Failure to Make Timely Payments Form

What is the Failure To Make Timely Payments

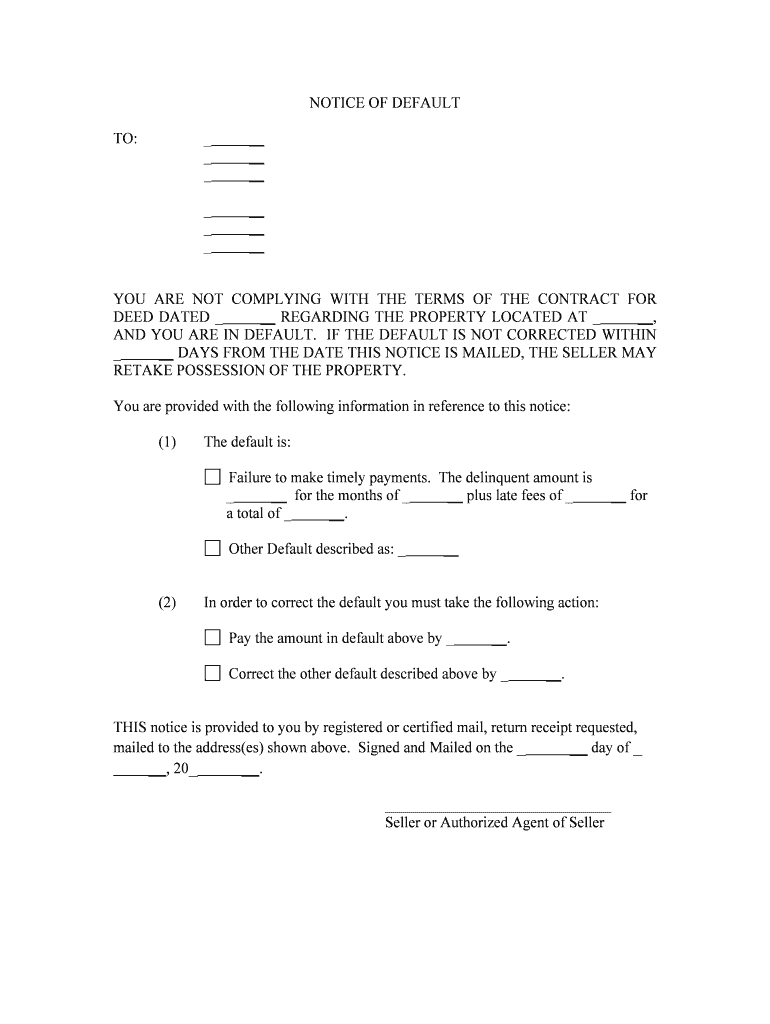

The failure to make timely payments form is a legal document used to outline instances where a party has not fulfilled their obligation to make payments by the agreed-upon deadlines. This form is crucial in various contexts, including loan agreements, rental contracts, and service agreements. It serves as a formal notice to the debtor, indicating the breach of contract and the potential consequences that may follow. Understanding the specifics of this form is essential for both creditors and debtors to ensure compliance with legal standards and to protect their rights.

Steps to complete the Failure To Make Timely Payments

Completing the failure to make timely payments form involves several important steps to ensure its validity and effectiveness. First, gather all relevant information, including the names of the parties involved, the payment terms, and the specific amounts due. Next, clearly state the reasons for the failure to make timely payments, providing any supporting documentation if necessary. After filling out the form, ensure that both parties sign it to acknowledge the breach. Finally, retain copies for your records and consider sending the form via a method that provides proof of delivery to maintain a clear record of communication.

Legal use of the Failure To Make Timely Payments

The legal use of the failure to make timely payments form is significant in enforcing contractual obligations. This form can serve as evidence in legal proceedings, demonstrating that a party has not adhered to the agreed payment schedule. For the form to be legally binding, it must comply with relevant laws and regulations, such as the Uniform Commercial Code (UCC) in the United States. Additionally, ensuring that the form is properly signed and dated is crucial for its enforceability in a court of law.

Penalties for Non-Compliance

Non-compliance with the terms outlined in the failure to make timely payments form can lead to various penalties. These may include late fees, increased interest rates, or legal action initiated by the creditor. In some cases, failure to address the non-payment could result in the loss of collateral or other assets. Understanding these potential consequences emphasizes the importance of adhering to payment agreements and addressing any issues promptly to avoid escalation.

Examples of using the Failure To Make Timely Payments

There are several scenarios in which the failure to make timely payments form may be utilized. For instance, a landlord may issue this form to a tenant who has not paid rent on time, outlining the overdue amount and the potential consequences of continued non-payment. Similarly, a lender might use this form to notify a borrower of missed loan payments, detailing the terms of the loan agreement and the implications of default. These examples illustrate the form's role in formalizing communication regarding payment obligations.

Who Issues the Form

The failure to make timely payments form can be issued by any party involved in a contractual agreement where payment obligations exist. Common issuers include landlords, lenders, service providers, and businesses that extend credit. It is essential for the issuer to ensure that the form is completed accurately and delivered to the appropriate party. This helps maintain transparency and accountability in financial transactions.

Digital vs. Paper Version

When considering the failure to make timely payments form, users have the option to choose between digital and paper versions. Digital forms offer several advantages, including ease of access, the ability to store documents securely, and the convenience of electronic signatures. In contrast, paper forms may be preferred in situations where physical signatures are required or for those who are more comfortable with traditional documentation methods. Regardless of the format chosen, ensuring compliance with legal standards is crucial for both versions.

Quick guide on how to complete failure to make timely payments

Effortlessly prepare Failure To Make Timely Payments on any device

Digital document management has gained traction among businesses and individuals alike. It offers a convenient eco-friendly substitute to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents rapidly without delays. Handle Failure To Make Timely Payments on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Failure To Make Timely Payments with ease

- Obtain Failure To Make Timely Payments and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Mark essential sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to distribute your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choosing. Modify and electronically sign Failure To Make Timely Payments to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What happens if I experience a Failure To Make Timely Payments?

A Failure To Make Timely Payments can lead to service interruptions or account suspension. We recommend contacting our support team to discuss your situation, as we may offer solutions or payment plans to help you regain access.

-

How can airSlate SignNow help prevent Failure To Make Timely Payments?

To avoid a Failure To Make Timely Payments, our platform provides features such as automated payment reminders and flexible billing options. These tools help ensure that you stay on track with your payment schedule and avoid any potential disruptions in service.

-

What are the pricing options for airSlate SignNow?

Our pricing plans are designed to be affordable and flexible, mitigating the risk of a Failure To Make Timely Payments. We have different tiers based on your business needs, and you can choose monthly or annual billing cycles that best suit your budget.

-

Are there penalties for a Failure To Make Timely Payments?

Yes, a Failure To Make Timely Payments may result in penalties or late fees, depending on our policy at the time. To avoid these issues, we recommend setting up reminders and maintaining an open line of communication with our support team.

-

What features does airSlate SignNow offer to streamline the signing process?

Our platform includes features such as document templates, real-time notifications, and customizable workflows to ensure your signing process is smooth and efficient. This can help reduce the risk of a Failure To Make Timely Payments by ensuring that all documents are handled promptly.

-

Can airSlate SignNow integrate with my existing accounting software to manage payments?

Yes, airSlate SignNow offers integrations with various accounting software solutions to help you manage your payments effectively. By integrating your accounts, you can reduce the chances of a Failure To Make Timely Payments due to miscommunication or manual errors.

-

What benefits can I expect from using airSlate SignNow?

Using airSlate SignNow will streamline your document signing process, improve compliance, and enhance collaboration. When implemented properly, these benefits can signNowly mitigate the likelihood of a Failure To Make Timely Payments.

Get more for Failure To Make Timely Payments

- Appl fill form

- Medical claim form palig com

- Please fill in information below the text

- Master of science in information systems peer evaluation form business uc

- American cancer society offline donation form

- Lobbyist registration form

- Limit to brand ltb or trade name statement form

- Sample electrical load calculation sheetto illustrate form

Find out other Failure To Make Timely Payments

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now