounts Judicial Council Forms

- Corrective action request form

- Maine revenue services supplement to the real estate transfer tax form maine

- A1 b2 c3 chart form

- Lesson 6 6 practice b applications of percents answers form

- Christian index cme church form

- Learning zone express worksheets form

- Program assessment template form

- Tc 96 184 pdf form

Find out other GC 400DGC 405D Schedule D, Losses On SalesStandard And Simplified Accounts Judicial Council Forms

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter