To EmployerTrusteeOther Payor of Funds Form

What is the To EmployerTrusteeOther Payor Of Funds

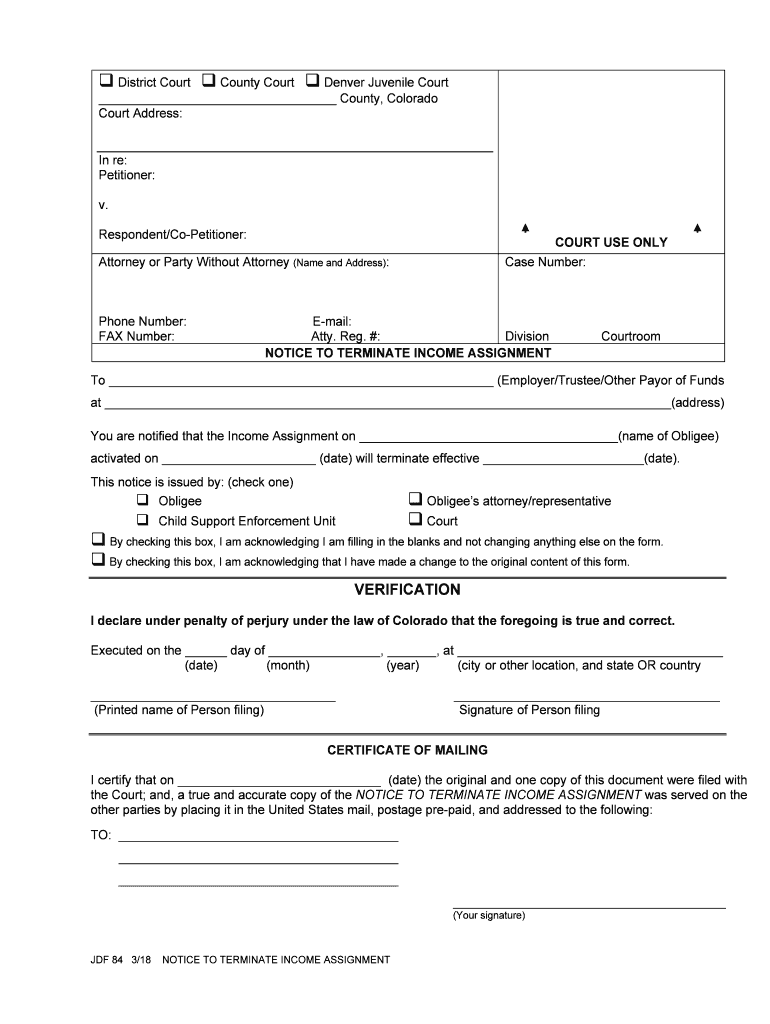

The To EmployerTrusteeOther Payor Of Funds form is a crucial document utilized in various financial transactions. It serves as a formal request for the transfer of funds from an employer, trustee, or other payors. This form is often required in contexts such as retirement account distributions, insurance payouts, or other financial obligations where funds need to be disbursed to individuals or entities. Understanding the purpose and implications of this form is essential for ensuring compliance and proper handling of financial transactions.

How to use the To EmployerTrusteeOther Payor Of Funds

Using the To EmployerTrusteeOther Payor Of Funds form involves several straightforward steps. First, identify the specific purpose for which the form is needed, such as a withdrawal or payment request. Next, accurately fill out all required fields, ensuring that the information provided is complete and correct. This includes details about the payor, the recipient, and the amount being requested. Once completed, the form should be submitted according to the guidelines provided by the payor, which may include online submission, mailing, or in-person delivery.

Steps to complete the To EmployerTrusteeOther Payor Of Funds

Completing the To EmployerTrusteeOther Payor Of Funds form involves a series of methodical steps:

- Gather necessary information, including personal details and financial account numbers.

- Clearly state the reason for the fund transfer, ensuring it aligns with the payor's requirements.

- Fill in the form accurately, double-checking for any errors or omissions.

- Sign and date the form to validate the request.

- Submit the form using the specified method, whether online, by mail, or in person.

Legal use of the To EmployerTrusteeOther Payor Of Funds

The legal use of the To EmployerTrusteeOther Payor Of Funds form is governed by various regulations that ensure its validity and enforceability. For the form to be legally binding, it must be completed in accordance with applicable laws, including those related to electronic signatures and data protection. Compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA) is essential for digital submissions. Additionally, the form should be retained for record-keeping purposes to provide evidence of the transaction in case of disputes.

Key elements of the To EmployerTrusteeOther Payor Of Funds

Several key elements must be included in the To EmployerTrusteeOther Payor Of Funds form to ensure its effectiveness:

- Payor Information: Details about the employer, trustee, or entity responsible for disbursing funds.

- Recipient Information: Accurate identification of the individual or organization receiving the funds.

- Amount Requested: The specific sum of money being requested for transfer.

- Reason for Transfer: A clear explanation of the purpose behind the fund request.

- Signature: The signature of the requester, confirming the authenticity of the request.

Examples of using the To EmployerTrusteeOther Payor Of Funds

There are various scenarios where the To EmployerTrusteeOther Payor Of Funds form is applicable:

- Requesting a distribution from a retirement account, such as a 401(k) or IRA.

- Initiating a claim for an insurance payout following a policyholder's death.

- Transferring funds from a trust to a beneficiary as part of estate planning.

- Requesting payment for services rendered or contractual obligations.

Quick guide on how to complete to employertrusteeother payor of funds

Complete To EmployerTrusteeOther Payor Of Funds seamlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without setbacks. Manage To EmployerTrusteeOther Payor Of Funds on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign To EmployerTrusteeOther Payor Of Funds without hassle

- Locate To EmployerTrusteeOther Payor Of Funds and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign To EmployerTrusteeOther Payor Of Funds to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the role of 'To EmployerTrusteeOther Payor Of Funds' in the signing process?

'To EmployerTrusteeOther Payor Of Funds' signifies the individual or entity that holds the authority to manage funds related to document transactions. Understanding this role is crucial for ensuring that resources are allocated correctly during the signing process. airSlate SignNow simplifies this by allowing seamless interaction with all stakeholders involved.

-

How does airSlate SignNow ensure security for 'To EmployerTrusteeOther Payor Of Funds' transactions?

airSlate SignNow prioritizes the security of all transactions, including those involving 'To EmployerTrusteeOther Payor Of Funds'. With top-notch encryption and secure access controls, your sensitive documents are well protected. This means that both signatures and financial transactions remain confidential and secure.

-

What features does airSlate SignNow offer for 'To EmployerTrusteeOther Payor Of Funds' interactions?

airSlate SignNow provides a range of features specifically tailored for 'To EmployerTrusteeOther Payor Of Funds' interactions. These include customizable templates, advanced eSignature options, and collaboration tools. These features streamline the signing process, making it easier to manage documents involving multiple payors.

-

Can I integrate airSlate SignNow with my existing systems for managing 'To EmployerTrusteeOther Payor Of Funds'?

Absolutely! airSlate SignNow offers robust integrations with various business systems, allowing you to incorporate 'To EmployerTrusteeOther Payor Of Funds' management seamlessly. By connecting with platforms such as CRM and ERP systems, you can enhance workflow efficiency while ensuring all transactions are well-documented.

-

What are the pricing plans available for using airSlate SignNow for 'To EmployerTrusteeOther Payor Of Funds'?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes handling 'To EmployerTrusteeOther Payor Of Funds' transactions. Each plan includes a variety of features to help teams collaborate effectively while managing documents. You can choose a plan that best fits your organization's needs and budget.

-

How can airSlate SignNow improve the efficiency of 'To EmployerTrusteeOther Payor Of Funds' processes?

By utilizing airSlate SignNow, businesses can signNowly enhance the efficiency of 'To EmployerTrusteeOther Payor Of Funds' processes. Its user-friendly interface enables faster document turnaround times and reduces the need for physical paperwork. This not only saves time but also decreases operational costs.

-

Is there a mobile app available for managing 'To EmployerTrusteeOther Payor Of Funds'?

Yes, airSlate SignNow features a mobile app that allows you to manage 'To EmployerTrusteeOther Payor Of Funds' transactions on the go. The app offers the same robust features as the desktop version, ensuring you can send, sign, and manage documents effortlessly anytime, anywhere.

Get more for To EmployerTrusteeOther Payor Of Funds

- Prize receipt form

- Sf lll form

- Cook county form ccm 0138

- Internal payment request form template

- Affidavit of surviving joint tenant ohio form

- Vital statistics university blvd jacksonville fl form

- Families forever enrollment form name address da

- Away from home care guest membership application p form

Find out other To EmployerTrusteeOther Payor Of Funds

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free