Texas Conditional Qualification Letter for Mortgage Form

Key elements of the Texas Conditional Qualification Letter For Mortgage

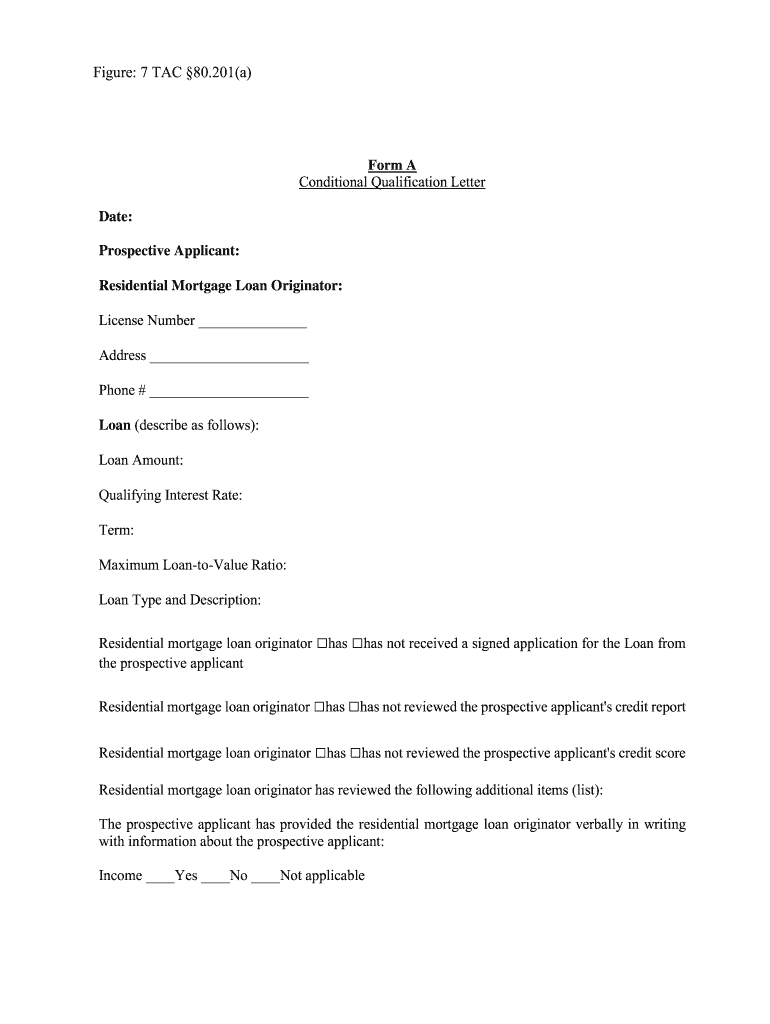

The Texas Conditional Qualification Letter for Mortgage is a crucial document that outlines the borrower’s eligibility for a mortgage loan. It typically includes the following key elements:

- Borrower Information: This section contains the borrower's name, address, and contact details.

- Loan Amount: The letter specifies the maximum loan amount the borrower is conditionally approved for.

- Loan Type: It indicates the type of mortgage, such as fixed-rate or adjustable-rate.

- Conditions: Any conditions that must be met before final approval are detailed here, such as additional documentation or credit checks.

- Expiration Date: The letter usually includes a date by which the conditional approval is valid.

- Lender Information: Contact details for the lending institution are provided for further inquiries.

How to obtain the Texas Conditional Qualification Letter For Mortgage

To obtain a Texas Conditional Qualification Letter for Mortgage, borrowers should follow these steps:

- Research Lenders: Identify lenders that offer conditional qualification letters and compare their terms.

- Gather Documentation: Prepare necessary documents such as proof of income, credit history, and identification.

- Complete Application: Fill out the lender's application form accurately, providing all requested information.

- Submit Application: Send the application along with supporting documents to the lender, either online or in person.

- Review Conditions: Once the lender reviews the application, they will issue a conditional qualification letter outlining the approval terms.

Steps to complete the Texas Conditional Qualification Letter For Mortgage

Completing the Texas Conditional Qualification Letter involves several important steps:

- Fill in Borrower Details: Ensure all personal information is accurate, including names and addresses.

- Specify Loan Details: Clearly indicate the desired loan amount and type.

- List Conditions: Include any conditions that must be satisfied for final approval, such as additional documentation requirements.

- Set Expiration Date: Determine and state the validity period of the letter.

- Review for Accuracy: Double-check all entries for correctness before submission.

Legal use of the Texas Conditional Qualification Letter For Mortgage

The Texas Conditional Qualification Letter serves as a preliminary approval for a mortgage, but it is not a guarantee of final loan approval. Legally, it provides borrowers with an indication of their eligibility based on the information provided at the time of application. It is important for borrowers to understand that the conditions outlined in the letter must be fulfilled for the loan to be finalized.

Examples of using the Texas Conditional Qualification Letter For Mortgage

Borrowers can use the Texas Conditional Qualification Letter in various scenarios:

- Home Buying: Presenting the letter to real estate agents or sellers can strengthen a buyer’s position in negotiations.

- Budget Planning: The letter helps borrowers understand their budget and what properties they can afford.

- Loan Comparisons: Borrowers can use the letter to compare offers from different lenders, ensuring they choose the best terms.

Eligibility Criteria

To qualify for a Texas Conditional Qualification Letter, borrowers typically need to meet certain eligibility criteria. These may include:

- Credit Score: A minimum credit score is often required, which varies by lender.

- Income Verification: Borrowers must provide proof of income to demonstrate their ability to repay the loan.

- Debt-to-Income Ratio: Lenders assess the borrower's debt-to-income ratio to ensure it falls within acceptable limits.

- Employment History: A stable employment history may be necessary to qualify.

Quick guide on how to complete conditional qualification letter form

Complete Texas Conditional Qualification Letter For Mortgage effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without delays. Handle Texas Conditional Qualification Letter For Mortgage on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign Texas Conditional Qualification Letter For Mortgage with ease

- Find Texas Conditional Qualification Letter For Mortgage and click Get Form to initiate the process.

- Take advantage of the tools we provide to fill out your document.

- Highlight important parts of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes only seconds and holds the same legal authority as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your requirements in document management with just a few clicks from any device you prefer. Edit and eSign Texas Conditional Qualification Letter For Mortgage and guarantee exceptional communication at any point of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Do I have to fill out a form to receive a call letter for the NDA SSB?

No form has to be filled for u to get your call-up letter.If you have cleared the written exam and your roll no. Is in the list, then sooner or later you will get your call-up letter.I would suggest you to keep looking for your SSB dates. Online on sites like Join Indian Army. Because the hard copy may be delayed due to postal errors or faults.Just to reassure you, NO FORM HAS TO BE FILLED TO GET YOUR SSB CALLUP LETTER.Cheers and All the Best

-

Is it compulsory to fill out the iVerify form for Wipro before getting a joining letter?

Yes, you should definitely will the form as you require it for your Background verification else the HR would mail and call every time unless you fill it.

-

Do I need to fill out a customs form to mail a 1 oz letter? Would I put the customs form outside the envelope or inside?

No. There are specific envelopes that are used to identify mail under 16 oz and don’t require a P.S. form. These envelopes have a colored stripe along its borders which indicates to the shipper that it’s an international mail piece.

-

How do I write qualification details in order to fill out the AIIMS application form if a student is appearing in 12th standard?

There must be provision in the form for those who are taking 12 th board exam this year , so go through the form properly before filling it .

-

How do I mail a regular letter to Venezuela? Do I need to fill out a customs form for a regular letter or do I just need to add an international mail stamp and send it?

You do not need to fill out a customs form for a regular letter sent from the US to any other country. Postage for an international letter under 1 ounce is currently $1.15. You may apply any stamp - or combination of stamps - which equals that amount.

Create this form in 5 minutes!

How to create an eSignature for the conditional qualification letter form

How to make an electronic signature for the Conditional Qualification Letter Form in the online mode

How to make an electronic signature for the Conditional Qualification Letter Form in Chrome

How to make an eSignature for putting it on the Conditional Qualification Letter Form in Gmail

How to generate an eSignature for the Conditional Qualification Letter Form right from your smart phone

How to generate an electronic signature for the Conditional Qualification Letter Form on iOS

How to create an eSignature for the Conditional Qualification Letter Form on Android

People also ask

-

What is a Texas Conditional Qualification Letter for Mortgage?

A Texas Conditional Qualification Letter for Mortgage is a document issued by lenders that indicates a borrower's eligibility for a mortgage, based on initial financial assessments. This letter outlines the conditions that must be met before final approval, offering peace of mind to homebuyers in Texas. It serves as a pre-approval that can strengthen your position when making offers on properties.

-

How can I obtain a Texas Conditional Qualification Letter for Mortgage?

To obtain a Texas Conditional Qualification Letter for Mortgage, you typically need to apply through a lender or mortgage broker who will assess your financial situation. This process often involves submitting documentation such as income statements, credit reports, and asset information. Once your application is reviewed, the lender will issue the letter if you meet their criteria.

-

What are the benefits of having a Texas Conditional Qualification Letter for Mortgage?

Having a Texas Conditional Qualification Letter for Mortgage provides several benefits including increased credibility with sellers and faster closing times. It demonstrates to sellers that you are a serious buyer with financial backing, which can make your offers more attractive. Additionally, it helps streamline the mortgage process, ensuring you have a clear understanding of what is needed for final approval.

-

How much does a Texas Conditional Qualification Letter for Mortgage cost?

The cost of obtaining a Texas Conditional Qualification Letter for Mortgage can vary depending on the lender and any associated fees. Some lenders may offer this service for free as part of their mortgage application process, while others might charge an application fee. It's advisable to compare different lenders to find the most cost-effective option.

-

What documents are required for a Texas Conditional Qualification Letter for Mortgage?

To secure a Texas Conditional Qualification Letter for Mortgage, you will generally need to provide documents such as proof of income, tax returns, bank statements, and details about any debts. Lenders may also request a credit report to evaluate your financial health. Having these documents ready can expedite the process and help you receive your letter more quickly.

-

How does airSlate SignNow facilitate the process of obtaining a Texas Conditional Qualification Letter for Mortgage?

airSlate SignNow simplifies the process of obtaining a Texas Conditional Qualification Letter for Mortgage by allowing you to electronically sign and send documents securely. Our user-friendly platform ensures that all necessary paperwork is handled efficiently, reducing delays in obtaining your qualification letter. With airSlate SignNow, you can save time and focus on finding your dream home.

-

Can I use my Texas Conditional Qualification Letter for Mortgage with any lender?

Yes, a Texas Conditional Qualification Letter for Mortgage can typically be used with any lender, although some lenders may have specific requirements regarding the letter's conditions. It's important to communicate with your chosen lender about the details of your qualification letter to ensure it meets their standards. This flexibility allows you to shop around for the best mortgage rates and terms.

Get more for Texas Conditional Qualification Letter For Mortgage

- Food service license application 2019 2020 food service license application 2019 2020 form

- Ap blamend form

- Corporation request form for certificates of good standing

- Terminal inspection fee statement form

- Ldhlagovassetsophretail food plan review questionnaire state of louisiana form

- Wwwsignnowcomfill and sign pdf form104298get and sign this form can be submitted electronically

- Ncuc form ce 2 revised april 2018

- Fillable online form char014 charitiesnyscom fax email

Find out other Texas Conditional Qualification Letter For Mortgage

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU