Application Standby Letter Credit 2008-2026

What is the Application Standby Letter Credit

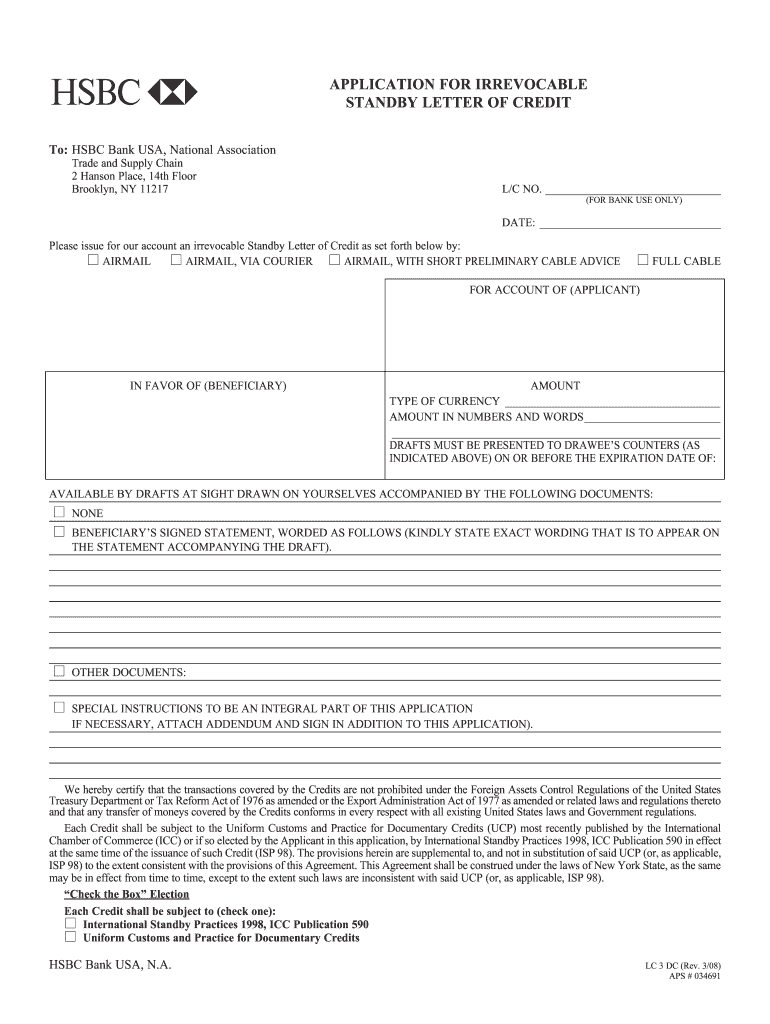

The application standby letter of credit is a financial document used primarily in business transactions to provide a guarantee of payment. It serves as a safety net for a beneficiary, ensuring they receive compensation in case the applicant fails to meet their contractual obligations. This type of letter is commonly utilized in real estate, construction, and international trade, where the risk of non-performance is significant. The standby letter of credit is not intended for immediate payment but rather as a backup assurance that can be drawn upon if necessary.

How to Use the Application Standby Letter Credit

Using an application standby letter of credit involves several key steps. First, the applicant must apply for the letter through a financial institution, providing necessary documentation and details about the transaction. Once issued, the letter can be presented to the beneficiary, who can draw upon it if the applicant defaults. It is essential to ensure that the terms and conditions outlined in the letter are clear and agreed upon by all parties involved. This clarity helps prevent disputes and ensures that the letter serves its intended purpose effectively.

Key Elements of the Application Standby Letter Credit

Several critical elements define the application standby letter of credit. These include:

- Beneficiary: The party entitled to receive payment if the applicant defaults.

- Applicant: The party applying for the letter, typically the one seeking to assure payment.

- Issuing Bank: The financial institution that issues the letter of credit and guarantees payment.

- Terms and Conditions: Specific requirements that must be met for the beneficiary to draw on the letter.

- Expiration Date: The date until which the letter remains valid.

Steps to Complete the Application Standby Letter Credit

Completing the application standby letter of credit involves a systematic approach:

- Gather necessary documentation, including identification and transaction details.

- Complete the application form, ensuring all information is accurate and complete.

- Submit the application to the issuing bank, along with any required fees.

- Review the terms and conditions provided by the bank.

- Receive the issued letter and verify that all details are correct.

Legal Use of the Application Standby Letter Credit

The legal use of the application standby letter of credit is governed by various regulations and laws. In the United States, it must comply with the Uniform Commercial Code (UCC) and any specific state regulations that may apply. Understanding these legal frameworks is essential to ensure the letter is enforceable and that all parties are protected. It is advisable to consult with a legal professional when drafting or executing a standby letter of credit to ensure compliance with all applicable laws.

Eligibility Criteria

Eligibility for obtaining an application standby letter of credit typically depends on several factors, including:

- The financial standing of the applicant, which may involve credit checks and financial statements.

- The nature of the transaction and the associated risks.

- Established relationships with the issuing bank, as prior banking history can influence approval.

- Compliance with any specific requirements set forth by the issuing bank.

Quick guide on how to complete blank letter of credit form

The optimal method to locate and endorse Application Standby Letter Credit

Across the entirety of your organization, ineffective workflows related to document approval can take up a considerable amount of labor hours. Executing documentation like Application Standby Letter Credit is a fundamental aspect of operations in any enterprise, which is why the effectiveness of each contract’s progression signNowly impacts the organization’s overall productivity. With airSlate SignNow, endorsing your Application Standby Letter Credit is as straightforward and swift as possible. This platform provides you with the latest version of virtually any document. Even better, you can authenticate it instantly without needing to install any external software on your computer or printing out physical copies.

Steps to obtain and sign your Application Standby Letter Credit

- Explore our collection by category or utilize the search functionality to locate the document you require.

- Examine the document preview by clicking Learn more to confirm it is the correct one.

- Press Get form to start editing immediately.

- Fill out your document and incorporate any necessary information using the toolbar.

- When finished, click the Sign tool to validate your Application Standby Letter Credit.

- Choose the signature method that suits you best: Draw, Generate initials, or upload a picture of your handwritten signature.

- Click Done to complete editing and move on to document-sharing options as required.

With airSlate SignNow, you have everything necessary to handle your documents efficiently. You can locate, fill out, modify, and even dispatch your Application Standby Letter Credit in a single tab without any difficulty. Enhance your workflows by employing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

What is the naughtiest thing you did in school?

I was part of a love triangle in high school, with two girls who were nearly as horny as I was. I eventually chose Makyla over the other girl, Cresslyn. I was shallow then, and chose Makyla, mostly on the basis of her slightly better looks and killer body. And she was a freak. Whereas Cresslyn was horny at certain times, Makyla wanted it all the time. I am surprised we didn’t get pregnant. But the funny thing is that, throughout most of high school, I couldn’t get enough of them and they couldn’t get enough of me. Makyla and Cresslyn really didn’t like each other, but they agreed to share me for the time being. I still considered myself with Makyla, though.The most daring thing I did was take Makyla out of convocation into a nearby hall for a blowjob, that led to other naughtier things with Cresslyn. This was pretty crazy because there were school officials all around and at least two student monitors. Cresslyn was one of them. They helped keep a watch on the rest of the school when everyone was in the gym or auditorium. The hall led to an obscure stairwell hardly anyone ever used anymore, so as soon as we got more than halfway up the stairs, Makyla dropped to her knees and unzipped me. I was in her mouth and already hard as a stone.I laid down on the stairs, legs straddled, pants and underwear down around my ankles. She was lying between my legs, head bobbing slowly up and down on my raging tool, watching me with those sexy brown eyes. I don’t know why she didn’t see Cresslyn coming down the stairs. OR maybe she did and was just rubbing it in her face.Anyhow, Cresslyn made a big show of catching us red-handed. She threatened to tell as I hurriedly stuck my member back in my pants and she pushed past us on the stairs. I grabbed her by the hand, pleading with her. She said this served me right for how I and Makyla had treated her.I asked her if we could work something out. She asked what I could possibly give her. I said that she could share me with Makyla right now and no one would suspect her since she was a monitor, if we went all the way upstairs and were quiet. Makyla started to object, but I silenced her with a look. She should have been a better lookout.Cresslyn said that there was one room that was open because the janitor had forgotten to lock it when she cleaned up the night before. We all scooted up the stairs, and when Cresslyn gave a thumbs up to the other student monitor, who asked if everything was clear, she came in the room and we got down to business.I made them both kneel and give me oral. They took turns. Then I took Cresslyn’s clothes off and ate her out. She had big breasts and a nice curvy figure. Makyla made sighs and rolled her eyes, but I distracted her by stopping to kiss her deeply, when I removed her top, and by kneading her ample orbs while resuming my assault on Cresslyn’s netherparts. Cresslyn groaned.I took turns pleasuring them both. I let Makyla sit on my manhood while Cresslyn sat on my mouth, facing each other. I noticed them both awkwardly avoiding eye contact, so, I let them switch. Cresslyn, who must have been sex-starved, began to give signs that she couldn’t take it anymore and quickly came all over me with a loud moan. Makyla, who was now sitting on my face, had to signNow back and cover her mouth to keep us from getting in trouble.Then, I fingered Makyla while I was eating her, long legs splayed, sitting on my mouth. Cresslyn had begun sucking me. I made Makyla come and it was my turn to cover her mouth. Her female parts produced copious amounts of thick liquid, which I swallowed.Makyla and Cresslyn both gave me attention next. Makyla licked all over my sack, which was saturated with saliva and Cresslyn’s nectar, while Cresslyn went up and down on me faster and faster. I wondered what Makyla felt about having to taste Cresslyn’s love juices. That thought triggered something in my loins and I could hold back no longer. I exploded in Cresslyn’s mouth. A little spilled on my nuts. Cresslyn said to make sure we didn’t leave any mess. She didn’t want to get in any trouble. Makyla obliged by licking up any remaining nut juice. We covered our “tracks”, got dressed, and slipped back in the convocation. A teacher asked where we were. Cresslyn said that she had been given permission to escort us to the restroom. Miraculously, the teacher bought it, probably because Cresslyn was the monitor and generally a goody-two shoes.Our triangle continued on though high school and our first year of college. By that time, we had all grown tired of each other.But I can’t believe, to this day, that we didn’t get in any trouble that day of the convocation.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

Do I have to fill out a form to receive a call letter for the NDA SSB?

No form has to be filled for u to get your call-up letter.If you have cleared the written exam and your roll no. Is in the list, then sooner or later you will get your call-up letter.I would suggest you to keep looking for your SSB dates. Online on sites like Join Indian Army. Because the hard copy may be delayed due to postal errors or faults.Just to reassure you, NO FORM HAS TO BE FILLED TO GET YOUR SSB CALLUP LETTER.Cheers and All the Best

Create this form in 5 minutes!

How to create an eSignature for the blank letter of credit form

How to make an electronic signature for your Blank Letter Of Credit Form online

How to make an electronic signature for the Blank Letter Of Credit Form in Chrome

How to generate an electronic signature for signing the Blank Letter Of Credit Form in Gmail

How to create an eSignature for the Blank Letter Of Credit Form right from your mobile device

How to create an eSignature for the Blank Letter Of Credit Form on iOS

How to make an electronic signature for the Blank Letter Of Credit Form on Android

People also ask

-

What is an Application Standby Letter Credit?

An Application Standby Letter Credit is a financial tool used to provide assurance to a party that payment will be made, typically in international trade. This type of credit acts as a backup payment mechanism, ensuring that funds are available if the primary payer defaults. With airSlate SignNow, you can easily manage and sign documents related to your Application Standby Letter Credit, streamlining your financial transactions.

-

How can airSlate SignNow help with Application Standby Letter Credit documentation?

airSlate SignNow simplifies the process of creating and managing documents for your Application Standby Letter Credit. Our platform allows you to easily eSign and send necessary agreements, ensuring that all parties can quickly access and approve documents. This not only speeds up the transaction process but also reduces paperwork and enhances security.

-

What are the pricing options for airSlate SignNow related to Application Standby Letter Credit?

airSlate SignNow offers various pricing plans to accommodate businesses of all sizes, ensuring a cost-effective solution for managing your Application Standby Letter Credit documentation. Our plans include features tailored for high-volume usage, allowing you to choose the most suitable option for your needs. Visit our pricing page for detailed information on each plan.

-

What features does airSlate SignNow offer for Application Standby Letter Credit?

When using airSlate SignNow for your Application Standby Letter Credit, you'll benefit from features such as customizable templates, secure eSigning, and real-time tracking. These features ensure that your documents are completed efficiently and securely, while also providing an easy way to manage multiple agreements simultaneously.

-

Is airSlate SignNow secure for handling Application Standby Letter Credit documents?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling your Application Standby Letter Credit documents. Our platform employs advanced encryption and authentication protocols to protect sensitive information, ensuring that your financial documents remain confidential and secure.

-

Can I integrate airSlate SignNow with other tools for Application Standby Letter Credit management?

Absolutely! airSlate SignNow offers seamless integrations with popular business tools, enhancing your workflow for managing Application Standby Letter Credit. Whether you use CRM systems, cloud storage solutions, or other software, our integrations allow you to streamline your processes and improve efficiency.

-

What are the benefits of using airSlate SignNow for Application Standby Letter Credit?

Using airSlate SignNow for your Application Standby Letter Credit provides numerous benefits, including enhanced efficiency, reduced paperwork, and improved collaboration. With our easy-to-use platform, you can streamline the signing process, minimize delays, and ensure that all parties are aligned, ultimately leading to faster transaction completions.

Get more for Application Standby Letter Credit

- Christmas assistance application form

- Jv 195 form

- Vaf1g form

- Utah tc 559 ext form

- Sending a payment abroad for bank use only input by verified by signal number if used signal number checked 2nd verification by form

- Broker associate application form

- How to file a sapcr in texas form

- 2010 credit app jampl building materials form

Find out other Application Standby Letter Credit

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now