The Property Has Been Damaged and the Seller Has Received Insurance Form

Understanding the Property Has Been Damaged and the Seller Has Received Insurance

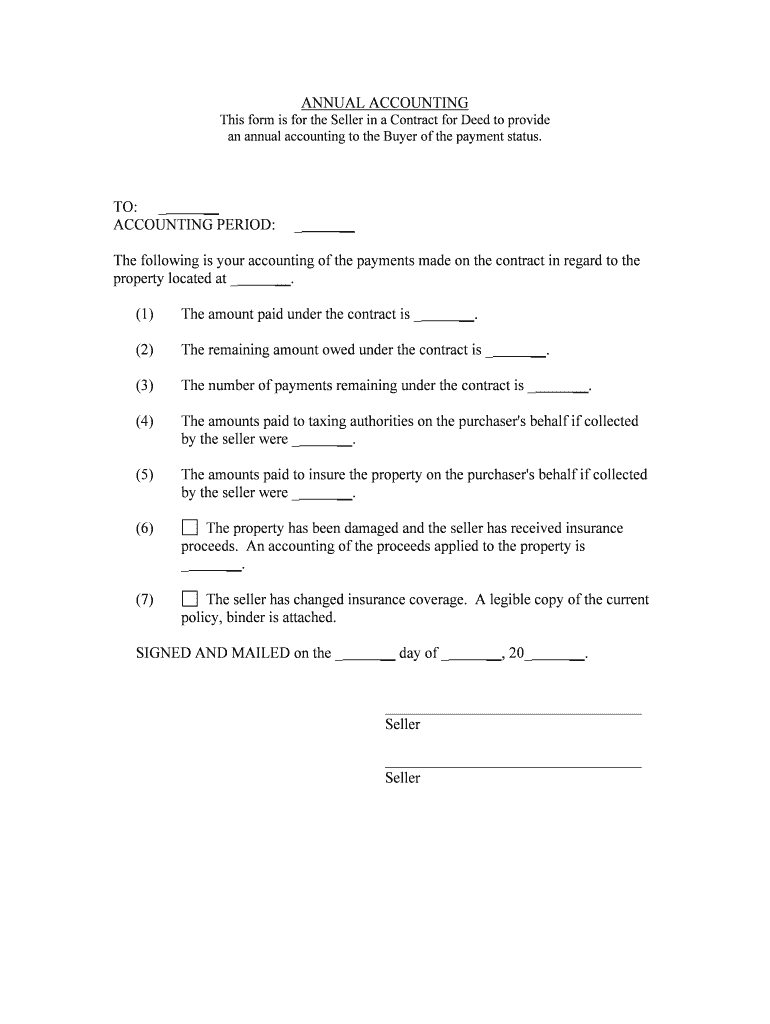

The property has been damaged and the seller has received insurance is a crucial document in real estate transactions, particularly when a property has sustained damage prior to sale. This form serves to outline the condition of the property and the insurance coverage that has been obtained to address any damages. It is essential for both buyers and sellers to understand the implications of this document, as it can affect negotiations, liability, and the overall transaction process.

Steps to Complete the Property Has Been Damaged and the Seller Has Received Insurance

Completing the property has been damaged and the seller has received insurance form requires careful attention to detail. Here are the steps involved:

- Gather necessary information about the property, including its address and details of the damage.

- Document the insurance coverage that has been received, including the insurance provider's name and policy number.

- Clearly outline the extent of the damage and any repairs that have been made or are planned.

- Ensure all parties involved in the transaction review and understand the information provided.

- Sign and date the form to validate its contents.

Legal Use of the Property Has Been Damaged and the Seller Has Received Insurance

This form is legally binding when completed correctly, as it provides a record of the seller's disclosures regarding the property's condition and insurance coverage. It is important to comply with local real estate laws and regulations to ensure that the form is recognized by courts and other legal entities. Failure to disclose relevant information may lead to legal repercussions for the seller.

Key Elements of the Property Has Been Damaged and the Seller Has Received Insurance

Several key elements must be included in the property has been damaged and the seller has received insurance form:

- Identification of the property and the parties involved in the transaction.

- A detailed description of the damage sustained by the property.

- Information regarding the insurance policy, including coverage limits and deductibles.

- Any repair work that has been completed or is planned.

- Signatures of all parties to affirm the accuracy of the information provided.

Examples of Using the Property Has Been Damaged and the Seller Has Received Insurance

Real-world scenarios illustrate the importance of this document. For instance, if a seller has experienced water damage due to a burst pipe, they must disclose this information to potential buyers. By providing the property has been damaged and the seller has received insurance form, the seller can demonstrate transparency and outline the insurance coverage that will address the damage. This can help build trust with buyers and facilitate a smoother transaction.

State-Specific Rules for the Property Has Been Damaged and the Seller Has Received Insurance

Real estate laws vary by state, and it is essential to be aware of any specific regulations governing the use of the property has been damaged and the seller has received insurance form. Some states may require additional disclosures or have different requirements for how this information must be presented. Consulting with a local real estate attorney or agent can provide clarity on these regulations.

Quick guide on how to complete the property has been damaged and the seller has received insurance

Accomplish The Property Has Been Damaged And The Seller Has Received Insurance effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary forms and securely store them online. airSlate SignNow provides all the tools you need to generate, modify, and electronically sign your documents swiftly without any delays. Handle The Property Has Been Damaged And The Seller Has Received Insurance on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest method to alter and eSign The Property Has Been Damaged And The Seller Has Received Insurance with ease

- Find The Property Has Been Damaged And The Seller Has Received Insurance and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight essential sections of the documents or redact sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information carefully and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choosing. Edit and eSign The Property Has Been Damaged And The Seller Has Received Insurance to ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What should I do if the property has been damaged and the seller has received insurance?

If the property has been damaged and the seller has received insurance, it's crucial to review the insurance policy details. Ensure that all necessary documentation, including estimates and photos of the damages, is prepared for submission. You may also consider utilizing airSlate SignNow to eSign any required forms for quicker processing.

-

How can airSlate SignNow help with documentation after the property has been damaged?

AirSlate SignNow simplifies the documentation process when the property has been damaged and the seller has received insurance. With our electronic signature capabilities, you can easily prepare and send necessary agreements, ensuring all parties can sign from anywhere. This speeds up the documentation process and helps in timely claims.

-

What features does airSlate SignNow offer for handling insurance claims?

AirSlate SignNow offers features like document templates, in-app signing, and document tracking specifically useful for handling situations when the property has been damaged and the seller has received insurance. Our user-friendly interface allows for seamless collaboration between all stakeholders in the claims process, ensuring nothing gets overlooked.

-

Is airSlate SignNow cost-effective for small businesses dealing with insurance claims?

Yes, airSlate SignNow provides a cost-effective solution for small businesses that need to manage documents related to claims, especially when the property has been damaged and the seller has received insurance. Our pricing plans are designed to cater to businesses of all sizes, allowing you to only pay for the features you need.

-

Can I integrate airSlate SignNow with other tools I use for insurance processing?

Absolutely! AirSlate SignNow integrates with various applications that are often used for insurance processing. This capability ensures that when the property has been damaged and the seller has received insurance, you can effortlessly connect your existing tools, streamlining your workflow.

-

What benefits does eSigning offer in the context of damaged property claims?

eSigning with airSlate SignNow provides signNow benefits for claims when the property has been damaged and the seller has received insurance. It allows for immediate, secure, and traceable signing of documents, reducing turnaround time and eliminating the hassle of physical paperwork.

-

How secure is airSlate SignNow when dealing with sensitive information related to property damage?

Security is a top priority at airSlate SignNow, especially when handling sensitive information like that of a property that has been damaged and the seller has received insurance. We utilize advanced encryption and security protocols to ensure that all documents are kept safe throughout the entire signing process.

Get more for The Property Has Been Damaged And The Seller Has Received Insurance

- Dyno liability release form

- Student non vocational enrolment contract liaison college form

- Patients pathsinc org form

- Supplier diversity application alaska airlines form

- Durable power of attorney alaska pdf alaska form

- Microsoft word contract template form

- Vafax form

- Wholesale pricing agreement template form

Find out other The Property Has Been Damaged And The Seller Has Received Insurance

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online