Potential Lessorlender Form

What is the Potential Lessorlender

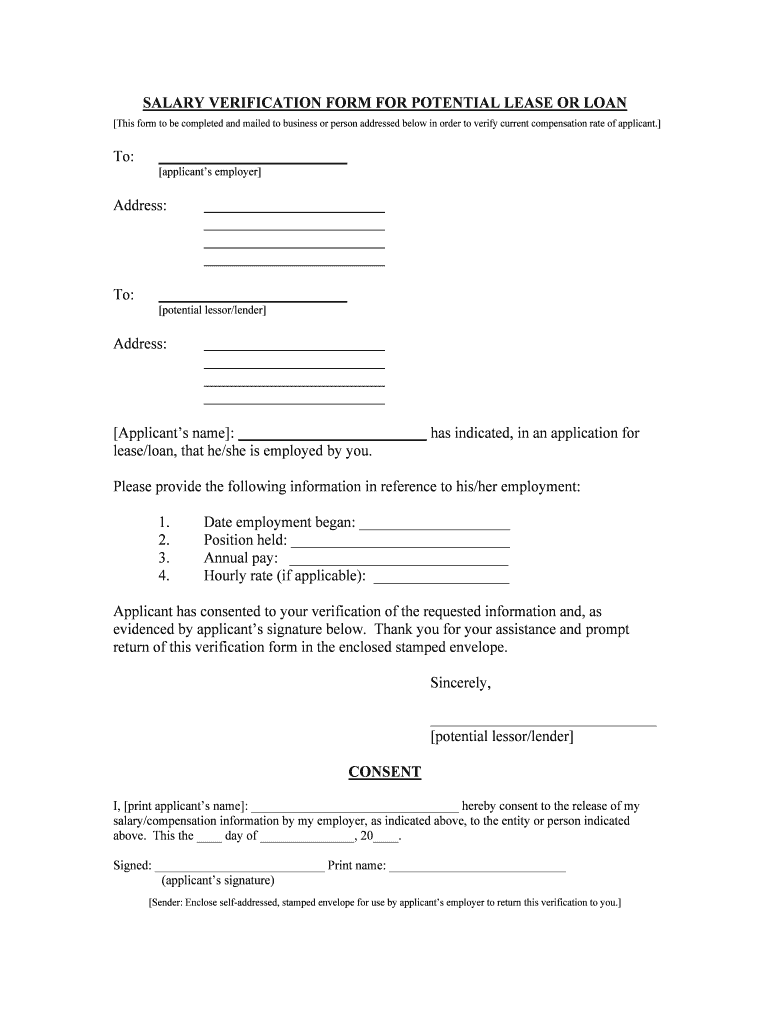

The Potential Lessorlender form is a critical document used in leasing and lending agreements. It serves as a preliminary agreement between parties, outlining the terms under which one party may lease or lend property or funds to another. This form typically includes essential details such as the identities of the parties involved, the description of the property or funds, and the terms of the agreement, including payment schedules and conditions for default. Understanding this form is vital for both lessors and lenders to ensure that their rights and obligations are clearly defined and legally enforceable.

Steps to complete the Potential Lessorlender

Completing the Potential Lessorlender form involves several key steps to ensure accuracy and compliance. First, gather all necessary information about both parties, including full names, addresses, and contact details. Next, clearly describe the property or funds being leased or lent, including any relevant identifiers such as serial numbers or addresses. After that, outline the terms of the agreement, including payment amounts, due dates, and any penalties for late payments. Finally, both parties should sign the document, ensuring that all signatures are dated and that any required witnesses or notarization is completed to enhance the form's legal standing.

Legal use of the Potential Lessorlender

The legal use of the Potential Lessorlender form hinges on its compliance with relevant laws and regulations. In the United States, electronic signatures are recognized under the ESIGN Act and UETA, making eSigned documents legally binding when executed properly. It is essential that the form includes all necessary terms and conditions to protect both parties' interests. Additionally, parties should retain copies of the signed document for their records, as this can serve as evidence in case of disputes. Understanding the legal implications of this form is crucial for ensuring that all transactions are conducted fairly and transparently.

Key elements of the Potential Lessorlender

Several key elements must be included in the Potential Lessorlender form to ensure its effectiveness and legality. These elements include:

- Identification of Parties: Full names and contact information of the lessor and the borrower or lessee.

- Description of Property or Funds: Detailed information about what is being leased or lent, including specifications and conditions.

- Terms of Agreement: Clear stipulations regarding payment amounts, schedules, and any penalties for non-compliance.

- Signatures: Signatures of both parties, along with dates, to validate the agreement.

- Witness or Notary Requirements: Depending on state laws, additional signatures may be necessary to enhance the document's validity.

How to use the Potential Lessorlender

Using the Potential Lessorlender form effectively involves understanding its purpose and following the established procedures. Begin by reviewing the form to ensure that all necessary sections are filled out accurately. Once completed, both parties should discuss the terms outlined in the form to ensure mutual understanding and agreement. After reaching a consensus, both parties should sign the document. It is advisable to keep a copy for personal records and provide a copy to the other party. This ensures that both sides have access to the agreed-upon terms and can refer back to them if needed.

State-specific rules for the Potential Lessorlender

State-specific rules can significantly impact the use of the Potential Lessorlender form. Each state may have unique regulations regarding leasing and lending agreements, including requirements for disclosures, interest rates, and permissible fees. It is essential for both parties to familiarize themselves with their state laws to ensure compliance. Some states may require additional documentation or specific language to be included in the agreement. Consulting with a legal professional can help clarify these requirements and ensure that the form meets all necessary legal standards.

Quick guide on how to complete potential lessorlender

Easily Prepare Potential Lessorlender on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely preserve it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Potential Lessorlender on any device with airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

How to Modify and eSign Potential Lessorlender Effortlessly

- Obtain Potential Lessorlender and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes just a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in a few clicks from your preferred device. Edit and eSign Potential Lessorlender and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how can it help a Potential Lessorlender?

airSlate SignNow is an easy-to-use eSignature solution that empowers businesses, including Potential Lessorlenders, to send and sign documents securely and efficiently. With its user-friendly interface, you can streamline your document workflows, ensuring faster deals and improved client satisfaction.

-

What are the pricing options for Potential Lessorlender users?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of Potential Lessorlenders. You can choose from monthly or annual subscriptions with features that match your business requirements, ensuring you get the best value for your investment.

-

What features should a Potential Lessorlender expect from airSlate SignNow?

The core features of airSlate SignNow include customizable templates, real-time tracking, and secure cloud storage, making it ideal for Potential Lessorlenders. Additionally, its robust API allows for easy integration with existing systems, enhancing your document management process.

-

How can airSlate SignNow benefit a Potential Lessorlender's business?

By using airSlate SignNow, a Potential Lessorlender can increase efficiency and reduce processing times for lease agreements and loan documents. This results in a smoother client experience, allowing you to close deals faster while maintaining compliance and security.

-

Is airSlate SignNow easy to integrate for a Potential Lessorlender?

Yes, airSlate SignNow is designed with integrations in mind, making it simple for a Potential Lessorlender to connect with other applications. Whether you're using CRM systems or other productivity tools, our platform supports seamless connections, enhancing your operational efficiency.

-

Can airSlate SignNow handle large volumes of documents for Potential Lessorlenders?

Absolutely! airSlate SignNow scales to meet the workloads of Potential Lessorlenders, whether you're signing a few documents or managing hundreds. Our cloud-based solution ensures that you can handle high volumes without compromising on performance or security.

-

What security measures does airSlate SignNow put in place for Potential Lessorlenders?

airSlate SignNow prioritizes security, offering features like AES-256 encryption, secure cloud storage, and compliance with industry standards such as GDPR and HIPAA. Potential Lessorlenders can trust that their sensitive documents are protected while utilizing our eSignature services.

Get more for Potential Lessorlender

- Form 941 ss rev january employers quarterly federal tax return american samoa guam the commonwealth of the northern mariana

- Student transition survey manatee online form

- 10 1141s potilaan hoitoon tai kohteluun liittyv muistutus korjattuindd hus form

- 8004688894 form

- 3 day notice st johns county clerk of courts form

- Pliego de prescripciones tecnicas para contratar la edicion de diverso material grafico para el patronato provincial de turismo form

- El bor publica los beneficiarios de las ayudas de la ader al form

- El gobierno de la rioja firma el contrato de compra venta y form

Find out other Potential Lessorlender

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP