Indiana Limited Liability Company Operating Agreement Form

What is the Indiana Limited Liability Company Operating Agreement

The Indiana Limited Liability Company Operating Agreement is a crucial legal document that outlines the management structure and operating procedures of an LLC in Indiana. This agreement serves as an internal guideline for the members of the LLC, detailing the rights and responsibilities of each member, as well as the operational protocols. It is not a requirement to file this document with the state, but having one is highly recommended for clarity and legal protection. The agreement can help prevent disputes among members by establishing clear expectations and procedures for decision-making.

Key elements of the Indiana Limited Liability Company Operating Agreement

Several key elements should be included in the Indiana Limited Liability Company Operating Agreement to ensure comprehensive coverage of all necessary aspects. These elements typically include:

- Member information: Names and addresses of all members involved in the LLC.

- Management structure: Details on whether the LLC will be member-managed or manager-managed.

- Voting rights: Specifications on how voting will occur and what percentage of votes is required for different decisions.

- Profit and loss distribution: Guidelines on how profits and losses will be allocated among members.

- Amendment procedures: The process for making changes to the agreement in the future.

Steps to complete the Indiana Limited Liability Company Operating Agreement

Completing the Indiana Limited Liability Company Operating Agreement involves several straightforward steps. Follow these guidelines to ensure you cover all necessary aspects:

- Gather member information, including names, addresses, and ownership percentages.

- Decide on the management structure, determining whether the LLC will be member-managed or manager-managed.

- Outline the voting rights and procedures for decision-making.

- Specify how profits and losses will be distributed among members.

- Include provisions for amending the agreement in the future.

- Review the document with all members to ensure agreement and understanding.

- Sign the completed agreement to make it effective.

Legal use of the Indiana Limited Liability Company Operating Agreement

The Indiana Limited Liability Company Operating Agreement is legally binding once it is signed by all members. While it does not need to be filed with the state, it plays a significant role in establishing the legal framework for the LLC. Courts may refer to this agreement in disputes among members, making it essential to ensure that it is clear, comprehensive, and accurately reflects the intentions of the members. Maintaining a well-drafted Operating Agreement can also help protect personal assets from business liabilities.

How to use the Indiana Limited Liability Company Operating Agreement

Using the Indiana Limited Liability Company Operating Agreement effectively involves adhering to its terms and ensuring all members understand their roles and responsibilities. Members should refer to the agreement whenever decisions need to be made regarding management, profit distribution, or any amendments. Regularly revisiting the agreement can help ensure it remains relevant as the business evolves. It is also advisable to consult legal professionals when making significant changes to the agreement or if disputes arise among members.

State-specific rules for the Indiana Limited Liability Company Operating Agreement

Indiana has specific regulations that govern the formation and operation of LLCs, which should be reflected in the Operating Agreement. For instance, the agreement should comply with Indiana's laws regarding member rights, management structures, and fiduciary duties. Additionally, the agreement should align with state statutes to ensure enforceability. Understanding these state-specific rules can help members draft an agreement that not only meets their needs but also adheres to legal requirements.

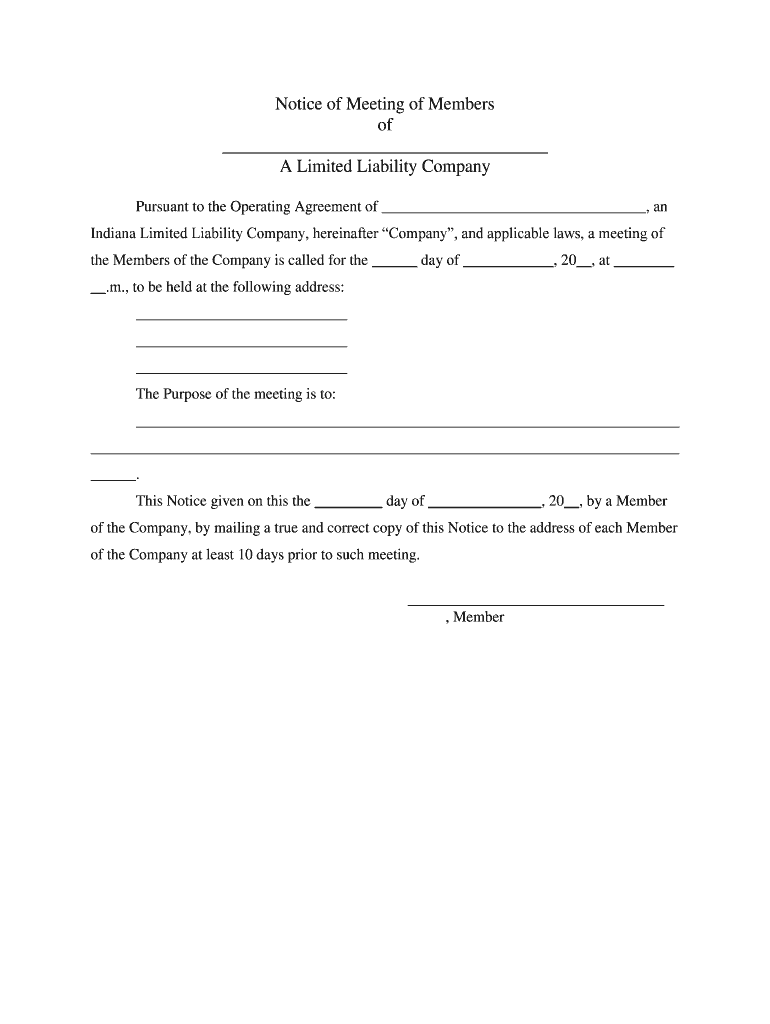

Quick guide on how to complete indiana limited liability company operating agreement

Prepare Indiana Limited Liability Company Operating Agreement effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitution for traditional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Indiana Limited Liability Company Operating Agreement on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to modify and electronically sign Indiana Limited Liability Company Operating Agreement without hassle

- Obtain Indiana Limited Liability Company Operating Agreement and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Indiana Limited Liability Company Operating Agreement and ensure effective communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Indiana Limited Liability Company Operating Agreement?

An Indiana Limited Liability Company Operating Agreement is a legal document that outlines the management structure and operating procedures of an LLC in Indiana. It establishes the rights and responsibilities of members, helping to prevent disputes and ensuring clarity in operations. Having an effective operating agreement is essential for compliance and can help protect personal assets.

-

Why do I need an Indiana Limited Liability Company Operating Agreement?

An Indiana Limited Liability Company Operating Agreement is crucial as it defines the financial and operational arrangements of your LLC. It not only articulates the roles of members but also safeguards personal assets from business liabilities. This document can also provide credibility and structure to your business dealings.

-

How much does it cost to create an Indiana Limited Liability Company Operating Agreement?

The cost of creating an Indiana Limited Liability Company Operating Agreement can vary based on the complexity of your LLC's structure. You may create one yourself for free, but using a service like airSlate SignNow can provide a cost-effective solution, typically ranging from $50 to $200 for professional templates. Investing in a well-drafted agreement is beneficial for long-term business success.

-

What features does airSlate SignNow offer for managing an Indiana Limited Liability Company Operating Agreement?

airSlate SignNow offers an intuitive platform that simplifies the creation, editing, and signing of your Indiana Limited Liability Company Operating Agreement. Features include easy document sharing, secure eSignature capabilities, and customizable templates that ensure compliance with Indiana state laws. This makes managing your operating agreement both efficient and straightforward.

-

Can I customize my Indiana Limited Liability Company Operating Agreement using airSlate SignNow?

Yes, you can easily customize your Indiana Limited Liability Company Operating Agreement using airSlate SignNow. The platform allows you to modify templates to fit your specific business needs, ensuring that all member roles and responsibilities are accurately reflected. Customization helps create a tailored approach that can address the unique dynamics of your LLC.

-

Is it legal to use an online service for my Indiana Limited Liability Company Operating Agreement?

Yes, using an online service like airSlate SignNow for your Indiana Limited Liability Company Operating Agreement is legal and widely accepted. Many entrepreneurs opt for online platforms due to their convenience and efficiency. However, it's important to ensure that the agreement complies with Indiana state law to protect your business interests.

-

How does airSlate SignNow ensure the security of my Indiana Limited Liability Company Operating Agreement?

airSlate SignNow prioritizes the security of your Indiana Limited Liability Company Operating Agreement with advanced encryption and secure cloud storage. This ensures that all documents are safely stored and only accessible to authorized users. Additionally, the platform provides audit trails and document tracking to enhance security and transparency.

Get more for Indiana Limited Liability Company Operating Agreement

- Chandler towing invoice template pdf form

- Application for approval to take examinations utah occupational dopl utah form

- Sutter health flyer template 2 line headline 1 column form

- Reading skills practice finding a job exercises form

- Christmas cookie order form

- Prime drug testing amarillo tx form

- Lions affordable hearing aid project application qualification lcif lcif form

- Vendor representative registration form

Find out other Indiana Limited Liability Company Operating Agreement

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online