Payment Fee of Five Per Cent 5% of Any Sum Due Hereunder If Said Payment is Made After Form

Understanding the Payment Fee of Five Per Cent 5% of Any Sum Due Hereunder If Said Payment Is Made After

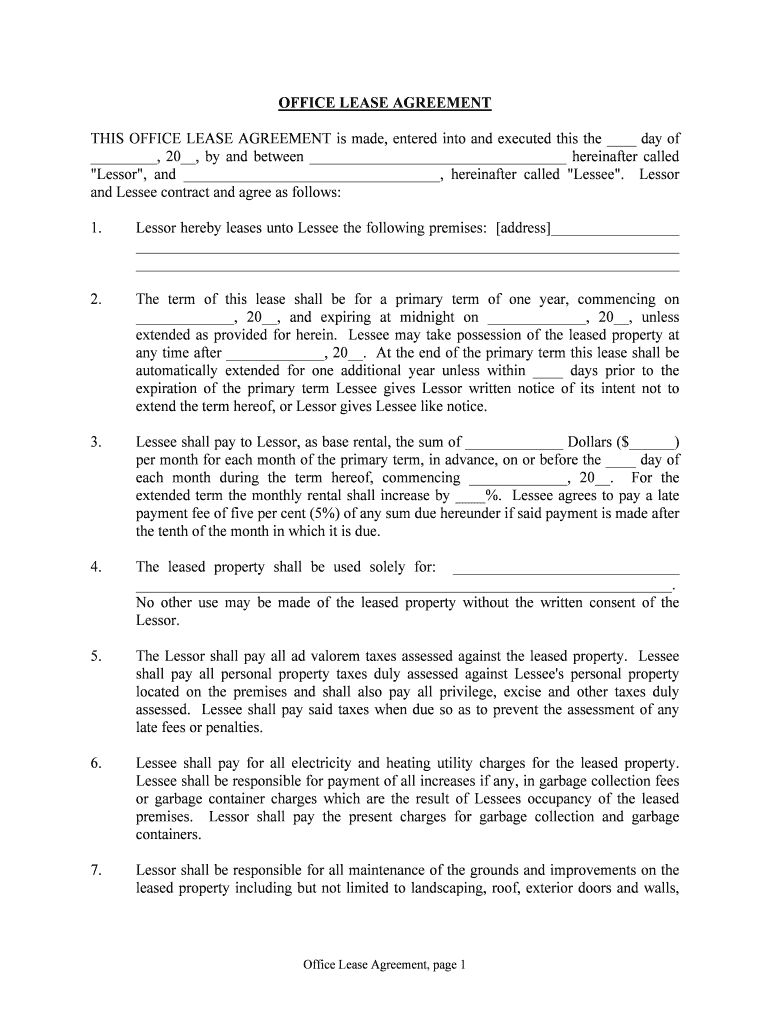

The payment fee of five per cent 5% of any sum due hereunder if said payment is made after is a financial penalty applied when payments are not made by the specified due date. This fee serves as an incentive for timely payments and helps maintain cash flow for businesses. It is essential to understand the implications of this fee, especially in contractual agreements, as it can significantly affect the total amount owed if payments are delayed.

How to Complete the Payment Fee of Five Per Cent 5% of Any Sum Due Hereunder If Said Payment Is Made After Form

Completing the payment fee of five per cent 5% of any sum due hereunder if said payment is made after form involves filling out specific details accurately. Start by entering the total amount due, followed by the payment date. If the payment is made after the due date, ensure to calculate the additional five per cent fee based on the total amount. Providing accurate information is crucial to avoid discrepancies and ensure compliance with the terms outlined in the agreement.

Legal Considerations for the Payment Fee of Five Per Cent 5% of Any Sum Due Hereunder If Said Payment Is Made After

The legal enforceability of the payment fee of five per cent 5% of any sum due hereunder if said payment is made after is contingent upon the terms outlined in the contract. It is vital to ensure that both parties agree to these terms and that they are clearly stated to avoid potential disputes. Compliance with relevant laws, such as the Uniform Commercial Code (UCC), can also affect the enforceability of this fee, making it essential to consult legal counsel when drafting or reviewing contracts.

Key Elements of the Payment Fee of Five Per Cent 5% of Any Sum Due Hereunder If Said Payment Is Made After

Several key elements define the payment fee of five per cent 5% of any sum due hereunder if said payment is made after. These include the due date for payment, the calculation method for the fee, and any grace periods that may apply. Additionally, the form should specify whether the fee is applied to the principal amount or the total amount due, including any previous fees. Clarity in these elements helps prevent misunderstandings and ensures all parties are aware of their obligations.

Examples of the Payment Fee of Five Per Cent 5% of Any Sum Due Hereunder If Said Payment Is Made After in Practice

Consider a scenario where a business has an invoice totaling one thousand dollars due on the first of the month. If the payment is made on the tenth, the payment fee of five per cent would apply, resulting in an additional fifty dollars owed. This example illustrates how the fee can accumulate, emphasizing the importance of timely payments. Understanding these practical implications can help individuals and businesses manage their finances more effectively.

Steps to Obtain the Payment Fee of Five Per Cent 5% of Any Sum Due Hereunder If Said Payment Is Made After Form

To obtain the payment fee of five per cent 5% of any sum due hereunder if said payment is made after form, follow these steps: First, identify the source of the form, which may be provided by your business or legal advisor. Next, ensure you have the necessary information regarding the payment terms and amounts due. Finally, fill out the form accurately, ensuring all details are correct before submission. Keeping a copy for your records is also advisable for future reference.

Quick guide on how to complete payment fee of five per cent 5 of any sum due hereunder if said payment is made after

Effortlessly Prepare Payment Fee Of Five Per Cent 5% Of Any Sum Due Hereunder If Said Payment Is Made After on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without complications. Manage Payment Fee Of Five Per Cent 5% Of Any Sum Due Hereunder If Said Payment Is Made After on any device using airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

The Simplest Way to Modify and Electronically Sign Payment Fee Of Five Per Cent 5% Of Any Sum Due Hereunder If Said Payment Is Made After with Ease

- Locate Payment Fee Of Five Per Cent 5% Of Any Sum Due Hereunder If Said Payment Is Made After and click on Get Form to begin.

- Utilize the available tools to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your requirements in document management with just a few clicks from any device you choose. Edit and electronically sign Payment Fee Of Five Per Cent 5% Of Any Sum Due Hereunder If Said Payment Is Made After to ensure exceptional communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Payment Fee Of Five Per Cent 5% Of Any Sum Due Hereunder If Said Payment Is Made After?

The Payment Fee Of Five Per Cent 5% Of Any Sum Due Hereunder If Said Payment Is Made After is a charge that applies when payments are not made within the specified terms. This fee is designed to encourage timely payments and ensure that we can continue to offer our cost-effective solutions without disruption.

-

How can I avoid the Payment Fee Of Five Per Cent 5% Of Any Sum Due Hereunder If Said Payment Is Made After?

To avoid the Payment Fee Of Five Per Cent 5% Of Any Sum Due Hereunder If Said Payment Is Made After, ensure that all payments are made by the due date outlined in your agreement. Setting up reminders or using automatic payment options can help you stay on track and avoid any extra charges.

-

What payment methods are available to prevent the Payment Fee Of Five Per Cent 5% Of Any Sum Due Hereunder If Said Payment Is Made After?

airSlate SignNow offers multiple payment methods, including credit cards, bank transfers, and online payment services. Utilizing these options can facilitate speedy transactions, helping you to avoid the Payment Fee Of Five Per Cent 5% Of Any Sum Due Hereunder If Said Payment Is Made After.

-

Is the Payment Fee Of Five Per Cent 5% Of Any Sum Due Hereunder If Said Payment Is Made After applicable to all customers?

Yes, the Payment Fee Of Five Per Cent 5% Of Any Sum Due Hereunder If Said Payment Is Made After is applicable to all customers who fail to make their payments on time. It’s important for all users to familiarize themselves with the payment terms to avoid this fee.

-

What features does airSlate SignNow offer to help manage payments effectively?

airSlate SignNow offers features like document tracking, automated reminders, and easy electronic payments to help you manage your transactions. Leveraging these tools can assist in maintaining your payment schedule and avoiding the Payment Fee Of Five Per Cent 5% Of Any Sum Due Hereunder If Said Payment Is Made After.

-

Can I receive notifications about upcoming payments to avoid the Payment Fee Of Five Per Cent 5% Of Any Sum Due Hereunder If Said Payment Is Made After?

Yes, airSlate SignNow provides notifications and reminders for upcoming payments. Receiving these alerts can help ensure you are informed of due dates, thus allowing you to avoid the Payment Fee Of Five Per Cent 5% Of Any Sum Due Hereunder If Said Payment Is Made After.

-

Are there any benefits to making timely payments to avoid the Payment Fee Of Five Per Cent 5% Of Any Sum Due Hereunder If Said Payment Is Made After?

Beyond avoiding the Payment Fee Of Five Per Cent 5% Of Any Sum Due Hereunder If Said Payment Is Made After, making timely payments fosters better relationships with service providers and can lead to preferential treatment and additional benefits, such as discounts or enhanced service options.

Get more for Payment Fee Of Five Per Cent 5% Of Any Sum Due Hereunder If Said Payment Is Made After

- Texas medicaid attestation for aca primary care tmhp com form

- Please check one covenant college lesson observation form

- Japan health certificate form

- Blank da 4187 filler form

- Emailing application for examination or employment state of connecticut form

- Award letter 23227 contract award letter date form

- Ivantage expanded market program form

- Lead based disclosure form 495583602

Find out other Payment Fee Of Five Per Cent 5% Of Any Sum Due Hereunder If Said Payment Is Made After

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement