DONATION PURSUANT to the Form

What is the donation pursuant to the form?

The donation pursuant to the form is a legal document that facilitates the transfer of assets or funds from one party to another, typically for charitable purposes. This form outlines the specifics of the donation, including the donor's information, the recipient organization, and the nature of the donation. It is essential for ensuring that both parties have a clear understanding of the terms and conditions of the donation, which can help prevent misunderstandings or disputes in the future.

Steps to complete the donation pursuant to the form

Completing the donation pursuant to the form involves several key steps to ensure accuracy and compliance with legal requirements. Start by gathering all necessary information, including the donor's details, the recipient's information, and the specifics of the donation. Next, fill out the form carefully, ensuring that all fields are completed accurately. After filling out the form, review it for any errors or omissions. Finally, sign the document electronically using a trusted eSignature solution, which will provide a secure and legally binding signature.

Legal use of the donation pursuant to the form

The donation pursuant to the form is legally binding when completed correctly. It must comply with relevant laws and regulations, including those governing charitable donations. To ensure legal validity, it is important to use an electronic signature solution that adheres to the ESIGN and UETA acts, which recognize electronic signatures as legally equivalent to traditional handwritten signatures. This compliance helps protect both the donor and the recipient in case of any disputes regarding the donation.

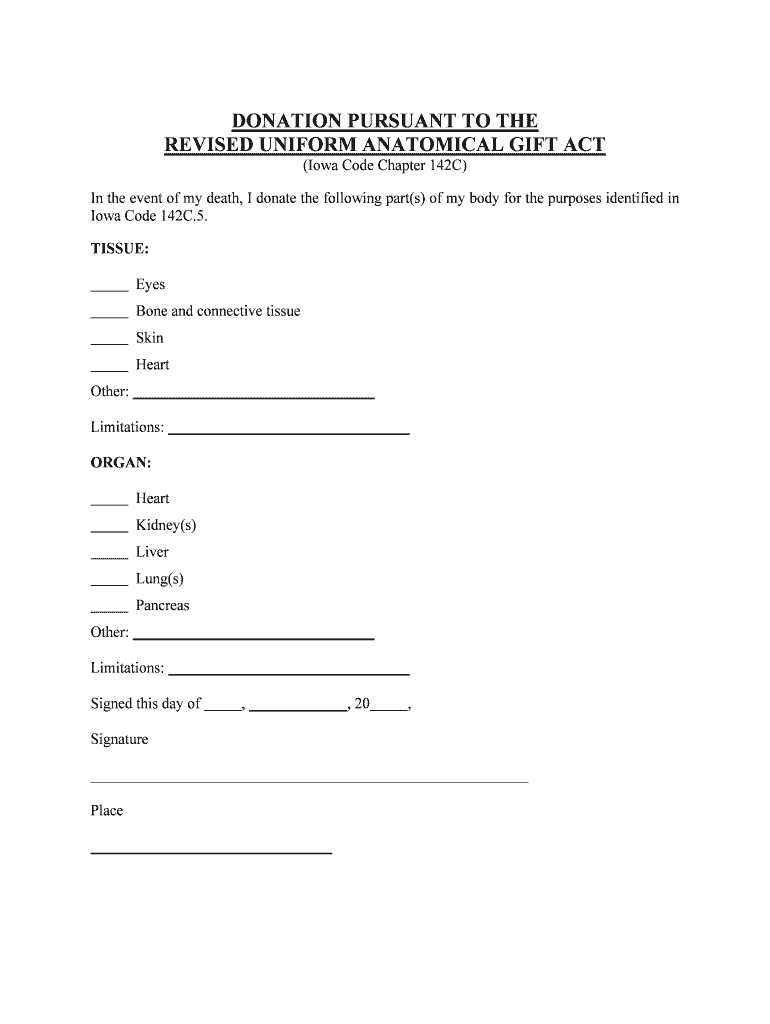

Key elements of the donation pursuant to the form

Several key elements make up the donation pursuant to the form. These include:

- Donor Information: The name, address, and contact details of the individual or organization making the donation.

- Recipient Information: The name and contact details of the organization receiving the donation.

- Donation Amount: The specific amount or value of the assets being donated.

- Purpose of Donation: A clear statement regarding the intended use of the donated funds or assets.

- Signatures: Both parties must sign the form to validate the transaction.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding charitable donations, which are crucial for both donors and recipients. Donors should be aware of the tax implications of their contributions, including potential deductions. To qualify for a tax deduction, the donation must be made to a qualified organization, and proper documentation must be maintained. The IRS requires that donors obtain a written acknowledgment from the recipient organization for donations over a certain amount, which should be included with their tax filings.

Form Submission Methods

The donation pursuant to the form can be submitted through various methods, depending on the preferences of both the donor and the recipient organization. Common submission methods include:

- Online Submission: Many organizations accept electronic submissions via their websites, allowing for a quick and efficient process.

- Mail: The completed form can be printed and mailed to the recipient organization for processing.

- In-Person: Donors may also choose to deliver the form in person, which can be beneficial for establishing a personal connection with the organization.

Quick guide on how to complete donation pursuant to the

Accomplish DONATION PURSUANT TO THE easily on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, amend, and electronically sign your documents swiftly without any holdups. Handle DONATION PURSUANT TO THE on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign DONATION PURSUANT TO THE effortlessly

- Find DONATION PURSUANT TO THE and click Get Form to initiate the process.

- Employ the tools we provide to fill out your form.

- Emphasize important parts of your documents or obscure confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and then click the Done button to save your adjustments.

- Select your preferred method to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tiring form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in a few clicks from any device you choose. Modify and eSign DONATION PURSUANT TO THE and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for making a DONATION PURSUANT TO THE airSlate SignNow service?

Making a DONATION PURSUANT TO THE airSlate SignNow service is straightforward. You can navigate to our donation section on the website, where you’ll find clear instructions on how to proceed. After selecting the desired donation amount, simply fill out the required fields and submit your payment.

-

What are the benefits of using airSlate SignNow for a DONATION PURSUANT TO THE?

Utilizing airSlate SignNow for a DONATION PURSUANT TO THE means you have access to a reliable and secure platform for your signing needs. The ease of electronic signatures speeds up the donation process signNowly, ensuring timely processing. Additionally, you can track the status of your document, providing peace of mind for your donation.

-

Are there any fees associated with a DONATION PURSUANT TO THE airSlate SignNow service?

While airSlate SignNow offers a cost-effective solution, there may be minimal transaction fees associated with processing a DONATION PURSUANT TO THE. We recommend reviewing our pricing page for detailed information on possible costs and any applicable discounts for bulk or recurring donations.

-

Can I integrate airSlate SignNow with other platforms for my DONATION PURSUANT TO THE?

Yes, airSlate SignNow offers extensive integrations with numerous platforms which can enhance your experience for a DONATION PURSUANT TO THE. You can connect with CRM systems, payment processors, or cloud storage services to streamline workflow and data management. This allows for a more efficient donation process.

-

How is my information protected when making a DONATION PURSUANT TO THE?

Your information is our top priority when making a DONATION PURSUANT TO THE with airSlate SignNow. We utilize industry-leading encryption and security protocols to safeguard your data. Our compliance with regulatory standards ensures both your personal and payment information are protected throughout the signing process.

-

What types of documents can I send for eSigning related to my DONATION PURSUANT TO THE?

You can send a variety of documents for eSigning related to your DONATION PURSUANT TO THE with airSlate SignNow. This includes donation agreements, acknowledgment letters, and tax documentation. Each document can be customized to meet your specific requirements, ensuring clarity in your donation process.

-

Is there support available if I encounter issues with a DONATION PURSUANT TO THE?

Absolutely, airSlate SignNow provides robust customer support for any issues that arise during the DONATION PURSUANT TO THE process. Our support team is available via chat, email, or phone to help address your concerns promptly. We strive to ensure your experience is seamless and efficient.

Get more for DONATION PURSUANT TO THE

Find out other DONATION PURSUANT TO THE

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure