The Seller Has Changed Insurance Coverage Form

What is the Seller Has Changed Insurance Coverage

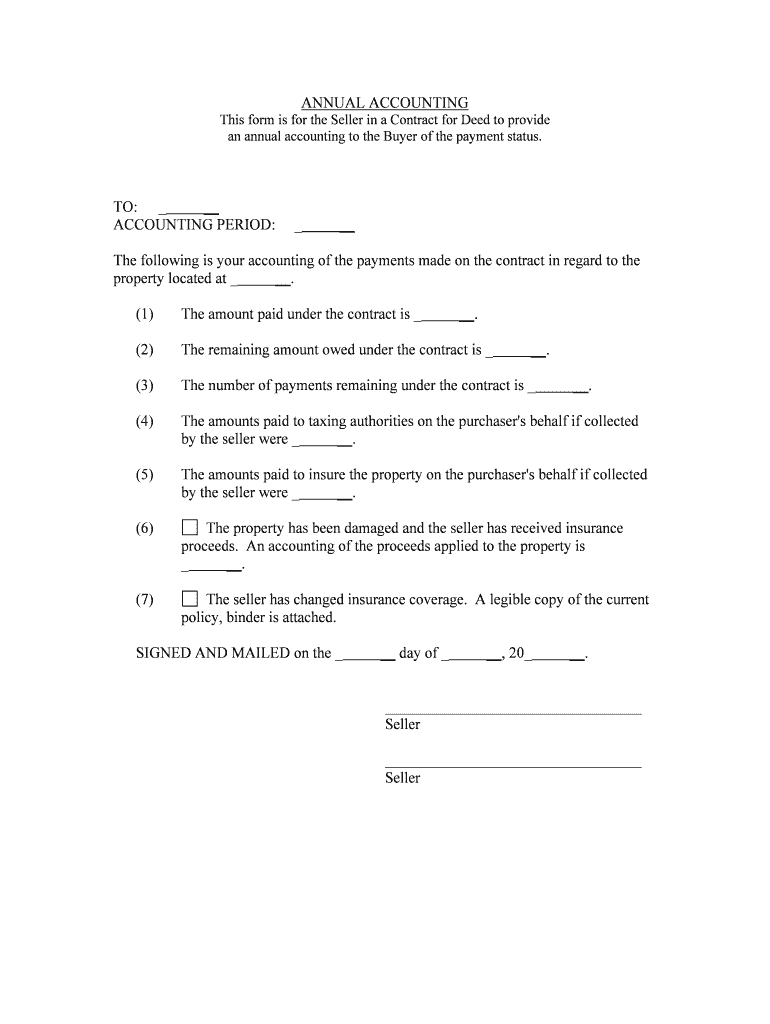

The Seller Has Changed Insurance Coverage form is a crucial document used in real estate transactions to inform relevant parties about changes in insurance coverage associated with a property being sold. This form ensures that buyers, sellers, and lenders are aware of any modifications to the insurance policy that could affect the property's value or the buyer's financial obligations. It typically includes details such as the type of coverage, effective dates, and any specific conditions or exclusions that may apply.

How to Use the Seller Has Changed Insurance Coverage

Using the Seller Has Changed Insurance Coverage form effectively involves several steps. First, the seller must accurately fill out the form, providing all necessary details regarding the insurance policy changes. Once completed, the form should be shared with the buyer and any relevant financial institutions. It is advisable to keep a copy for personal records. Utilizing electronic tools for this process can streamline the sharing and signing of the document, ensuring all parties have access to the most current information.

Steps to Complete the Seller Has Changed Insurance Coverage

Completing the Seller Has Changed Insurance Coverage form requires careful attention to detail. Follow these steps:

- Gather all relevant insurance documents related to the property.

- Fill in the seller's information, including name and contact details.

- Provide details about the insurance coverage, such as the provider, policy number, and coverage limits.

- Indicate the effective date of the new coverage.

- Sign and date the form to validate the information provided.

- Distribute copies to the buyer and any involved lenders or agents.

Legal Use of the Seller Has Changed Insurance Coverage

The legal use of the Seller Has Changed Insurance Coverage form is essential for ensuring compliance with real estate regulations. This form serves as a formal notification to all parties involved in the transaction about the changes in insurance coverage. It is important that the form is filled out accurately and signed by the seller, as it may be required for closing the sale. Failure to provide this information could lead to disputes or complications during the transaction process.

Key Elements of the Seller Has Changed Insurance Coverage

Key elements of the Seller Has Changed Insurance Coverage form include:

- Seller Information: Name, address, and contact details of the seller.

- Insurance Details: Name of the insurance provider, policy number, and type of coverage.

- Effective Date: The date when the new insurance coverage takes effect.

- Signatures: Required signatures from the seller and potentially the buyer or agent.

Examples of Using the Seller Has Changed Insurance Coverage

Examples of situations where the Seller Has Changed Insurance Coverage form is applicable include:

- A seller updates their homeowner's insurance policy to include additional coverage for natural disasters.

- A property is sold, and the seller needs to inform the buyer of changes made to the insurance policy prior to closing.

- Changes in the insurance provider necessitate a formal notification to the buyer about the new terms of coverage.

Quick guide on how to complete the seller has changed insurance coverage

Complete The Seller Has Changed Insurance Coverage effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Handle The Seller Has Changed Insurance Coverage on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and electronically sign The Seller Has Changed Insurance Coverage effortlessly

- Locate The Seller Has Changed Insurance Coverage and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information using the tools provided specifically for this purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign The Seller Has Changed Insurance Coverage and ensure clear communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What should I do if the seller has changed insurance coverage?

If the seller has changed insurance coverage, it's crucial to review the new policy details to ensure they meet your needs. signNow out to the seller for clarification on the coverage changes and how they affect your agreement. Consider consulting with a legal expert to understand any implications when signing documents.

-

How can airSlate SignNow help with documenting insurance coverage changes?

airSlate SignNow streamlines the process of documenting changes if the seller has changed insurance coverage. Our eSignature solution allows you to easily create, send, and sign documents securely. This ensures all parties have a clear record of the new insurance details and agreements.

-

Are there any costs associated with using airSlate SignNow for insurance document signing?

airSlate SignNow offers competitive pricing for its eSignature services, allowing you to efficiently manage documents when the seller has changed insurance coverage. We provide various pricing plans suitable for both individuals and businesses, ensuring you can choose the best option for your needs without breaking the bank.

-

What features does airSlate SignNow offer for real estate transactions?

When the seller has changed insurance coverage, airSlate SignNow features include customizable document templates, in-app signing, and automated workflows. These features simplify the signing process, allowing you to focus on closing deals while ensuring all documents are securely managed and stored.

-

Can I integrate airSlate SignNow with other tools I use?

Yes, airSlate SignNow can be seamlessly integrated with various tools that enhance your workflow when the seller has changed insurance coverage. You can connect it with customer relationship management (CRM) systems and document storage solutions, making it easier to manage your documents and communications.

-

Is it safe to share sensitive documents about insurance changes with airSlate SignNow?

Absolutely, airSlate SignNow prioritizes the security of your documents. When the seller has changed insurance coverage, you can trust that our platform employs advanced encryption and security measures to protect sensitive information during transmission and storage.

-

How does airSlate SignNow improve the efficiency of signing insurance documents?

airSlate SignNow enhances the efficiency of signing insurance documents by providing a user-friendly interface and quick access to signing options. When the seller has changed insurance coverage, this means you can expedite the process of obtaining necessary signatures, reducing delays in transactions.

Get more for The Seller Has Changed Insurance Coverage

- American diversified publications form

- Mvdb 19 form

- Genworth declaration of attorney in fact form

- 0p175 form

- Apwu request for information documents for grievance processing apwu request for information documents for grievance processing

- Ee 11aimpairment benefits response form

- Transfer of debt agreement template form

- Transfer of ip rights agreement template form

Find out other The Seller Has Changed Insurance Coverage

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online