Sportsmans Warehouse Credit Card Application Online Form

What is the Sportsman's Warehouse Credit Card Application Online

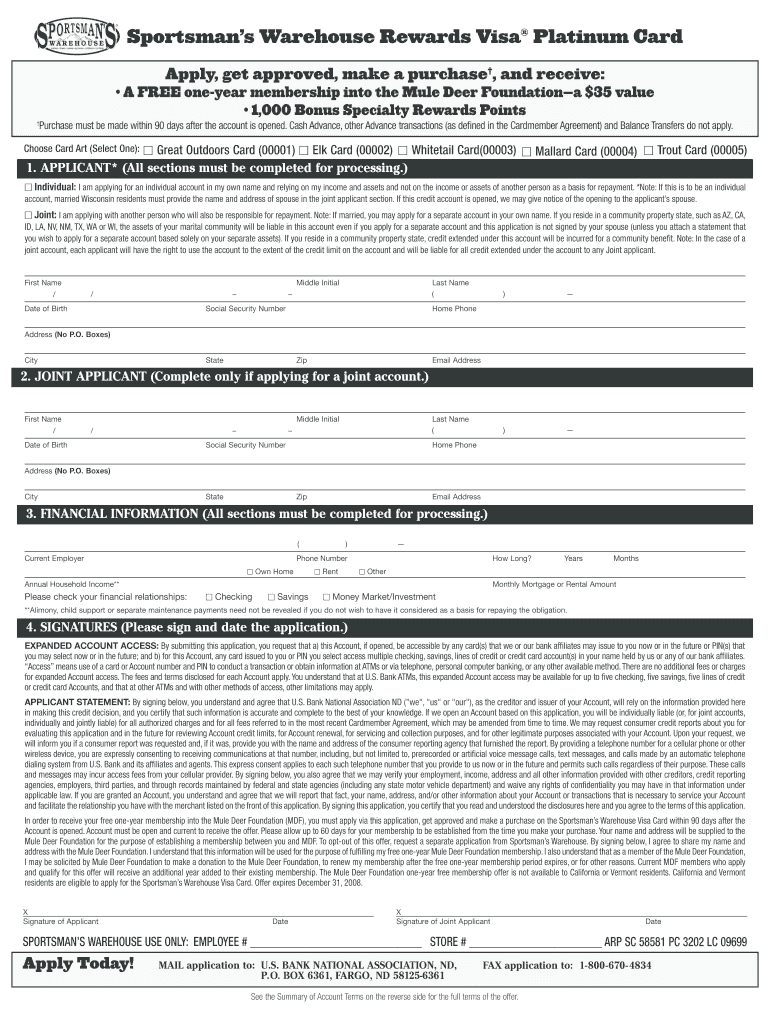

The Sportsman's Warehouse credit card application online is a digital form that allows customers to apply for a credit card specifically designed for use at Sportsman's Warehouse. This application provides an easy and convenient way for customers to gain access to special financing options, rewards, and exclusive offers. By completing the application online, users can avoid the need for paper forms and streamline the process of obtaining a credit card tailored to their outdoor and sporting needs.

Steps to Complete the Sportsman's Warehouse Credit Card Application Online

Completing the Sportsman's Warehouse credit card application online involves several straightforward steps. First, users need to visit the official Sportsman's Warehouse website and navigate to the credit card application section. Once there, they will be prompted to enter personal information, including their name, address, and Social Security number. Next, applicants should provide financial details such as income and employment status. After filling out the necessary fields, users can review their information for accuracy before submitting the application. Finally, applicants will receive a confirmation of their submission and, in many cases, an immediate decision regarding their credit application.

Key Elements of the Sportsman's Warehouse Credit Card Application Online

The key elements of the Sportsman's Warehouse credit card application online include personal identification information, financial details, and consent to credit checks. Applicants must provide their full name, address, date of birth, and Social Security number to verify their identity. Financial information typically includes annual income and employment details, which help determine creditworthiness. Additionally, applicants must agree to the terms and conditions associated with the credit card, including any fees, interest rates, and promotional offers.

Legal Use of the Sportsman's Warehouse Credit Card Application Online

When utilizing the Sportsman's Warehouse credit card application online, it is essential to comply with legal requirements governing electronic signatures and consumer credit applications. The application must adhere to regulations such as the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These laws ensure that electronic submissions are legally binding and protect consumers' rights. By using a secure platform like airSlate SignNow, applicants can ensure that their submissions meet legal standards and maintain the integrity of their personal information.

Eligibility Criteria for the Sportsman's Warehouse Credit Card

Eligibility for the Sportsman's Warehouse credit card typically requires applicants to be at least eighteen years old and a resident of the United States. Additionally, individuals must have a valid Social Security number and a steady source of income. Creditworthiness is assessed based on factors such as credit history and score. Meeting these criteria increases the likelihood of approval for the credit card, allowing customers to enjoy the benefits associated with it.

How to Use the Sportsman's Warehouse Credit Card

Once approved for the Sportsman's Warehouse credit card, users can take advantage of various benefits. The card can be used for purchases at Sportsman's Warehouse stores and online, allowing customers to earn rewards points on their spending. Users can also access special financing offers during promotional periods. To manage their account, cardholders can log in to their online account, where they can view statements, make payments, and track rewards. Keeping track of spending and payments helps maintain good credit standing and maximizes the benefits of the card.

Quick guide on how to complete how do i apply for a sportsmans warehouse credit card form

Effortlessly Prepare Sportsmans Warehouse Credit Card Application Online on Any Device

Online document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, as you can obtain the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without any holdups. Handle Sportsmans Warehouse Credit Card Application Online on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

How to Alter and Electronically Sign Sportsmans Warehouse Credit Card Application Online with Ease

- Locate Sportsmans Warehouse Credit Card Application Online and click Get Form to begin.

- Utilize the features we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that function.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to preserve your modifications.

- Choose how you want to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Sportsmans Warehouse Credit Card Application Online and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

When you apply for a credit card on the phone, does the operator simply fill out a web form the way you would if you applied online? Or do you get to explain situations if you are denied at first?

Don't waste your time calling in, just fill it out online yourself. Your financial details and credit score are put through an automated system. Your credit history does all of the explaining for you unfortunately. Also, ditto to what Bryan said about higher end cards, they will actually take the time to verify your income and personal assets in some cases to offset tarnished credit.

-

What are the best ways to build up my credit score?

Screw credit.It’s the biggest scam in history.But to answer your question, the recipe for good credit is simple:Pay off your debt.Yeah, I know, it’s a no brainer.You can do this in two ways:1) Start with the smallest balance and pay as much as you can towards it while making minimum payments on everything else. As you pay off each card, snowball that payment into other cards.2) Start with the card with the highest interest rate. Then do the same as above.While you’re doing that…Cut up your retail credit cards. Don’t use them again unless you get a kick out of paying 20% more for everything you buy.These cards are useless and the “rewards” you get aren’t even close to the amount of interest you’re paying.Keep one or two of your favorite cards and USE them. Pay them off each week/month, keeping a zero balance.I do this on Sundays. I transfer money from my checking to credit card each week. Each week is started with a zero balance.ProTip: Get a cash back reward card and pay it off each week/month. In other words, they’re paying you to use the card.Lower your debt to income ratio. The lower your total debt is compared to what you bring home, the better.Don’t max out your cards. The lower the amount you owe on your card compared to the amount you have available, boosts your credit.IF YOU’RE ALREADY LATE ON PAYMENTS:Don’t use settlement companies. Ever.Don’t use consolidation companies. Ever.Don’t use Payday loans. Ever.Don’t use title loans. Ever.Warning:If you have a savings account with a credit card you’re late on, the bank can (and will) take whatever you have saved.If by some miracle you qualify for a consolidation loan from your bank, then make damn sure you close the other lines of credit…otherwise you’ll “find yourself” with double the debt you had before.Rolling credit over to a new promotional interest rate card is dangerous. If you miss one payment, it can trigger a retroactive interest penalty and suddenly you have more debt that you did before the rollover.Banks are the taxi cabs of personal finance.Extinct, expensive and bad service. Banks nickel and dime you while “storing” your money. You’re basically paying for awful service while they use your money to make money.Screw that.Use a credit union.They are owned by the members. Credit unions have competitive rates. They are usually easier to deal with. Credit unions are now everywhere.Pick a good one, treat them right, pay on time and you’ll never hurt for money again.Credit is a scam.You've been brainwashed to think credit is the key to financial freedom.Credit is used to enslave you. It’s a trick to keep you in the debt game.Don’t play by the rigged rules.Take out too much, you’re penalized. Don’t use enough, you’re penalized. Something bad happens to you, you’re penalized.Know what’s crazy?I’ve gotten loans, cars, apartments, phones and utilities while having “bad credit” in the form of:A foreclosureLate paymentsNo paymentsAm I a bad consumer? No.In all three cases, my credit was being used as leverage to extract cash creditors had no right to.Foreclosure: The foreclosure was due to fraud and the bank, who accepted a forged signature, still tried to screw me. They wanted me to liquidate my savings and retirement just to end up broke and still have bad credit.What did I do? Nothing. I kept my money. Then I bought a sports car.Late payment: An old apartment complex moved a cleaning fee into collections because I was “late” on paying it. My bad…I left them a sparkling clean apartment.What did I do? Got a better apartment. Told the new property if they wanted a good resident then I’m ready to sign. If not, I have the money and means to go somewhere else.No payment: A medical bill was moved to collections because the insurance company and doctor’s office messed up the billing. But the collector wanted me to do the work of figuring out what someone else screwed up. Not. My. Job.What did I do? Got a physical. Then I told them to figure it out and never call me again.Unfortunately for the collectors, the bullying didn’t work because I made damn sure I was in good standing with my credit union.Bad credit? My credit union didn’t care. They got paid, so what?Keep in mind. Creditors use their leverage to drain the middle class of their savings.Some states have allowed creditors to place a lien on your home or garnish your wages to collect on unsecured debt. If you are unfortunate enough to live in one of these states, get rid of the debt, get rid of your bank, build up your emergency fund and move.For more info on your state, you can look here (I have no affiliation with the site and can’t vouch for the accuracy of the info).So how did I get my good credit back?I kept doing what I always did. I paid my credit union on time and was a good member.The funny thing about debt is…When I paid off my debt and started an easy budget, it felt like I had more money and more freedom than when I had no budget.Weird, right?So when you choose to live within your means, pay off your debt and build an emergency fund, you’ll never have to look at your credit again.And if you do want a loan, you can walk in to your credit union and get whatever you want.Why does this work?Because when in doubt, follow the golden rule.The guy with the gold rules.

