Installment Agreement ConservationTools Form

What is the Installment Agreement ConservationTools

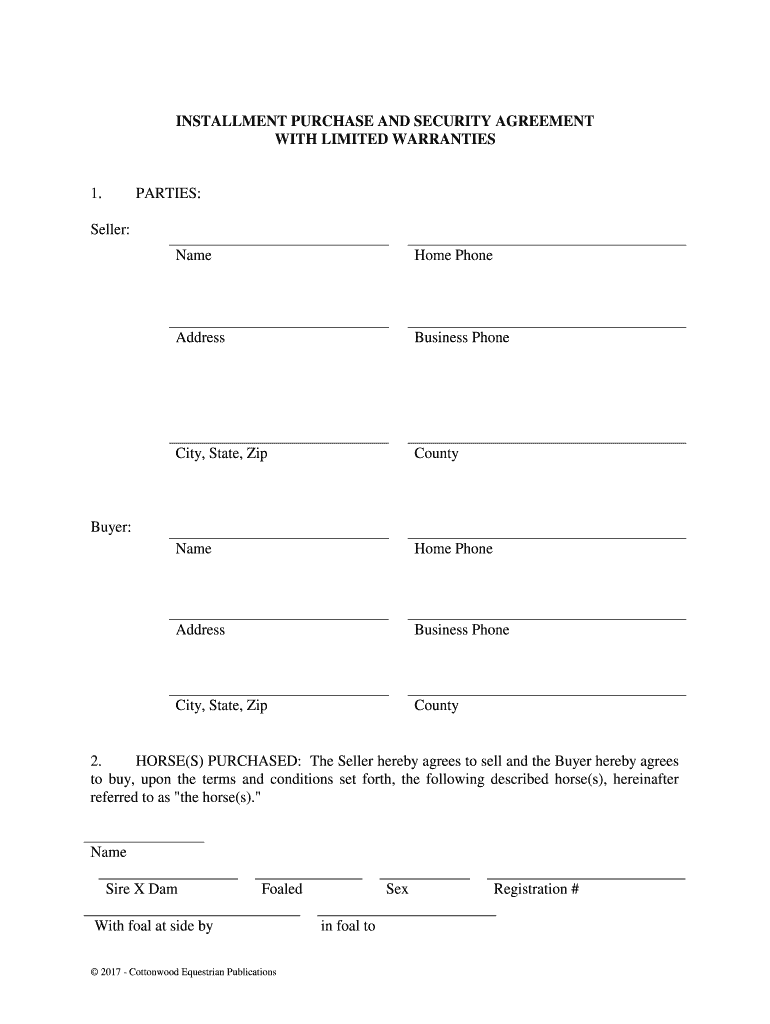

The Installment Agreement ConservationTools is a structured form designed to facilitate the arrangement of payment plans between parties, particularly in financial or legal contexts. This form allows individuals or businesses to outline the terms under which payments will be made over time, ensuring clarity and mutual understanding. It serves as a formal agreement that can be enforced in a court of law, provided it meets the necessary legal requirements.

How to use the Installment Agreement ConservationTools

Using the Installment Agreement ConservationTools involves several straightforward steps. First, gather all relevant information, including the names and contact details of all parties involved, the total amount owed, and the proposed payment schedule. Next, fill out the form accurately, ensuring all sections are completed. Once the form is filled, it should be reviewed by all parties to confirm agreement on the terms. Finally, each party should sign the document electronically or physically, depending on their preference, to make it legally binding.

Steps to complete the Installment Agreement ConservationTools

Completing the Installment Agreement ConservationTools requires careful attention to detail. Follow these steps:

- Gather necessary information such as personal details and financial data.

- Clearly outline the payment terms, including the total amount, payment frequency, and due dates.

- Include any relevant conditions or stipulations that may affect the agreement.

- Review the completed form for accuracy and completeness.

- Obtain signatures from all parties involved to finalize the agreement.

Legal use of the Installment Agreement ConservationTools

The legal use of the Installment Agreement ConservationTools is crucial for ensuring that the agreement is enforceable. To be legally binding, the form must include essential elements such as the names of the parties, the total amount owed, and a clear payment schedule. Additionally, compliance with relevant laws, such as the Electronic Signatures in Global and National Commerce (ESIGN) Act, is necessary when signing electronically. This ensures that the agreement holds up in a court of law if disputes arise.

Key elements of the Installment Agreement ConservationTools

The key elements of the Installment Agreement ConservationTools include:

- Parties Involved: Names and contact information of all signatories.

- Payment Amount: Total sum owed and individual payment amounts.

- Payment Schedule: Frequency of payments and due dates.

- Terms and Conditions: Any stipulations that govern the agreement.

- Signatures: Required signatures to validate the agreement.

Examples of using the Installment Agreement ConservationTools

Examples of using the Installment Agreement ConservationTools can be found in various scenarios. For instance, a small business may use this form to negotiate a payment plan with a supplier for outstanding invoices. Another example is an individual setting up a payment arrangement with a creditor to settle a debt over time. These instances demonstrate the form's versatility in both personal and professional contexts.

Quick guide on how to complete installment agreement conservationtools

Effortlessly prepare Installment Agreement ConservationTools on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly and without delays. Handle Installment Agreement ConservationTools on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign Installment Agreement ConservationTools with ease

- Obtain Installment Agreement ConservationTools and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal authority as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you would prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from any device you choose. Edit and eSign Installment Agreement ConservationTools to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Installment Agreement ConservationTool?

An Installment Agreement ConservationTool is a specialized feature within airSlate SignNow that allows businesses to manage their installment agreements efficiently. By using this tool, organizations can streamline the documentation process, ensuring accuracy and compliance while saving time.

-

How much does the Installment Agreement ConservationTool cost?

The pricing for the Installment Agreement ConservationTool varies based on your subscription plan with airSlate SignNow. It’s designed to be cost-effective, allowing businesses to choose a plan that suits their needs while taking advantage of the advanced features offered.

-

What features are included in the Installment Agreement ConservationTools?

The Installment Agreement ConservationTools come with a range of features, including customizable templates, automated reminders, and secure e-signing capabilities. These features are designed to enhance the efficiency of handling installment agreements within your organization.

-

What are the benefits of using Installment Agreement ConservationTools?

Using the Installment Agreement ConservationTools can signNowly reduce the time spent on managing documents. Benefits include increased accuracy in agreement tracking, enhanced compliance, and improved collaboration among team members, all while providing a user-friendly experience.

-

Can I integrate Installment Agreement ConservationTools with other software?

Yes, airSlate SignNow's Installment Agreement ConservationTools can be seamlessly integrated with various platforms and CRM systems. This allows you to connect your existing tools and streamline your workflow, enhancing your overall productivity.

-

Is the Installment Agreement ConservationTool secure for sensitive documents?

Absolutely! The Installment Agreement ConservationTools utilize industry-leading security measures to ensure your sensitive documents are protected. With end-to-end encryption and compliance with data protection regulations, you can trust airSlate SignNow to keep your information safe.

-

How do I get started with Installment Agreement ConservationTools?

Getting started with the Installment Agreement ConservationTools is easy. Simply sign up for an airSlate SignNow plan that includes this feature, and access the tools through your dashboard. Comprehensive tutorials and customer support are available to guide you through the process.

Get more for Installment Agreement ConservationTools

- Bdvr 108 form

- Form i 9 employment eligibility verification barry university barry

- Affidavit verifying status columbus georgia columbusga form

- 2000421 fll trophy small form

- Aosup2 form

- Electronic clearing service credit clearing real time gross settlementrtgs msmedibangalore gov form

- Legal payment contract template form

- Legal separation contract template form

Find out other Installment Agreement ConservationTools

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast