A Mortgage Note Payable with a Fixed Interest Rate Requires Form

What is a mortgage note example?

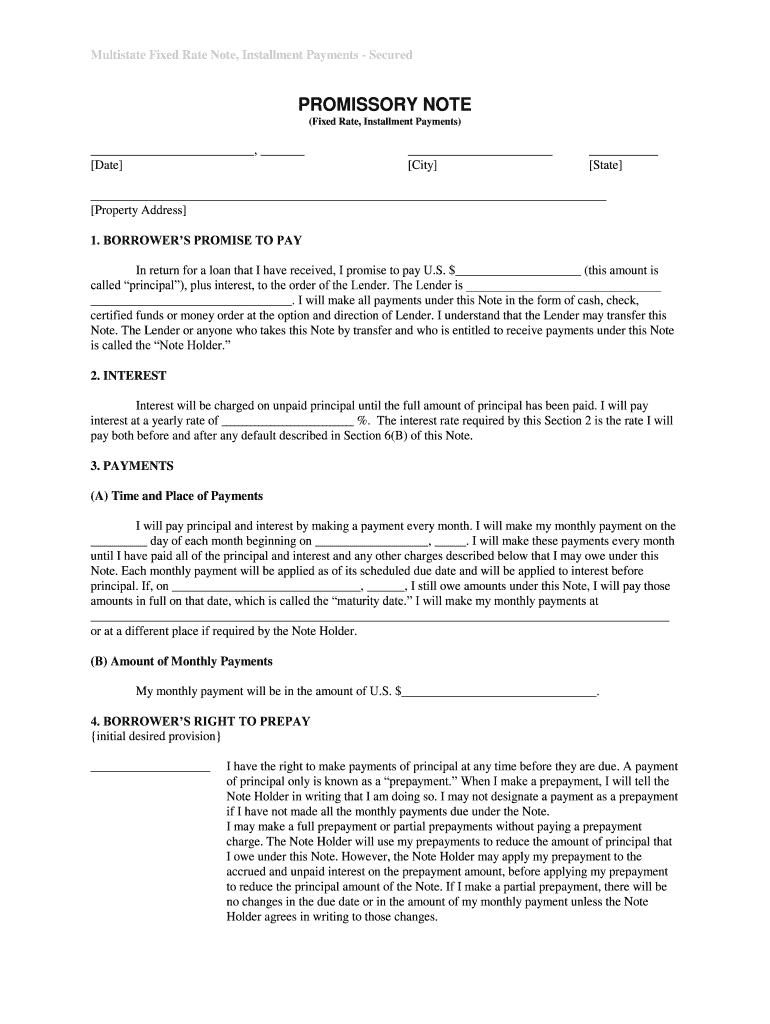

A mortgage note is a legal document that outlines the terms of a loan secured by real estate. It serves as a promise to repay the borrowed amount, detailing the interest rate, payment schedule, and consequences of default. A typical mortgage note example includes the names of the borrower and lender, the loan amount, the property address, and the terms of repayment. This document is crucial for both parties, as it establishes the legal obligations and rights associated with the mortgage.

Key elements of a mortgage note example

Understanding the key elements of a mortgage note is essential for anyone involved in real estate transactions. A comprehensive mortgage note example typically includes:

- Borrower and lender information: Names and addresses of both parties.

- Loan amount: The total sum borrowed.

- Interest rate: The percentage charged on the loan amount.

- Payment schedule: Details on how often payments are made (monthly, quarterly, etc.) and the duration of the loan.

- Property description: Legal description of the property being mortgaged.

- Default terms: Conditions under which the lender can take action if the borrower fails to make payments.

Steps to complete a mortgage note example

Completing a mortgage note requires careful attention to detail. Here are the steps to follow:

- Gather necessary information: Collect all relevant details about the borrower, lender, and property.

- Draft the note: Use a template or create a document that includes all key elements.

- Review terms: Ensure all terms, such as interest rate and payment schedule, are clearly defined.

- Sign the document: Both parties must sign the mortgage note to make it legally binding.

- Store securely: Keep the signed document in a safe place, as it is an important legal record.

Legal use of a mortgage note example

The legal validity of a mortgage note is contingent upon compliance with state laws and regulations. In the U.S., a properly executed mortgage note is enforceable in court. It must be signed by the borrower and may require notarization, depending on state requirements. Additionally, the document should adhere to the guidelines set forth by the Uniform Commercial Code (UCC) to ensure it is recognized as a negotiable instrument.

How to use a mortgage note example

A mortgage note example can serve various purposes beyond just a template for drafting. It can be used for:

- Education: Helping borrowers understand their obligations and rights.

- Negotiation: Providing a basis for discussions between lenders and borrowers regarding loan terms.

- Documentation: Serving as a reference for legal proceedings or disputes related to the mortgage.

Examples of using a mortgage note example

Real-world scenarios illustrate the application of a mortgage note example. For instance, a first-time homebuyer may use a mortgage note template to understand the terms of their loan before signing. Similarly, a lender may refer to a mortgage note example when creating customized loan agreements for different borrowers. These examples help clarify expectations and ensure all parties are aware of their responsibilities.

Quick guide on how to complete a mortgage note payable with a fixed interest rate requires

Complete A Mortgage Note Payable With A Fixed Interest Rate Requires seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily locate the required form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents promptly and without issues. Handle A Mortgage Note Payable With A Fixed Interest Rate Requires on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign A Mortgage Note Payable With A Fixed Interest Rate Requires effortlessly

- Find A Mortgage Note Payable With A Fixed Interest Rate Requires and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Don't worry about lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and eSign A Mortgage Note Payable With A Fixed Interest Rate Requires and ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a mortgage note example?

A mortgage note example is a written document that outlines the terms of a mortgage agreement between the borrower and lender. It typically includes the loan amount, interest rate, repayment schedule, and other important details. Understanding a mortgage note example is crucial for anyone considering a mortgage as it clarifies their obligations.

-

How does airSlate SignNow simplify the signing of mortgage notes?

AirSlate SignNow provides an intuitive platform that allows users to quickly create, send, and eSign mortgage notes. The seamless interface ensures that all parties can easily access the document and complete the signing process without unnecessary delays. This simplification leads to faster transactions and improved efficiency.

-

Are there templates for mortgage note examples available in airSlate SignNow?

Yes, airSlate SignNow offers a variety of templates, including mortgage note examples, to help users quickly draft their documents. These templates ensure that all necessary information is included and formatted correctly, saving time and minimizing errors. Users can customize these templates to fit their specific needs.

-

What are the pricing options for using airSlate SignNow for mortgage notes?

AirSlate SignNow offers several pricing plans designed to accommodate businesses of all sizes. The plans are cost-effective, ensuring that users can access essential features for managing mortgage note examples without breaking the bank. Detailed pricing information can be found on the airSlate SignNow website.

-

Can I integrate airSlate SignNow with other software for managing mortgage notes?

Yes, airSlate SignNow seamlessly integrates with various applications and software, making it easier to manage mortgage note examples alongside your existing tools. This integration allows you to streamline your workflow and improve efficiency in document management. Popular integrations include CRM systems and cloud storage services.

-

What benefits does airSlate SignNow offer for mortgage note management?

AirSlate SignNow enhances mortgage note management by providing a secure, efficient, and user-friendly platform. Users can quickly create, send, and track mortgage notes, ensuring that all parties remain informed throughout the process. Additionally, the eSigning feature improves turnaround times signNowly.

-

Is it secure to eSign mortgage notes using airSlate SignNow?

Yes, security is a top priority for airSlate SignNow. The platform employs advanced encryption and compliance with industry standards to ensure that all eSigned mortgage notes are protected from unauthorized access. Users can confidently send and sign documents knowing their information is secure.

Get more for A Mortgage Note Payable With A Fixed Interest Rate Requires

- Lease counter offer letter sample form

- Dart paratransit application 36333486 form

- Asset disposition list form

- University student reporting an incident form

- Jetform80001102 library ifd dor ms

- Rpd 41329 sustainable building tax credit claim form

- Lease for room rental agreement template form

- Lease for truck and trailer agreement template form

Find out other A Mortgage Note Payable With A Fixed Interest Rate Requires

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast