CONTRACTOR'S LIST INDIVIDUAL Form

What is the CONTRACTOR'S LIST INDIVIDUAL

The CONTRACTOR'S LIST INDIVIDUAL is a crucial document used by businesses in the United States to maintain a record of individual contractors they engage for various services. This list helps ensure compliance with tax regulations and facilitates the accurate reporting of payments made to contractors. By documenting contractor details, businesses can streamline their accounting processes and fulfill their obligations to the Internal Revenue Service (IRS).

How to use the CONTRACTOR'S LIST INDIVIDUAL

Using the CONTRACTOR'S LIST INDIVIDUAL involves several straightforward steps. First, businesses should gather essential information about each contractor, including their name, address, Social Security number, and the nature of the services provided. Once this information is compiled, it can be entered into the form. This list should be updated regularly to reflect any changes in contractor status or details, ensuring that the information remains accurate and compliant with IRS requirements.

Steps to complete the CONTRACTOR'S LIST INDIVIDUAL

Completing the CONTRACTOR'S LIST INDIVIDUAL requires careful attention to detail. Here are the steps to follow:

- Collect the necessary information for each contractor, including personal details and service descriptions.

- Fill out the form accurately, ensuring all entries are legible and correct.

- Review the completed list for any errors or omissions.

- Save a copy of the completed form for your records.

- Submit the form as required by your business's accounting practices or IRS guidelines.

Legal use of the CONTRACTOR'S LIST INDIVIDUAL

The legal use of the CONTRACTOR'S LIST INDIVIDUAL is essential for compliance with federal tax laws. This document serves as a record for the IRS, ensuring that businesses report contractor payments accurately. Failure to maintain this list can result in penalties or audits, making it vital for businesses to understand their legal obligations regarding contractor documentation.

Key elements of the CONTRACTOR'S LIST INDIVIDUAL

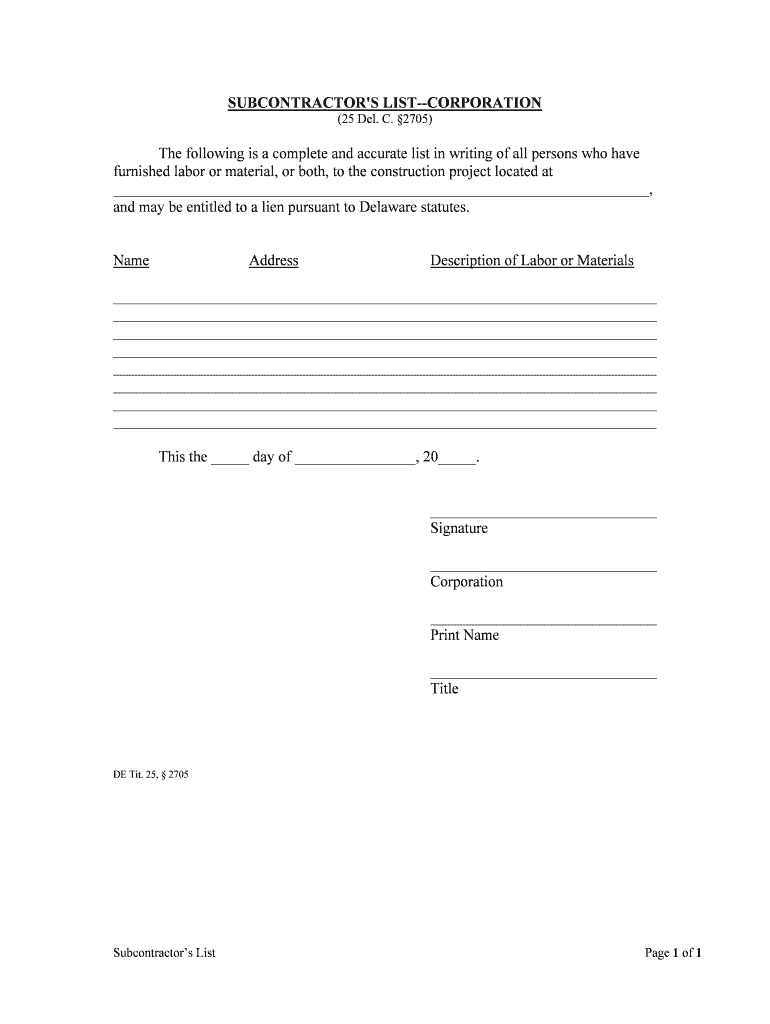

Several key elements must be included in the CONTRACTOR'S LIST INDIVIDUAL to ensure its effectiveness and compliance:

- Contractor's full name

- Contractor's address

- Social Security number or Employer Identification Number (EIN)

- Description of services provided

- Total amount paid during the reporting period

Examples of using the CONTRACTOR'S LIST INDIVIDUAL

Businesses can use the CONTRACTOR'S LIST INDIVIDUAL in various scenarios. For instance, a construction company may maintain a list of subcontractors hired for specific projects, while a consulting firm may track independent contractors providing specialized services. These examples illustrate how the form can help businesses manage contractor relationships and ensure compliance with tax reporting requirements.

Quick guide on how to complete contractors list individual

Complete CONTRACTOR'S LIST INDIVIDUAL effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without any hold-ups. Manage CONTRACTOR'S LIST INDIVIDUAL on any device using airSlate SignNow's Android or iOS applications and enhance your document-based processes today.

The simplest way to modify and eSign CONTRACTOR'S LIST INDIVIDUAL with ease

- Obtain CONTRACTOR'S LIST INDIVIDUAL and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and hit the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign CONTRACTOR'S LIST INDIVIDUAL to ensure excellent communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a CONTRACTOR'S LIST INDIVIDUAL?

A CONTRACTOR'S LIST INDIVIDUAL is a curated list of individual contractors that businesses can access to find qualified professionals for their projects. This list is essential for streamlining hiring processes and ensures that you connect with the right talent quickly.

-

How can I create a CONTRACTOR'S LIST INDIVIDUAL using airSlate SignNow?

Creating a CONTRACTOR'S LIST INDIVIDUAL with airSlate SignNow is simple. You can easily compile a list of individual contractors by using our document management features to gather and organize contractor information efficiently in one location.

-

What are the benefits of using the CONTRACTOR'S LIST INDIVIDUAL?

The CONTRACTOR'S LIST INDIVIDUAL helps businesses save time and resources by providing a direct way to access qualified contractors. Additionally, it allows for easy comparison of skills and rates, ensuring that you find the best fit for your specific needs.

-

Is there a cost associated with accessing the CONTRACTOR'S LIST INDIVIDUAL?

Accessing the CONTRACTOR'S LIST INDIVIDUAL is included in your airSlate SignNow subscription, making it a cost-effective solution. You won’t incur additional charges for utilizing this feature, allowing businesses to manage costs while searching for contractors.

-

How does airSlate SignNow facilitate the management of a CONTRACTOR'S LIST INDIVIDUAL?

airSlate SignNow streamlines the management of a CONTRACTOR'S LIST INDIVIDUAL through efficient document workflow solutions. You can organize documents, track communications, and manage contracts all in one platform, enhancing your project management capabilities.

-

Can I integrate the CONTRACTOR'S LIST INDIVIDUAL with other tools?

Yes, the CONTRACTOR'S LIST INDIVIDUAL can be integrated with various third-party tools and applications. This makes it easier to synchronize your data and maintain fluid communication across platforms, optimizing your workflow.

-

What security measures are in place for the CONTRACTOR'S LIST INDIVIDUAL?

AirSlate SignNow addresses security with top-notch protocols to protect your CONTRACTOR'S LIST INDIVIDUAL. This includes encryption features and secure storage, ensuring that your data remains private and only accessible to authorized individuals.

Get more for CONTRACTOR'S LIST INDIVIDUAL

- How to write and publish a book form

- Combine for high school football players registration form

- Goverment direct deposit form 1199a

- Privacy act statements form

- The new payment vs form

- Residential purchase property sale agreement template form

- Residential purchase agreement template form

- Residential rent agreement template form

Find out other CONTRACTOR'S LIST INDIVIDUAL

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF

- How Do I Sign Oregon Non-disclosure agreement PDF

- Sign Oregon Non disclosure agreement sample Mobile

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple