Form 11F CRO Statement of Particulars Section 882 Taxes Consolidation Act Form 11F CRO Statement of Particulars Section 882 Taxe 2024-2026

Understanding Form 11F: Statement of Particulars

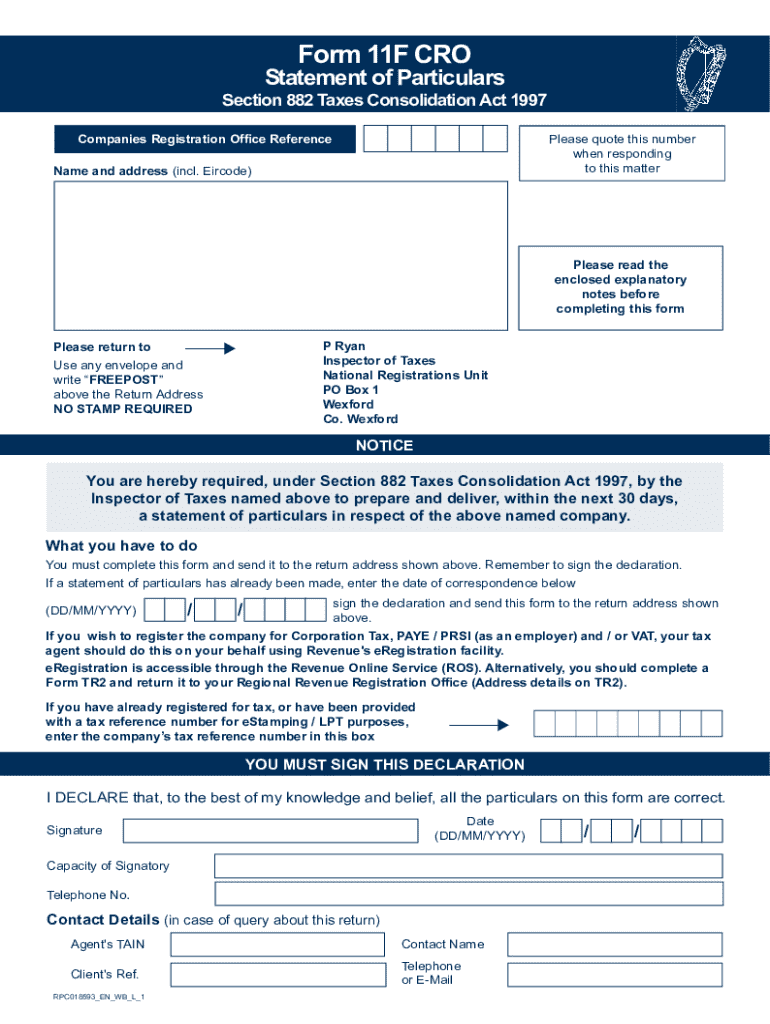

The Form 11F is a critical document under the Section 882 of the Taxes Consolidation Act. It serves as a Statement of Particulars for certain taxpayers, specifically those who are non-resident companies earning income in the United States. This form is essential for reporting income and ensuring compliance with U.S. tax regulations. Understanding its purpose and requirements is crucial for accurate tax reporting.

Steps to Complete Form 11F

Completing the Form 11F involves several key steps. First, gather all necessary financial documents that detail your income and expenses related to U.S. sources. Next, accurately fill out each section of the form, ensuring that all information is correct and complete. Pay particular attention to the income sections, as errors can lead to delays or penalties. After completing the form, review it thoroughly before submission to ensure compliance with all requirements.

Obtaining Form 11F

The Form 11F can be obtained through the official IRS website or by contacting the IRS directly. It is available in a downloadable format, allowing taxpayers to print and fill it out manually. Additionally, some tax preparation software may include this form, providing a convenient option for those who prefer digital completion. Ensure that you are using the most current version of the form to avoid any issues with your submission.

Key Elements of Form 11F

Form 11F includes several important sections that taxpayers must complete. Key elements include identification information, details of income earned in the U.S., and any deductions or credits applicable. Each section is designed to capture specific information that the IRS requires for tax assessment. Understanding these elements can help streamline the completion process and ensure that all necessary information is reported accurately.

Legal Use of Form 11F

The Form 11F is legally required for non-resident companies that have U.S. source income. Failure to file this form can result in significant penalties, including fines and interest on unpaid taxes. It is essential for taxpayers to understand their obligations under U.S. tax law and to ensure that they file the Form 11F timely and accurately to maintain compliance.

Filing Deadlines for Form 11F

Timely filing of Form 11F is crucial to avoid penalties. The standard deadline for submission is typically the 15th day of the sixth month following the end of the tax year. For example, if your tax year ends on December 31, the form would be due by June 15 of the following year. Taxpayers should be aware of these deadlines and plan accordingly to ensure that their forms are submitted on time.

Quick guide on how to complete form 11f cro statement of particulars section 882 taxes consolidation act form 11f cro statement of particulars section 882

Complete Form 11F CRO Statement Of Particulars Section 882 Taxes Consolidation Act Form 11F CRO Statement Of Particulars Section 882 Taxe effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed materials, as you can easily find the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents promptly without any holdups. Manage Form 11F CRO Statement Of Particulars Section 882 Taxes Consolidation Act Form 11F CRO Statement Of Particulars Section 882 Taxe on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form 11F CRO Statement Of Particulars Section 882 Taxes Consolidation Act Form 11F CRO Statement Of Particulars Section 882 Taxe without any hassle

- Find Form 11F CRO Statement Of Particulars Section 882 Taxes Consolidation Act Form 11F CRO Statement Of Particulars Section 882 Taxe and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize relevant portions of the documents or redact sensitive details using tools that airSlate SignNow specifically supplies for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of sending your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate the printing of new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you select. Modify and eSign Form 11F CRO Statement Of Particulars Section 882 Taxes Consolidation Act Form 11F CRO Statement Of Particulars Section 882 Taxe to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 11f cro statement of particulars section 882 taxes consolidation act form 11f cro statement of particulars section 882

Create this form in 5 minutes!

How to create an eSignature for the form 11f cro statement of particulars section 882 taxes consolidation act form 11f cro statement of particulars section 882

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 11f and how can airSlate SignNow help?

Form 11f is a specific document used for various administrative purposes. airSlate SignNow simplifies the process of filling out and signing form 11f by providing an intuitive platform that allows users to easily create, send, and eSign the document securely.

-

Is there a cost associated with using airSlate SignNow for form 11f?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that streamline the management of form 11f, ensuring that you get the best value for your investment.

-

What features does airSlate SignNow offer for managing form 11f?

airSlate SignNow includes features such as customizable templates, automated workflows, and real-time tracking for form 11f. These tools enhance efficiency and ensure that your documents are processed quickly and accurately.

-

Can I integrate airSlate SignNow with other applications for form 11f?

Absolutely! airSlate SignNow supports integrations with various applications, allowing you to streamline your workflow for form 11f. This means you can connect with tools like CRM systems, cloud storage, and more to enhance your document management process.

-

What are the benefits of using airSlate SignNow for form 11f?

Using airSlate SignNow for form 11f offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. The platform ensures that your documents are signed and stored securely, making it easier to manage your administrative tasks.

-

How does airSlate SignNow ensure the security of form 11f?

airSlate SignNow prioritizes security by employing advanced encryption and authentication measures for form 11f. This ensures that your sensitive information remains protected throughout the signing process, giving you peace of mind.

-

Is it easy to use airSlate SignNow for form 11f?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to manage form 11f. The platform provides a straightforward interface that guides users through the process of creating, sending, and signing documents.

Get more for Form 11F CRO Statement Of Particulars Section 882 Taxes Consolidation Act Form 11F CRO Statement Of Particulars Section 882 Taxe

Find out other Form 11F CRO Statement Of Particulars Section 882 Taxes Consolidation Act Form 11F CRO Statement Of Particulars Section 882 Taxe

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later