Fidelity Opening a New Trust Account Applicatoon Form

Understanding the irrevocable funeral trust prearranged

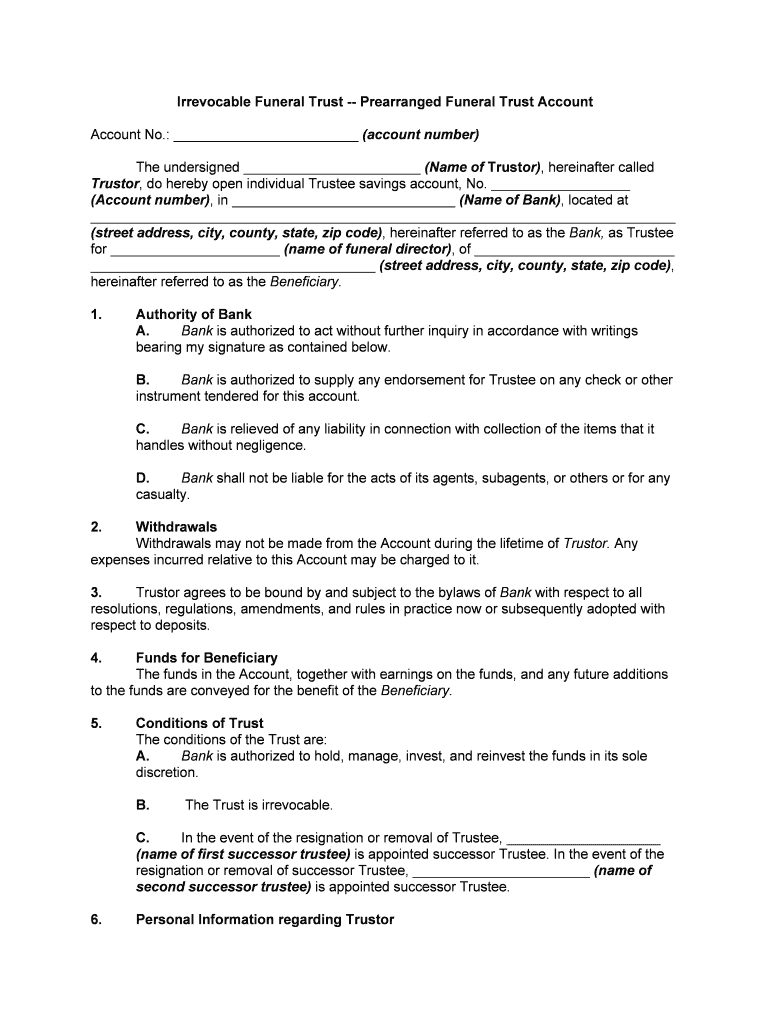

An irrevocable funeral trust prearranged is a financial tool designed to set aside funds for funeral expenses. By establishing this type of trust, individuals can ensure that their funeral costs are covered without burdening their loved ones. The trust is legally binding and cannot be altered or revoked once it is established, providing peace of mind regarding future expenses. This type of trust is particularly beneficial for those who wish to plan their funeral arrangements in advance and manage their estate efficiently.

Key elements of an irrevocable funeral trust

Several key elements define an irrevocable funeral trust prearranged. These include:

- Funding: The trust is funded with a specific amount of money, which is typically held in a separate account.

- Beneficiary Designation: The trust specifies the beneficiaries who will receive the funds for funeral expenses.

- Restrictions: Once established, the terms of the trust cannot be modified, ensuring that the funds are used solely for the intended purpose.

- Legal Requirements: The trust must comply with state laws regarding funeral trusts, which can vary significantly.

Steps to establish an irrevocable funeral trust

Establishing an irrevocable funeral trust involves several steps:

- Research: Investigate different funeral homes and their prearrangement options.

- Consultation: Meet with a financial advisor or attorney to discuss your intentions and understand the legal implications.

- Documentation: Complete the necessary paperwork, which may include a trust agreement and funding instructions.

- Funding the Trust: Deposit the agreed-upon amount into the trust account.

- Review: Regularly review the trust to ensure it meets your needs and remains compliant with state regulations.

Legal use of an irrevocable funeral trust

The legal use of an irrevocable funeral trust prearranged is primarily to ensure that funds are allocated specifically for funeral expenses. This legal structure protects the funds from being used for other purposes and can also have implications for Medicaid eligibility, as the trust may be excluded from the individual's assets. It is important to consult with a legal professional to navigate the specific laws in your state regarding irrevocable trusts.

Required documents for setting up the trust

To set up an irrevocable funeral trust, several documents are typically required:

- Trust Agreement: A formal document outlining the terms and conditions of the trust.

- Identification: Personal identification documents for the individual establishing the trust.

- Funding Source Documentation: Evidence of the funds being allocated to the trust.

- Beneficiary Information: Details regarding the beneficiaries designated to receive the funds.

Eligibility criteria for establishing the trust

Eligibility to establish an irrevocable funeral trust generally includes:

- Being of legal age, typically eighteen years or older.

- Having the financial means to fund the trust adequately.

- Understanding the irrevocable nature of the trust and its implications on estate planning.

Quick guide on how to complete fidelity opening a new trust account applicatoon

Complete Fidelity Opening A New Trust Account Applicatoon seamlessly on any gadget

Managing documents online has gained traction among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the right format and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents rapidly without hold-ups. Handle Fidelity Opening A New Trust Account Applicatoon on any device using airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The easiest way to modify and electronically sign Fidelity Opening A New Trust Account Applicatoon effortlessly

- Obtain Fidelity Opening A New Trust Account Applicatoon and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or conceal sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, either by email, text message (SMS), invite link, or download it to your computer.

Forget about misplaced or lost files, cumbersome form searches, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Fidelity Opening A New Trust Account Applicatoon and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fidelity opening a new trust account applicatoon

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an irrevocable funeral trust prearranged?

An irrevocable funeral trust prearranged is a financial arrangement that allows individuals to set aside funds specifically for their funeral expenses. This type of trust ensures that the funds are protected and cannot be altered, ensuring that your preferences for funeral services are met without financial burdens on your loved ones.

-

How does an irrevocable funeral trust prearranged benefit me?

The primary benefit of an irrevocable funeral trust prearranged is peace of mind. It ensures that your funeral expenses are covered, alleviating the financial stress on your family during a difficult time. Additionally, it may help shield your assets from being considered in eligibility for Medicaid.

-

What are the costs associated with setting up an irrevocable funeral trust prearranged?

The costs for setting up an irrevocable funeral trust prearranged can vary widely based on the provider and the funeral services you choose. Typically, you will need to consider any initial funding required to start the trust, as well as any administrative fees associated with maintaining it. It's important to compare options to find the best value.

-

Can I change the details of my irrevocable funeral trust prearranged?

One defining feature of an irrevocable funeral trust prearranged is that once it is established, the terms usually cannot be changed. This means your choices regarding funeral services, pricing, and allocation of funds are locked in to ensure your wishes are honored. Therefore, it is crucial to carefully consider your options before setting up the trust.

-

How does an irrevocable funeral trust prearranged affect my estate planning?

An irrevocable funeral trust prearranged can greatly enhance your estate planning by ensuring that your funeral costs are covered without burdening your heirs. This type of trust is considered non-countable when determining financial eligibility for government assistance programs. By planning ahead, you also reduce the financial uncertainty surrounding your passing.

-

Is an irrevocable funeral trust prearranged easy to set up?

Yes, setting up an irrevocable funeral trust prearranged is generally a straightforward process. Most funeral service providers can help guide you through the steps, from selecting desired services to completing necessary paperwork. With the right support, you can efficiently secure your wishes for the future.

-

Are there tax implications for an irrevocable funeral trust prearranged?

Typically, funds placed into an irrevocable funeral trust prearranged may not be considered taxable. However, it's essential to consult with a financial advisor to understand your specific tax situation, as there may be exemptions or regulations that apply. This proactive approach ensures that you maximize the benefits of your trust.

Get more for Fidelity Opening A New Trust Account Applicatoon

- Three individuals to an l form

- Application for a disabled hunter permit form

- Chapter 9 proceedings to establish title without form

- Wyoming state lien law summary levyvon beck form

- Under wyoming law any person who takes part in any sport or recreational opportunity form

- Wy stat29 10 101 29 10 101 preliminary notice of right form

- Wyoming statutes title 29 liens29 10 101findlaw form

- Wyoming preliminary notice guide all you need to know form

Find out other Fidelity Opening A New Trust Account Applicatoon

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast