Form W 8ben

What is the Form W-8BEN

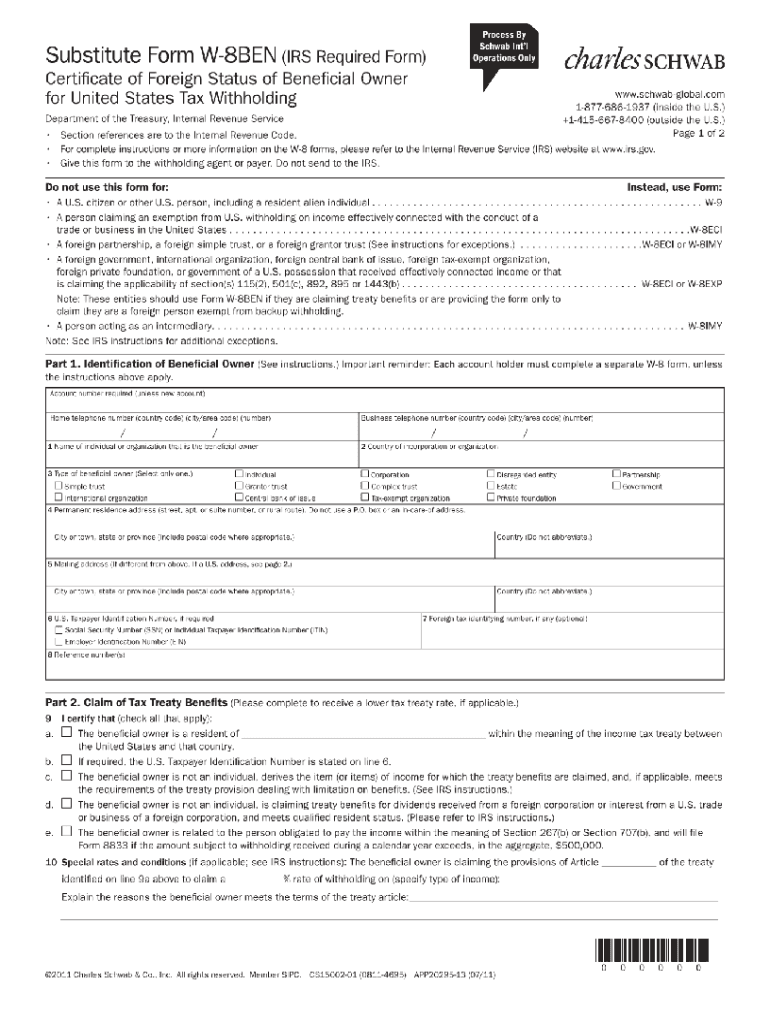

The Form W-8BEN is a tax form used by foreign individuals and entities to certify their foreign status. It is primarily utilized to claim tax treaty benefits and to avoid or reduce withholding tax on certain types of income, such as dividends, interest, and royalties, received from U.S. sources. By completing this form, individuals can ensure that they are not subject to unnecessary taxation on income that is exempt under U.S. tax law.

Steps to Complete the Form W-8BEN

Completing the Form W-8BEN involves several key steps:

- Provide Personal Information: Enter your name, country of citizenship, and address. Ensure that the information matches your official identification documents.

- Claim Tax Treaty Benefits: If applicable, indicate your eligibility for benefits under a tax treaty between your country and the United States.

- Sign and Date the Form: Your signature certifies that the information provided is accurate and complete. Include the date of signing.

After completing the form, it is crucial to ensure that all information is accurate to avoid delays or issues with tax withholding.

How to Obtain the Form W-8BEN

The Form W-8BEN can be obtained directly from the Internal Revenue Service (IRS) website. It is available for download as a PDF, which can be printed and filled out manually. Additionally, many financial institutions and tax professionals provide copies of the form for their clients. Ensure you are using the most current version of the form to comply with IRS regulations.

Legal Use of the Form W-8BEN

The Form W-8BEN is legally binding when filled out correctly and submitted to the appropriate withholding agent. It serves as a declaration of your foreign status and claims any applicable tax treaty benefits. Failure to provide a valid W-8BEN may result in higher withholding tax rates on U.S. income. It is essential to keep the form updated, especially if there are changes in your residency status or tax treaty eligibility.

Key Elements of the Form W-8BEN

The key elements of the Form W-8BEN include:

- Identification of the Beneficial Owner: This section requires personal details of the individual or entity claiming benefits.

- Claim of Tax Treaty Benefits: This part allows the claimant to specify which treaty benefits they are eligible for, if any.

- Signature and Certification: The form must be signed by the beneficial owner, certifying the accuracy of the information provided.

Each of these elements is crucial for ensuring the form's validity and compliance with U.S. tax laws.

Filing Deadlines / Important Dates

While the Form W-8BEN does not have a specific filing deadline, it must be submitted before the payment is made to ensure proper withholding rates. It is advisable to provide the form to the withholding agent as soon as possible to avoid unnecessary withholding. Additionally, the form should be updated every three years or whenever there is a change in circumstances affecting the information provided.

Quick guide on how to complete w 8 ben form

Prepare Form W 8ben effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without delays. Manage Form W 8ben on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to edit and eSign Form W 8ben with ease

- Obtain Form W 8ben and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of missing or lost files, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Modify and eSign Form W 8ben to ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do you appeal if you were erroneously reported as a US person and as a result became flagged by FATCA as a US person?

As long as you've been flagged by a Foreign Financial Institution and this organization approaches you with questions or a W-8/W-8-BEN/W-8-BEN-E/W-9 form to fill out, you can provide evidence of the correct situation regarding U.S. income taxation.

-

How can you fill out the W-8BEN form (no tax treaty)?

A payer of a reportable payment may treat a payee as foreign if the payer receives an applicable Form W-8 from the payee. Provide this Form W-8BEN to the requestor if you are a foreign individual that is a participating payee receiving payments in settlement of payment card transactions that are not effectively connected with a U.S. trade or business of the payee.As stated by Mr. Ivanov below, Since Jordan is not one of the countries listed as a tax treaty country, it appears that you would only complete Part I of the Form W-8BEN, Sign your name and date the Certification in Part III.http://www.irs.gov/pub/irs-pdf/i...Hope this is helpful.

-

How do I fill out the Amazon Affiliate W-8 Tax Form as a non-US individual?

It depends on your circumstances.You will probably have a form W8 BEN (for individuals/natural persons) or a form W8 BEN E (for corporations or other businesses that are not natural persons).Does your country have a double tax convention with the USA? Check here United States Income Tax Treaties A to ZDoes your income from Amazon relate to a business activity and does it specifically not include Dividends, Interest, Royalties, Licensing Fees, Fees in return for use of a technology, rental of property or offshore oil exploration?Is all the work carried out to earn this income done outside the US, do you have no employees, assets or offices located in the US that contributed to earning this income?Were you resident in your home country in the year that you earned this income and not resident in the US.Are you registered to pay tax on your business profits in your home country?If you meet these criteria you will probably be looking to claim that the income is taxable at zero % withholding tax under article 7 of your tax treaty as the income type is business profits arises solely from business activity carried out in your home country.

-

Which W-8 form should I fill out as an LLC company?

How do they know to request a W-8 instead of a W-9? Are you Foreign?Assuming you need to submit a W-8 instead of a W-9, here are the questions to guide your W-8 decision.Do you have other members in your LLC? If you are the only member, a Single Member LLC is a Disregarded Entity taxed on your personal tax return. So you would submit the W-8BEN.If you have other members, are you subject to the default status or have you elected corporate status?If you are subject to the default status, your LLC is taxed as a partnership so submit the W-8IMYIf you elected Corporate status, submit the W-8BEN-E.https://www.irs.gov/pub/irs-pdf/...Other great answers here. Especially good advice from Carl and Mark, get to a CPA.

-

Do I need US EIN taxpayer ID to properly fill out a W8-BEN form?

Since I have asked this question, I believe that I should share the knowledge I have managed to collect in its regard.So, it appears that you should file a SS-4 form to apply for the Employer Identification Number (EIN). To this successfully you will need to have a contract signed with customer in the USA. You will have to show given contract to the US IRA.The downside of this method is that:It requires for you to sign contract with US party prior to the acquiring the EINYou will have to mail originals of your Passport/Natinal ID and contract to the IRA.Instead of going that way, I have decided to register my own "Disregarded entity"-type LLC.If you are also considering going that way, please note that the most popular state for registering such companies (namely, Delaware) is not necessary best for your particular case.AFAICK, tax-wise, there are two top states:Delaware (DE): Sales Tax = 0%, Income Tax = 6.95%Nevada (NV): Sales tax = 7.93%, Income Tax = 0%You will need to find registered agent to register your LLC properly.

Create this form in 5 minutes!

How to create an eSignature for the w 8 ben form

How to make an electronic signature for the W 8 Ben Form in the online mode

How to make an electronic signature for your W 8 Ben Form in Chrome

How to create an eSignature for putting it on the W 8 Ben Form in Gmail

How to create an eSignature for the W 8 Ben Form from your smartphone

How to create an electronic signature for the W 8 Ben Form on iOS devices

How to make an electronic signature for the W 8 Ben Form on Android OS

People also ask

-

What is Form W 8ben and why do I need it?

Form W 8ben is a certification form used by foreign individuals and entities to confirm their foreign status for U.S. tax withholding purposes. By submitting Form W 8ben, you can ensure that you are not subject to higher withholding taxes on income received from U.S. sources. Understanding how to properly complete and use Form W 8ben is essential for compliance and financial efficiency.

-

How does airSlate SignNow facilitate the signing of Form W 8ben?

airSlate SignNow provides an intuitive platform that allows users to easily create, send, and eSign Form W 8ben electronically. With its user-friendly interface, you can quickly fill out the required fields, add your signature, and send the document securely to recipients, ensuring a streamlined process for handling tax-related forms.

-

Is there a cost associated with using airSlate SignNow for Form W 8ben?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. While there is a cost associated with using the platform, the investment is justified by the efficiency and security it provides for managing important documents like Form W 8ben. You can choose a plan that best fits your budget and requirements.

-

Can I integrate airSlate SignNow with other applications for managing Form W 8ben?

Absolutely! airSlate SignNow offers seamless integrations with various applications such as Google Drive, Dropbox, and CRM systems, making it easier to manage Form W 8ben and other documents. These integrations enhance your workflow and ensure that important tax forms are easily accessible and manageable within your existing systems.

-

What security measures does airSlate SignNow have in place for Form W 8ben?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like Form W 8ben. The platform employs advanced encryption methods, secure cloud storage, and strict access controls to ensure that your documents remain safe and confidential throughout the signing process.

-

How can airSlate SignNow improve the efficiency of handling Form W 8ben?

Using airSlate SignNow to manage Form W 8ben can signNowly streamline your document workflow. The platform allows for quick edits, easy sharing, and fast eSigning, which reduces the time spent on paperwork and minimizes delays in processing important tax forms.

-

What features does airSlate SignNow offer for managing Form W 8ben?

airSlate SignNow comes equipped with a range of features designed to enhance your document management experience, including customizable templates for Form W 8ben, automated reminders for signers, and comprehensive tracking of document status. These features ensure that you never miss an important deadline and that your documents are handled efficiently.

Get more for Form W 8ben

Find out other Form W 8ben

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now