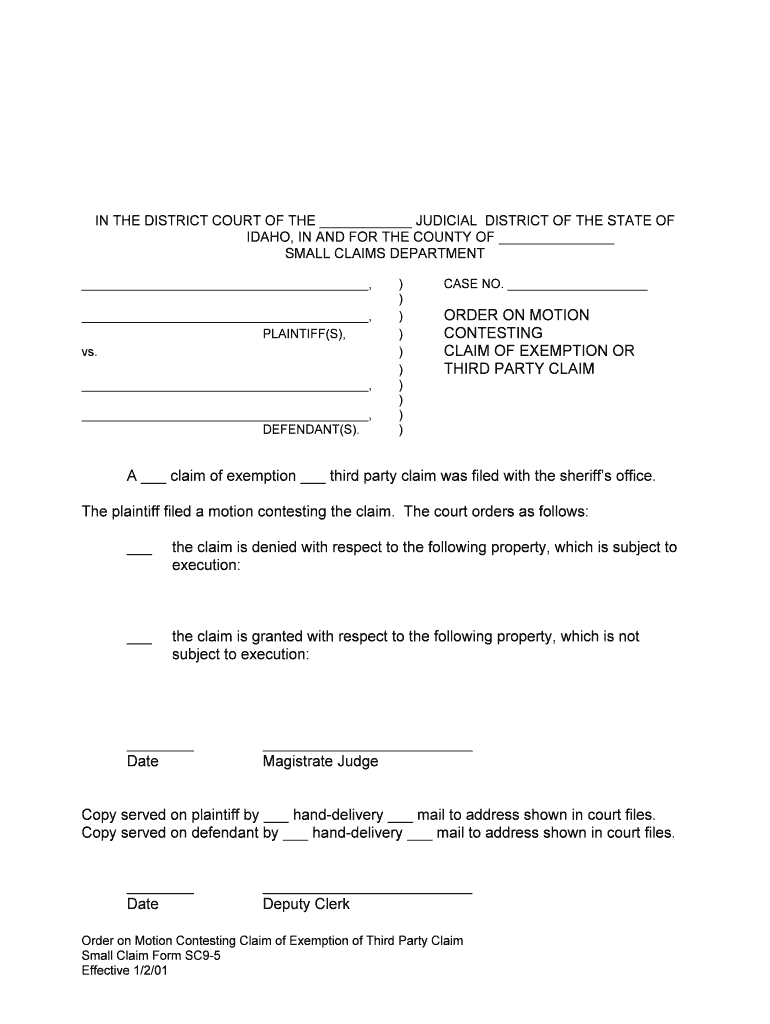

CLAIM of EXEMPTION or Form

What is the CLAIM OF EXEMPTION OR

The CLAIM OF EXEMPTION OR is a specific form used in the United States to allow individuals or entities to claim exemption from certain tax obligations. This form is typically associated with various tax-related scenarios, such as exemptions from withholding or specific tax liabilities. Understanding the purpose of this form is crucial for taxpayers who wish to navigate their tax responsibilities effectively.

How to use the CLAIM OF EXEMPTION OR

Using the CLAIM OF EXEMPTION OR involves a straightforward process. First, you need to determine if you qualify for an exemption based on your financial situation or specific criteria set by the IRS. Once eligibility is established, you can fill out the form accurately, ensuring that all required information is included. After completing the form, it should be submitted to the appropriate tax authority to process your exemption request.

Steps to complete the CLAIM OF EXEMPTION OR

Completing the CLAIM OF EXEMPTION OR involves several key steps:

- Review the eligibility criteria to confirm that you qualify for an exemption.

- Gather necessary documentation that supports your claim.

- Fill out the form accurately, ensuring all information is correct and complete.

- Review the form for any errors or omissions before submission.

- Submit the form to the relevant tax authority either online, by mail, or in person.

Key elements of the CLAIM OF EXEMPTION OR

Several key elements must be included in the CLAIM OF EXEMPTION OR to ensure its validity:

- Personal Information: This includes your name, address, and taxpayer identification number.

- Exemption Reason: Clearly state the reason for claiming the exemption.

- Signature: Your signature is required to validate the form.

- Date: The date of submission must be included.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the CLAIM OF EXEMPTION OR. These guidelines outline eligibility requirements, the proper completion of the form, and submission procedures. It is essential to review these guidelines to ensure compliance and to avoid any potential penalties associated with incorrect submissions.

Eligibility Criteria

To qualify for the CLAIM OF EXEMPTION OR, individuals must meet certain eligibility criteria. This may include income thresholds, specific tax statuses, or other conditions defined by the IRS. Understanding these criteria is vital for ensuring that the exemption is valid and accepted by tax authorities.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the CLAIM OF EXEMPTION OR can result in penalties. These may include fines, interest on unpaid taxes, or other legal repercussions. It is important to understand the implications of non-compliance to avoid negative consequences.

Quick guide on how to complete claim of exemption or

Effortlessly Prepare CLAIM OF EXEMPTION OR on Any Device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and without complications. Handle CLAIM OF EXEMPTION OR on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Edit and eSign CLAIM OF EXEMPTION OR with Ease

- Locate CLAIM OF EXEMPTION OR and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive details with the tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form hunting, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign CLAIM OF EXEMPTION OR and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a CLAIM OF EXEMPTION OR and why is it necessary?

A CLAIM OF EXEMPTION OR is a legal document used to assert an exemption from certain taxes or legal obligations. It is important for individuals and businesses to file this claim correctly to avoid unnecessary financial penalties. Utilizing airSlate SignNow ensures that your CLAIM OF EXEMPTION OR is processed efficiently and securely.

-

How can airSlate SignNow help me manage my CLAIM OF EXEMPTION OR?

airSlate SignNow offers an intuitive platform for creating, signing, and sending your CLAIM OF EXEMPTION OR. With customizable templates and automated workflows, you can simplify the entire process, ensuring compliance and reducing the chance of errors. Our solution is designed to make document management hassle-free.

-

Is airSlate SignNow cost-effective for filing a CLAIM OF EXEMPTION OR?

Yes, airSlate SignNow provides a cost-effective solution for managing your CLAIM OF EXEMPTION OR. With competitive pricing plans, you can choose the level of service that suits your needs without overspending. Our pricing flexibility makes it accessible for both individuals and businesses.

-

What features make airSlate SignNow ideal for CLAIM OF EXEMPTION OR?

airSlate SignNow includes essential features like eSignature capabilities, document templates, and secure cloud storage, specifically beneficial for handling CLAIM OF EXEMPTION OR. The user-friendly interface allows for easy navigation and quick document processing, ensuring your claims are filed swiftly.

-

Can I track the status of my CLAIM OF EXEMPTION OR with airSlate SignNow?

Yes, with airSlate SignNow, you can easily track the status of your CLAIM OF EXEMPTION OR. Our platform provides real-time notifications and updates, so you are always informed about the progress of your documents. This feature helps you stay organized and on top of your filing requirements.

-

Does airSlate SignNow integrate with other applications for CLAIM OF EXEMPTION OR?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage your CLAIM OF EXEMPTION OR alongside your other business processes. By connecting with popular software solutions, you can streamline your workflows and improve overall efficiency.

-

How secure is airSlate SignNow when handling CLAIM OF EXEMPTION OR documents?

Security is a top priority for airSlate SignNow. Our platform utilizes advanced encryption and compliance protocols to ensure that your CLAIM OF EXEMPTION OR documents are protected from unauthorized access. You can trust our system to keep your sensitive information safe.

Get more for CLAIM OF EXEMPTION OR

- Hipaa request for amendment of the medical record form doc colorado state university evaluation of administrative professionals

- Massachusetts form 2

- Brokeragelink application union form

- Sehr geehrter dienstgeber dem acrobat reader nicht mglich ist und smtliche form

- How to complete your highmark blue cross blue shield enrollment form

- Stock option startup agreement template form

- Stock options agreement template form

- Stock purchase agreement template form

Find out other CLAIM OF EXEMPTION OR

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free