REQUEST for ADMINISTRATIVE REVIEW of INCOME TAX OFFSET Form

What is the REQUEST FOR ADMINISTRATIVE REVIEW OF INCOME TAX OFFSET

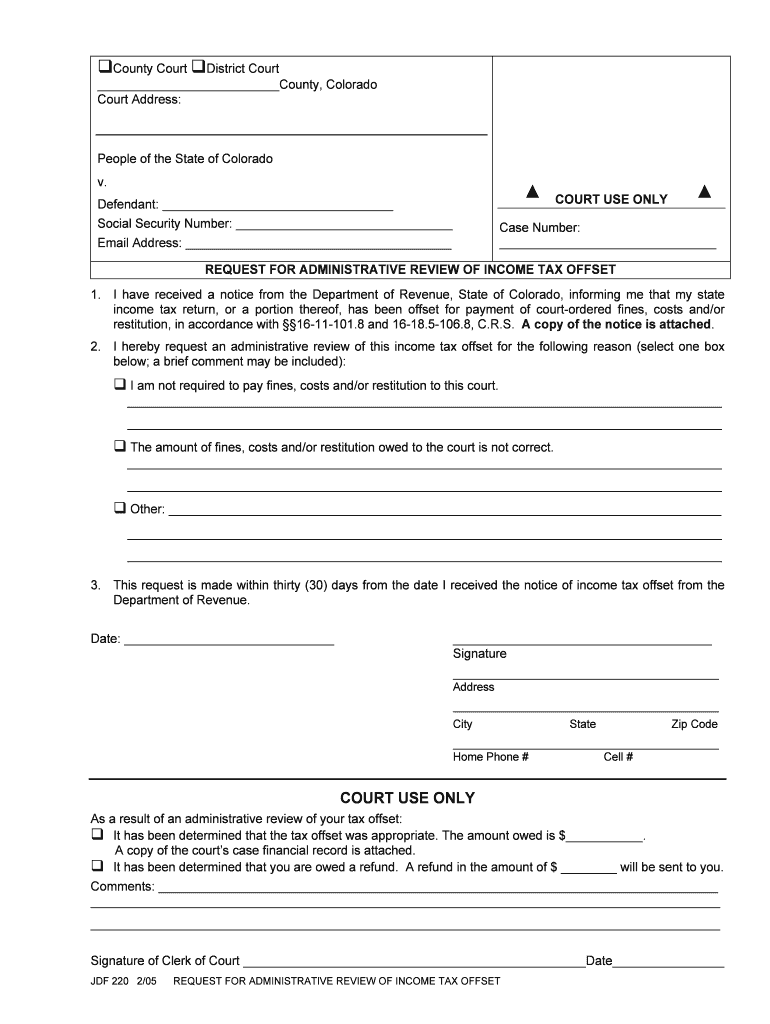

The REQUEST FOR ADMINISTRATIVE REVIEW OF INCOME TAX OFFSET is a formal document that taxpayers in the United States can submit to contest an income tax offset. This offset typically occurs when the government withholds a portion of a taxpayer's refund to settle outstanding debts, such as student loans or unpaid taxes. By filing this request, individuals seek a review of the offset decision, allowing them to present their case and potentially reclaim their withheld funds.

Steps to complete the REQUEST FOR ADMINISTRATIVE REVIEW OF INCOME TAX OFFSET

Completing the REQUEST FOR ADMINISTRATIVE REVIEW OF INCOME TAX OFFSET involves several essential steps:

- Gather necessary documentation, including any notices received regarding the offset.

- Fill out the request form accurately, ensuring all information matches your tax records.

- Provide a clear explanation of why you believe the offset is incorrect, including any supporting evidence.

- Review the completed form for accuracy and completeness before submission.

- Submit the form via the designated method, whether online, by mail, or in person, as specified by the relevant tax authority.

Legal use of the REQUEST FOR ADMINISTRATIVE REVIEW OF INCOME TAX OFFSET

The legal use of the REQUEST FOR ADMINISTRATIVE REVIEW OF INCOME TAX OFFSET is governed by federal and state tax laws. It serves as a formal avenue for taxpayers to challenge the legality of an income tax offset. To ensure that the request is legally valid, it must comply with the requirements set forth by the Internal Revenue Service (IRS) and any applicable state tax agencies. This includes adhering to deadlines and providing sufficient documentation to support the claim.

Required Documents

When submitting the REQUEST FOR ADMINISTRATIVE REVIEW OF INCOME TAX OFFSET, certain documents are typically required to support your case. These may include:

- A copy of the notice you received regarding the offset.

- Your tax return for the year in question.

- Any relevant correspondence with the IRS or state tax authority.

- Proof of payment or documentation demonstrating the offset's inaccuracy.

Form Submission Methods

Taxpayers can submit the REQUEST FOR ADMINISTRATIVE REVIEW OF INCOME TAX OFFSET through various methods. Common submission options include:

- Online submission through the IRS or state tax agency's official website.

- Mailing the completed form to the appropriate tax office.

- In-person delivery at designated tax office locations.

Eligibility Criteria

To be eligible to file the REQUEST FOR ADMINISTRATIVE REVIEW OF INCOME TAX OFFSET, taxpayers must meet specific criteria. Generally, these include:

- Being the individual whose tax refund was offset.

- Having a valid reason to contest the offset, supported by documentation.

- Filing the request within the designated timeframe set by the IRS or state tax authority.

Quick guide on how to complete request for administrative review of income tax offset

Complete REQUEST FOR ADMINISTRATIVE REVIEW OF INCOME TAX OFFSET easily on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage REQUEST FOR ADMINISTRATIVE REVIEW OF INCOME TAX OFFSET on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The simplest way to modify and eSign REQUEST FOR ADMINISTRATIVE REVIEW OF INCOME TAX OFFSET effortlessly

- Locate REQUEST FOR ADMINISTRATIVE REVIEW OF INCOME TAX OFFSET and click Get Form to begin.

- Use the tools we offer to finish your document.

- Mark pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from a device of your choice. Edit and eSign REQUEST FOR ADMINISTRATIVE REVIEW OF INCOME TAX OFFSET and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a REQUEST FOR ADMINISTRATIVE REVIEW OF INCOME TAX OFFSET?

A REQUEST FOR ADMINISTRATIVE REVIEW OF INCOME TAX OFFSET is a formal process you can initiate to contest a tax refund offset. This request allows taxpayers to provide proof and justification against the offset, potentially recovering withheld funds. Utilizing airSlate SignNow simplifies this process with digital documentation.

-

How can airSlate SignNow assist with the REQUEST FOR ADMINISTRATIVE REVIEW OF INCOME TAX OFFSET?

airSlate SignNow enables users to easily create, send, and sign documents related to the REQUEST FOR ADMINISTRATIVE REVIEW OF INCOME TAX OFFSET. The platform streamlines the submission process while maintaining compliance with legal standards. This ensures your requests are managed efficiently and securely.

-

What features does airSlate SignNow offer for managing tax offset requests?

With airSlate SignNow, you can access features such as customizable templates, electronic signatures, and real-time document tracking. These tools are designed to facilitate smooth communication regarding the REQUEST FOR ADMINISTRATIVE REVIEW OF INCOME TAX OFFSET. Our integration also allows seamless sharing of documents with tax professionals and authorities.

-

Is there a cost associated with using airSlate SignNow for tax offsets?

Yes, airSlate SignNow offers various pricing plans that cater to businesses of all sizes. Our plans are designed to provide excellent value while enabling users to manage the REQUEST FOR ADMINISTRATIVE REVIEW OF INCOME TAX OFFSET effectively. Check our website for detailed pricing options to find the best fit for your needs.

-

Can I integrate airSlate SignNow with my existing software tools?

Absolutely! airSlate SignNow integrates with various applications such as Google Drive, Salesforce, and Dropbox. These integrations make it easier to manage your documentation for the REQUEST FOR ADMINISTRATIVE REVIEW OF INCOME TAX OFFSET, enhancing your overall workflow efficiency.

-

What are the benefits of using airSlate SignNow for document management?

Using airSlate SignNow for document management provides convenience, cost savings, and secure access. With features tailored for the REQUEST FOR ADMINISTRATIVE REVIEW OF INCOME TAX OFFSET, it allows you to reduce processing time and improve workflow productivity. Our platform is designed with user experience in mind, ensuring everyone can navigate it easily.

-

How secure is my information when using airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols to protect your data during the entire process, including the REQUEST FOR ADMINISTRATIVE REVIEW OF INCOME TAX OFFSET. Rest assured, your documents and personal information are safeguarded against unauthorized access.

Get more for REQUEST FOR ADMINISTRATIVE REVIEW OF INCOME TAX OFFSET

Find out other REQUEST FOR ADMINISTRATIVE REVIEW OF INCOME TAX OFFSET

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent