Notarized Certification of No Changes in the Previous Documents Form

What is the Notarized Certification of No Changes in the Previous Documents

The Notarized Certification of No Changes in the Previous Documents is a formal declaration that verifies the accuracy and consistency of previously submitted documents. This certification is often required in various legal and administrative contexts to confirm that no alterations have been made since the original submission. It serves as a safeguard against discrepancies and ensures that all parties involved have access to the same information. This certification is typically notarized, adding an extra layer of authenticity and legal standing.

How to Use the Notarized Certification of No Changes in the Previous Documents

Using the Notarized Certification of No Changes in the Previous Documents involves several steps. First, gather all relevant documents that require certification. Next, complete the certification form accurately, ensuring that all information matches the original documents. After filling out the form, present it to a notary public, who will verify your identity and witness your signature. Once notarized, the certification can be submitted along with the original documents to the relevant authority or organization. This process helps maintain transparency and trust in legal and business transactions.

Steps to Complete the Notarized Certification of No Changes in the Previous Documents

To complete the Notarized Certification of No Changes in the Previous Documents, follow these steps:

- Collect all documents that have been previously submitted and require certification.

- Fill out the certification form, ensuring all details are accurate and reflect the original documents.

- Schedule an appointment with a notary public to have the certification notarized.

- Present your identification and the completed form to the notary.

- Sign the certification in the presence of the notary, who will then affix their seal and signature.

- Submit the notarized certification along with the original documents to the appropriate entity.

Legal Use of the Notarized Certification of No Changes in the Previous Documents

The legal use of the Notarized Certification of No Changes in the Previous Documents is crucial in various scenarios, including court proceedings, business transactions, and regulatory compliance. This certification provides legal assurance that the information presented has not been altered, which can be vital in disputes or audits. It is recognized by many institutions as a valid form of verification, thus facilitating smoother processes in legal and administrative matters.

Key Elements of the Notarized Certification of No Changes in the Previous Documents

Key elements of the Notarized Certification of No Changes in the Previous Documents include:

- Identification of the signer: Full name and contact information.

- Details of the original documents: A description of the documents being certified.

- Statement of no changes: A clear declaration that no alterations have occurred.

- Notary information: The notary's name, signature, and seal, along with the date of notarization.

Examples of Using the Notarized Certification of No Changes in the Previous Documents

Examples of situations where the Notarized Certification of No Changes in the Previous Documents may be required include:

- Submitting documents for a loan application where previous financial statements are involved.

- Providing documentation for legal proceedings, such as divorce or custody cases.

- Ensuring compliance with regulatory bodies in business transactions.

- Verifying the accuracy of tax documents submitted to the IRS.

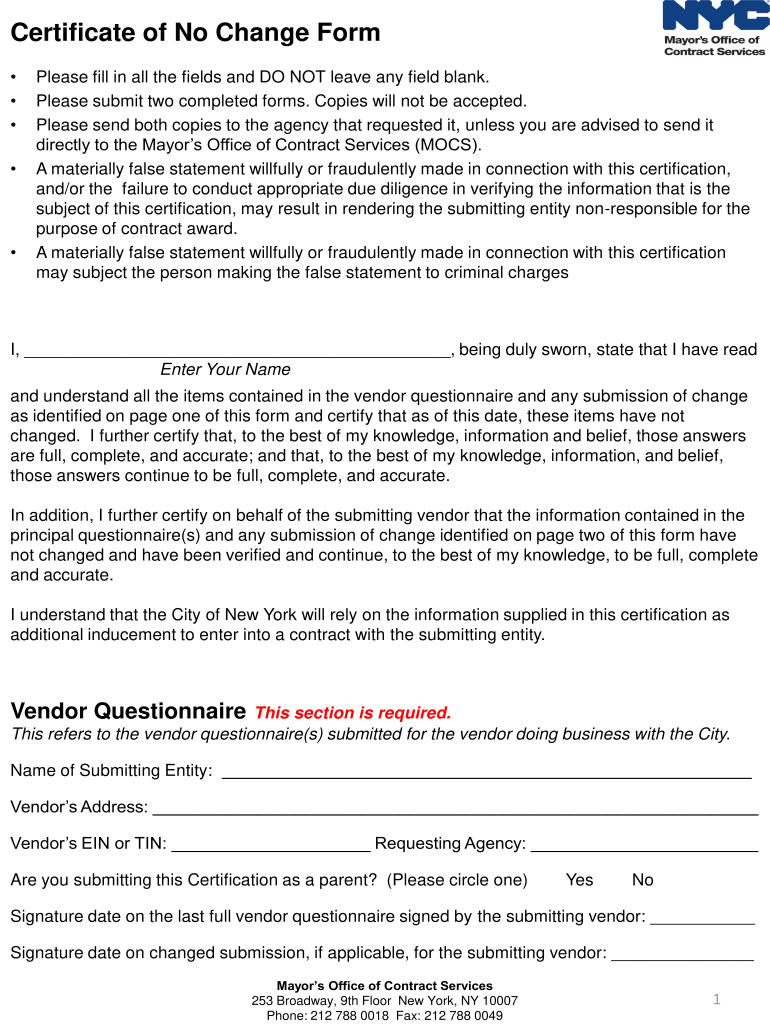

Quick guide on how to complete certificate of no change form

The optimal method to locate and authorize Notarized Certification Of No Changes In The Previous Documents

At the magnitude of your whole organization, ineffective workflows concerning paper endorsement can consume a signNow amount of productive time. Approving documents like Notarized Certification Of No Changes In The Previous Documents is a fundamental aspect of operations in any field, which is why the effectiveness of each agreement’s lifecycle signNowly impacts the organization’s overall success. With airSlate SignNow, authorizing your Notarized Certification Of No Changes In The Previous Documents is as straightforward and rapid as possible. You’ll gain access to this platform's latest version of almost any form. Even better, you can endorse it instantly without needing to install external software on your device or printing physical copies.

Steps to obtain and authorize your Notarized Certification Of No Changes In The Previous Documents

- Explore our archive by category or use the search bar to find the document you require.

- View the document preview by clicking on Learn more to verify it’s the correct one.

- Press Get form to begin editing right away.

- Fill out your document and include any essential information using the toolbar.

- Once completed, click the Sign feature to authorize your Notarized Certification Of No Changes In The Previous Documents.

- Choose the signature method that suits you best: Draw, Create initials, or upload a picture of your handwritten signature.

- Click Done to conclude editing and move on to document-sharing options if necessary.

With airSlate SignNow, you possess everything required to manage your documents effectively. You can search for, complete, edit, and even send your Notarized Certification Of No Changes In The Previous Documents in one tab with no complications. Enhance your workflows by utilizing a singular, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How can I prepare my English for a banking exam?

9Good Question>>>This question is good bcz there is a lot of peoples who have suffer from this problem. In bank exams the cut off of English is quite low, yet almost 60% people failed here in English section only, why?, this is a big problem but luckily I have a solution for this problem which break hurdles of your path easily with minimal efforts. So, first take a look of the whole syllabus of English which is asked in banks exams>>>RC, Spot the Error, Fillers, Cloze test, Sentence Arrangement.This is short look of the pattern of asking questions in Bank’s papers. I wood tell you here what should you do to get through this. Here are some important things which you should do for boosting your numbers in English section especially.Problems :1.Grammar : You read this or not, it doesn’t matter in bank exams. Anyone who has a little bit of understanding of english only as a language, can do its questions when it comes in D-day, but the only point is he/she had a general Idea about solving question which varied from person to person. If you’re the aspirant of SSC then you have to know about grammar little bit more but if you’re a aspirant of banking exams then it doesn’t matter more. Anyway, if someone amongst you want to read Grammar then don’t use too many books for Grammar, if you want you can use this book SHINE BOOK but even if you not take this then also its not harm you bcz this book contained some rarest SSC level grammar rules which can also helpful for you in your understanding of the subject a bit more.2. Word Power : It is the key for your success, How?, I would tell you here. Fillers, Cloze test will create almost 99% questions based on word power bcz if you know the importance of any word as well as their meanings then you can use to it in fillers and Cloze test. Honestly 100% questions you can do it only through this even if 40 % question RC will be based on word power. How you built it, I would tell you later.3. 60% RC : It will covered from your understanding. Suppose anyone who had a sufficient knowledge of English can read a passage and knew easily about central Idea which is only 10% of RC but what about the other 50%. Therefore you have to understand this from your own. So, How would you acheive it, I would tell you later.4. ABCDE : You’ve a question in front of you which carry 5 Questions and the funny part is if you solved it only once then you can score 5 marks easily may be in 2 minutes but there are two main problems which hardly thinks by anyone, which is Understanding and Reading speed. If you reading with speed, you hardly understand the topic and vice versa.Solution :Read a English newspaper daily. This is the panacea for you, How?, I would tell you here and all we talked about the role of Newspaper in many areas in English sections.If you read a newspaper your reading speed will grow. After reading it regularly your understanding power will grow. If you found some words new for you and if you google it then your word power also grow. In a nutshell, your overall knowledge will grow. Now the question is how someone read a newspaper who has never read it before for a competitive purpose, Don’t worry I would tell also this to you here.Whenever you reading a newspaper, first read the content of any article and then translare it in your own language as it is. For Example : If you belong to Orissa then first read it in English and then translate it in Odia, similarly, hindi, urdu or any other language you prefer. don’t think about the time, select only one article and finish it patiently by taking time. Read only one paragraph in a day but finsh it like that if someone ask anything about you from that article may be in moulded form, you can answered about it effectively, bcz if you read like that you can solve Rc, Cloze test, Filler & sentence arrangement in 100% while in the case of spot error only 60% in which you can understand the error through your understanding part.Smart study : The articles or pages you choose from a newspaper choose it by filtering other news other than Financial awareness or business part because the article or topic you are reading may be comes in your mains.If you do this whatever I would tell you here then you can first got improvement in yourself about reading things as well as word power. By this you can start to linking words in sentences which will help you in spot errors and filler sections and after linking sentences you can actually improve your sentence arrangement areas. If you can understand it whatever I say here and you used to it the I bet you, your english will be improved after giving some if your time.Tips 1. Don’t afraid of English, treat it just like anyother language.Tips 2. Attempt all questions of English in prelims as well as mains bcz here you easily score more with a good knowledge of wordpower.If you still wants to clear some queries then ask it on my fb or insta profile. I’ll promise you to answered your querry within first 24 hours, I have already solved 100+ people queries related to various competitive exams like UPSC/SSC & of courses of Bank exams as well through fb & instagram, whenever they ask.Best of luck…!!!

-

What is the most bizarre thing a coworker has done to get fired?

We had a guy show up drunk to work and run a tractor up and kind of over a prune tree.That in it of itself would probably have been enough to get him fired, but it would also have been excused. Prunes aren’t worth a damn thing anymore, the tractor was fine (so far), everything could have been forgiven unless my boss realized he was drunk if he would have just walked away. Hell, even if my boss had realized he was drunk he probably would have forgiven it.He’s fired two people in his 25 years of being boss man, one of whom got in the face of his dad who had just had a stroke and the other one managed to spend 8 hours not mowing a yard, then call us up and say he needed some OT to finish. (I’m the boss’ personal go-getter, aka the company bitch).But no, this piece of intellectual brilliance decides that he was going to pull the tractor back down with his Tacoma. Why he didn’t just reverse the tractor off of the tree will forever confuse me, but I digress.He gets his baby Yota over to the tractor, takes a tow rope and hooks up to the front (the end that’s in the air) of the tractor, and left the tractor in gear. Anyone who’s ever tried to do anything knows exactly what’s happening next, which turned into a Tow Mater and sons experiment. He drops his truck into four wheel, hits the gas, andPuts the tractor on its ass. My boss and I come rolling around the corner as he was running from his truck back to his tractor. But even then, my boss didn’t fire him — the guy just quit from shame/embarrassment. The cocaine story has this one beat, but I can’t miss an opportunity to show some tractor tipping.EDIT: Since I’ve got a couple requests: during prune harvesting season we bring in a lot of outside labor contractors. As is common with most job sites, there’s no drinking or consumption of drugs or alcohol allowed during company time on company property. One of the guys, we’ll call him B, every day showed up to work like he’d just ate a bag of freakin’ coffee beans. He mellowed out all morning long, but he was weird, because after lunch he would be really low, but then he’d slam his ass in gear and be rolling along pretty well all afternoon.One day my boss and I decided I was going to learn the ropes from B (he was the best equipment operator we had) so I followed him everywhere. His morning pick-me-ups? Line of cocaine. He mellowed out throughout the day because he would hollow out and put joints inside of his apples that he would “eat” while in the machine, (the machine guys can’t see each other, so we had no idea he was lighting up). He told me the secret to this was putting them inside of a little ziploc baggie to keep them dry. For lunch, he would do another line of coke, then drink a frosty forty, pour another frosty forty in his water jug (we always assumed he brought the extra one from home and left it by his car full of ice so he could drink cold water in the afternoons without having to move). He’d discovered from years of practice I guess that the line of coke and frosty forty counter-act each other well enough that you don’t seem obviously drunk, but you don’t seem too enthused to be doing your job either.Needless to say, the boss man and I were pretty shocked. Nobody said anything because we needed to finish out the harvest, and as I said previously, this guy was a fantastic machine op, but we kept the harvest in house the following year.

-

How does one change a LLC legal name in Washington state?

According to the Washington Secretary of State's website, you change the legal name of an Washington LLC by filing a Certificate of Amendment, a one-page, four-line form with a $30 filing fee. See Washington Limited Liability Companies (LLC).If you are unclear on how to fill out this form, if this is in fact the correct form for the purpose you have in mind, or what other forms you have to file, and with whom, once you've successfully changed the name of the LLC, you should consult with a business law attorney in the state of Washington. It's a virtual certainty that you'll have to report the change of name to, at a minimum, the IRS and your state tax authority, as well as to any agency which has issued your LLC any form of business license.

-

I am a layman. What is Form 16, Income Tax return and the fuss about it?

The filing of Income Tax returns is a mandatory duty along with the payment of Income Tax to the Government of India . As the season closes by (last date of filing return - 5th August for 2014), many new tax-payers are in qualms as to how to go with the procedure as well as do away with the seemingly complicated mechanism behind it .Following are some of the pointers , which I acquired through self-learning (all are written considering the tax procedures for an Individual, and not Companies or other organizations). Here goes :1) Firstly , it is important to understand that Income Tax return is a document which is filed by you stating your Total Income in a Financial Year through various sources of income i.e Salary , business, house property, etc . (Financial Year is the year of your income , and Assessment Year is the year next to it in which the tax is due . Eg - Financial Year 2013-14, Assessment Year 2014-15)It also states the Taxable income on that salary and the Total tax payable with surcharges and Education Cess . The Taxable income has an exemption of upto 2 lakh rupees(For an individual, and not a senior citizen) for this assessment year , and 2.5 lakhs for the next (As per the new budget) . You also get tax exemptions on various other investments/allowances such as HRA , Fixed Deposits , Insurance Policies , Provident Funds , Children's Education , etc under various clauses of Section 80.People should know that return is filed to intimate the Government of your tax statements and it should not be confused with the Tax-refund one gets if there is a surplus tax paid by you to the Government . Return is not Refund .2) Government of India collects Income Tax through three modes :a) TDS - Tax Deduction at Source . TDS is the system in which any corporation/business as an Employer is supposed to deduct the Income tax of an Employee from his/her salary at source and submit it to the GOI before the end of Financial Year . The tax is deducted regularly from the employee's salary in certain percentage so as to overcome the liability of Total Tax to be paid by the employer for the Financial Year.The Employer issues a TDS Certificate in the form of Form 16 or Form 16A to the Employee which would be used to claim the TDS by the employee while filing his/her return . Form 16 is the certificate issued for the tax deducted under the head Salaries . Form 16A is issued for tax deducted for income through other sources such as interests on securities,dividends,winnings,etc.If the employee has some extra income through other sources , he/she should intimate the Employer about it before so as to include it for TDS . The total tax paid by you through TDS is also available online on the TRACES portal which is linked to your Bank Account and PAN No. for your convenience . You can also generate and validate your Form 16 / 16A from the website to file your return online .b) Advance Tax and Self Assessment Tax .Advance Tax may also be called 'Pay as you earn' Tax . In India one has to estimate his income during the financial year.If your projected tax liability of the current Financial year is more than Rs 10000, you are supposed to pay Advance tax !This has to be paid in three instalments. 30 % by 15th Sept,60% minus first instalment by 15th Dec and 100% minus 2nd instalment by 15th March.For individuals who are earning only through salaries , the Advance Tax is taken care of through TDS by the employers and there is hardly any Advance Tax to be paid . But for individuals who have other sources of income , they have to pay Advance Tax .If one forgets to pay he is liable to pay interest @ 1% p.m.Self-Assessment Tax - While filing your Return of Income, one does a computation of income and taxes to be filled in the Return. On computation, sometimes it is noted that the Taxes paid either as Advance Tax or by way of TDS fall short of the Actual Tax Payable . The shortfall so determined is called the Self Assessment Tax which is payable before filing the Return of Income. c) TCS - Tax Collection at Source .Tax Collected at Source (TCS) is income tax collected by a Seller from a Payer on sale of certain items. The seller has to collect tax at specified rates from the payer who has purchased these items : Alcoholic liquor for human consumption Tendu leaves Timber obtained under a forest lease Timber obtained by any mode other than under a forest lease Any other forest produce not being timber or tendu leaves Scrap Minerals being coal or lignite or iron ore Scrap BatteriesSalaried Individuals are not concerned with TCS .3) Online Procedure for Filing your Return , Payment of Tax , and viewing/generating your TDS certificate . a) Filing Income Tax Return :The procedure is as simple as it gets . You have to go to the E-filing homepage of the GOI , i.e https://incometaxindiaefiling.go... and login to your account . If you don't have an account yet , you can create it through the 'Register Yourself' link above it . All you need is a PAN No. (obviously) . After logging in , you have to go to the E-file tab and select the 'Prepare and Submit online ITR' option . Alternatively , you can select the 'Upload Return' option to upload your return through an XML file downloaded from the 'Downloads' tab and filled offline by you .You have to enter your PAN No, select ITR Form name 'ITR1' (Form ITR1 is for salaried individuals, income from house property and other income) , select Assessment year and submit .Now all you have to do is fill the form with the tabs Personal Information , Income Details , Tax Details , Tax Paid and Verification and 80G to complete your Return and submit it to the Income Tax Department .The 'Income Details' tab asks for your Total Income through various sources , and Tax exemptions claimed by you under various clauses of Section 80 . It also computes the Income tax liability of yours for that Financial Year . The 'Tax details' tab asks for the TAN (Tax Deduction Account Number) and Details of Form 16/16A issued by the employer/generated by you for TDS . It also asks for Advance Tax / Self Assessment Tax, if paid and the Challan no. of the payment receipt .The 'Tax Paid and Verification' Tab asks for your Bank Account Number and IFSC code . If there is a surplus tax paid by you in the form of TDS/Advance Tax , you will get its refund with interest in a 4 months period by the Income Tax Department . After submitting the Return , you get a link on your registered E-mail id . This link provides you the ITR-V document (an acknowledgement slip) which you have to download , print , put your signature , and send it to the Bangalore division of the Income Tax Department for completion of your Return Filing . The address is mentioned in the document . Alternatively , you can evade the ITR-V process and opt to digitally sign in the beginning of E-filing , but the process requires you to spend money and is to be renewed every year .b) Payment of Tax - You can pay the TDS (Not required for an individual, it is to be paid by the employer) , Advance Tax or Self Assessment Tax through the portal of Tax Information Network , i.e e-TAX Payment System After filling the required form (ITNS 280 for Income Tax) , you pay the tax through your Bank Account , and get a Challan receipt which will be used during filing your return .c) View/ Generate TDS Certificate online .You can do it by logging on to the TRACES portal of the Tax Deduction System , i.e , Page on tdscpc.gov.in You will have to register yourself before logging in through your PAN no.You can view the details of your TDS deducted by the Employer via From 26AS on the portal .Also , you can generate your TDS Certificate in the form of Form 16/16A by entering the TAN No. of your Employer .

-

Can we convert an H4 visa to an F1 visa?

In general, it is possible to change status from H-4 to F-1 provided that you have the appropriate (I-20) documentation from the school you intend to attend.Note that H-4 is a dual intent visa, but F-1 is not; as a result, you may be denied the change of status if USCIS concludes that you have immigrant intent.Note also that change of status only applies while you are in the United States. If you are not in the United States and have a currently valid H-4 visa, but wish to obtain an F-1 visa, you must simply apply for an (entirely new) F-1 visa. While you can reuse some of the documentary evidence you collected for the H-4 visa for the F-1 application, it will be a new application.

-

Do you have to change your name on your driver's license, SS card, and passport right away after you get married (assuming that you changed your name on your marriage license)?

You don’t HAVE to change your name on any of these items AT ALL if you get married. You can CHOOSE to do so if you want to. Some women CHOOSE to keep their maiden name when they get married and there is no reason why they shouldn’t do so.Men don’t change their names to take their wife’s surname and there is no reason why a wife SHOULD take her husband’s surname.My first wife change her surname to mine after we got married.My second wife changed her surname to be the same as mine BEFORE we got married because she thought that it would just make things easier for her if she had the same surname as me even though wed weren’t married. Then, when we got married, the marriage celebrant thought it amazing that we both happened to have the same surname - what a coincidence - until we explained why and how.My third wife kept her OWN surname when we got married as that was her identity and she saw no reason to change it.

Create this form in 5 minutes!

How to create an eSignature for the certificate of no change form

How to make an electronic signature for your Certificate Of No Change Form online

How to create an eSignature for the Certificate Of No Change Form in Google Chrome

How to create an eSignature for putting it on the Certificate Of No Change Form in Gmail

How to make an eSignature for the Certificate Of No Change Form from your smart phone

How to create an eSignature for the Certificate Of No Change Form on iOS devices

How to create an electronic signature for the Certificate Of No Change Form on Android OS

People also ask

-

What is a signNowd Certification Of No Changes In The Previous Documents?

A signNowd Certification Of No Changes In The Previous Documents is a formal declaration by a notary public confirming that no alterations have been made to previously executed documents. This certification is essential for legal processes, ensuring the integrity of the original documents remains intact.

-

How can airSlate SignNow assist with obtaining a signNowd Certification Of No Changes In The Previous Documents?

airSlate SignNow streamlines the process of obtaining a signNowd Certification Of No Changes In The Previous Documents by allowing users to electronically sign and securely send their documents. Our platform integrates with notary services, making it easy to get the necessary certification without unnecessary hassle.

-

What are the costs associated with obtaining a signNowd Certification Of No Changes In The Previous Documents via airSlate SignNow?

The costs for obtaining a signNowd Certification Of No Changes In The Previous Documents through airSlate SignNow depend on the specific notary service you choose to integrate with. However, our platform offers cost-effective solutions that simplify the eSigning process, making it budget-friendly for businesses.

-

What features does airSlate SignNow offer for managing documents requiring signNowd Certification Of No Changes In The Previous Documents?

airSlate SignNow offers a comprehensive suite of features, including customizable templates, secure storage, and tracking capabilities. These features help users manage documents that require signNowd Certification Of No Changes In The Previous Documents efficiently and effectively.

-

Can I integrate airSlate SignNow with my existing workflow for signNowd documents?

Yes, airSlate SignNow is designed to integrate seamlessly with your existing workflow. Whether you use CRM systems, cloud storage, or other document management tools, our platform supports integrations that enhance the process of obtaining a signNowd Certification Of No Changes In The Previous Documents.

-

What benefits does airSlate SignNow provide for businesses needing signNowd documents?

With airSlate SignNow, businesses can signNowly reduce the time and complexity involved in obtaining signNowd documents. The ability to receive a signNowd Certification Of No Changes In The Previous Documents electronically not only speeds up the process but also enhances compliance and security for your sensitive documents.

-

Is airSlate SignNow secure for handling signNowd documents?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure access controls, to ensure that all documents, including those requiring a signNowd Certification Of No Changes In The Previous Documents, are protected from unauthorized access.

Get more for Notarized Certification Of No Changes In The Previous Documents

- Banakhat karar in gujarati pdf download form

- Self certification form wales

- Hackers bible form

- Taco bell w2 former employee

- Client registration form sunbed glowauckley co uk

- Louisiana manufactured housing commission form

- Certificate of insurance insured name address city state zip this certificate is issued as a matter of information only and

- Beauty pageant forms

Find out other Notarized Certification Of No Changes In The Previous Documents

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now