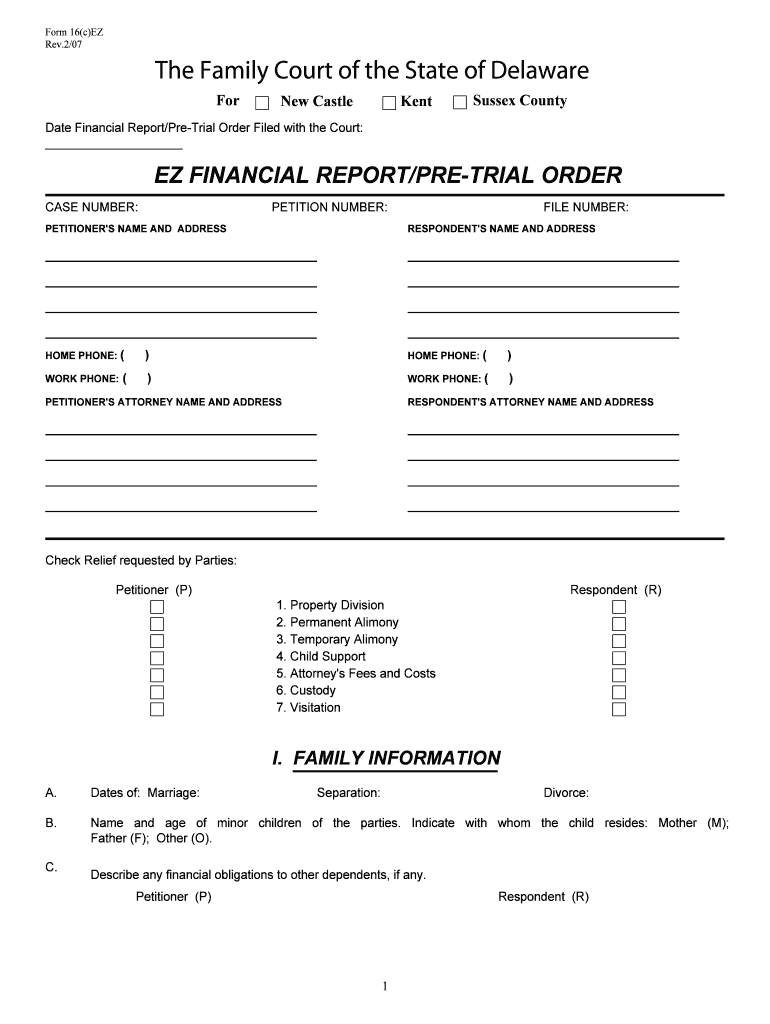

Form 16cEZ

What is the Form 16cEZ

The Form 16cEZ is a specific tax form utilized in the United States, primarily designed for reporting certain financial information to the Internal Revenue Service (IRS). This form is typically used by individuals or entities to declare income, deductions, and other relevant financial details required for accurate tax assessment. Understanding the purpose and requirements of the Form 16cEZ is essential for compliance with federal tax regulations.

How to use the Form 16cEZ

Using the Form 16cEZ involves several key steps. First, ensure you have the most current version of the form, which can be obtained from the IRS website or authorized providers. Next, gather all necessary documentation, such as income statements and deduction records. Fill out the form by accurately entering the required information, ensuring that all figures are correct and that you have included any applicable deductions. Finally, submit the completed form to the IRS by the designated deadline, either electronically or via mail.

Steps to complete the Form 16cEZ

Completing the Form 16cEZ requires careful attention to detail. Follow these steps for successful completion:

- Download the latest version of the Form 16cEZ from the IRS website.

- Gather all necessary financial documents, including W-2s, 1099s, and receipts for deductions.

- Begin filling out the form, starting with your personal information, such as name and Social Security number.

- Input your total income, ensuring that all sources are accurately reported.

- List any deductions you are eligible for, following the guidelines provided with the form.

- Review the completed form for accuracy and completeness.

- Submit the form by the IRS deadline, choosing your preferred submission method.

Legal use of the Form 16cEZ

The legal use of the Form 16cEZ is governed by IRS regulations. To ensure the form is legally binding, it must be completed accurately and submitted on time. Additionally, it is crucial to maintain records of the submitted form and any supporting documentation for future reference. Compliance with IRS guidelines is essential to avoid penalties and ensure that the information reported is considered valid and enforceable.

Filing Deadlines / Important Dates

Filing deadlines for the Form 16cEZ are critical to ensure compliance with IRS regulations. Typically, the form must be submitted by April 15 of the tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check the IRS website for any updates or changes to filing deadlines, as well as to be aware of any extensions that may apply.

Required Documents

To complete the Form 16cEZ, several documents are required to ensure accurate reporting. These include:

- W-2 forms from employers, detailing wages and tax withholdings.

- 1099 forms for any freelance or contract work, reporting additional income.

- Receipts for deductible expenses, such as medical costs or charitable contributions.

- Any other relevant financial statements that support income and deductions reported on the form.

Quick guide on how to complete form 16cez

Facilitate Form 16cEZ effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Form 16cEZ on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The easiest method to edit and electronically sign Form 16cEZ with ease

- Locate Form 16cEZ and then click Get Form to begin.

- Employ the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you prefer to send your form, via email, text message (SMS), or shareable link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Form 16cEZ to ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Form 16cEZ and how does it work?

Form 16cEZ is a simplified version of Form 16C, specifically designed to streamline the eSigning process for businesses. It allows users to send and electronically sign documents quickly and efficiently, eliminating the need for printing and scanning. With airSlate SignNow, you can complete your Form 16cEZ seamlessly, ensuring compliance and saving time.

-

What are the pricing plans for using Form 16cEZ with airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Our plans include a free trial option, allowing prospective customers to explore the features related to Form 16cEZ at no cost. For detailed pricing information, you can visit our website or contact our sales team.

-

What features does airSlate SignNow offer for managing Form 16cEZ?

With airSlate SignNow, users have access to features that enhance the management of Form 16cEZ, such as customizable templates, automated workflows, and real-time tracking. These tools ensure that you can manage your documents efficiently and securely, making the eSigning process smooth and effective.

-

What benefits does airSlate SignNow provide for businesses using Form 16cEZ?

airSlate SignNow provides numerous benefits for businesses using Form 16cEZ, including increased productivity by reducing the time spent on document management. Additionally, the platform ensures compliance and security, thereby boosting customer trust. The ease of eSigning also contributes to better business relationships and quicker transaction times.

-

Is Form 16cEZ compatible with other document formats?

Yes, Form 16cEZ is compatible with various document formats, allowing users to upload, sign, and send files with ease. airSlate SignNow supports integrations with popular file types, enabling a seamless experience for all your document management needs. This compatibility enhances the flexibility of handling different documents within the platform.

-

Can Form 16cEZ be integrated with other software applications?

Absolutely! Form 16cEZ can be integrated with various software applications, enhancing your workflow efficiency. airSlate SignNow supports numerous integrations with popular business tools, providing a comprehensive solution for document management and eSigning, ensuring that you can work within your preferred ecosystem.

-

What security measures are in place for Form 16cEZ?

Security is a top priority for airSlate SignNow when handling Form 16cEZ. Our platform employs advanced encryption methods to protect your documents and data during transmission and storage. Additionally, we provide user authentication features, ensuring that only authorized individuals can access sensitive documents.

Get more for Form 16cEZ

- Enter exit checklist city park apartments form

- Plant mitosis microviewer activity answer key form

- Mymosaicinfo form

- Live lean form

- Orange county schools nc form

- Keplers law worksheet form

- Subvenciones destinadas a la promocin de la innovacin form

- La prolongacin de la crisis sanitaria y su impacto en la salud form

Find out other Form 16cEZ

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later