-

How can one fill a PAN card application with initials?

The PAN Card Application has specific guidelines that no initials be included for the First Name, Middle Name, and Last Name fields of the applicant, his/her father and mother.While initials are not permitted in the above mentioned fields, you have the option to choose how your name appears on the PAN Card. There you could have initials listed.For example, lets take the name Virat Kholi.First Name would be Virat.Last Name would be Kholi.Name on Card can be any of the following:Virat KholiViratK ViratVirat KIf you would like to check how the application turns out, you could submit an online PAN Card Application and download the pre-filled PDF form for free at Brokerage Free - New PAN ApplicationHope this information is helpful.Thanks.

Create this form in 5 minutes!

How to create an eSignature for the how do i apply for a sportsmans warehouse credit card form

How to make an electronic signature for the How Do I Apply For A Sportsmans Warehouse Credit Card Form online

How to make an eSignature for the How Do I Apply For A Sportsmans Warehouse Credit Card Form in Chrome

How to create an electronic signature for putting it on the How Do I Apply For A Sportsmans Warehouse Credit Card Form in Gmail

How to create an electronic signature for the How Do I Apply For A Sportsmans Warehouse Credit Card Form straight from your mobile device

How to make an electronic signature for the How Do I Apply For A Sportsmans Warehouse Credit Card Form on iOS

How to make an electronic signature for the How Do I Apply For A Sportsmans Warehouse Credit Card Form on Android OS

People also ask

-

What is the Sportsmans Warehouse Credit Card Application Online process like?

The Sportsmans Warehouse Credit Card Application Online is a straightforward process that can be completed in just a few minutes. You’ll need to provide personal information and financial details. Once submitted, you will receive a prompt response regarding your application status, allowing you to enjoy the benefits of the card quickly.

-

What are the benefits of applying for the Sportsmans Warehouse Credit Card Online?

Applying for the Sportsmans Warehouse Credit Card Online offers several benefits, including exclusive discounts, rewards points on purchases, and special financing options. The online application is convenient and can be completed from the comfort of your home. Additionally, cardholders may receive promotional offers throughout the year.

-

Is there a fee associated with the Sportsmans Warehouse Credit Card Application Online?

There is no fee to apply for the Sportsmans Warehouse Credit Card Online. However, once approved, certain fees may apply based on your account usage and terms. It’s important to review the cardholder agreement for any potential fees associated with the credit card.

-

What information do I need to provide for the Sportsmans Warehouse Credit Card Application Online?

For the Sportsmans Warehouse Credit Card Application Online, you will need to provide your name, address, Social Security number, and income details. This information helps the issuer assess your creditworthiness and determine your eligibility for the card. Ensure that all information is accurate to avoid delays in processing.

-

How long does it take to get approved for the Sportsmans Warehouse Credit Card Online?

The approval process for the Sportsmans Warehouse Credit Card Application Online is typically quick, often providing results within minutes. In some cases, additional documentation may be required, which could extend the timeline. You can check your application status online for updates.

-

Can I manage my Sportsmans Warehouse Credit Card account online?

Yes, once you have your Sportsmans Warehouse Credit Card, you can manage your account online through the issuer's website. This allows you to view your balance, make payments, and track rewards all in one place. The online management tools make it easy to stay on top of your finances.

-

What rewards can I earn with the Sportsmans Warehouse Credit Card?

With the Sportsmans Warehouse Credit Card, you can earn rewards points on every purchase made at Sportsmans Warehouse and affiliated retailers. These points can be redeemed for discounts on future purchases or special promotions. This feature enhances the value of your card and encourages savings on outdoor gear.

Get more for Sportsmans Warehouse Credit Card Application Online

Find out other Sportsmans Warehouse Credit Card Application Online

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free