Schwab Supplementary Tax Information

What is the Schwab Supplementary Tax Information

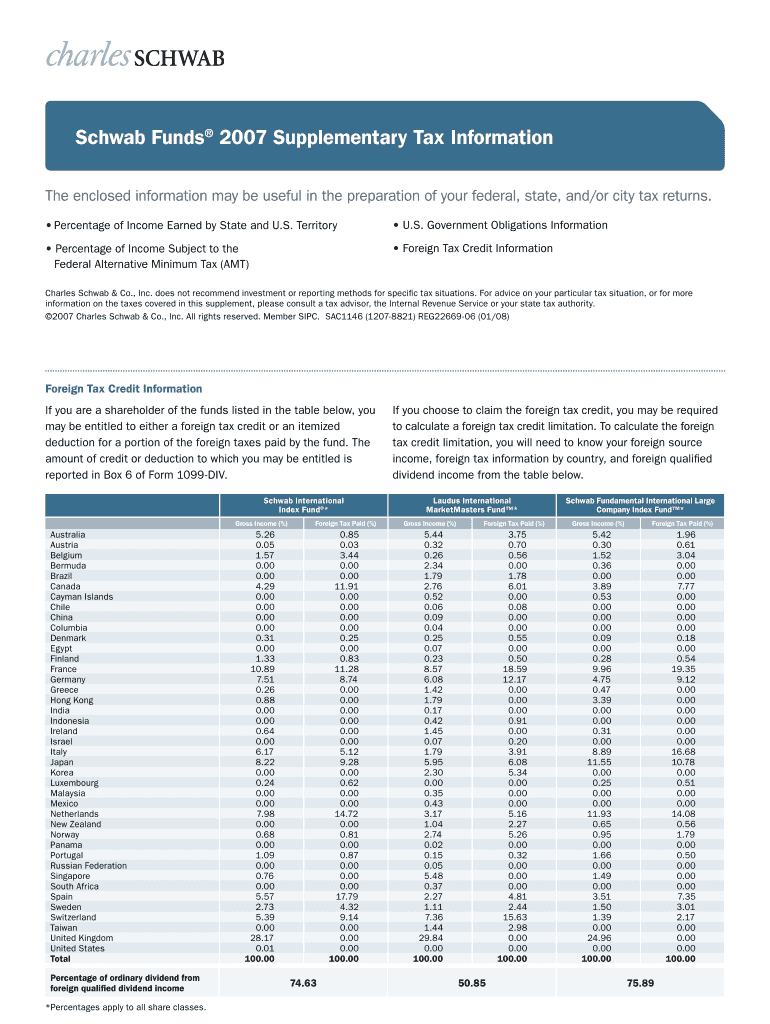

The Schwab 2023 supplementary tax information provides essential details for taxpayers regarding their investment accounts and transactions with Charles Schwab. This document typically includes information about dividends, interest income, and capital gains that may affect an individual's tax obligations. Understanding this information is crucial for accurate tax reporting and compliance with IRS regulations.

How to Obtain the Schwab Supplementary Tax Information

To obtain the Schwab supplementary tax information, account holders can log into their Charles Schwab online account. Once logged in, navigate to the tax documents section where the supplementary tax information for the current year is available for download. Alternatively, Schwab may also send this information via mail to account holders, ensuring they have access to necessary tax documents for filing purposes.

Steps to Complete the Schwab Supplementary Tax Information

Completing the Schwab supplementary tax information involves several steps to ensure accuracy and compliance. First, gather all relevant financial documents, including previous tax returns and any investment statements. Next, review the supplementary tax information provided by Schwab for any entries that require additional clarification or documentation. Finally, accurately report the information on your tax return, ensuring that all figures match the details provided in the Schwab documentation.

Legal Use of the Schwab Supplementary Tax Information

The Schwab supplementary tax information is legally recognized as a valid source for reporting income and capital gains on tax returns. It is essential for taxpayers to use this information correctly to comply with IRS guidelines. Failure to report the information accurately can lead to penalties or audits, making it vital to understand the legal implications of the data provided in the supplementary tax information.

Key Elements of the Schwab Supplementary Tax Information

Key elements of the Schwab supplementary tax information include details about various types of income such as dividends, interest, and capital gains. Additionally, the document outlines any tax withholding that may have occurred and provides necessary identification numbers. Understanding these elements helps taxpayers accurately report their earnings and ensure compliance with federal tax laws.

Filing Deadlines / Important Dates

Filing deadlines for tax returns typically fall on April 15 of each year, but it is important to check for any extensions or changes. Additionally, taxpayers should be aware of specific deadlines for submitting any supplementary tax information. Missing these deadlines can result in penalties, so staying informed about important dates is crucial for timely filing.

Quick guide on how to complete schwab supplementary tax information 2024

Effortlessly Prepare schwab supplementary tax information 2024 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers a perfect environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly, without any delays. Manage charles schwab 2024 supplementary tax information on any device using airSlate SignNow's apps for Android or iOS and enhance any document-related procedure today.

How to edit and eSign charles schwab tax documents with ease

- Locate schwab 2023 supplementary tax information and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive details with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your updates.

- Select your preferred method to send your form—via email, SMS, invitation link, or download it to your device.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that necessitate printing out new copies. airSlate SignNow addresses all your document management needs with just a few clicks from your chosen device. Edit and eSign schwab 2024 supplementary tax information to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs schwab funds tax center

-

When I fill out my tax information for a new employer, what do I put for max withholding, to get the biggest possible tax return?

It sounds like you wish to get a large tax return. In that case when filling out your W-4 form you should claim S-0 (that’s single with zero exemptions). This means that your employer will take out the maximum amount. For those people who insist upon the government having use of their money all year there is also an option to have additional funds taken out and held and then returned when your annual return is filed. For that matter you could allow the government to keep it all during the year and then when you file your return instead of taking a refund just tell them to keep it toward next years return. Seriously, I know the large tax return seems nice and for some people that is how they save for vacations and other things, but a tax return is not a gift from the USA. It is your money and receiving a large tax return means that you allowed someone else to have your money for a year without paying you interest for the privilege of keeping your money.

-

How do I fill tax information to sell on Amazon if I live in Saudi Arabia?

If your business entity is incorporated in another country by a partner accounting and consulting firm, they should be able to also deal with the tax requirements for that location. It's merely an expense to pay, sometimes monthly, sometimes yearly. I'm not here to advertise but my team here has been helping companies do this for over 10 years now. Amazon has a site specifically for compliance references. They link to partner companies around the world that assist with this kind of thing. Just google “amazon FBA compliance reference” you should be able to find their site.

-

How do I fill out a 1120 tax report?

If you are not sophisticated with taxes, DON'T try this form. You can get yourself in a lot of trouble. Get a good CPA or EA. The time and effort it will take you to figure this thing out is not worth it. If you value your time at more than the minimum wage, you will save time and money by hiring a professional.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

Related searches to charles schwab tax forms

Create this form in 5 minutes!

How to create an eSignature for the schwab tax documents

How to create an eSignature for the Schwab 2011 Supplementary Tax Information online

How to create an eSignature for the Schwab 2011 Supplementary Tax Information in Google Chrome

How to generate an eSignature for putting it on the Schwab 2011 Supplementary Tax Information in Gmail

How to make an electronic signature for the Schwab 2011 Supplementary Tax Information from your smartphone

How to create an electronic signature for the Schwab 2011 Supplementary Tax Information on iOS devices

How to create an eSignature for the Schwab 2011 Supplementary Tax Information on Android

People also ask charles schwab 2021 supplementary tax information

-

What is charles schwab supplementary tax information 2023 and why is it important?

Charles Schwab supplementary tax information 2023 refers to the additional tax documents and details provided by Charles Schwab to assist with tax reporting. This information is crucial for accurate tax filing and understanding investment income, helping individuals maximize their tax benefits.

-

How can I access charles schwab supplementary tax information 2023?

You can access charles schwab supplementary tax information 2023 through the Charles Schwab website or by logging into your account. This information is typically available in the tax documents section, providing you with the necessary data to assist with your tax preparation.

-

Are there any fees associated with obtaining charles schwab supplementary tax information 2023?

There are no fees associated with obtaining charles schwab supplementary tax information 2023. Charles Schwab provides this information free of charge to help customers manage their tax obligations efficiently.

-

How does charles schwab supplementary tax information 2023 benefit investors?

Charles Schwab supplementary tax information 2023 benefits investors by providing detailed information about dividends, interest, and capital gains. This clarity helps investors to accurately report their income, potentially leading to tax savings and better financial planning.

-

Can I integrate airSlate SignNow for document signing related to charles schwab supplementary tax information 2023?

Yes, you can integrate airSlate SignNow with your workflow to facilitate document signing related to charles schwab supplementary tax information 2023. This integration streamlines the process, making it easier to manage your tax documents securely and efficiently.

-

What features of airSlate SignNow help with managing charles schwab supplementary tax information 2023?

AirSlate SignNow offers features such as electronic signatures, document templates, and secure cloud storage that can assist in managing charles schwab supplementary tax information 2023. These tools enhance productivity and ensure that all documents are easily accessible and securely signed.

-

Is airSlate SignNow a cost-effective solution for handling charles schwab supplementary tax information 2023?

Yes, airSlate SignNow is designed to be a cost-effective solution for handling charles schwab supplementary tax information 2023. With competitive pricing plans and a range of features tailored for businesses, it helps save both time and resources during the tax preparation process.

Get more for charles schwab supplementary tax information 2023

Find out other schwab supplementary tax information

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy